Statement on the publication of the Financial Stability Review 2024 on 21 November 2024

Check against delivery.

Ladies and gentlemen,

I warmly welcome you to the presentation of the Bundesbank’s Financial Stability Review this year. In our Financial Stability Review, we assess the state of the German financial system. In doing so, we take a holistic view rather than approaching it from the individual institution level.

We are currently experiencing a period of strong structural change in the economy, accompanied by technological progress, geopolitical shifts and high levels of uncertainty. A stable and resilient financial system is intrinsic to the real economy’s ability to handle all of these changes and challenges well.

So what is the current state of the financial system? In order to assess this, it is helpful to take another brief look back at how the German financial system has fared up to this point.

The period up to the start of 2022 was marked by very low interest rates, high credit growth and extremely low credit defaults. Along the way, a number of vulnerabilities had built up within the German financial system. These were exposed, to some extent, by the sharp rise in interest rates since 2022.

We will then turn our attention to the present day to examine how the German financial system is currently faring. Interest rates have passed their peak. The ECB Governing Council has already lowered interest rates three times. The financial system has weathered the earlier period of exceptionally strong interest rate rises well. Vulnerabilities have been decreasing in an orderly fashion – albeit only gradually.

However, the path ahead is an arduous one: geopolitical tensions continue to harbour risks to the future stability of the financial system. Not only that, but the financial system must confront the structural change I mentioned earlier.

1 How has the German financial system fared up to this point?

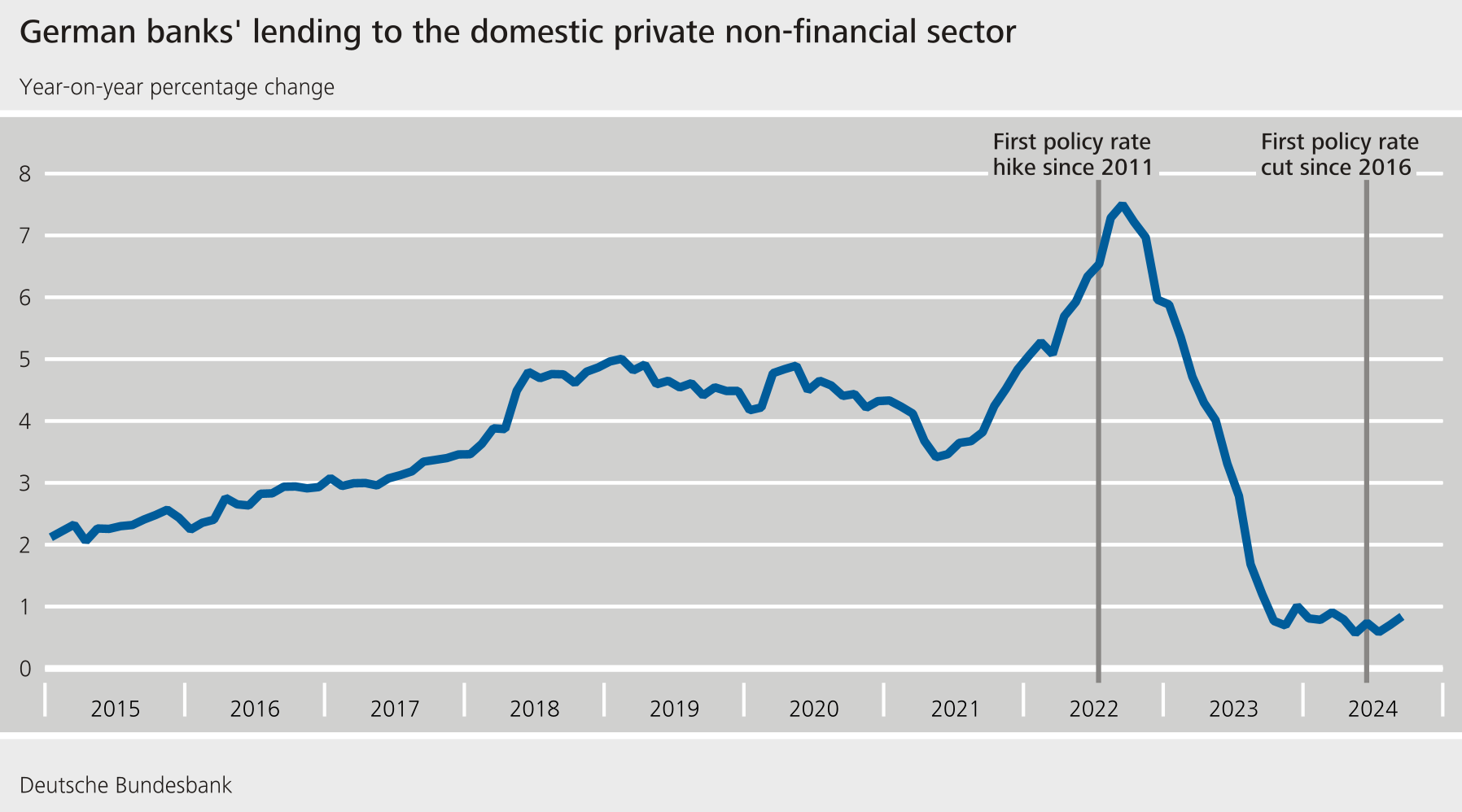

Following the global financial crisis of 2007-08, many central banks around the world lowered policy rates significantly in order to stimulate the economy and promote lending. In view of stubbornly low inflation, interest rates remained very low until 2022. The German economy was stable, we saw few insolvencies, and unemployment was low. Exceptionally low interest rates were accompanied by dynamic credit growth.[1] Despite the economic slump during the coronavirus pandemic, there were very few credit defaults.

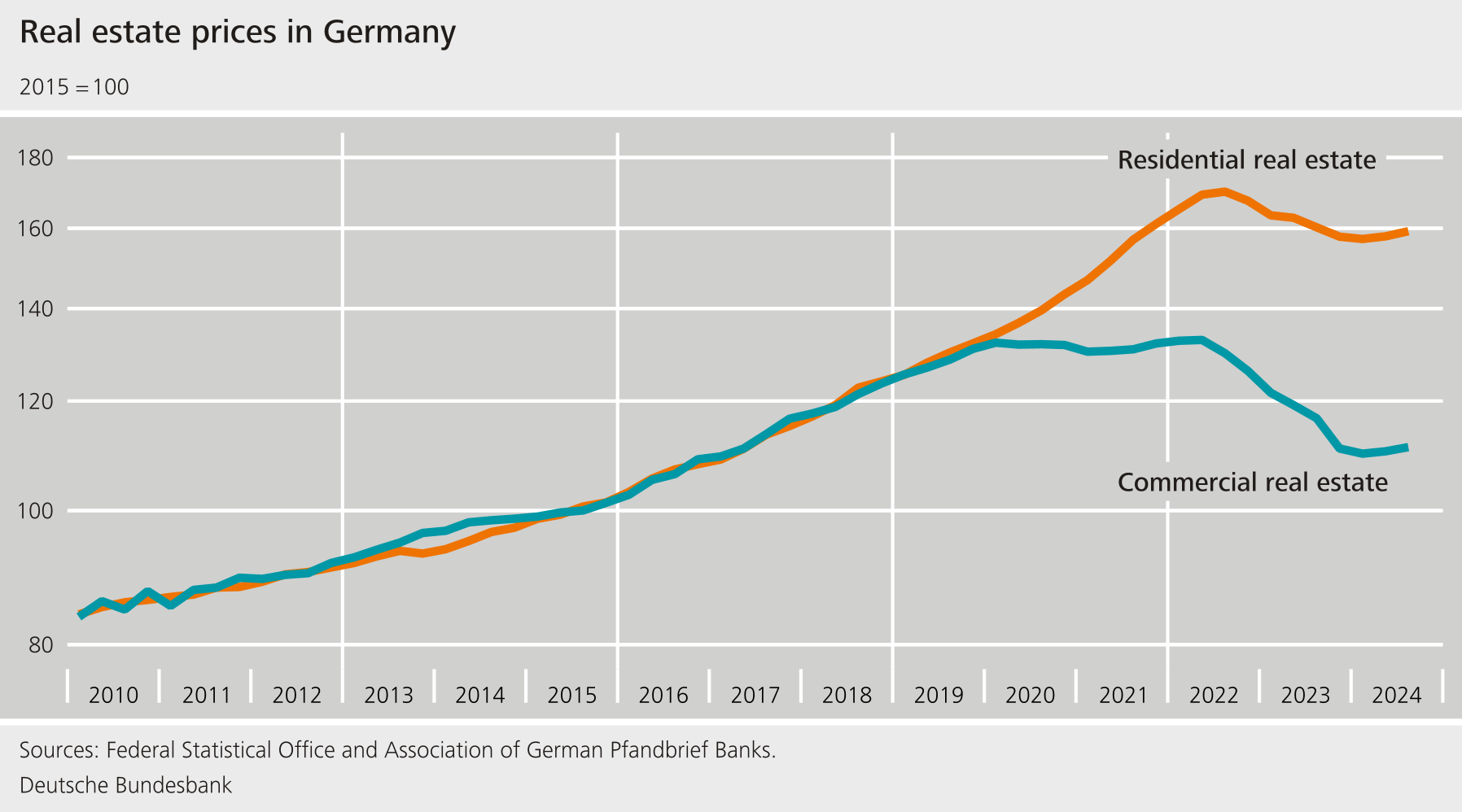

During the period of low interest rates, vulnerabilities built up in the German financial system, making it susceptible to shocks. In the past, the Bundesbank repeatedly emphasised that the long economic upswing and historically low credit defaults made it more difficult to assess future risks. As a result, banks were in danger of tending to underestimate credit risk. At the same time, some assets, such as residential real estate, were overvalued by up to 30% according to Bundesbank estimates.[2] As a result, banks were probably more likely to overestimate the value of their credit collateral. In addition, banks and insurers took on significant interest rate risk.

Following a period of low interest rates that lasted almost ten years, since mid-2022 we have been seeing the strongest rise in interest rates in 25 years. This was triggered by spiking inflation in the wake of the pandemic, fuelled by the energy crisis resulting from Russia’s invasion of Ukraine. The higher interest rates and energy prices caused a number of risks to emerge. Inflation, the tense economic situation and higher interest rates weighed on household incomes and firms’ profits.[3] Real estate prices fell and credit risk rose.

Banks and insurers accumulated unrealised losses. The risk of disorderly developments was elevated. Such developments can lead to high volatility on the financial markets and increase uncertainty in the real economy, impacting negatively on the economy as a whole.

At the end of 2023, higher interest rates had not yet fully filtered through to the real economy. Households were and are still largely shielded from the rise in interest rates with respect to loans they have already taken out, as they have long interest rate fixation periods in their loan agreements. Enterprises, on the other hand, often have shorter interest rate fixation periods and were affected more quickly by the rise in interest rates.

One year ago, the duration and scope of the correction in the real estate markets was unclear. It was also uncertain how credit risk would evolve in light of higher interest rates and real economic weakness.

2 How is the German financial system currently faring?

The financial system has weathered the exceptionally strong rise in interest rates well. Inflation has fallen considerably in the meantime and is close to 2% again. Against this backdrop, the ECB Governing Council has already lowered interest rates three times. However, the financial markets do not expect interest rates to fall to the levels seen in the years prior to the interest rate hike.

Banks’ lending is stabilising. The downward trend seen last year has not continued. Growth in loans to non-financial corporations and to households has stabilised at low levels.

New lending has increasingly been recovering. There is no evidence to suggest that banks were restricting their credit supply. Lending declined mainly due to lower demand for credit in view of higher borrowing costs.

Residential real estate prices have risen on the previous quarter for the first time in two years.[4] Commercial real estate prices are not declining any further, at least.

However, the risk of further price declines remains high, partly on account of continued structural change in the commercial real estate sector, together with more home office, online shopping and higher energy standards for buildings.

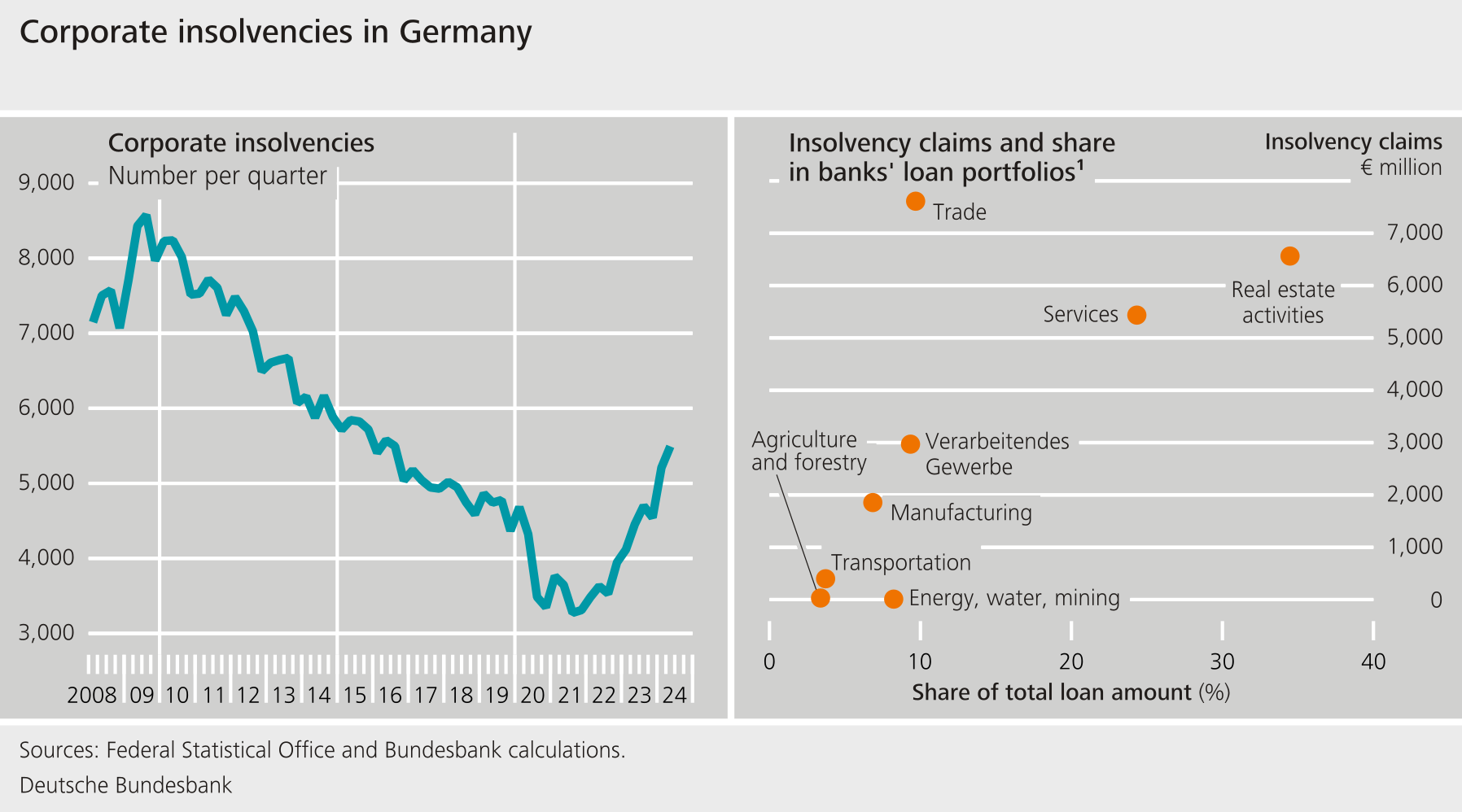

And there are challenges from another source as well: German economic activity remains weak; corporate insolvencies have – from a low level – risen significantly.

The earnings situation is strained for many enterprises, but capitalisation is sound. By long-term standards, the number of insolvencies is not particularly high. That said, insolvency claims have climbed considerably since October 2023. Where trading companies are concerned they are particularly high – totalling over €7 billion as at the end of June 2024. Insolvency claims against the services sector[5] and against the real estate activities sector are somewhat lower, but nevertheless substantial, amounting to around €5.5 billion and roughly €6.5 billion, respectively. The latter make up a substantial share of bank loans to non-financial corporations, at around one-third. All three sectors together actually account for just under 70% of such bank lending.

These figures show that many sectors are being affected by the weak state of economic activity and by structural change. At least in the case of companies in the real estate activities sector, the fact that many of these loans are secured acts as a pressure valve. Losses should be smaller if that loan collateral can be realised. Furthermore, risks from commercial real estate are concentrated amongst a handful of banks and insurers.

Overall, credit risk in the corporate sector and risks stemming from the overvaluation of assets and credit collateral are low.

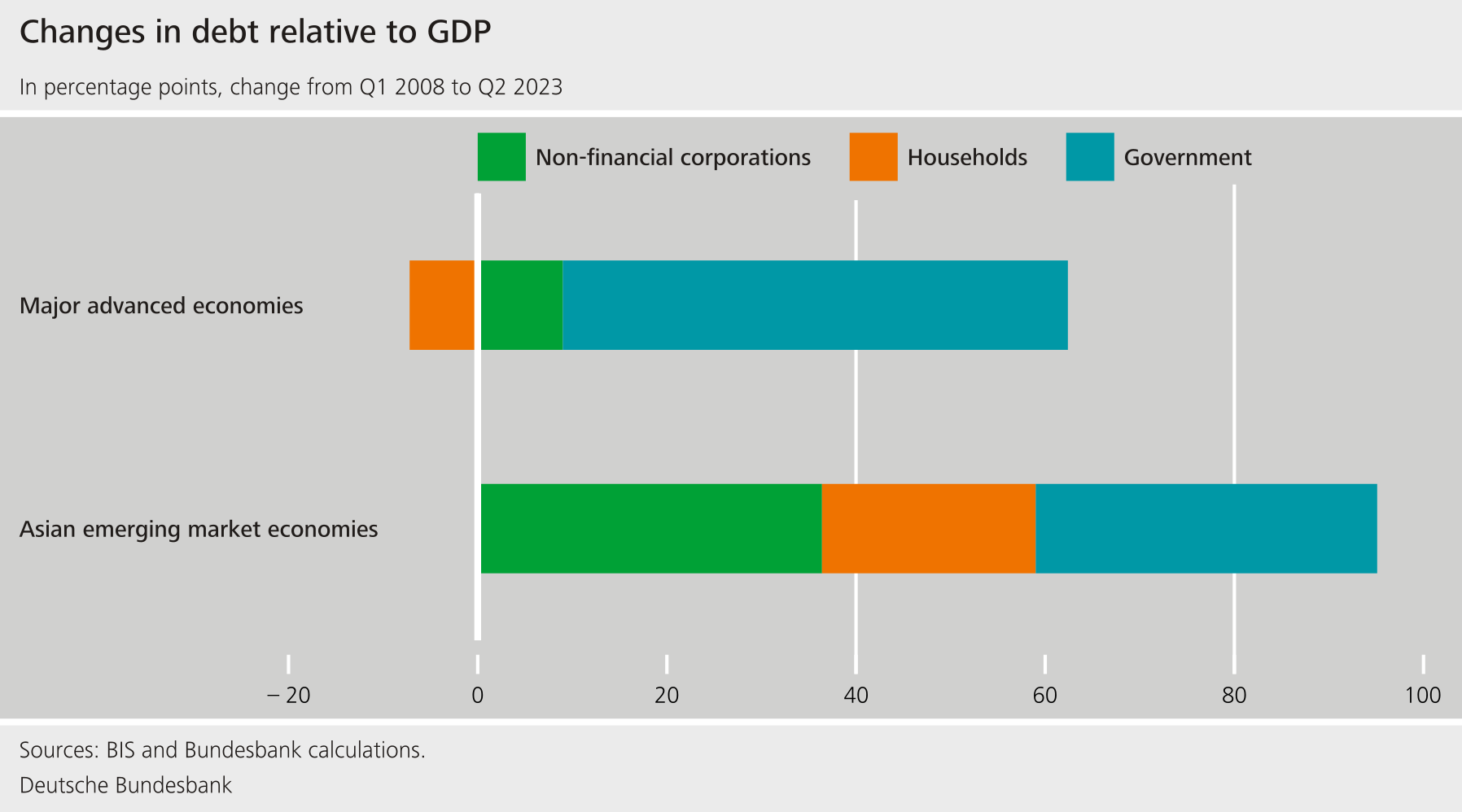

Public and private debt levels remain high worldwide, making the financial system vulnerable to problematic developments and shocks. Governments and households are less able to absorb the effects of negative developments if their debt levels are already high. Government debt is expected to rise further in some euro area countries. The increase in risk premia for French government bonds after snap elections were called in June 2024 highlights how sensitive markets can be to the risk of rising government debt.

The debt levels of non-financial corporations and governments have risen since 2008, in some cases significantly so. In large advanced economies, households have reduced their debt.

In the past, risks to financial stability have mainly arisen from high levels of debt in the private sector.[6]

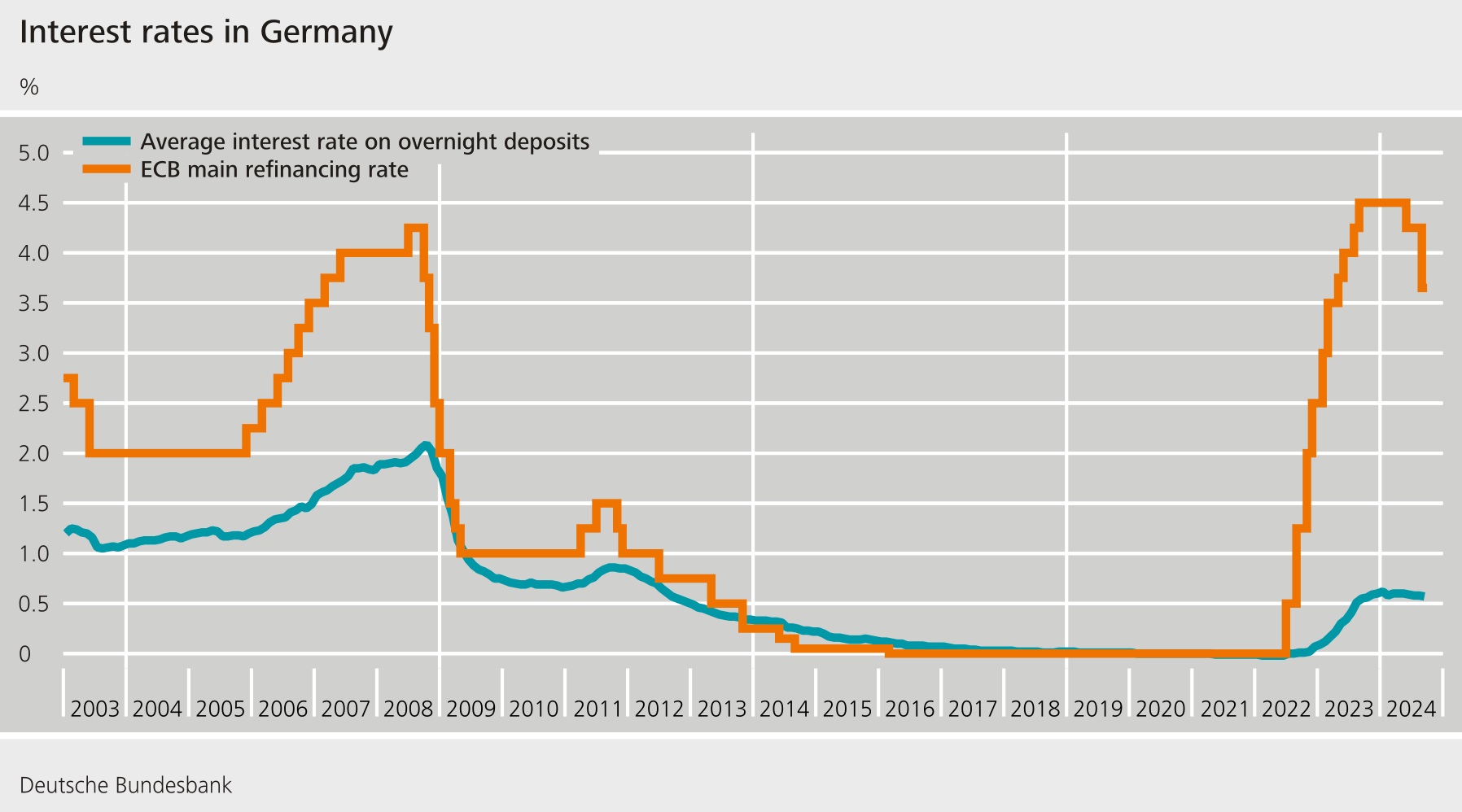

The banking sector generated high net interest income last year, not least because interest rates on overnight deposits were not raised as sharply as would have been expected based on past trends.[7]

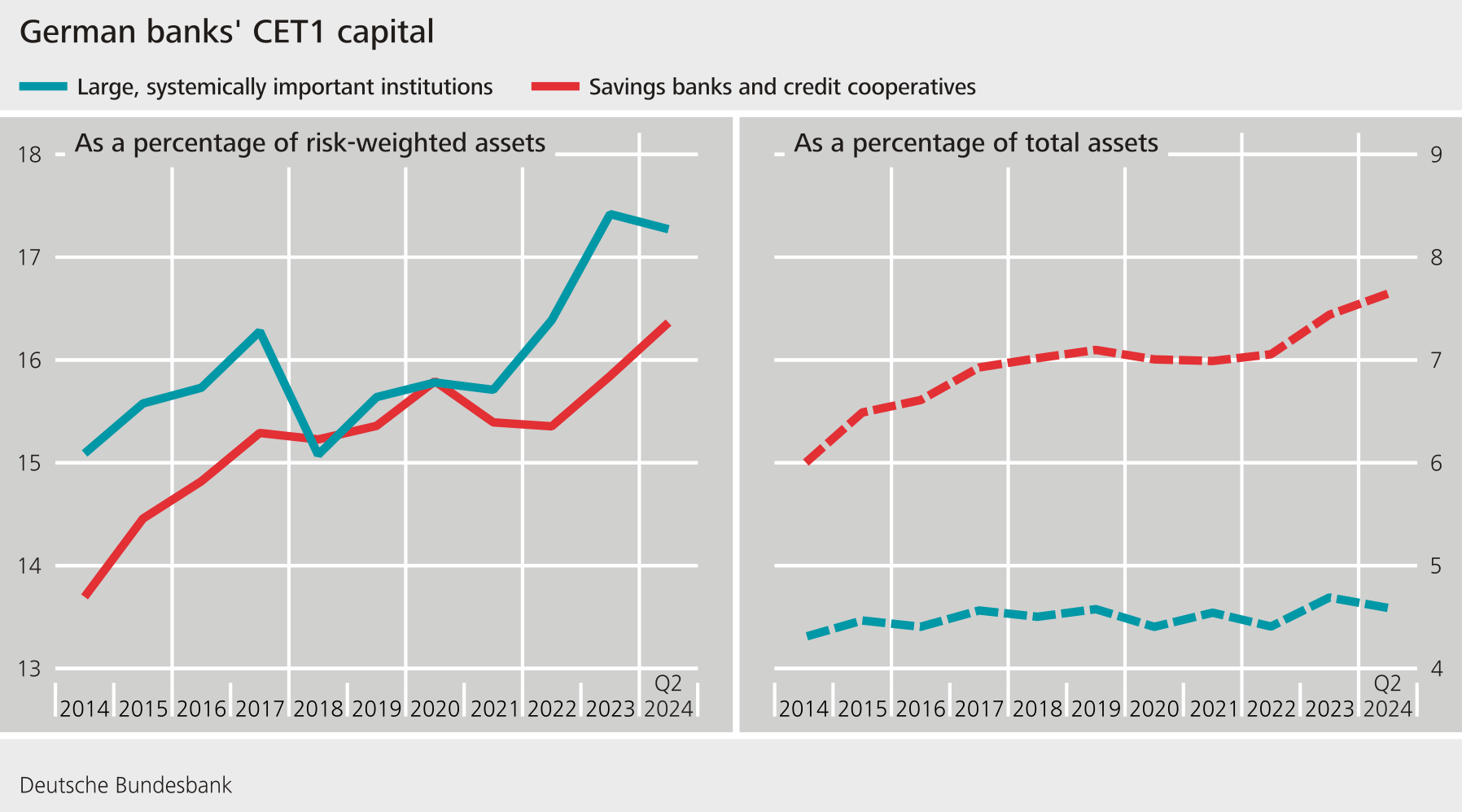

Banks’ capitalisation has improved steadily over recent years. The risk-weighted common equity tier 1 ratio of large, systemically important institutions stood at over 17% in the second quarter of 2024. That of savings banks and credit cooperatives came to around 16.5%.

While the high capital ratios point to a good level of resilience in the banking sector, banks must remain vigilant. Resilience might be overestimated on account of the continued presence of unrealised losses and due to low risk weights.

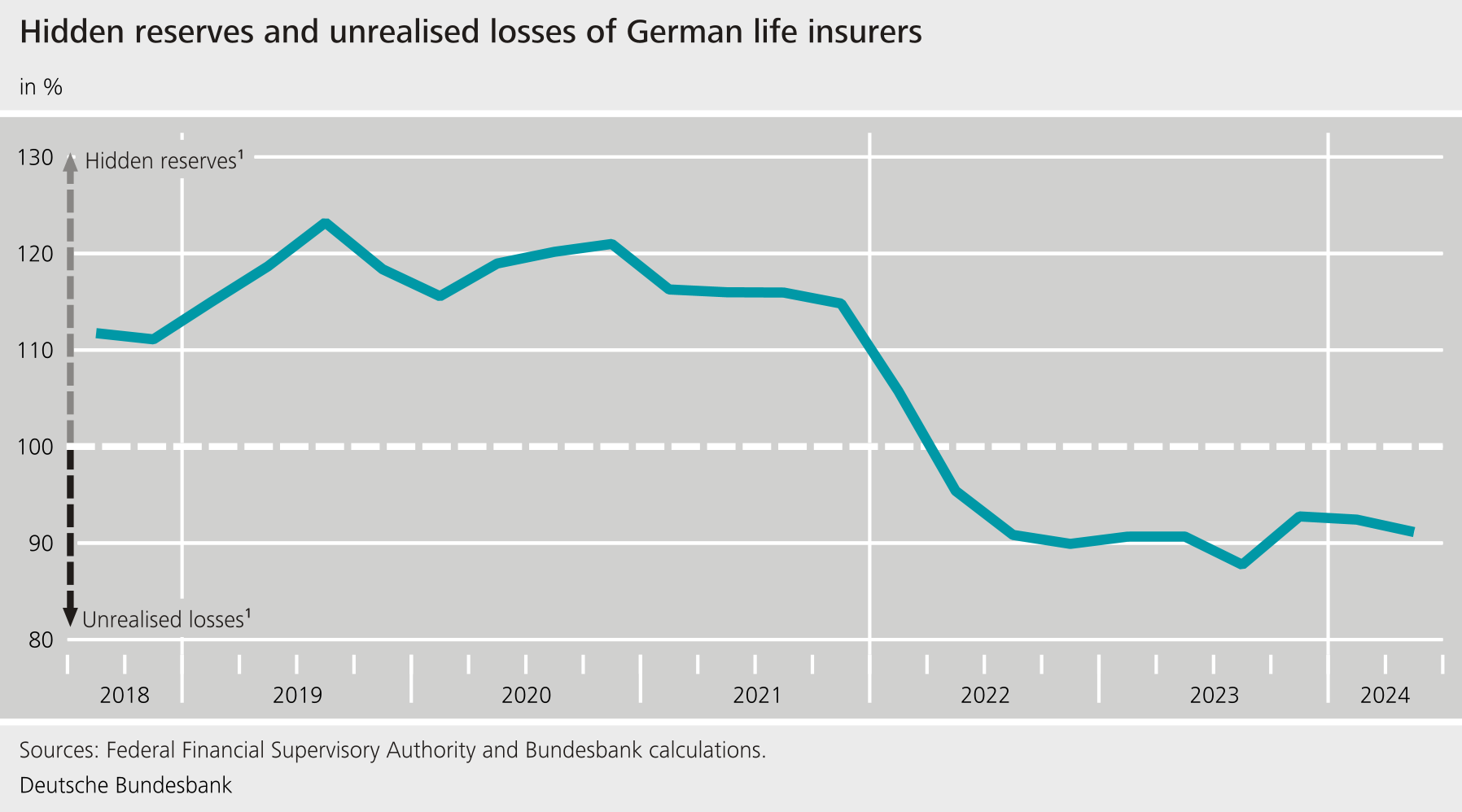

Like banks, German non-bank financial intermediaries – that is to say, investment funds, insurers, pension funds and other financial institutions – have weathered the rise in interest rates well. The rise in interest rates has left German life insurers with unrealised losses that are larger and decreasing more slowly than they are for banks due to the long maturities of the assets involved.

In the past, life insurers have invested countercyclically and put money in riskier bonds. Their behaviour served to stabilise the financial system. The unrealised losses have removed these incentives in many cases, as selling assets would mean realising those losses. That said, life insurers’ regulatory capital base remains sound.

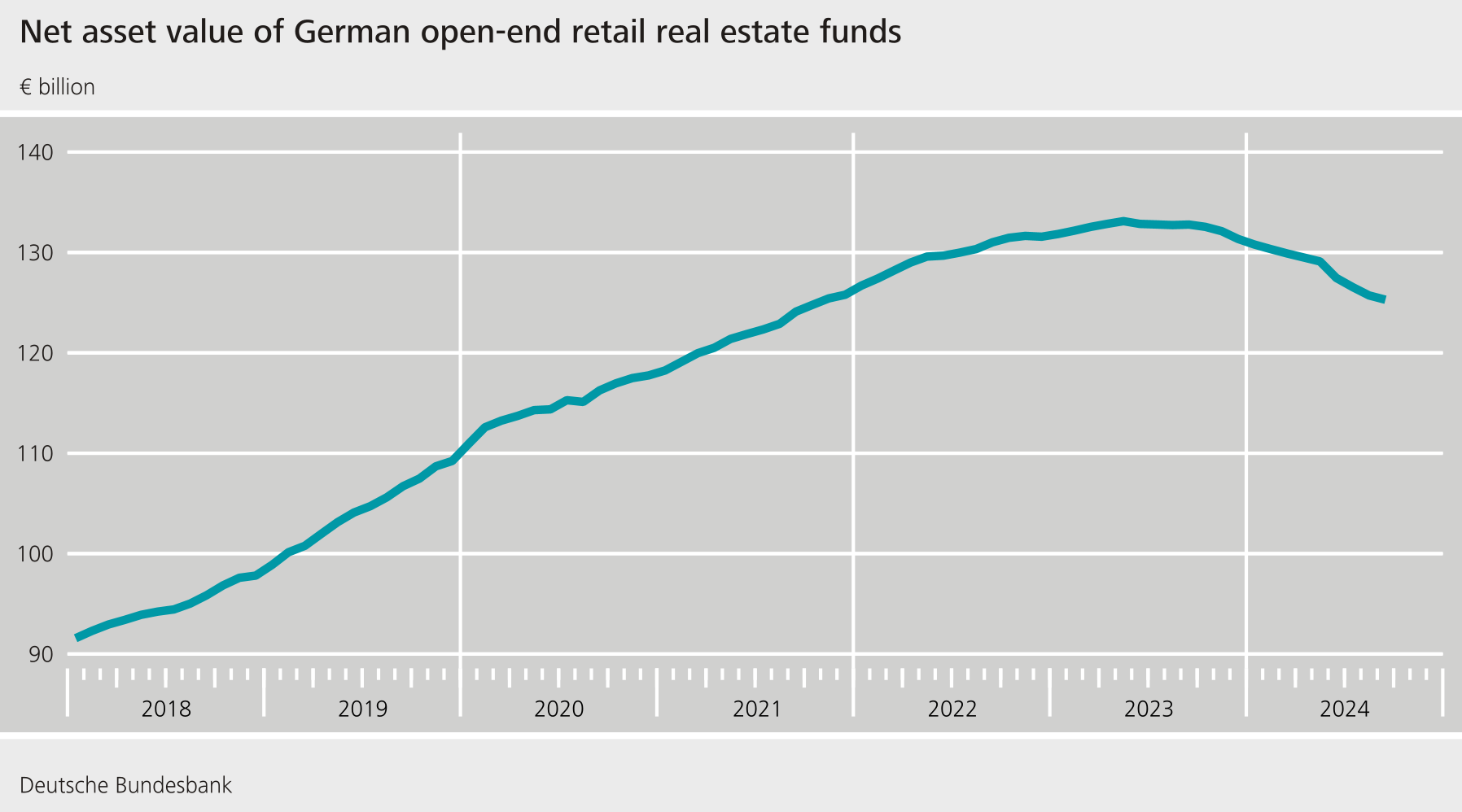

Developments in the commercial real estate markets are influencing German open-end retail real estate funds. As a rule, such funds have high liquidity risk. Most recently they have seen net outflows, with investors anticipating higher returns on alternative investments. This could accentuate negative developments in commercial real estate.

But liquidity risk is being kept in check by redemption notice periods and minimum holding periods.

A special article in this year’s Financial Stability Review examines government bond markets in Germany and Italy and shows that investment funds play an important role in price discovery and shock propagation in the financial system. The work is based on a joint project with the Banca d’Italia.

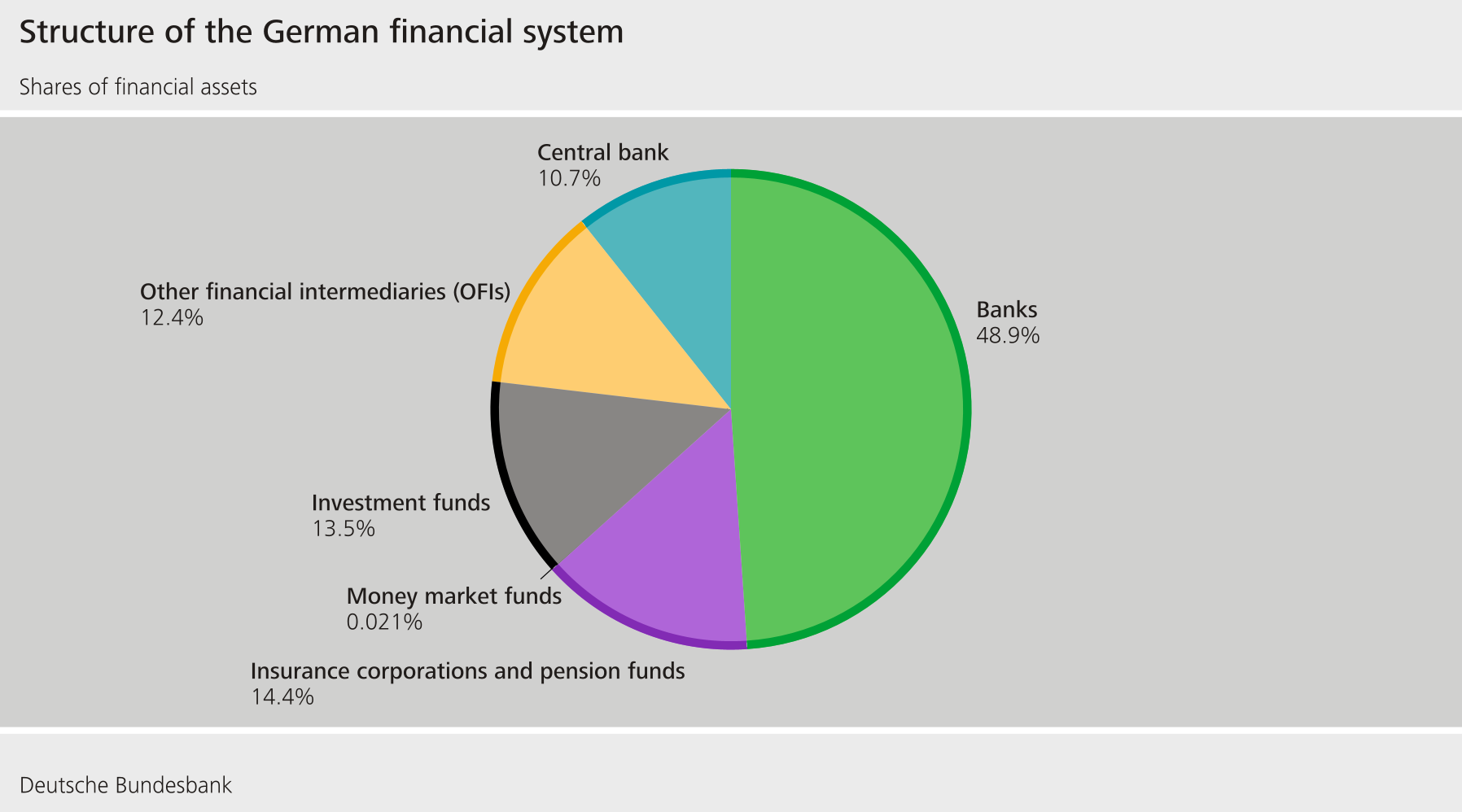

Structural change in the German and European financial systems has seen investment funds and other financial intermediaries that are not part of the banking sector become more important. The sector has experienced strong growth since the global financial crisis. Investment funds, insurers and pension funds as well as other financial institutions together hold around 40% of all financial assets in the German financial system – an increase of 15 percentage points since 2009.

Claims on this sector account for about 12% of German banks’ total assets. Interconnectedness means that losses in this sector can also impact the German banking system.

3 How will the German financial system fare in the future?

The financial system is facing acute challenges due to geopolitical tensions and a weak economy. The economy is also undergoing transformation. This is making supervisors more vigilant, particularly with regard to the commercial real estate sector.

As a result of good wage settlements, households have been able to increase their debt sustainability and are resilient.

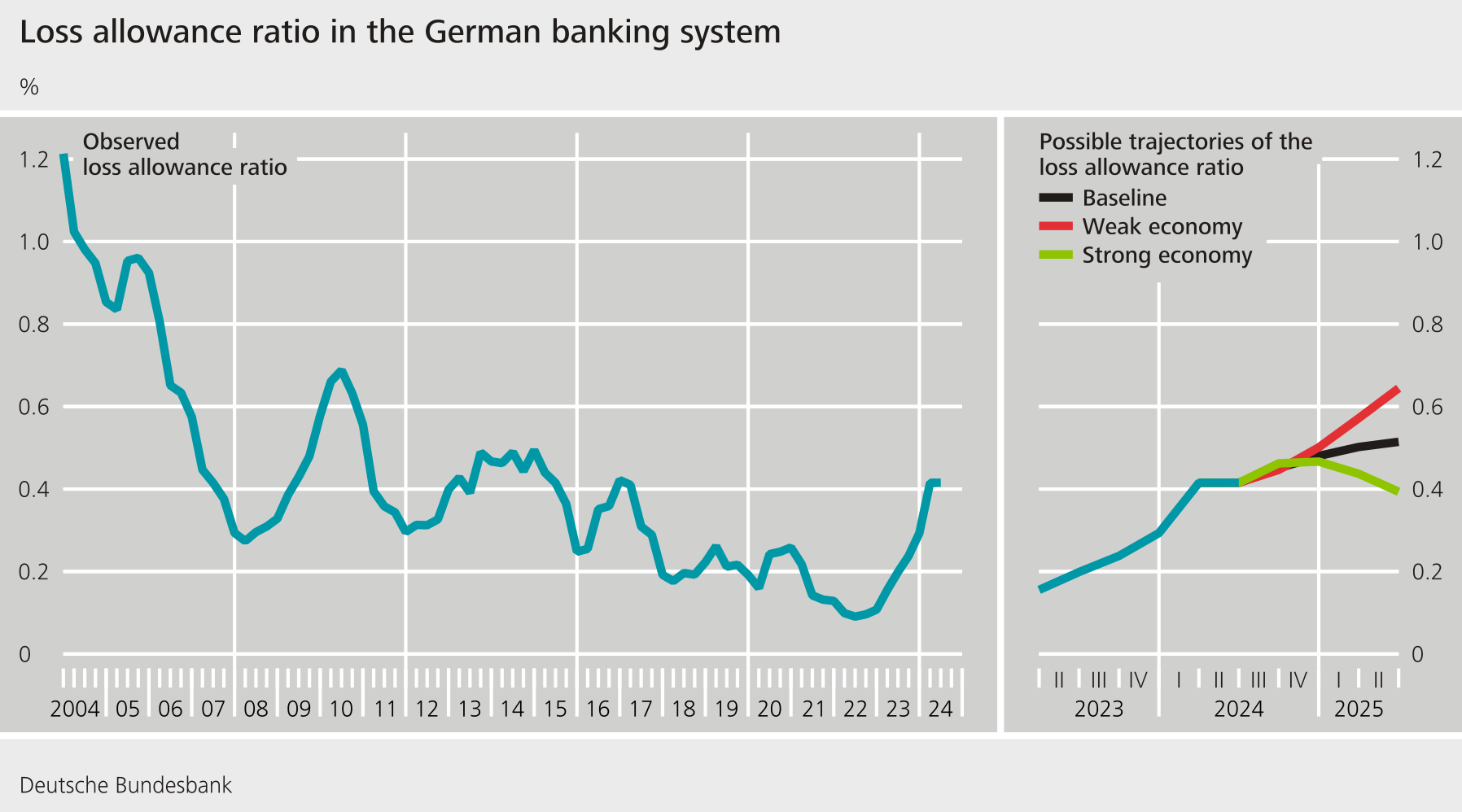

In recent quarters, banks have made significantly higher loss allowances for loans to households and non-financial corporations. According to an estimate by the Bundesbank, loss allowances could increase further in the coming quarters if economic activity were to weaken significantly.

Growing trade conflicts and market uncertainty, against a backdrop of greater political fragmentation in the global economy, may exacerbate the challenges facing the German financial system.

The commercial real estate market remains a source of elevated risk. In our view, the likelihood of prices falling further is very high.

Climate change also poses huge challenges for the economy and the financial sector. In another special article, we examine the impact of climate change on the German financial system. Overall, the effects still seem manageable at present.

Risks from geopolitical tensions remain high and may jeopardise the stability of the financial system. Banks should incorporate geopolitical risks into their scenarios and also prepare for very negative scenarios.

Since the outbreak of the Russian war of aggression against Ukraine, cyber attacks on the financial sector have increased significantly. So far, the damage inflicted has only been minor. However, attack surfaces are growing as the financial system becomes increasingly digitalised and IT networking becomes greater.

From the perspective of macroprudential supervision, what can we do now to support the resilience of the financial system?

The resilience of the banking system is adequate thanks to high capital reserves. Vulnerabilities are declining, but only gradually. The financial system weathered the phase of exceptionally strong rises in interest rates well overall. Given the overall risk situation, the 2022 package of macroprudential measures, containing the countercyclical capital buffer and the sectoral systemic risk buffer, remains appropriate.

Macroprudential supervision continues to evolve. It must retain its ability to take action, especially during periods of stress. The preventive orientation of macroprudential policy needs to be strengthened. Capital buffers that can be released by supervisors are an important instrument in this context. Thanks to the package of macroprudential measures, these are currently large. They can be drawn down in the event of disorderly developments, or a crisis. This reduces the likelihood of banks offering fewer loans during periods of stress.

Looking at the regulation of financial intermediaries in the non-bank sector, the macroprudential perspective should be strengthened. To achieve this, we need to be able to monitor developments in this sector more closely in order to identify risks. Foundations should be laid for a European and international exchange of information on non-bank financial intermediaries.

Finally, a reliable climate policy framework and disclosure requirements may reduce the risks to the financial system stemming from climate change. A globally coordinated approach is key, particularly in regard to climate change. Climate policy should have a long-term focus and avoid unexpected and immediate carbon price increases. A strict obligation to disclose information on carbon emissions will improve the distribution of capital and can mitigate the risks faced by the German financial system.

Market participants’ behaviour can have a decisive impact on liquidity conditions on the government bond market. Given the important role played by investment funds on the German government bond market, it is vital that we expand our insights into their strategies and behaviour.

4 Conclusion

There are a number of challenges ahead of us, then. Our top priority must be a resilient financial system.

This not only requires us to continuously monitor developments and identify risks in the financial system; we must also be in a position to adapt our macroprudential measures flexibly.

This is the only way to ensure that we can cope with the uncertainties of the future and safeguard the stability of our financial system in the long term.

Footnotes:

- See Deutsche Bundesbank (2023), Financial Stability Review.

- See Deutsche Bundesbank (2021), Monthly Report, February 2021.

- See Deutsche Bundesbank (2023), Financial Stability Review.

- See Federal Statistical Office (2024), Prices of residential property in the 2nd quarter of 2024: -2.6% year on year. First quarter-on-quarter price increase since 2nd quarter of 2022, press release of 20 September 2024.

- Comprising accommodation and food service activities, information and communication, healthcare, professional, scientific and technical activities, education, arts and other (economic) service activities.

- See Jordà, Ò., M. Schularick, A. Taylor (2016), Sovereigns Versus Banks: Credit, Crises, And Consequences, Journal of the European Economic Association, Vol. 14(1), pp. 45-79.

- For information on net interest income, see Deutsche Bundesbank (2024), Monthly Report, September 2024.