Bundesbank publishes gold bar list

On 7 October, the Deutsche Bundesbank published a list detailing its holdings of gold bars in custodian storage in Frankfurt am Main, London, Paris and New York. The list contains the bar numbers, melt or inventory numbers, the gross and fine weight as well as the fineness of the gold. The Bundesbank uses this information for the inventory management and accounting of its gold holdings.

In future, the gold bar list will be updated and published once a year on the Bundesbank's website and will list its gold bar holdings, broken down by custodian, as at the end of the preceding calendar year.

Second largest holder of gold in the world

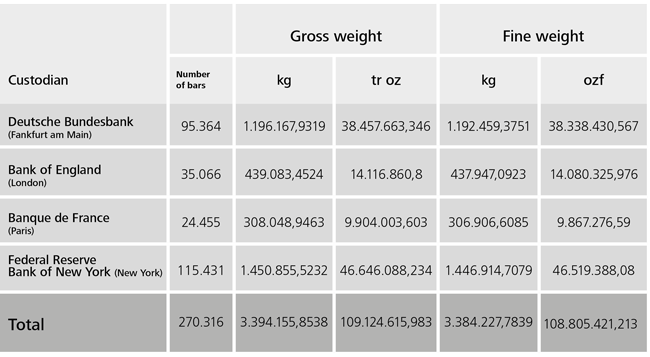

The Bundesbank currently holds around 3,384 tonnes of gold. At the end of 2014, these gold holdings were worth approximately €107 billion. This makes Germany the second largest holder of gold in the world after the United States. These holdings account for two-thirds of Germany’s foreign reserves. The Bundesbank holds and manages the country's gold, which it keeps in storage with four custodians worldwide, as part of these reserve assets.

As the Bundesbank neither buys nor sells gold, with the exception of the gold that is sold to the Federal Ministry of Finance every year for the purpose of minting gold coins, Germany's gold holdings have remained virtually constant. In recent years, these sales of gold to the Federal Ministry of Finance have resulted in a reduction in Germany's gold holdings by between three and six tonnes per year.

Storage of the gold

As at 31 December 2014, 35 percent of Germany's gold holdings were in storage in Frankfurt am Main, 43 percent in New York, 13 percent in London and the remaining 9 percent in Paris.

This distribution of Germany's gold reserves will, however, be changing in future. "By 2020 at the latest, half of Germany's gold reserves will be stored in Germany,"

said Bundesbank Executive Board member Carl-Ludwig Thiele. To this end, since 2013 the Bundesbank has been successively relocating 374 tonnes of gold from Paris and 300 tonnes of gold from New York to Frankfurt am Main. This means that, in future, 50 percent of Germany's gold reserves will be in storage in Germany, 37 percent at the US Federal Reserve Bank and 13 percent at the Bank of England. As France, like Germany, is a euro-area member state, all gold reserves currently held in custodian storage at the Bank of France will be transferred to Germany during the relocation process.