Collateral account

Customer information

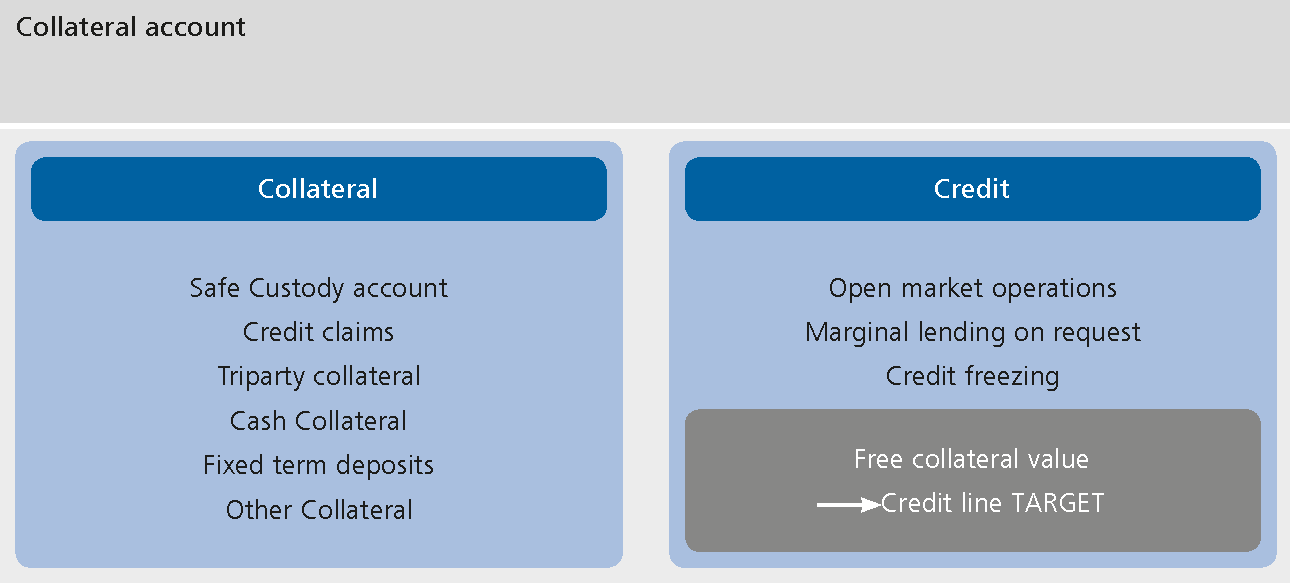

As part of its collateral management, the Deutsche Bundesbank provides its monetary policy counterparties with the (collateral) accounts and (operational) safe custody accounts required for posting monetary policy collateral (marketable and non-marketable assets). In a collateral account, valued collateral stocks are compared against total utilisation. Free collateral value may be transmitted to the TARGET-Bundesbank primary Main Cash Account (MCA) as a variable or, if desired, fixed credit line.

The Deutsche Bundesbank uses a pooling system to collateralise Eurosystem credit operations. The advantage of this system is that the collateral values of all submitted collateral are combined in a single collateral account rather than individual eligible assets being allocated to specific monetary policy operations. Credit utilisation must be adequately covered by eligible collateral at all times.