Asset purchases have significant impact on TARGET2 balance

The Bundesbank's TARGET2 balance has again increased considerably since the beginning of 2015 and currently amounts to around €950 billion. The general public is following this development with a certain degree of concern. To put the significance of the balance into perspective, it is important to understand how the TARGET2 system works.

Central banks’ payment system

TARGET2 is the payment system used by Eurosystem central banks to quickly settle payments in real time. It enables both national and cross-border payments to be settled quickly and cheaply in central bank money. Last year, the Bundesbank alone processed around 76 million transactions with a total value of about €174 trillion using TARGET2. This is the equivalent of more than fifty times total German economic output in one year.

Transactions processed using TARGET2 can take a wide variety of forms, such as payment for a goods delivery, purchase of a security, depositing of funds at a bank or repayment of a loan. Payments within Germany are settled by the Bundesbank alone. Cross-border transactions require the involvement of the relevant foreign central bank.

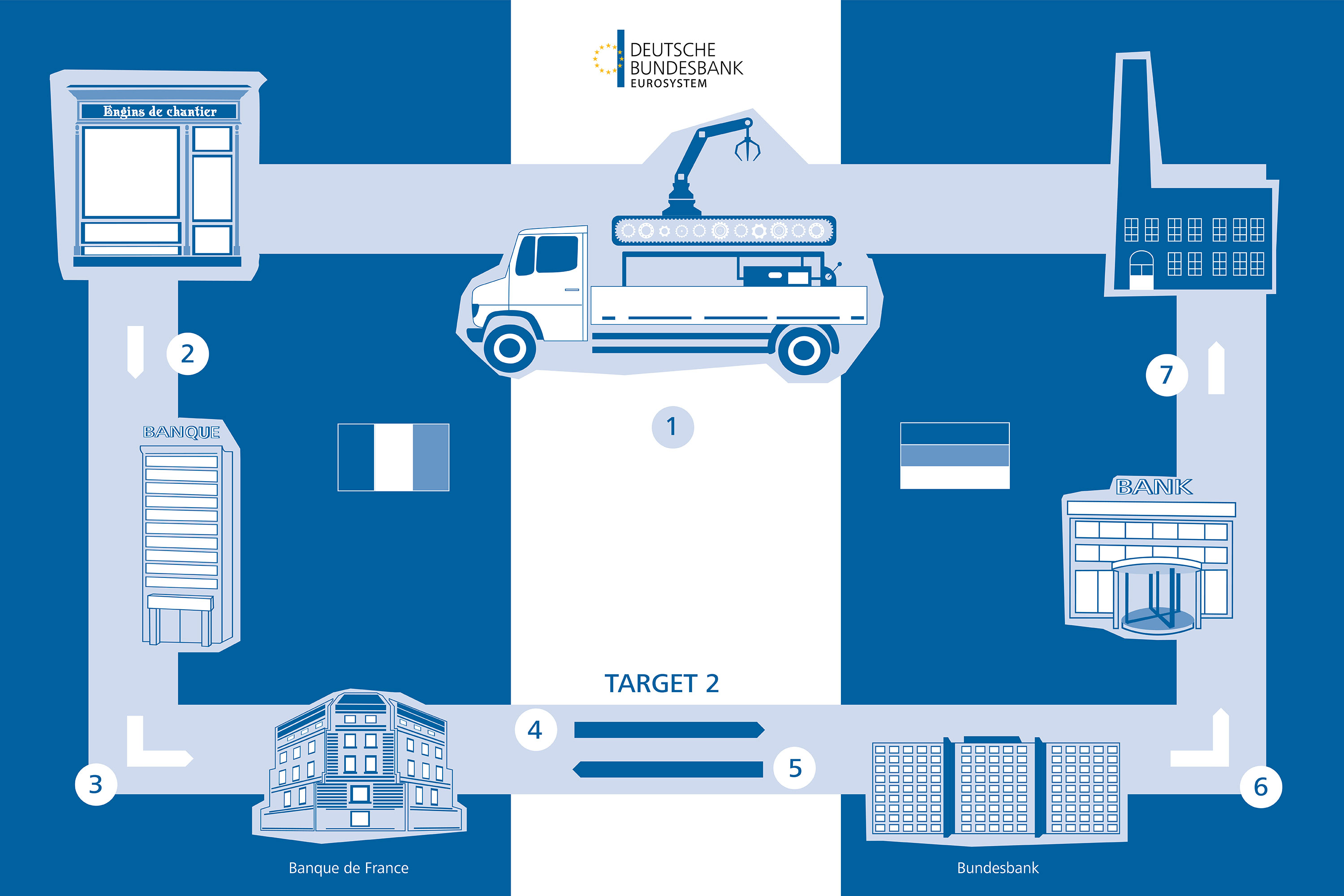

An example: A French company purchases goods from a German trading partner (1) and pays for this import. The French importer’s bank in France debits the purchase amount from its customer’s account (2). At the same time, it submits a credit transfer in TARGET2 to the German exporter’s bank in Germany to the Banque de France (3). The Banque de France then debits the amount from the TARGET2 account it operates for the French commercial bank and simultaneously posts a liability owed to the Bundesbank (4). For its part, the Bundesbank posts a claim on the Banque de France (5) and credits the amount to the German commercial bank’s TARGET2 account (6). The German commercial bank credits the amount in question to the account it operates for the German exporter (7). The German exporter can now use these funds.

The high number of payments made each day means that the Eurosystem national central banks (NCBs) have a large volume of mutual claims and liabilities in TARGET2. At the end of a business day, these claims and liabilities are automatically cleared in a settlement system and transferred to the European Central Bank (ECB) (not shown in the diagram) leaving a single NCB liability to, or claim on, the ECB – the TARGET2 balance.

Higher balances due to liquidity provision by NCBs

Up until the outbreak of the financial crisis, NCBs settled their TARGET2 balances relatively quickly. Banks provided each other with sufficient liquidity in the form of central bank money on the interbank market, irrespective of the country in which they were based. A bank with a liquidity deficit generally found another bank to lend it central bank money; this type of transaction was also shown in the TARGET2 system.

One consequence of the financial crisis was an outflow of liquidity from banks, in particular those based in the countries hardest hit by the crisis. However, because the market for cross-border lending among banks was only working to a limited extent, some banks could no longer raise adequate funding in the interbank market. In response, the Eurosystem NCBs provided credit institutions with additional liquidity against adequate collateral thus compensating for the limited functioning of the interbank market. The resultant cross-border liquidity flows ultimately caused the sharp and ongoing increase in TARGET2 balances in the euro area. While credit institutions domiciled in Germany continued to attract substantial inflows from abroad, some commercial banks from other euro-area countries experienced difficulties securing sufficient funds in the market.

Further increase owing to asset purchases

While the Bundesbank’s TARGET2 balance has decreased fairly continuously since the crisis in the euro area peaked in 2012, it has risen again since the start of 2015. This rise can primarily be explained by the Eurosystem’s asset purchases in the context of the asset purchase programme (APP). Eurosystem central banks purchase a significant proportion of the assets from credit institutions that are domiciled outside the euro area. Many of these credit institutions participate in TARGET2 via an account with the Bundesbank. For instance, if the Dutch or Spanish central bank purchases securities from a commercial bank domiciled in London and if this commercial bank has a TARGET2 account with the Bundesbank, the countervalue is credited to this account. If the purchasing central bank has TARGET2 claims (as is currently the case for the Dutch central bank, for example), they are reduced by the corresponding amount. If the purchasing central bank has TARGET2 liabilities, by contrast (as is currently the case for the Spanish central bank, for example), they increase. The Bundesbank’s TARGET2 claim rises in both instances. The recent increase in the Bundesbank’s TARGET2 balance is therefore first and foremost linked to the extensive asset purchases by the Eurosystem central banks, which had already reached a volume of over €2.5 trillion by the end of August 2018.

Against this backdrop, the Bundesbank’s TARGET2 balance is likely to remain at a high level as long as the Eurosystem continues its asset purchases which, according to the current decision, will be until the end of 2018. A clear decline in the TARGET2 balance is not expected until the Eurosystem reduces the liquidity created by its non-standard measures and the cross-border interbank market in the Eurosystem takes on a more significant role.

The debate about TARGET2 balances ranges from occasional questions about liability to calls for TARGET2 balances to be settled regularly or for TARGET2 claims to be collateralised. TARGET2 balances would then involve a risk if a country with a negative balance were to leave the euro area. In this hypothetical scenario, the ECB's claim on the national central bank in question would continue to exist in full. Only if this claim were not settled in its entirety would a value adjustment have to be made, which might ultimately result in the ECB recording a loss. Any participation in the ECB’s loss would have the effect of reducing the national central banks’ profits in line with their capital shares. The level of Germany’s TARGET2 claims via the Bundesbank on the ECB would be irrelevant in this case, meaning that central banks with TARGET2 claims vis-à-vis the ECB as well as those with TARGET2 liabilities would bear the remaining loss proportionally.