July results of the Bank Lending Survey in Germany Increased demand for loans to enterprises

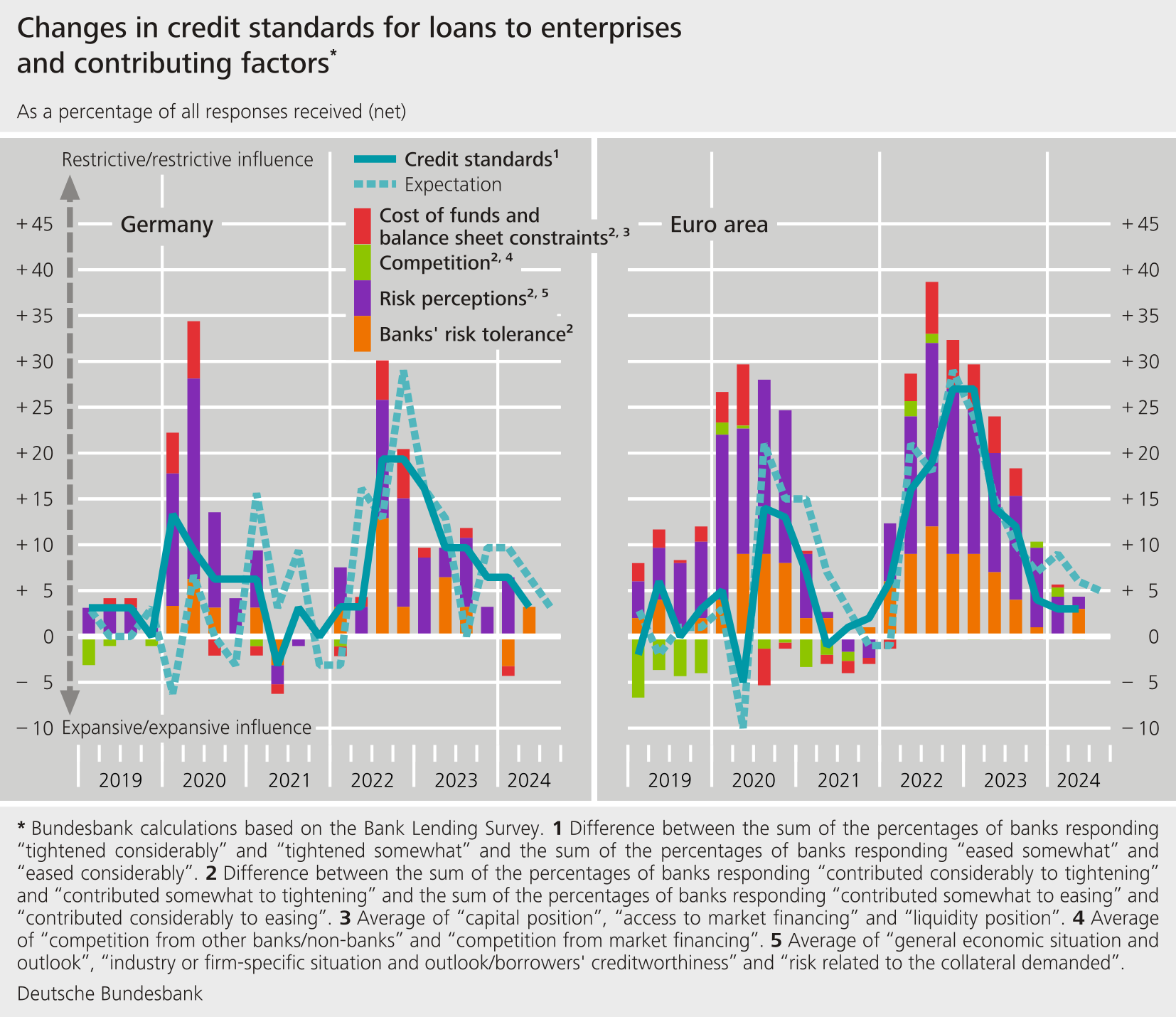

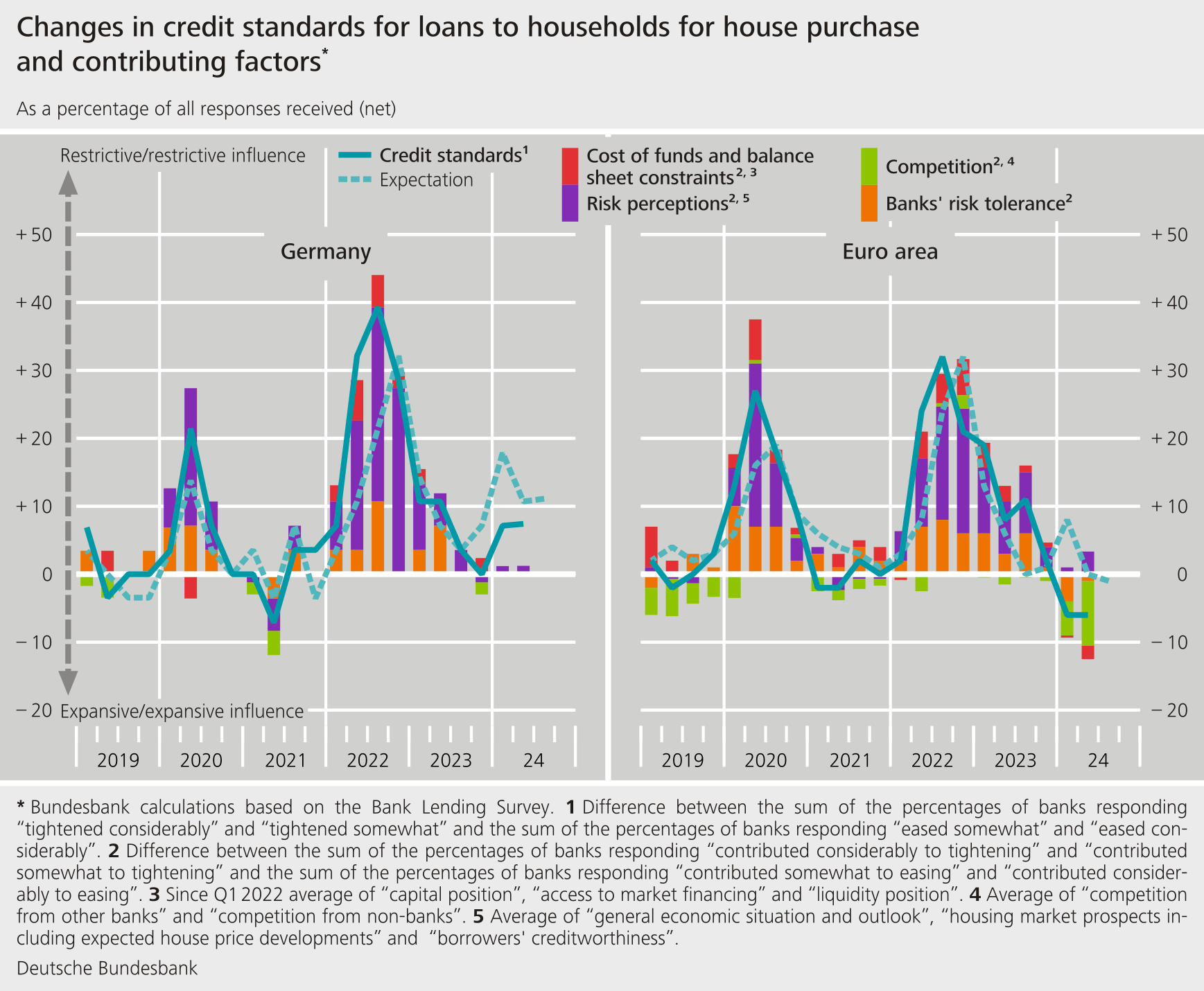

- The German banks responding to the Bank Lending Survey (BLS) barely tightened their credit standards for loans to enterprises any further in the second quarter of 2024. They slightly tightened their credit standards for loans to households for house purchase and for consumer credit and other lending to households. Overall, the adjustments were somewhat less than had been planned in the previous quarter.

- The surveyed banks made hardly any changes to their credit terms and conditions for loans to enterprises. Terms and conditions were eased for loans to households for house purchase and tightened for consumer credit and other lending to households.

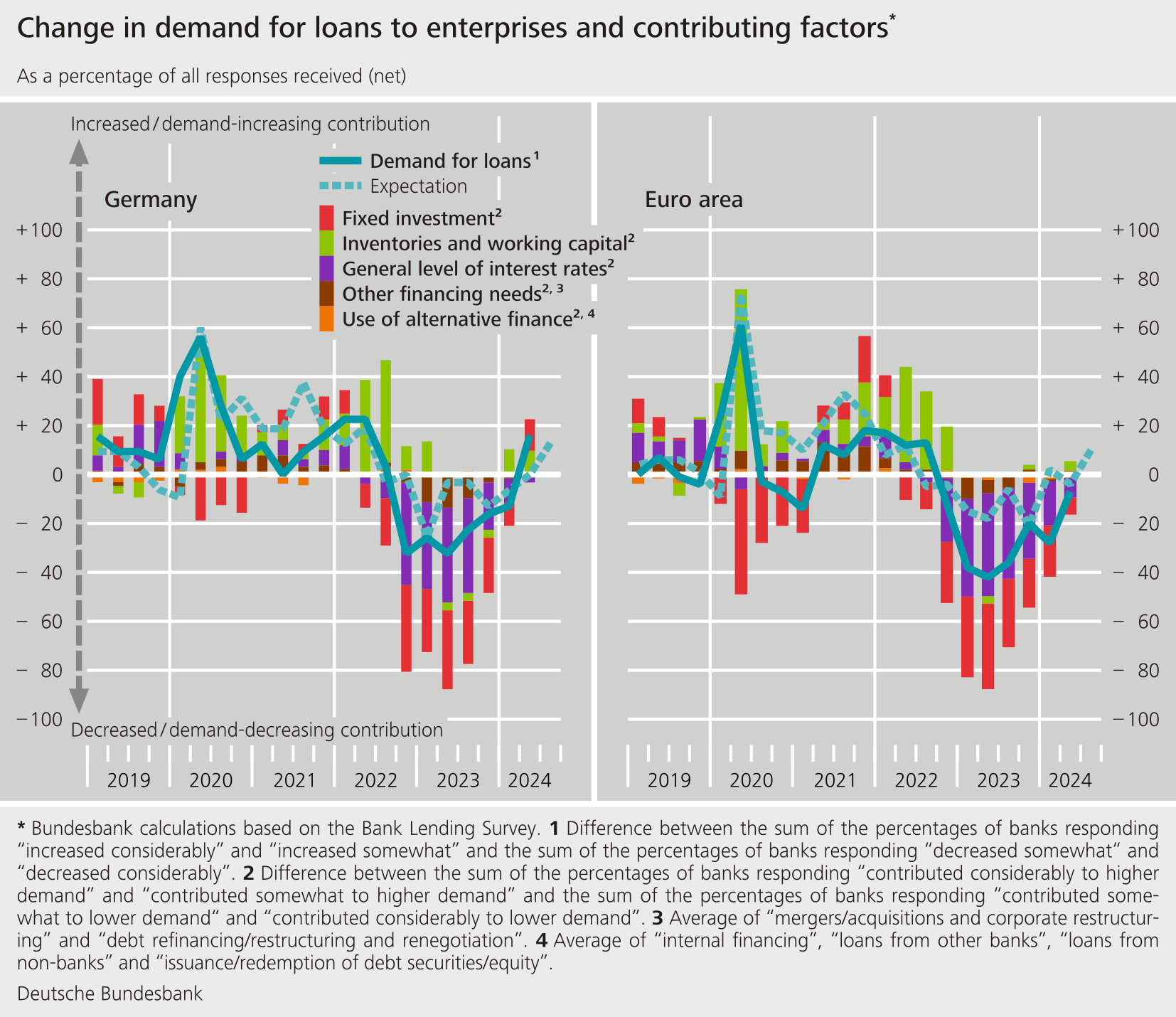

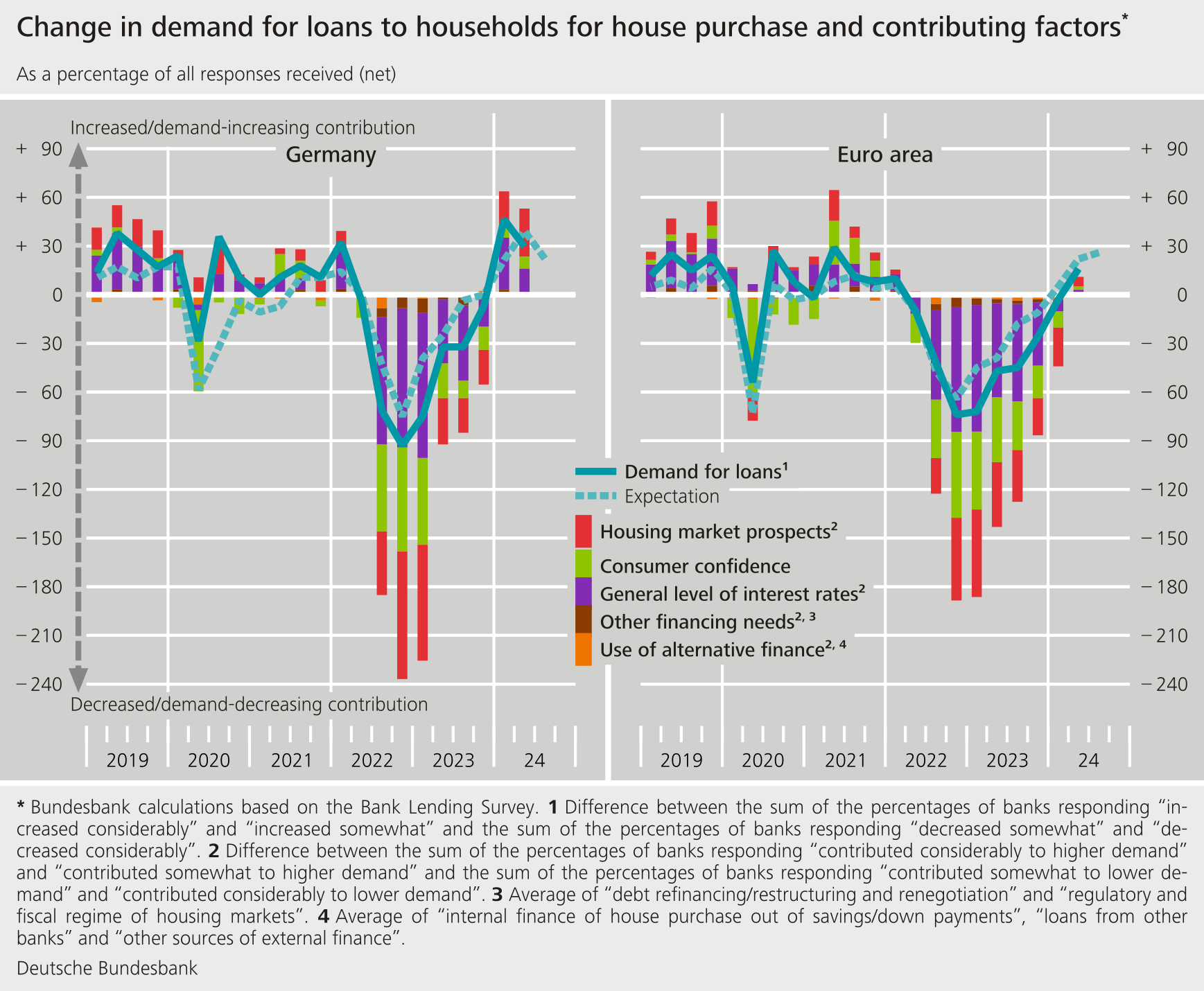

- Demand for loans rose across all loan categories; loans to enterprises picked up for the first time in nearly two years. The upturn in loans to households observed in the previous quarter continued.

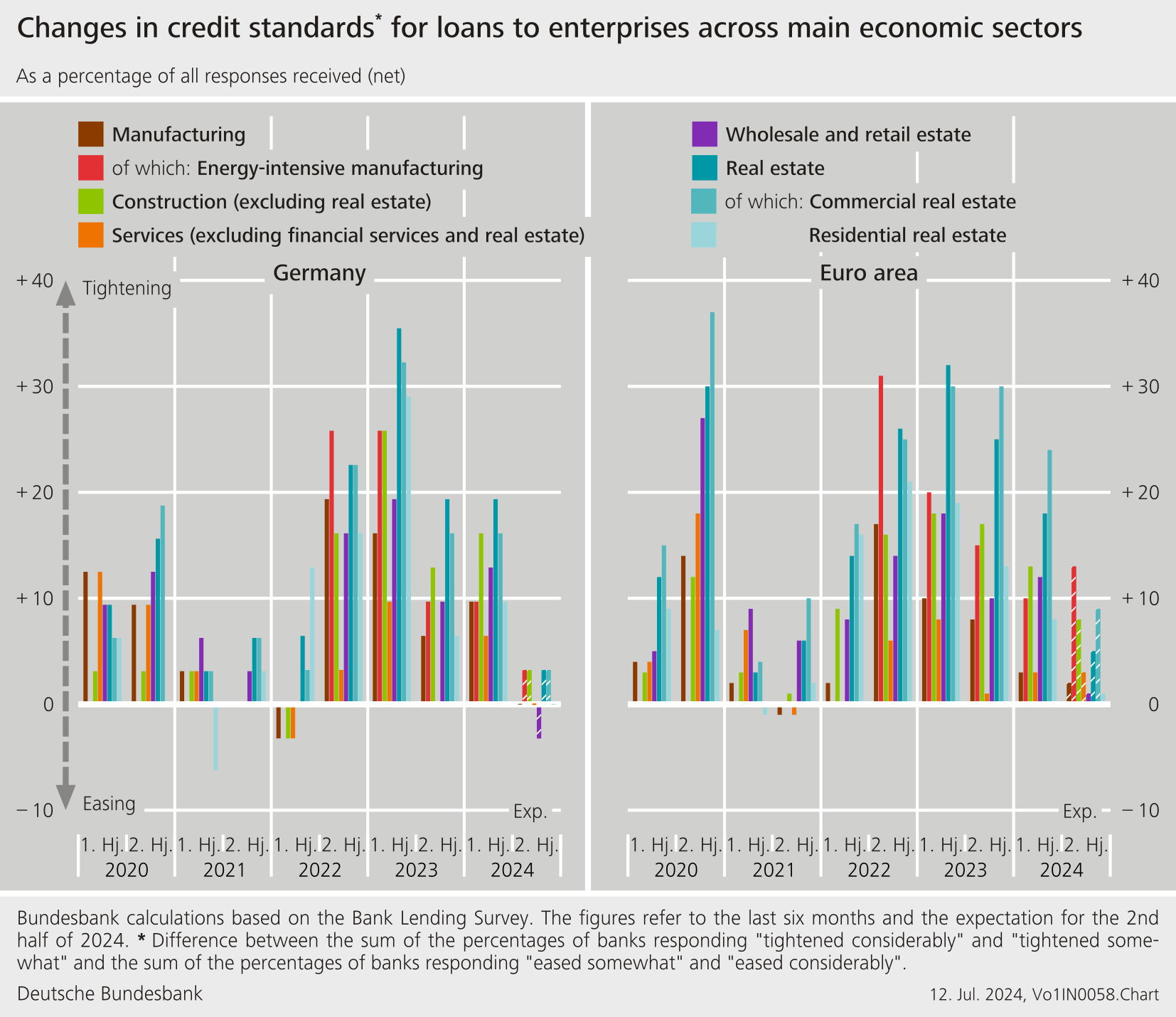

- The tightening of lending policies for loans to enterprises was strongest in the commercial real estate sector over the past six months.

- The level of the non-performing loans (NPL) ratio and other indicators of credit quality had tightening effects on the lending policies for loans to enterprises and for consumer credit and other lending to households over the past six months.

- Climate-related risks and measures to cope with climate change have had a restrictive impact on credit standards for loans to enterprises over the past 12 months. The more the enterprises contributed to climate change, the greater that impact was.

The BLS covers three loan categories: loans to enterprises, loans to households for house purchase, and consumer credit and other lending to households. The surveyed banks tightened their credit standards (i.e. their internal guidelines or loan approval criteria) in all three BLS loan categories. The net percentage of banks that adjusted their requirements was +3 % for loans to enterprises (compared with +6 % in the previous quarter), +7 % for loans for house purchase (compared with +7 % in the previous quarter), and +7 % for consumer credit and other lending to households (compared with +14 % in the previous quarter).In the loans to enterprises and loans to households for house purchase categories, the tightening was somewhat smaller than the plans for the second quarter indicated in the previous survey round. According to the BLS banks, the most recent marginal tightening of credit standards for loans to enterprises was due to their reduced risk tolerance. The banks mainly attributed the tightening of credit standards for loans to households to their perception of increased credit risk, reporting that this was due to households’ lower creditworthiness. In the third quarter of 2024, the banks are planning to tighten their credit standards further in all loan categories.

The banks made hardly any changes to their credit terms and conditions (i.e. the terms and conditions actually approved as laid down in the loan contract) for loans to enterprises. Terms and conditions were eased overall for loans to households for house purchase. The expansionary adjustments are the outcome of reduced lending rates and lower margins on loans for house purchase. As regards consumer credit and other lending to households, meanwhile, increased lending rates were the main reason for the tightened credit terms and conditions overall.

Enterprises’ demand for bank loans in Germany went back up for the first time in nearly two years. In the previous quarter, banks had still been expecting financing needs to remain unchanged for the second quarter. Banks mainly attributed the upturn in demand to increased financing needs on the part of large enterprises for fixed investment and for inventories and working capital. The general level of interest rates has now been having only a marginally negative impact on demand, after previously being the main reason for the decline in demand since mid-2022 on the heels of the monetary policy tightening.

The upswing in demand for loans for house purchase continued in the second quarter. According to the BLS banks, this was primarily due to an improved assessment of housing market prospects by households. The general level of interest rates also stimulated demand, the banks reported. The banks mainly attributed the increase in demand for consumer credit and other lending to households’ increased consumer confidence. The loan rejection ratio rose once again in the loans to enterprises category. It declined for the first time in six years in the loans to households for house purchase category and increased again slightly for consumer credit and other lending to households. For the next three months, the surveyed banks are expecting to see demand increase further across all three loan categories.

The July survey round contained ad hoc questions on participating banks’ financing conditions and about the impact of non-performing loans (NPLs) and other indicators of credit quality on the institutions’ lending policies. It also contained a question on their credit standards and credit terms and conditions, and on demand for loans across the main sectors of economic activities. In addition, for the second time, BLS banks were surveyed on the impact of climate change on bank lending. They were asked to report on the impact for “green” firms (firms that do not contribute or contribute little to climate change), firms in transition (firms that contribute to climate change, which are making relevant progress in the transition), and “brown” firms (firms that contribute strongly to climate change, which have not yet started or have so far made only little progress in the transition). Another ad hoc question assessed the impact of excess liquidity on bank lending.

Against the backdrop of conditions in financial markets, German banks reported that their funding situation had improved somewhat compared with the previous quarter. In particular financing via medium to long-term debt securities improved.

In the first half of 2024, the level of the NPL ratio (the stock of gross non-performing loans on the bank’s balance sheet as a percentage of the gross carrying amount of loans) and other indicators of credit quality had restrictive effects on lending policies for loans to enterprises and for consumer credit and other lending to households. For the second half of 2024, the banks are expecting the NPL ratio and other indicators of credit quality to continue having a restrictive effect on their lending policies for loans to enterprises.

The tightening of credit standards for loans to enterprises was strongest in the real estate sector over the past six months. Yet again, commercial real estate loans were particularly affected. However, restrictive adjustments were made in all the other economic sectors covered by the survey as well. Alongside the real estate sector, this tightening was comparatively strong in construction (excluding real estate). On the other hand, the banks tightened their credit standards less strongly in the wholesale and retail trade, manufacturing and services sectors. For the next six months, banks are not expecting to make any noteworthy adjustments in any of the economic sectors, the first time they have reported this for quite some time.

Climate-related risks and measures to cope with climate change have had a restrictive impact on credit standards for loans to enterprises over the past 12 months. The more the enterprises contributed to climate change, the greater that impact was. The effects of climate change had a restrictive impact on credit terms and conditions, especially those for loans to “brown” firms. The effect was expansionary, on the other hand, for loans to “green” firms. Over the next twelve months, banks are expecting to see climate change have further restrictive effects on their lending policies, particularly in the case of “brown” firms, but also for firms in transition. In the case of “green” firms, though, banks are expecting to see an easing effect. At the same time, the impact of climate change, taken in isolation, stimulated demand from “green” firms for loans from German banks. Demand from firms in transition and from “brown” firms was not affected by climate change, meanwhile. For the next twelve months, banks are expecting to see climate change stimulate demand, particularly from firms in transition but also from “green” firms.

The banks do not see developments in excess liquidity held with the Eurosystem as having had any meaningful impact on bank lending over the past six months. By their account, that is unlikely to change in the next six months.