Nothing new about negative real interest rates on deposits

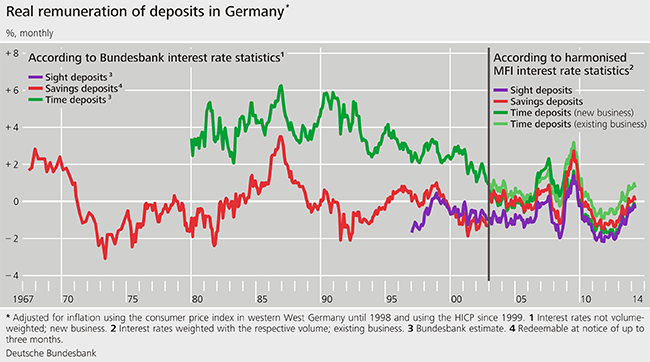

Today’s low interest rates are making it difficult for investors to preserve the value of their assets. After all, if the interest received is lower than the rate of inflation, the value of an investment will diminish over time. However, this state of affairs – a negative real interest rate on deposits – is by no means a new phenomenon that is unique to the prevailing low-interest-rate environment. As it happens, negative real rates of interest have been the norm, rather than the exception, over recent decades. Even before the onset of the financial crisis— specifically, in the 1970s, the early 1990s and in the first decade of this century – the interest which bank customers received, particularly on their savings deposits, did not cover the rate of inflation. In fact, these spells of negative real interest rates have even held the upper hand, historically speaking. The average real rate of interest across the entire period (also excluding the financial crisis) was in negative territory for savings deposits and instant access deposits (“sight deposits”) alike.

The interest paid on fixed-term deposits (“time deposits”), meanwhile, has undergone structural change over the years. Their volume is lower than that of savings and sight deposits, however. Real interest rates paid on these longer-term deposits have contracted continuously since the 1980s. Between 2010 and 2013, interest rates were clearly below zero for the first time on record. In a normal setting, longer-term deposits traditionally yield a higher rate of interest than short-term ones. The low-interest-rate environment has caused interest rates on longer-term deposits (time and savings deposits) to converge sharply with those on sight deposits.

The decline in annual inflation rates in Germany since 2012 has sent real interest rates back up to the current level of close to zero across all types of deposits. This means they have returned to pre-2007 levels, even though nominal rates have been in historically low territory since 2009. The Bundesbank considers it unlikely that credit institutions will impose negative nominal interest rates on deposits in the persistent low-interest-rate environment. For one thing, Germany’s savings banks and credit cooperatives in particular rely on household and corporate deposits, which are by far their most important source of funding. For another, there is currently fierce competition in the German banking sector for customer deposits, which are one of the most stable sources of funding even in times of crisis, and foreign credit institutions also joined the fray a few years ago.

The interest rate statistics portrayed in the chart, being the Bundesbank’s interest rate statistics up until 2002 and the harmonised MFI interest rate statistics as of 2003, are comparable only to a very limited extent. The differences between the two sets of statistics are explained in detail in the article from the January 2004 Monthly Report entitled “The new MFI interest rate statistics – methodology for collecting the German data”.