Useful information

Settlement of payments under the SCT Inst scheme

TIPS settles instant payments according to the requirements formulated by the European Payments Council (EPC) in the SEPA Instant Credit Transfer (SCT Inst) scheme.

Thus, an SCT Inst payment should have an end-to-end processing time between scheme participants of ten seconds or less. This time begins when the originator’s payment service provider applies a time stamp as soon as all the necessary checks have been completed and the amount to be transferred has been blocked on the originator’s account.

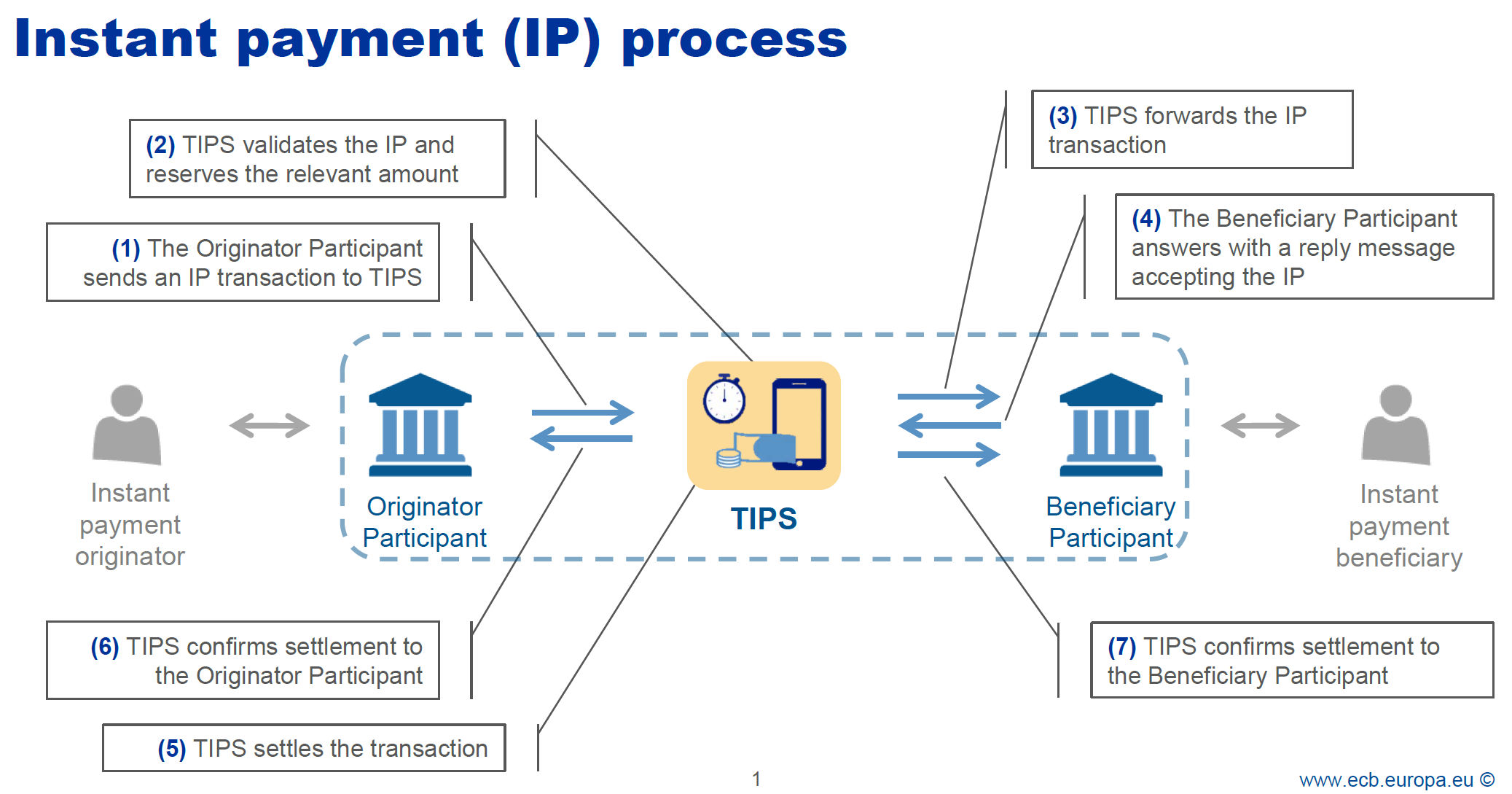

When TIPS receives an SCT Inst payment transaction message, the amount to be transferred is blocked on the TIPS account of the participant sending the payment and the message is forwarded to the payment service provider receiving the payment for acceptance. This receiving participant sends either a positive or a negative reply. If the reply is positive, TIPS will perform settlement; if it is negative, the blocked amount is released again. In both cases, the sending participant is notified about the successful or failed transaction. Once the beneficiary’s payment service provider has received confirmation from TIPS, it can make the transferred amount available to the beneficiary.

TIPS works on a transaction-by-transaction basis – i.e. each payment is processed and settled individually. By their very nature, instant payments need to be settled immediately or almost immediately, so transactions should not be queued or held for later processing. This is why transactions are immediately rejected if there is insufficient cover on the TIPS account to be debited. Payments cannot be prioritised – transactions are processed in the order in which the system received them.

Payment messages under the SCT Inst scheme are based on the ISO 20022 standard. TIPS also uses ISO 20022-compliant messages for messages which are not specified by the scheme (e.g. liquidity transfers and notifications).

In accordance with the requirements of the SCT Inst scheme, TIPS operates 24 hours a day, seven days a week and 365 days a year, including on official TARGET holidays.

Who can participate?

Any institution that has a main cash account (MCA) in T2 can open a TIPS dedicated cash account (TIPS DCA). In addition, participation in the EPC’s SEPA Instant Credit Transfer scheme (SCT Inst scheme) is required.

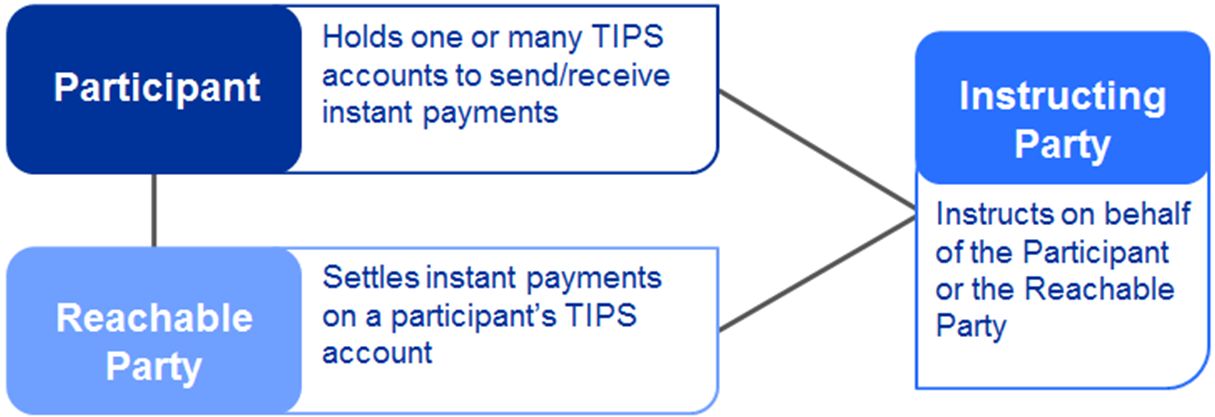

However, it is also possible to settle payments in TIPS without having an own TIPS account; to do so, an institution can be registered as a reachable party by a TIPS account holder. Payments from or to a reachable party are then settled on the participant’s TIPS DCA. Furthermore, participants are not required to have their own MCA to be registered as a reachable party. The only requirements are that participants can be reached in TIPS by means of their own business identifier code (BIC) and that they participate in the EPC’s SEPA Instant Credit Transfer scheme. If necessary, the account holder can limit the use of the account by a reachable party by setting individual limits.

Both TIPS participants and reachable parties can either exchange messages directly with TIPS themselves or appoint a third party, known as an instructing party, to do so on their behalf. This could be, for example, a (different) participant, a technical service provider or a clearing system.

TIPS participants are provided with a TIPS directory containing all BICs that can be reached via TIPS for the settlement of SCT Inst payments, and which is updated each business day.

Liquidity management

TIPS uses TIPS dedicated cash accounts, or TIPS DCAs for short, to settle instant payments. These accounts are operated in TIPS on a credit balance basis and can be supplied with liquidity from the main cash account (MCA) or DCAs held in the other TARGET Services. Liquidity transfer orders can be instructed in either application-to-application (A2A) mode or user-to-application (U2A) mode (via the graphical user interfaces).

Liquidity can be transferred between TARGET Services during T2 opening hours. Outside these hours, credit balances provided for the settlement of instant payments remain on the TIPS accounts so that operations can continue smoothly. In other words, they are not automatically transferred back to the MCA at the end of a business day. Furthermore, TIPS accounts are provided with liquidity through incoming instant payments.

TIPS participants that additionally settle instant payments in an ancillary system can use their TIPS DCA to increase or reduce their liquidity position in the ancillary system. To this end, liquidity transfers within TIPS between TIPS DCAs and the technical accounts of the ancillary systems can be instructed around the clock.

Holders of TIPS accounts can set thresholds so that they are notified whenever the account balance exceeds or falls below a certain level. If other institutions or branches are set up as reachable parties (see section “Who can participate”), account holders can restrict the use of the TIPS account by setting individual limits.

By registering the account accordingly in the Common Reference Data Management (CRDM) component, credit balances on a TIPS DCA at the end of each business day are counted towards compliance with the minimum reserve requirement and when making recourse to automated overnight credit.

T2 business days are authoritative for TIPS – that is to say, one business day ends and the next one begins shortly after 18:00, Monday to Friday.

Beyond the euro

TIPS is designed as a settlement platform with multi-currency capability, i.e. alongside instant payments in euro (SCT Inst), TIPS can also process instant payments in other currencies. This requires the respective central bank to be connected to TIPS in order to facilitate the provision of liquidity in its currency. The Swedish Riksbank was the first central bank to complete the connection and since February 2024, instant payments in Swedish krona (SEK) are being settled via TIPS. On average, 2.5 million payments per day are recorded in TIPS from the Swish mobile payment system, which is widely used in Sweden. The central banks of Denmark, Norway and Iceland are currently in the process of being connected.

The next step is to also make cross-currency instant payments possible in TIPS. To this end, a cross-currency project has been launched, which is preparing for pilot operations in EUR, SEK and DKK.

Fit for the future

Innovative payment solutions, such as using mobile phone numbers to address payments, are becoming increasingly widespread in our mobile society. Through the provision of the Mobile Proxy Lookup (MPL) service, TIPS offers participating payment service providers the opportunity to offer such a service to their customers. The combination of an IBAN and a mobile telephone number can be stored in the MPL and requested by other payment service providers. As a result, instant payments that a payer sends to a mobile phone number can be assigned to the payee’s account and forwarded accordingly.