Customer Access Mechanism (CAM)

Preliminary remarks: customer groups at the Deutsche Bundesbank

With regard to account management and the processing of cashless payments, the Deutsche Bundesbank makes a basic distinction between "deposit-taking credit institutions" (credit institutions within the meaning of Article 4 (1) number 1 of Regulation (EU) No 575/2013) and "other account holders". The latter category includes the following customer groups:

- Public administrations and entities with a private legal form performing the activities of public administrations or processing payments on their behalf.

- Charitable organisations

- Payment service providers within the meaning of section 1 (1) numbers 2 to 5 of the Payment Services Oversight Act (Zahlungsdiensteaufsichtsgesetz or ZAG), credit institutions with partial banking licence as well as financial service institutions within the meaning of section 1 (1a) of the German Banking Act (Kreditwesengesetz).

The four components: CAM-Individual, CAM-SEPA, CAM-Instant and CAM-IMPay

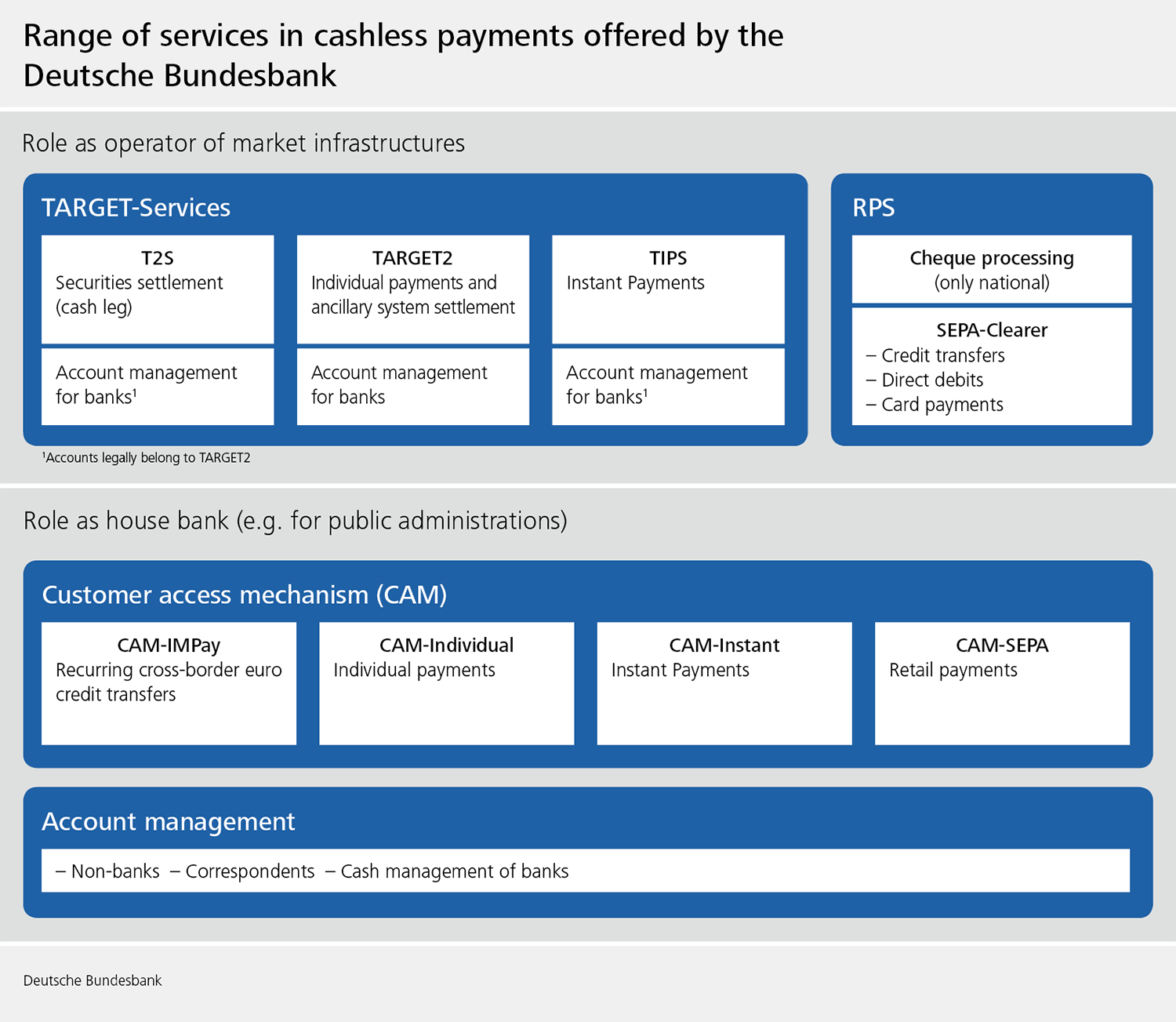

Credit transfer and collection orders initiated by other account holders (with and without a bank sort code) are processed by the Bundesbank using its Customer Access Mechanism (CAM). The CAM procedure is made up of four components, CAM-Individual, CAM-SEPA, CAM-Instant and CAM-IMPay.

- CAM-Individual can be used for the submission of the following types of credit transfer:

- Same-day euro credit transfers for execution in Germany, EU/EEA member states and third countries.

- Foreign payment transfers (in foreign currency) for execution in EU/EEA member states and third countries provided the currency is listed in the "Notice on foreign exchange operations".

The CAM-SEPA component is available to other account holders without a bank sort code for effecting domestic and cross-border

- SEPA credit transfers

- SEPA direct debits (CORE and B2B)

Other account holders without a bank sort code can submit and receive SEPA instant credit transfers via CAM-Instant.

In addition, the Bundesbank's CAM-IMPay procedure accepts the following types of credit transfer from public administrations and entities operating in private legal form

- Euro-denominated credit transfers for execution in EU/EEA member states as well as in third countries

provided the payment arises from a public mandate (eg statutory pension and accident insurance payments, indemnification payments).