National cheque processing

The rules and regulations for the processing of cheque payments in Germany are stipulated in the agreement on the collection of cheques (Cheque Agreement) and the agreement on the collection of traveller's cheques (Traveller's Cheque Agreement) of the German Banking Industry Committee.

- Paperless cheque collection procedure (BSE)

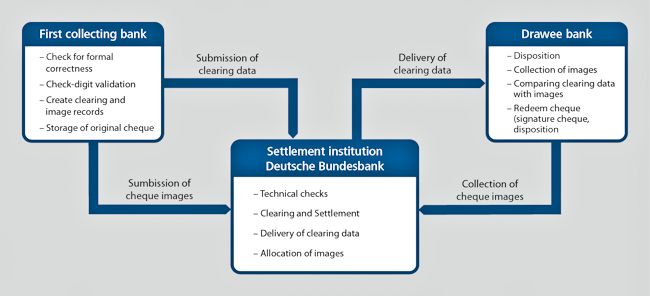

The paperless cheque collection procedure is used for cheques worth less than €6,000. The cheques are not exchanged in paper form. The paper cheques can be requested by the cheque depository, however. - Image-based cheque collection procedure (ISE)

In the ISE procedure, the Deutsche Bundesbank, functioning as a clearing house for cheque payments in accordance with Article 31 of the Cheque Act (Scheckgesetz), receives cheques with a value of €6,000 or more not in paper form but as an electronic image along with the corresponding clearing data record. The clearing house forwards these cheque images either to the drawee bank or to an office designated by said bank, which then checks the respective image of the cheque to decide whether it should be honoured. Returns of cheques that have not been honoured are also effected through the clearing house. In the event of a cheque not being honoured and provided the deadline has been observed in accordance with Article 29 of the Cheque Act, the clearing house issues a declaration within the meaning of Article 40 (3) of said Act deeming that there has been refusal of payment and delivers this to the cheque submitter upon request.

The legal requirements for the ISE procedure are set out in the Regulation "Verordnung über Abrechnungsstellen im Scheckverkehr (Abrechnungsstellenverordnung)."

- Section 1 of the Regulation concerning clearing houses for cheque payments defines the Bundesbank as a clearing house within the meaning of Article 31 of the Cheque Act.

- Section 2 of the Regulation stipulates that cheques may be presented as images by electronic data transmission. Pursuant to section 2 (2) of the Regulation, the electronic submission of cheques by way of data transmission requires that an electronic image of the cheque that depicts the entire cheque (ie including all components listed in Article 1 of the Cheque Act or substitute components pursuant to Article 2 (2) to (4) of the Cheque Act) is transmitted to the clearing house in accordance with its rules. The purpose of this rule is to enable the drawee bank to verify whether the cheque can be honoured after the electronic image of the cheque has been transmitted by the clearing house; this verification is broadly equivalent to that of the physically submitted original cheque. From a legal perspective, delivery of the image to the clearing house is therefore deemed equivalent to actual presentation of the cheque.

The clearing house can also determine the reason for the refusal of payment pursuant to Article 40 (3) without physical availability of the cheque by issuing a dated declaration that the cheque has been submitted on time and has not been paid. It therefore remains possible to manage cheque proceedings in accordance with the Code of Civil Procedure (Zivilprozessordnung) even when the ISE procedure is used. There are no discernible disadvantages for the drawee bank either, as it can undertake the verification of cheque encashment using the cheque image forwarded to it in the same way as if the original cheque had been submitted. In case of any doubt when checking the signature, the drawee bank is free to request the original cheque for further checks under the modified Cheque Agreement.

The cheque processing service of the Deutsche Bundesbank's retail payment system (RPS) enables credit institutions to exchange the BSE and ISE clearing data records taken from the cheques. The ISO 20022 format, as defined by the German Banking Industry Committee, is used in this process. The available communication procedures are SWIFTNet FileAct and EBICS.