Despite pandemic, no significant deterioration in debt situation of euro area enterprises and households

How did the debt of households and non-financial corporations evolve during the course of pandemic? This is a question that Bundesbank experts explore in the current edition of the Bank’s Monthly Report. And because the current high rates of inflation mean that a normalisation of monetary policy is drawing closer, the Bank’s economists also analysed how normalising the policy stance would impact on the debt situation of non-financial corporations and households. The overall conclusion made by the Bank’s economists is that, despite the impact of the coronavirus pandemic, the debt situation of non-financial corporations and households in the euro area has not deteriorated significantly. Furthermore, they also found that the expected normalisation of monetary policy will probably not unduly exacerbate the debt situation of non-financial corporations and households.

Significant growth in debt

The outbreak of the coronavirus pandemic in particular saw non-financial corporations take on significantly more debt, the Monthly Report article explains, noting that they did so to make up for the distinct drop in sales and to build up buffers for potential liquidity bottlenecks. That notwithstanding, only in Spain did the debt ratio increase noticeably across the entire period, the economists write. As a precautionary measure, non-financial corporations increased their stocks of liquid assets – that is, currency and deposits – on a considerable scale, particularly at the outbreak the pandemic. This, the Bank’s experts explain, pushed down the debt coverage ratio across all countries. Leverage, by contrast, moved in different directions in different countries, rising in Italy and climbing significantly in Spain, but falling in both Germany and France as well as in the euro area as a whole. However, certain firms that were hit particularly hard by the pandemic saw both their debt ratios and leverage rise substantially.

Taking on debt to buy real estate

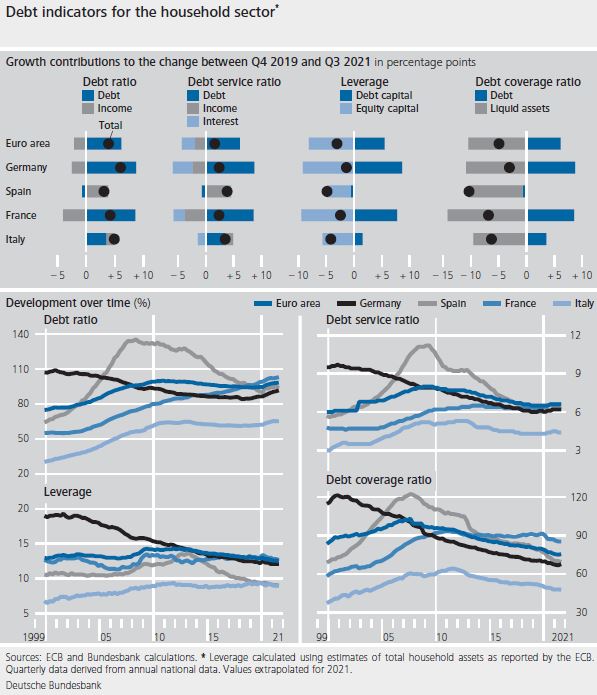

Turning to the household sector, the analysis found that the debt ratio and debt service ratio has increased across all countries. In Germany, France and the euro area as a whole, this was attributable solely to the increase in debt, with households borrowing to purchase residential real estate in particular. Because opportunities for consumption were limited – for example due to closed shops, postponed journeys and cancelled events – households also cut back on their spending. The relatively robust growth in income meant they could thus accumulate excess savings.

How monetary policy normalisation might impact on debt

The Bank’s experts then proceeded to analyse how a possible normalisation of monetary policy might impact on the debt situation of non-financial corporations and households in the euro area. As part of this, they simulated possible developments in the debt service ratio. Via interest payments, this metric is directly influenced by the general interest rate environment and therefore by monetary policy. The simulations carried out by the Bank’s experts indicate that, up to the end of 2024, the debt service ratio at the euro area level will increase only for households and noticeably so only under adverse conditions. Covering a period from the fourth quarter of 2021 to the end of 2024, these simulations were based on the ECB staff macroeconomic projections for the euro area from March 2022.

The results are uncertain, however. The war in Ukraine, in particular, is likely to alter the development of the variables used in the simulations, the article explains. For example, real economic metrics could be lower than assumed in the macroeconomic projections, while prices might increase more strongly that previously forecast. “This would tend to push up nominal income flows somewhat and mitigate developments in the debt service ratio

.”

Indicators

Specifically, the Bank’s economists examined the following indicators:

- The debt ratio expresses the debt of non-financial corporations and households in relation to their disposable income. A higher debt ratio means that debt has increased relative to current income.

- Leverage measures debt capital as a proportion of total assets. Higher leverage means that debt is covered to a lesser extent by assets.

- The debt service ratio represents interest payments and amortisations in relation to disposable income. A higher debt service ratio indicates a lesser ability to settle due payment obligations out of current income.

- The debt coverage ratio measures debt in proportion to liquid assets in the form of currency and deposits. A higher debt coverage ratio indicates a lesser ability to settle due payment obligations by reducing liquidity reserves.

For all the metrics, a higher level is indicative of a worse debt situation.

Further information from the ECB

Monthly Report

only in German