Payments in Germany Payment statistics for 2017

Payment service providers in Germany

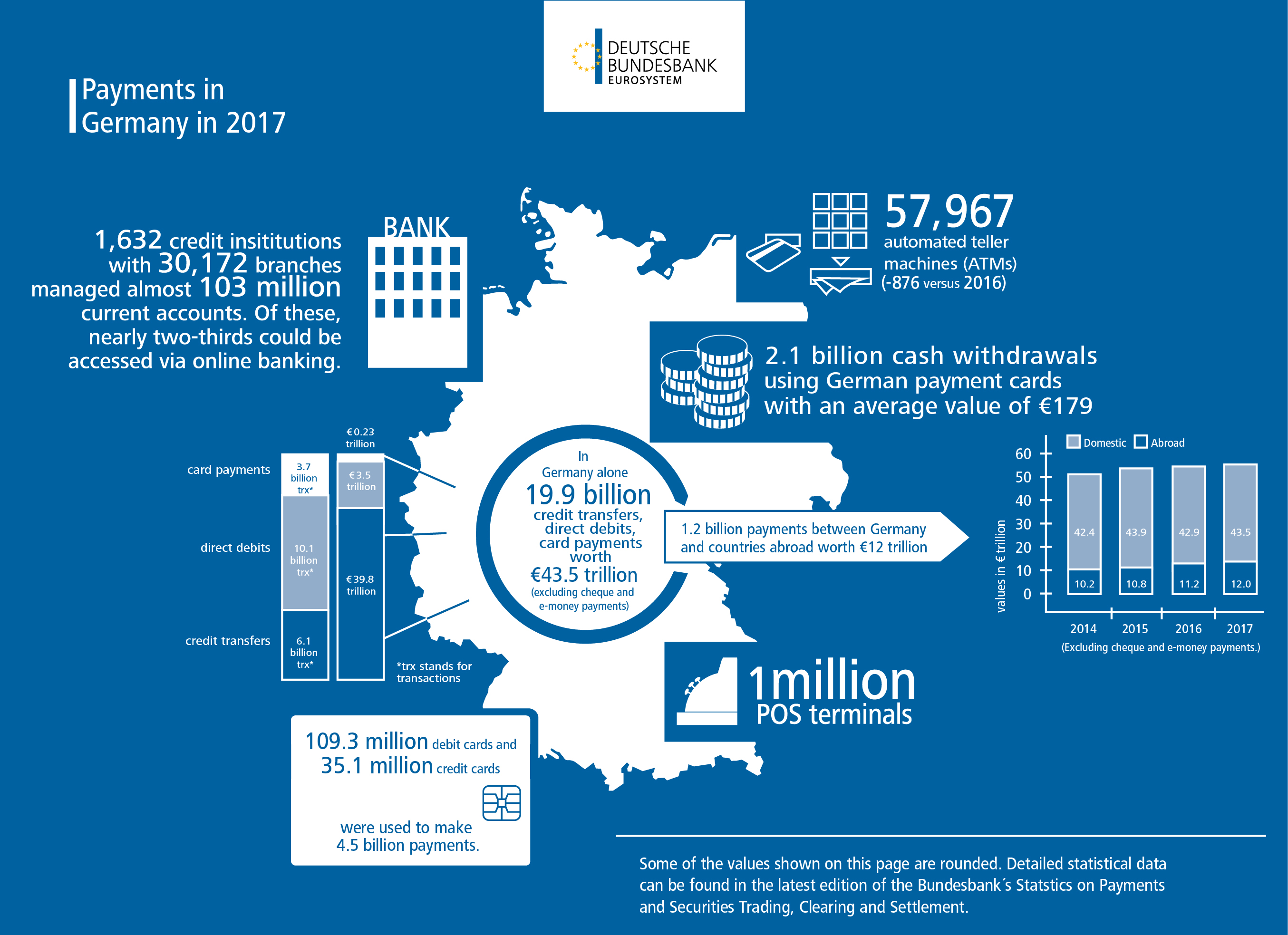

The number of payment service providers in Germany is continuing to decline. This is due to mergers, above all in the credit cooperative and savings bank sectors. Besides credit institutions, payment service providers also include licensed electronic money institutions and payment institutions. As at 31 December 2017, these payment service providers were operating around 150 million accounts.[1] Of this number, roughly 103 million were current accounts, and they had a credit balance of around €1.4 trillion at year-end. This represents an increase of 11.3% on the previous year. Current accounts are the fulcrum of the payments world, given that they feature directly or indirectly in all forms of non-cash payment.

Development in non-cash payments by payment instrument

Direct debits were the most frequently used payment instrument in Germany again in 2017, accounting for 10.3 billion transactions, followed by credit transfers (6.3 billion transactions) and card payments (4.5 billion transactions). Other payment instruments, such as e-money, are only used sparingly in Germany. Looking at each instrument in terms of its share of the total value of transactions, the chart below shows that credit transfers with an average transaction value of €8,000 accounted for more than 92% of the total value of transactions. That corresponds to a total value of €51.4 trillion, which is roughly 16 times Germany’s gross domestic product. Note, however, that this figure also includes business transactions. By contrast, the average transaction values of direct debits and card payments are significantly lower, with direct debits averaging €372 per transaction (a total of €3.8 trillion) and card payments €62 per transaction (a total of €281 billion).

Compared with the 2014 data, both the number and value of transactions overall have risen. The evolution of card transactions is noteworthy. These increased by 11% in terms of numbers and 9% in terms of value on the previous year. At a fifth of transactions, card payments are still relatively insignificant as a proportion of total non-cash payment transactions, however.

Digitalisation of financial services

The general trend towards greater digitalisation, with providers of payment services adapting their pricing strategy accordingly, is likely to have fuelled further growth in the online banking segment. Not only did the number of current accounts operated online come in 4.8% higher than in 2016 at roughly 66 million accounts; the number of credit transfers initiated electronically was also 152 million higher than one year earlier (+ 2.7%). Last year, non-paper based credit transfers as a share of the total number of credit transfers amounted to 91.7% in terms of numbers and 93% in terms of value. There was also an increase in online banking based credit transfers. For the most part, this item captures credit transfers initiated via payment initiation services.[2] In a year-on-year comparison, these payments increased by 9.8% in terms of numbers and by 11.4% in terms of value.

Cross-border payments

In total only 5.5% of the number and 21% of the value of all the transactions in 2017 involved counterparties outside Germany. Compared with the previous year those transactions rose in both, number and value. Around 11.5% of the cross-border transactions saw German credit institutions exchange payments with credit institutions outside the EU. Within the EU, Germany’s biggest partners are Luxembourg, the United Kingdom, Austria and France, each of which accounted for more than 100 million cross-border transactions. In terms of value, payments worth more than €1 trillion were exchanged with the United Kingdom and with France.

Measured in terms of value, credit transfers account for a large proportion of cross-border transactions. Their value increased by 7% in 2017 to stand at €11.6 trillion. Card payments clearly stand out in an analysis of the number of cross-border transactions. Out of a total of roughly 1.2 billion cross-border transactions, 66% alone were initiated using a debit or credit card. However, the average value of a card payment abroad, at around €67, was significantly lower than that of a cross-border credit transfer (€70,542) or cross-border direct debit (€1,325). Overall, roughly 7.5% of all direct debit volumes (2.1% of all direct debit transactions) were collected from accounts operated outside Germany. In the previous year, this figure stood at 6.4% of volumes (and 1.6% of transactions).

Cards and terminals in Germany

In 2017, 1.8 million additional debit and credit cards were issued in all, of which there were 1.2 million cards with a delayed debit function. The number of debit cards increased by just 438,000, though they do account for the bulk of payment cards, at 109 million cards. In statistical terms, then, each account holder has at least one debit card.

Whereas 68% of debit cards (74.8 million cards) also have an e-money function built into the card’s chip, this function was used at least once with just 3.4 million cards. A number of banks having switched to issuing new debit cards without this e-money function over the past few years, these cards have been declining in number. Other e-money cards, such as prepaid credit cards issued by a number of institutions, saw growth of 13.5%, albeit from a very low level of roughly 760,000 issued cards in 2016.

Last year also saw German payment service providers provide net around 16,000 new payment terminals (POS terminals) in Germany. Overall, then, slightly more than 1 million POS terminals which accept card payments were available at the end of 2017. Outside Germany, there are 188,000 POS terminals operated by German payment service providers.

All the data mentioned in this article are taken from the Deutsche Bundesbank’s Statistics on Payments and Securities Trading, Clearing and Settlement, which readers can download at the bottom of this page.

Further information on the individual statistical items can be found in the General guidelines on payment statistics, which are also available at the bottom.

The statistical data on payments and securities trading, clearing and settlement are collected by the Bundesbank annually from domestic payment service providers on the basis of the Regulation on payment statistics (ECB/2013/43).

Payment initiation services carry out credit transfers on the customer’s behalf via the customer’s online banking account (such as Sofortüberweisung).