Own funds requirements

The prudential own funds requirements reflect a risk-oriented approach to supervision which is designed, depending on a bank's individual risk positions, to ensure that capital backing is as commensurate with risk as possible.

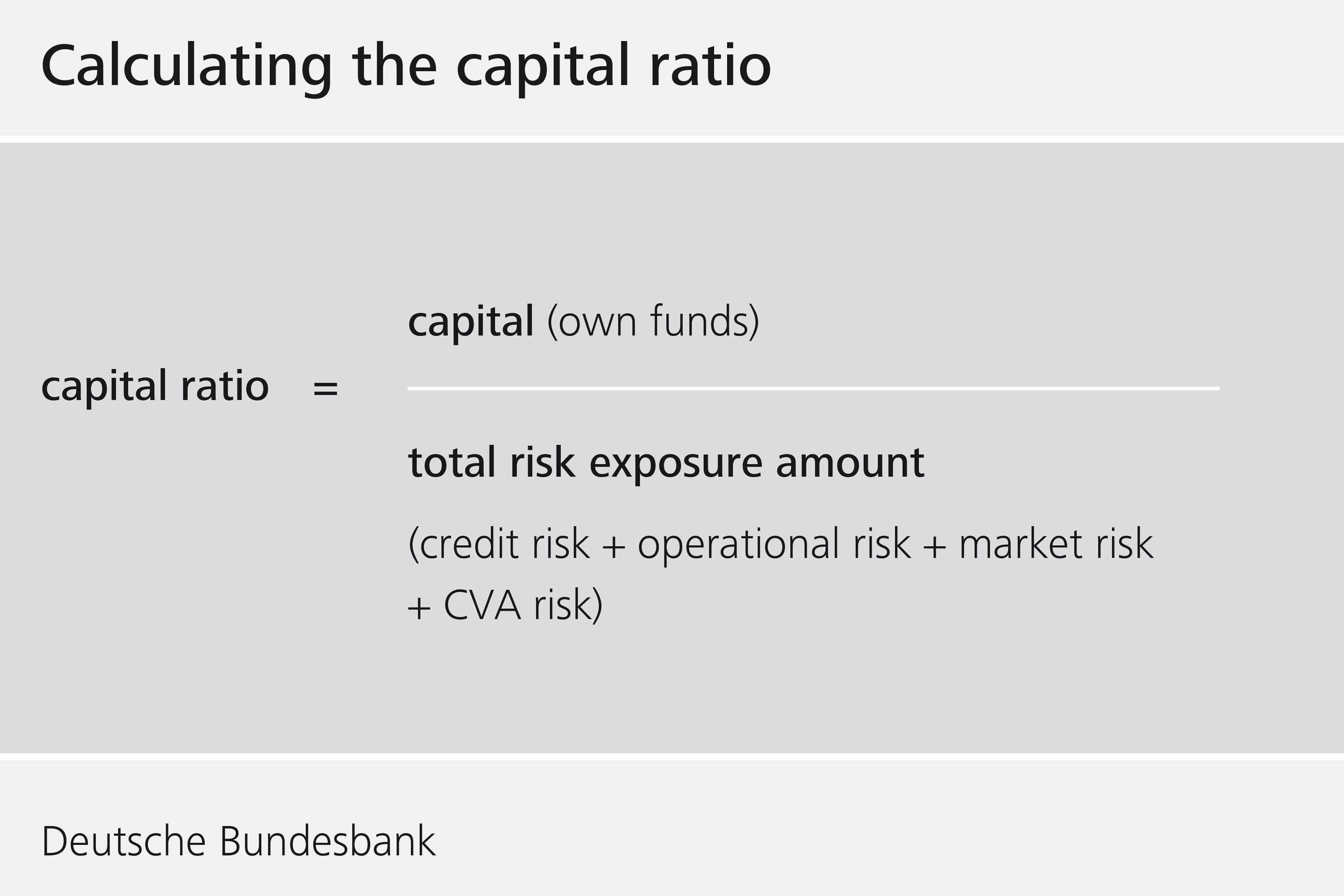

According to the rules of the Capital Requirements Regulation (CRR), banks must calculate a total risk exposure amount, which is the sum of their credit risk, their operational risk, their market risk and the risk of a credit valuation adjustment (CVA risk). This total risk exposure amount is compared to own funds to yield the bank's capital ratio.

According to Article 92 CRR, institutions must, at all times, satisfy the following own funds requirements:

- a common equity tier 1 capital ratio of 4.5%

- a tier 1 capital ratio of 6.0%

- a total capital ratio of 8.0%.

The capital requirements apply to single entities as well as (pursuant to section 10a of the German Banking Act in conjunction with Article 11 CRR) to groups of institutions and financial holding groups on a consolidated basis.

In addition to these minimum own funds requirements, institutions must meet capital buffer requirements.

Components for calculating the capital ratio

Further information on capital buffer requirements

National legal basis

EU legislation

Capital Requirements Regulation - CRR