Digitalization, Competition, and Financial Stability Opening remarks prepared for the Seminar "Statistics on Fintech – Bringing Together Demand and Supply to Measure its Impact" organized by the Irving Fisher Committee (IFC) and the Bank Negara Malaysia (BNM)

Check against delivery.

I would like to thank Fabian Bichlmeier, Manuel Buchholz, Ulf von Kalckreuth, Matthias Köhler, Stephan Müller, Jens Reich, Joerg Stephan, Benjamin Weigert, Matthias Weiß, and Grit Winkler for their most helpful contributions and comments on an earlier draft. All remaining errors and inconsistencies are my own.

Digital innovations and improvements in information technology have the potential to significantly change the competitive structure of banking markets. They are transforming the way in which information is collected, processed, and analysed. FinTechs and BigTechs potentially have comparative advantages over banks in deploying big data techniques, artificial intelligence, machine learning, or social media data for credit scoring or risk assessments.

There are different channels through which digital innovations can impact banking markets, with different implications for competition and financial stability. Banks can develop new technologies in-house, FinTechs can provide specific financial services, or BigTechs can use their existing network structures to provide a large range of financial services to customers (FSB 2019). New market entrants may provide services to incumbent financial firms or cooperate with existing financial firms such as banks in order to offer new or enhanced financial products to customers. By providing services to incumbents, technology can be improved and costs can be reduced. But new market entrants may also target limited, high value added elements of the value chain of banks and financial firms.

Central banks have many reasons to take an interest in these developments as the structure of the financial system shapes the transmission of monetary policy. Central banks are providers of payment systems, and they contribute to banking and financial market supervision. Technological innovation in the financial sector thus affects central banks along many dimensions.

In this paper, I focus on another important mandate of central banks: financial stability. After the global financial crisis, central banks were assigned a crucial role in contributing to a stable financial system. According to the German financial stability legislation, for instance, the Bundesbank is a member of the national Financial Stability Committee and provides analytical inputs on the stability of the German financial system. For this purpose, the Bundesbank defines “financial stability” as a situation in which the financial system performs its key functions for the real economy in terms of allocating savings, investments, and risks as well as providing the infrastructure for the payments system. A stable financial system is not a source of shocks that destabilize the economy, nor does it excessively contribute to the amplification of shocks to the system. Vulnerabilities for the financial system can emerge through various channels: risks at large and systemically important financial institutions, a high degree of interconnectedness in the financial system, and common exposure to the same shocks. Enhancing the resilience of individual financial institutions through higher equity capital – and thereby also enhancing the resilience of the financial systems as such — has thus been a key objective of the post-crisis reform agenda.

Assessing the financial stability implications of digital financial services thus requires an understanding of how vulnerabilities emerge and how they change over time. This includes assessing the risks of individual institutions, connections with other institutions, and exposure to common shocks. In addition, to the extent that FinTechs and BigTechs change the value chains of financial activities and cooperate with several financial institutions, disruptions of these value chains might become systemic.

Obtaining reliable information on the activities of FinTechs and BigTechs from traditional statistics and reporting systems is difficult though. Given this patchy knowledge base, it is vital to monitor the resilience of financial institutions. Whether emerging vulnerabilities will ultimately endanger financial stability crucially depends on the resilience. It is interesting to note that some new providers of digital financial services, such as BigTechs, are not funded through deposits and are well capitalized. This may – a priori – mitigate financial stability concerns. Yet, if these companies venture into the realm of “traditional” financial services such as deposit-taking and lending business or innovatively bundle existing services and products to create a new product. In this case, FinTechs and BigTechs may assume the same or even higher risks as regulated financial institutions. Hence, assessments of resilience and of the related risks may change, which requires first and foremost adequate coverage of these institutions in official statistics.

This note discusses how digital innovations can be a catalyst for structural change in the financial system and affect the risk-stability trade off. It argues that better statistics are needed in order to improve surveillance. Better statistics help in addressing the “big data paradox” – while the benefits and challenges arising from digital innovation and better processing of data have been discussed at length, existing statistical systems provide little information for a structured surveillance of these trends. Results of a survey recently conducted by the Irving Fisher Committee (IFC) shows that central banks are closing data gaps and gathering data from FinTech infrastructure (such as crypto-assets exchanges) and service providers.[1] International cooperation is a key aspect here, and more work needs to be done with regard to the statistical business classification of FinTech firms.[2]

1 Digital innovations as a catalyst for structural change in the financial system

a) Drivers of market dynamics

Historically, structural changes in the financial system have been a consequence of the process of financial innovation in terms of new products or services, new production processes, or new organizational forms (Frame, Wall and White 2018; Frame and White 2014). Financial innovation has often had its roots in advances in the processing power of IT systems and lower costs for data storage (Beck, Chen, Lin and Song 2016). This has reduced transaction costs and information asymmetries, thus affecting a key function of banks in the financial system (Mishkin and Strahan 1999; Leland and Pyle 1977). Advances in IT infrastructure made it possible to manage large securities portfolios and led to the development of automated credit scoring models which inter alia facilitated the securitization of assets (Berger 2003).

In a similar vein, digitalization has the potential to change the competitive advantages of providers of financial services. New market entrants may have superior technologies for the screening of borrowers and thus lower information asymmetries (Dell’Arricia 1998; Dell’Arricia, Friedman and Marquez 1999). BigTech firms have access to a wide range of customer data, which may be used to improve risk assessments and the screening of borrowers (Frost, Gambacorta, Huang, Shin and Zbinden 2019). These advantages have been identified for FinTech lenders (Jagtiani and Lemieux 2018; Fuster, Plosser, Schnabl and Vickery 2018). Additionally, BigTech firms might be able to achieve economies of scale through network effects. As a result, business models of financial institutions that are based on the cross-subsidization of different types of services may come under pressure.

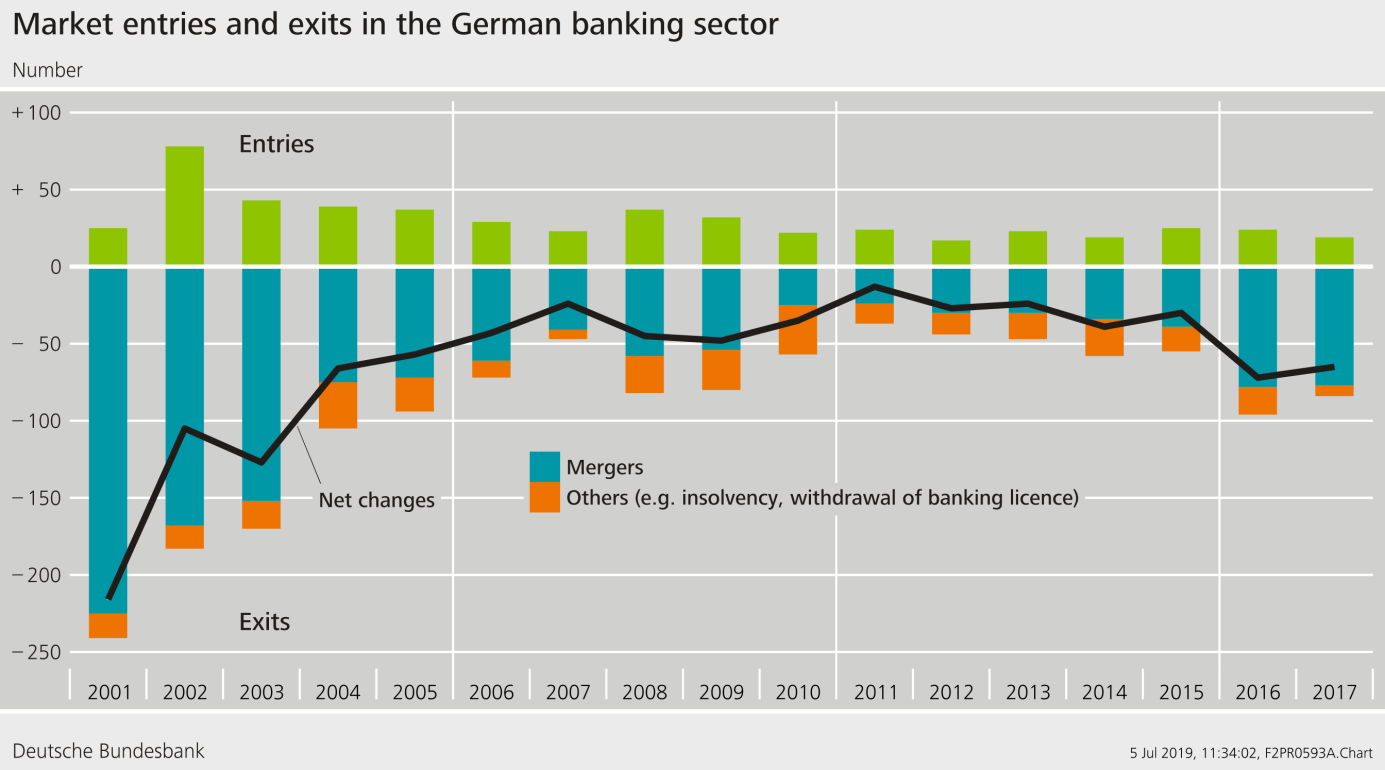

Forecasting how these trends will affect market dynamics in the financial services sector is difficult. In the past, entry into banking systems of advanced market economies has been rather limited due to strong market positions of incumbents and saturated markets. Exit has been driven primarily by mergers and acquisitions of smaller banks.

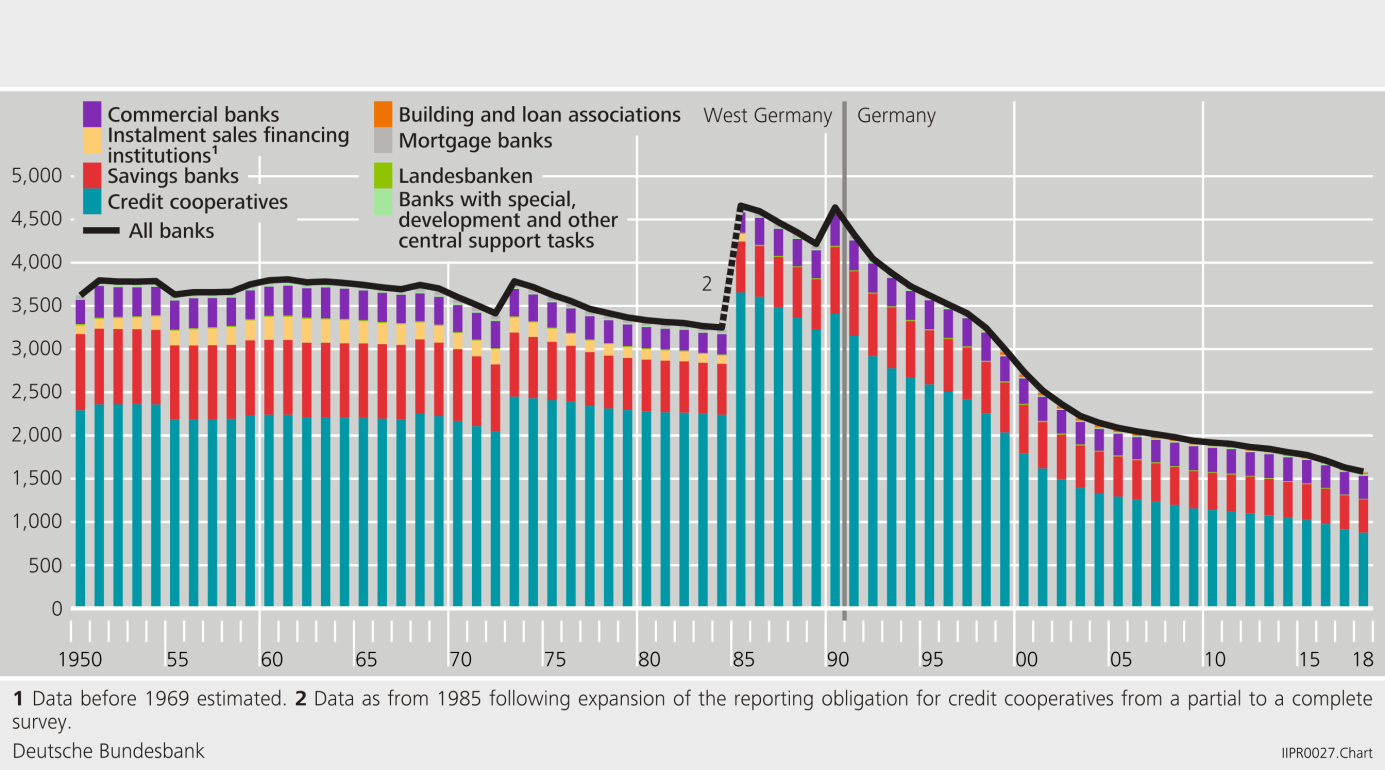

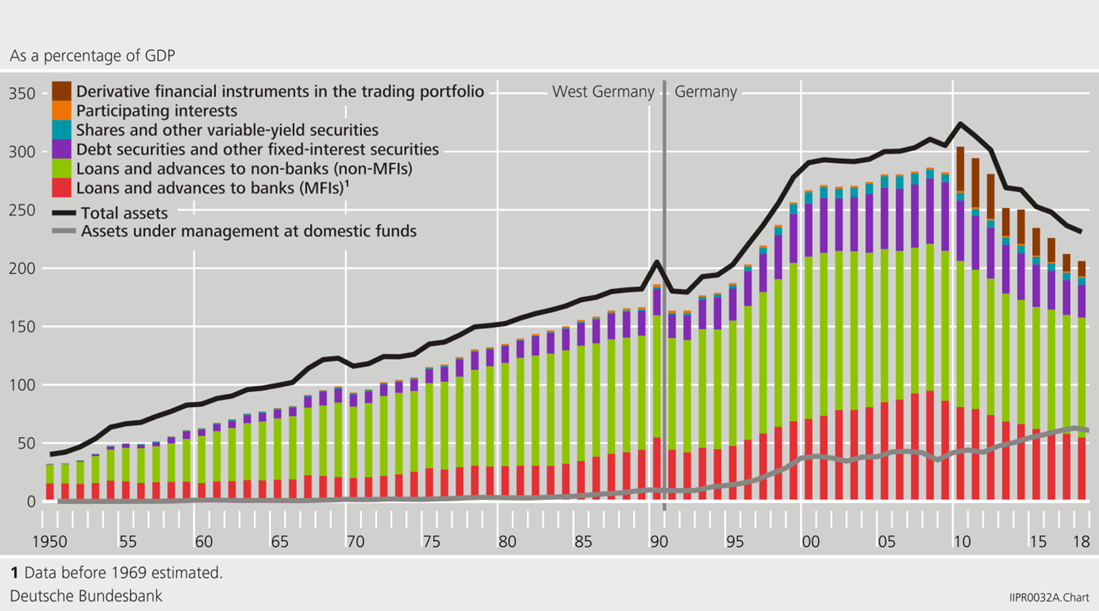

Take the German banking sector as an example. The number of banks in Germany has been in continuous decline over the past few decades (Figure 2), reflecting pressure to rationalize and cutting costs. Despite this shrinking of the market in terms of the number of institutions, the size of the German banking system in terms of total assets to GDP increased steadily until the global financial crisis (Figure 3). Following the financial crisis, large German banks, and in particular the Landesbanken, have scaled back their interbank activities and their foreign operations (Deutsche Bundesbank 2017).

Adjustment along the extensive margin shows some interesting patterns of entry and exit (Figure 4). In the past, there have been relatively few market entries, most of them – with a share of 60% – through foreign banks. Mergers among smaller banks have been the main exit channel. Implications for capacities in the banking sector have been limited though because the merged banks typically carry on conducting the business of the absorbed entities. Other exit channels, with potentially larger effects on overall capacities, have been more limited.

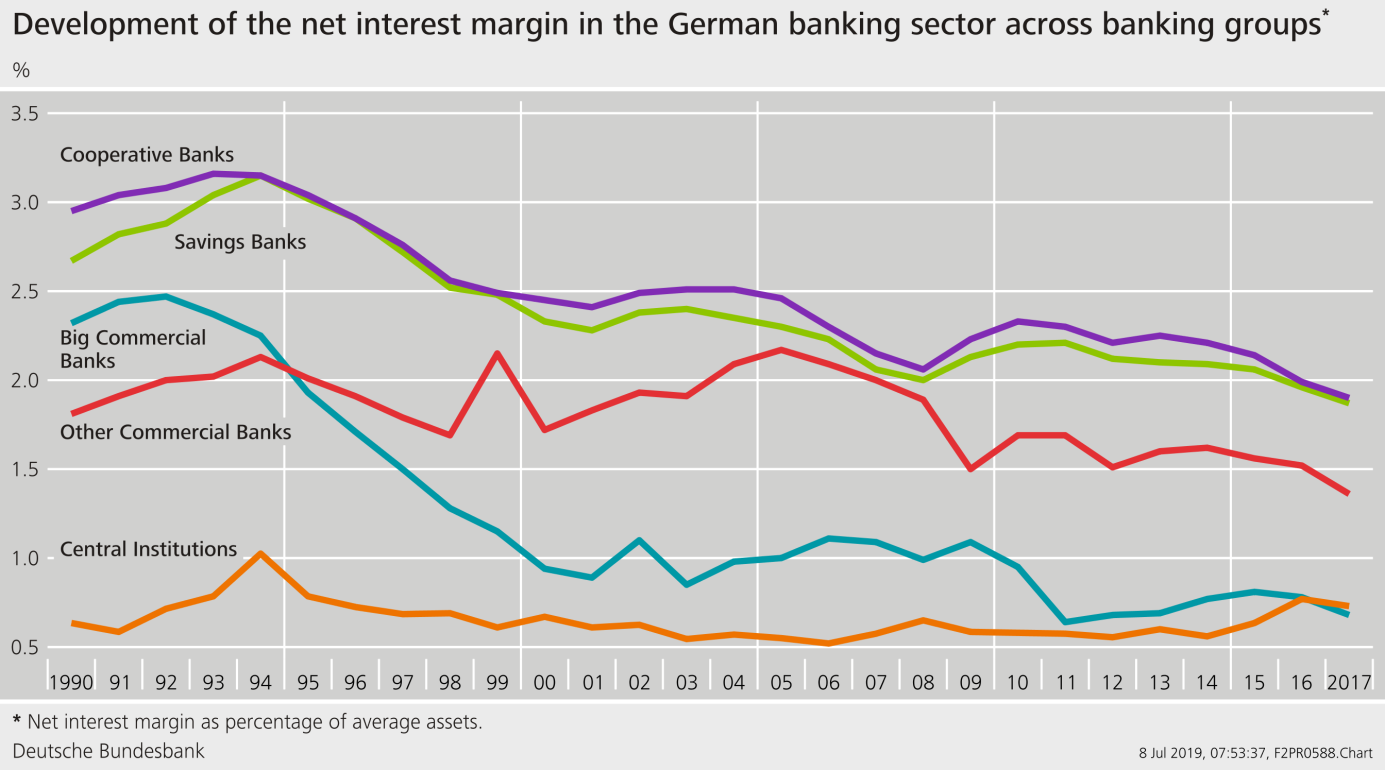

These trends have also had an impact on pricing and interest margins. Interest margins in the German banking sector have been narrowing steadily over the past decades (Figure 1). Recently, margins have come under pressure as it is difficult for banks to pass negative monetary policy rates on to customer deposits. However, low and declining profitability is not a recent phenomenon. Low interest rates rather aggravate structural pressure on bank profitability due to fiercer competition as a result of greater transparency, reduced switching costs, and the entry of new suppliers of financial services.

b) Implications for productivity

Increasing assets of financial institutions and thus financial deepening have been global phenomena, at least until the financial crisis. However, while the size of the global financial sector has grown significantly, it has not been one of the sectors that have innovated a lot. Relative to GDP, assets of German banks, for example, have increased from around 50% to more than 200% since the 1950s (Figure 2). Trends are similar for other banking systems. However, data for the past 150 years show that financial services in the US have been produced under constant returns to scale, with an annual average cost between 1.5% and 2% of outstanding assets (Philippon 2015). Bazot (2017) documents similar trends for European banks, albeit based on shorter time series. More recently, roughly since the global financial crisis, the costs of financial intermediation seem to have declined as a result of improved technology and increased competition (Philippon 2019).

The potential of banks to realize economies of scale and scope has been a recurring theme in the empirical literature. Recent research challenges the view that there are relevant economies of scale in banking. Instead, the systemic risk externalities that large banks pose to financial systems may outweigh cost advantages due to size. Funding cost advantages are a proxy for the implicit government subsidy accruing to systemic banks and thus the expected bailout that debt holders expect to receive (Siegert and Willison 2015). Banks’ expectation that they will be bailed out in case of distress may affect their behavior, and particularly increase their size and complexity beyond socially optimal levels. Estimates of economies of scale in banking find that the potential cost advantages are smaller than the costs to the macro-economy due to systemic risk and distorted incentives (Boyd and Heitz 2016). Once controlled for too-big-to-fail (TBTF) status, banks no longer benefit from economies of scale (Davies and Tracey 2014).

How digital innovations affect productivity in banking crucially depends on changes in the competitive structure of markets. As in other industries, the entry of new, more productive firms and the exit of incumbent, less productive firms, can be a channel for improvements in productivity.

This process of “creative destruction” is, however, constrained by the fact that financial institutions which are being restructured or are eventually resolved may pose threats to financial stability. Dynamics of entry and exit thus differ across banks and non-financial institutions: in the event of insolvency, liabilities of non-financial firms can be frozen, and the firm can be gradually restructured and, possibly, resolved. Applying standard insolvency procedures to banks is more difficult because of their short-term liabilities and the risk of runs and contagion effects. One core objective of post-crisis financial sector reforms has thus been to restore normal market functioning, inter alia, by introducing restructuring and resolution regimes for systemically important banks.

c) Implications for financial stability

Digital financial innovation and the entry of new providers of financial services may not only affect productivity and efficiency but may also have important consequences for financial stability. In financial services, unlike in other industries, increased competition may not be welfare enhancing (Corbae and Levine 2018). Instead, the link between competition and risk in banking is non-linear (Martinez-Miera and Repullo 2010): A low degree of competition generates monopoly rents which the bank manager wants to protect by investing in safe assets (Keeley 1990). Accordingly, risk would increase if competition becomes more intense. However, weaker competition also drives up interest rate costs, borrowers choose riskier projects, and banks become riskier (Boyd and De Nicoló 2005). If this mechanism dominates, increased competition would tend to lower risks of individual financial institutions.

Reflecting the opposing theoretical mechanisms, empirical studies find it difficult to establish a clear relationship between competition and risk, and the link between risk and competition depends on the type of bank and the type of risk considered (Freixas and Ma 2014).

Changing patterns of competition in the banking industry can have implications for financial stability that go beyond those for individual banks. Insufficient exit can lead to overcapacity and excessive risk-taking by weakly capitalized banks, weaken aggregate profitability, and limit banks’ ability to rebuild buffers following negative shocks. Generally, the link between competition and financial stability depends on the nature of the shock, risk-taking incentives at the level of the individual firm, and the overall structure of the banking system. In a highly concentrated banking system, dominated by a few banks, an idiosyncratic shock hitting a large financial institution can have repercussions for the entire system (granularity effects or “too big to fail”). But a decentralized and weakly competitive banking system populated by many small banks might also have destabilizing features. If many smaller banks are exposed to the same (macroeconomic) risks, this may create systemic instability as well (“too many to fail”).

How the entry of new firms and the use of new technologies in the provision of financial services affects financial stability is thus hard to predict. It depends on changes in the riskiness of individual institutions and on structural features of the financial system such as the degree of concentration, interconnectedness, and commonality in the exposure to shocks. Assessing the costs and benefits of new financial technologies is, therefore, conceptually difficult. Lack of data adds an additional layer of complexity: many new entrants and suppliers of financial services are hardly covered by official statistics on the financial sector.

This moves resilience against shocks and against mismeasurement of vulnerabilities to center stage. It is interesting to note that many BigTechs firms are quite well capitalized compared to banks. For example, ratios of equity to total assets are in the range of 30% for companies like Amazon or Apple or around 75% for Google or Facebook.[3] For comparison: The aggregate unweighted Tier1 capital ratio of banks is in the range of about 9% for US banks and 6% for euro area banks (CGFS 2018). Obviously, BigTechs are not banks – hence the funding structures and business models are not comparable.[4] Risk assessments must take into account the structure of asset portfolios, maturity structures, exposures to common shocks, or funding structures. Key to a surveillance of the emerging market for financial services and changing vulnerabilities is thus sufficiently detailed and granular information on all relevant actors.

2 Regulatory responses

Digitalization and increased competition through new market entrants is only one of the key trends affecting market structure. In addition, post-crisis financial sector reforms affect the competitive structure of banking markets: More stringent capital requirements, as a core reform element, aim at shifting activities towards better-capitalized banks. Policies reducing implicit subsidies for systemically important financial institutions (“ending too-big-to-fail”) affect the market power of banks that benefited from such subsidies. For reforms strengthening bank capital to be effective, they need to be accompanied by reforms of resolution frameworks which enable weak financial institutions to exit the market without adverse effects on financial stability.

At the same time, many regulatory discussions related to FinTech and BigTech center around entry regulations: Should the new suppliers of financial services face the same regulations and licensing requirements as incumbents? Or should regulators lower entry barriers to stimulate competition? Are regulatory “sandboxes” the solution?

Answering these questions requires, first and foremost, an assessment of the business models of new market entrants. If the characteristics of these firms resemble those of regulated financial institutions in terms of risk characteristics that justify regulation, regulation should adequately address those risks.

In addition, attention should focus not only on entry regulation and prudential requirements but also on exit regulation. If digital innovations catalyze structural change, the implications for market dynamics, productivity, and financial stability depend on the effectiveness of resolution regimes. The ongoing ex post evaluation of TBTF reforms by the Financial Stability Board (FSB) can be expected to provide useful insights as it assesses – inter alia – the effects of new resolution regimes.[5] The evaluation focuses on the implementation of reforms, their credibility and effectiveness in terms of coping with the failure of systemic banks.

Potential regulatory implications go beyond the prudential regulation of banks. How BigTechs will be able to enter the market for traditional banking activities will crucially depend on their ability to utilize customer data across different services. Close cooperation is thus needed between prudential regulators, competition authorities as well as data and consumer protection agencies. The use of new information technologies may increase the risks of cyber attacks, making necessary improved cyber-mapping, reporting, and – potentially – regulation.[6] Also, violation of privacy rules could be a concern if BigTech and FinTech firms provide banking services. Of course, appropriate privacy regulation are also required if traditional banks start providing services beyond traditional banking services.

Policy trade-offs may require coordination across different authorities. The new rules for the recovery and resolution of banks in Europe can serve as an example, as they explicitly address such trade-offs. The Bank Recovery and Resolution Directive (BRRD) is, in principle, distinct from competition law.[7] At the same time, its objective is to allow banks to be liquidated, and eventually resolved, without recourse to taxpayers’ money. If, however, financial stability is at risk, the BRRD allows for public support. Such permission is subject to stringent conditions that have to take into account the rules of EU competition policy.[8] Different authorities – resolution and competition authorities – therefore interact, each operating within their clearly defined mandates. Balancing the different objectives may, at times, seem cumbersome and bureaucratic. Well-designed regulatory measures can thus ensure that increased competition need not come at the expense of financial stability.[9]

From a macroprudential perspective, assessing the need for regulatory responses requires an understanding of markets and market structures. Ideally, decisions on regulations should be taken as part of a structured policy process (Buch, Vogel and Weigert 2018). Such a policy process involves four steps: defining policy objectives for macroprudential policies, choosing intermediate objectives and appropriate indicators, linking instruments to these indicators through ex-ante evaluation studies, and analyzing the effects of these policies through ex-post evaluation studies.

Having sufficient and reliable data early on is a key ingredient for such a policy process. Without good data, monitoring key indicators and assessing vulnerabilities is difficult, and there will be an insufficient basis for ex ante policy evaluation.

3 Better statistics for improved surveillance

Reliable statistics are the first ingredient in any discussion on regulatory responses to financial innovation from a macroprudential perspective. This presents a ”chicken-and-egg” problem: Decisions on (macroprudential) regulation – including the decision whether or not to regulate – require good and reliable data as an input into surveillance work. At the same time, data on financial institutions are traditionally collected within the context of (micro)prudential regulation and for monetary policy purposes. Hence, data would be collected after taking the decision to regulate.

One key policy response to digital innovations and new providers of financial services is thus to address what one may call the “big data paradox”: On the one hand, new technologies promise a better, faster, and safer provision of financial services and a more efficient use of data. On the other hand, financial regulators are struggling to understand the implications of digital innovations because there is hardly any consistent statistical information on how those innovations change market structures.

Following the financial crisis, new statistical projects have thus been launched that decouple monitoring from regulation and that satisfy the data needs of a wide range of policy fields. Within the European System of Central Banks, for example, AnaCredit (analytical credit datasets) and the Securities Holdings Statistics provide granular information that provides inputs for a large range of central banking tasks.There have also been several national and international initiatives aimed at closing data gaps regarding non-bank financial intermediation. The goal of these initiatives is to enhance the monitoring of risks by improving primary statistics on non-bank financial intermediation in financial accounts (ESRB 2019). Especially with regard to FinTech and BigTech, this requires both, defining the institutions that enter the industry and provide financial services as well as the definition of the services provided.

Currently, many statistics on the financial sector do not capture FinTechs as most are recorded as providers of non-financial services. Therefore, activities of these firms are not recorded systematically, and information on the riskiness of BigTechs and FinTechs is patchy. Currently, it is even difficult to obtain accurate figures on the total number of firms on the market or their market shares. Therefore, initiatives are needed to improve the statistical reporting on new financial activities, including information on activities, risks, and capitalization. Such initiatives also need to be coordinated globally.

The evolution of service provision by FinTechs and BigTechs is a particularly important issue for central banks. Essentially, all business areas are affected, including financial stability, prudential supervision, payments, markets, and monetary analysis. But data requirements go beyond immediate central banking tasks. Data on these firms is also needed in areas such as cyber security or competition policy. Hence, there is a need to monitor new trends, and this requires harmonized statistical definitions.

In order to close these gaps, a Working Group on FinTech Data Issues was set up by the IFC to take stock of existing data sources, identify data gaps, provide guidance on FinTech classification issues, and develop a way forward. In addition, the IFC has conducted a membership survey in 2019, which informs about approaches that central banks pursue with regard to FinTech data. The survey covers the current statistical infrastructure, “FinTech gaps” in statistics, FinTech data demands from a user perspective, ongoing initiatives to measure FinTech, and the role of international coordination. One of the main issues is that there is no clear definition of what “FinTech” and “BigTech” actually mean. The Financial Stability Board defines FinTech as a technologically-enabled financial innovation that could result in new business models, applications, processes or products with an associated material effect on the provision of financial services. This definition does not match easily with existing statistical concepts, and official data are often lacking.

A review of statistical classification systems such as the Central Product Classification (CPC) for products and the International Standard Industrial Classification of All Economic Activities (ISIC) shows that defining FinTech firms from a statistical point of view is challenging. FinTechs are currently in a state of "limbo" with regard to classification as they do not (yet) have a position in statistical classification systems. The IFC membership survey’s preliminary results suggest that this is one of the most important issues. For all definitions currently in use, including the FSB definition cited above, the two descriptors "innovative" and "technology" are essential. These concepts are not time-invariant. Thus, a firm that is labeled “FinTech” today may not be a “FinTech” firm ten years from now even if it continues to provide the same services, mainly because the technology will not be “new” anymore. One may be able to distinguish between FinTechs and other providers of financial or non-financial services, given the current state of financial technology, but these distinctions will not lead to partitions that are stable over time, in the way they need to for statistical classification purposes.

FinTech activities combine both, IT-driven business services as well as financial service. Strikingly, in a sample of 180 German FinTech firms,[10] von Kalckreuth and Wilson (2019) find that only 20% of these FinTech firms were classified as financial corporations in the Business Register of the Federal Statistical Office (Destatis). The other 80% are classified as non-financial companies of various sorts, mostly IT service providers. Though the quantitative size of German FinTechs is (still) small, that means that our statistical picture may be missing out the most dynamic elements of the financial sector landscape. This could potentially lead to statistical biases when measuring the size and growth of the financial sector as well as its value chains and thus its connectedness. Currently, dynamics in the FinTech sector are not being adequately captured by the financial sector statistics.[11]

Better coverage of FinTech requires close cooperation of national statistical institutes and central banks in coordinated data collection efforts. This is one of the key results of the IFC membership survey. There is a large variety of data collected by central banks, but the collection process is not harmonized at the international level. Therefore, a systematic exchange of experience and data is needed to make further progress in statistical recording of FinTech activity and providers of digital financial services more generally.

But there are also good news. The NACE classification is about to be revised. It is important that this revision, and possibly also a revision of the underlying ISIC, will adequately reflect the development of the financial sector by classifying FinTechs as financial enterprises.[12] This may require a discussion on how to adequately capture firms offering a mix of products and financial services.

In order to enable statistics to register and map financial activity in the economy, two ingredients are needed. First, identification of the key processes necessary to produce financial services. Second, a classification of activities and products as "financial”, no matter whether they are provided by a traditional financial institution or IT companies specialized in elements of the financial value chain. This will make statistical measurement immune to outsourcing and specialization within the financial industry and ensure flexibility with regard to future technological progress. Capturing financial services provided by BigTechs also requires that statistical reporting on the provision of financial services should not depend on the industry classification of a firm.

Monitoring FinTech services also requires new techniques for observing activities of financial and non-financial enterprises. A combination of traditional survey techniques and automated web scraping was recently used for the 2018 report on alternative finance platforms in Europe by the Cambridge Centre for Alternative Finance.[13] It remains to be seen how well digitalized data collection techniques can be fitted into the infrastructure of official statistics.

4 Summing Up

Undoubtedly, technological innovation can bring important improvements in productivity and convenience to the financial services industry. It serves as a catalyst for structural change and thus requires careful monitoring of market dynamics and implications for risk.

Going forward, I see four main priorities for regulators and supervisors:

First, improving the statistics database on providers of digital financial services is key. We need better data to assess risks, vulnerabilities, and resilience. Entry into the provision of financial services should be conditional upon the provision of sufficient data and information that allows regulators to make the necessary assessments of risks. A recent survey by the Irving Fisher Committee shows that the statistical infrastructure is not yet geared to this new phenomenon. There is a lack of shared concepts and data. Strong cooperation on the national and the international level will thus be needed, which is one of the priorities of future work in the IFC.

Second, activities should be regulated irrespective of the institution offering it. This should eliminate possibilities for regulatory arbitrage so that risks are not shifted from regulated sectors toward new market participants for which these rules do not apply. Hence, regulation of new market participants should follow the principle of “same risk, same rules”.

Third, speeding up structural change might be perceived as being excessively disruptive at the current juncture. It may be argued that testing the new resolution regimes too early could undermine the credibility of reforms. Yet, simply preserving the current market structures entails risks as well. Protecting the market shares of (large) incumbent financial institutions might counteract the reforms’ objectives to address the too-big-to-fail issue. The potential for harnessing efficiency gains may be squandered.

Fourth, close cooperation between regulators is needed. This includes international cooperation in case innovations can have cross-border implications. But cooperation is also needed between regulators such as competition authorities and financial regulators that have to assess and deal with relevant aspects of the same market.

5 References

Bazot, G. (2017). Financial Consumption and the Cost of Finance: Measuring Financial Efficiency in Europe (1950–2007). Journal of the European Economic Association 16(1): 123–160.

Beck, T., T. Chen, C. Lin, and F. Song (2016). Financial innovation: The bright and the dark sides. Journal of Banking & Finance 72: 28-51.

Berg, T., and J. Gider (2016). What Explains the Difference in Leverage between Banks and Non-Banks?. Journal of Financial and Quantitative Analysis 52: 2677-2702.

Berger, A. (2003). The Economic Effects of Technological Progress: Evidence from the Banking Industry. Journal of Money, Credit and Banking 35(2): 141-176.

Boyd, J. H., and G. De Nicoló (2005). The Theory of Bank Risk Taking and Competition Revisited. The Journal of Finance 60(3): 1329-1343.

Boyd, J. H., and A. Heitz (2016). The Social Costs and Benefits of Too-big-to-fail Banks. A “Bounding” Exercise. Journal of Banking and Finance 68: 251–265.

Buch, C. M., E. Vogel, and B. Weigert (2018). Evaluating Macroprudential Policies. ESRB Working Paper No 76. Frankfurt a.M..

Deutsche Bundesbank (2017). Financial Stability Review. November 2017. Frankfurt a.M..

Carletti, E., and A. Smolenska (2017). 10 Years On from the Financial Crisis: Co-Operation Between Competition Agencies and Regulators in the Financial Sector. OECD Directorate for Financial and Enterprise Affairs. Competition Committee. Working Party No. 2 on Competition and Regulation. DAF/COMP/WP2(2017)8. Paris.

Committee on the Global Financial System (CGFS) (2018). Structural Changes in Banking after the Crisis. CGFS Papers No 60. Basel.

Corbae, D., and R. Levine (2018). Competition, Stability, and Efficiency in Financial Markets. In: 2018 Jackson Hole Symposium: Changing market Structure and Implications for Monetary Policy. forthcoming.

Davies, R., and B. Tracey (2014). Too Big to Be Efficient? The Impact of Implicit Subsidies on Estimates of Scale Economies for Banks. Journal of Money, Credit and Banking 46 (s1): 219–253

Dell’Ariccia, G. (1998). Asymmetric Information and the Market Structure of the Banking Industry. IMF Working Paper No. 98/92. Washington DC.

Dell’Ariccia, G., E. Friedman, and R. Marquez (1999). Adverse Selection as a Barrier to Entry in the Banking Industry. The RAND Journal of Economics 30(3): 515-534.

Dorfleitner, G., L. Hornuf, M. Schmitt, and M. Weber (2017). FinTech in Germany. Springer, Heidelberg, New York, London.

European Systemic Risk Board (ESRB) (2019). EU Non-bank Financial Intermediation Risk Monitor 2019. Frankfurt a.M..

Financial Stability Board (FSB) (2019). FinTech and market structure in financial services: Market developments and potential financial stability implications. Basel.

Frame, S., L. Wall, and L. White (2018). Technological Change and Financial Innovation in Banking: Some Implications for Fintech. Federal Reserve Bank of Atlanta Working Paper 2018-11. Atlanta.

Frame, S., and L. White (2014). Technological Change, Financial Innovation, and Diffusion in Banking. The Oxford Handbook of Banking 2nd edn. Oxford.

Freixas, X., and K. Ma (2014). Banking Competition and Stability: The Role of Leverage. Tilburg University Discussion Paper 2014-009. Tilburg.

Frost, J., L. Gambacorta, Y. Huang, H. S. Shin, and P. Zbinden (2019). BigTech and the changing structure of financial intermediation. BIS Working paper. Basel.

Fuster, A., M. Plosser, P. Schnabl, and J. Vickery (2018). The Role of Technology in Mortgage Lending. FED New York. Staff Report No. 836. New York.

von Kalckreuth, U., and N. Wilson (2019). Towards integrating Fintech into statistical classification systems – a process oriented approach. Irving Fisher Committee Working Group on FinTech Data. Mimeo. Frankfurt a.M..

Keeley, M. C. (1990). Deposit Insurance, Risk, and Market Power in Banking. American Economic Review 80(5): 1183-1200.

Leland, H. E., and D. H. Pyle (1977). Informational Asymmetries, Financial Structure and Fi-nancial Intermediation. Journal of Finance 32(2): 371-387.

Martinez-Miera, D., and R. Repullo (2010). Does Competition Reduce the Risk of Bank Failure?. The Review of Financial Studies 23(10): 3638-3664.

Mishkin, F., and P. Strahan. (1999). What will technology do to financial structure?. NBER Working Paper 6892. Cambridge MA.

Philippon, T. (2015). Has the US Finance Industry Become Less Efficient? On the Theory and Measurement of Financial Intermediation. American Economic Review 105(4): 1408–1438.

Philippon, T. (2019). On Fintech and Financial Inclusion. Mimeo. New York.

Siegert, C., and M. Willison (2015). Estimating the Extent of the ‘Too big to fail’ Problem – a Review of Existing Approaches. Bank of England Financial Stability Paper 32. London.

Figures

Figure 1: Interest margins in the German banking sector

The graph depicts the size-weighted ratio of the net interest margin to total assets for different groups of banks. The net interest margin is defined as the difference between interest income and interest expenses. For the denominator the yearly average of total assets is used. Interest margins in the German banking sector have been narrowing steadily over the past decades. Recently, margins have come under pressure as it is difficult for banks to pass negative monetary policy rates on to customer deposits.

Figure 2: Number of Banks in Germany 1950-2018

The process of consolidation, which had been evident for some time, gained traction in the 1990s. This holds especially true for the cooperative bank sector with its very large branch network, as credit institutions set out to streamline costs. Momentum waned after the turn of the millennium, however. The aggregate number of institutions across all categories of banks shrank by more than half between 1990 and 2015. Advancing digitalisation has further eroded the importance of branches as a sales channel, while the pressure to reduce the cost base through economies of scale has fostered the spread of direct banking. The surge in 1985 can be ascribed to a one-off effect resulting from the expansion of data collection for credit cooperatives from a partial to a complete survey.

Figure 3: Assets of German Banks (1950-2018)

Deregulation in the 1990s enabled large banks, in particular, to expand. The upturn in capital market financing was chiefly driven by four sets of financial market promotion legislation in Germany. The third legislation, dating from 1998, had the greatest impact on the volume of bank debt issuance. The financial crisis brought to a halt a trend of financial market liberalisation, which had been unfolding since the 1990s. The spread of the subprime crisis to the money market in summer 2007 and the Lehman Brothers failure in September 2008 made it more difficult and more expensive for German banks to obtain finance on the interbank and capital markets. In particular, the Landesbanken and mortgage banks – categories of banks which had been hit hard by restructuring and resolution – saw their total assets contract. This contributed significantly to the decline in the aggregated total assets of the German banking system. Implementation of the German Act to Modernise Accounting Law (Bilanzrechtsmodernisierungsgesetz), which introduced accounting of derivatives in the trading portfolio, is driving the notable increase in the aggregated total assets of the German banking system in 2010. This caused a large rise in total assets, especially for the big banks and the Landesbanken.

Figure 4: Entries and exits in the German banking sector

In the past, there have been relatively few market entries, most of them through foreign banks. Mergers among smaller banks have been the main exit channel. Implications for capacities in the banking sector have been limited though because the merged banks typically carry on conducting the business of the absorbed entities. Other exit channels, with potentially larger effects on overall capacities, have been more limited.

- The IFC is a forum of central bank economists and statisticians that operates under the auspices of the Bank for International Settlements (BIS).

- The results of the IFC-survey on Fintech data will be summarized in a report and made publicly available on the BIS website (https://www.bis.org/ifc/publications.htm?m=3%7C46%7C94).

- These numbers are taken from Bloomberg and refer to the first quarter of 2019.

- See Berg and Gider (2016) for a discussion on the leverage ratios of banks and non-financial firms.

- Updated information on the evaluation, including consultative and final reports, will be available at: https://www.fsb.org/work-of-the-fsb/implementation-monitoring/effects-of-reforms/

- The G7 has, for instance, agreed on common principles for addressing cyber risks: https://www.bundesbank.de/en/tasks/topics/g7-countries-adopt-reports-on-cybersecurity-764644

- See item 7 of the European Commission’s Banking Communication 2013: “Financial stability remains of central importance in the Commission's assessment of state aid to the financial sector under this Communication.” Art. 107(3)b.

- BRRD, Art. 32(4)d: [an institution shall be deemed failing or likely to fail if] “extraordinary public financial support is required except when, in order to remedy a serious disturbance in the economy of a Member State and preserve financial stability […].”[…] “In each of the cases mentioned […], the guarantee or equivalent measures referred to therein shall be confined to solvent institutions and shall be conditional on final approval under the Union State aid framework.”

- In a similar vein, Carletti and Smolenska (2017) argue that viewing financial regulations through the lens of competition theory and enhancing cooperation between different authorities can be beneficial.

- Using a list of FinTech firms taken from Dorfleitner, Hornuf, Schmitt and Weber (2017), von Kalckreuth and Wilson (2019) could match 180 of the 433 firms on that list to entries in the Destatis Business Register.

- Data on the “use side” of FinTech by households and firms is also extremely scarce. In this regard, an ongoing household survey on credit platforms and robo-advice run by the Bundesbank may serve as a valuable prototype. First results are expected to be published at the beginning of 2020.

- Issues related to the classification of FinTech are discussed in von Kalckreuth and Wilson (2019).

- See Ziegler, Shneor, Gravey, Wenzlaff, Yerolemou, Rui and Zhang (2018: p. 19) on methodology.