January results of the Bank Lending Survey in Germany Banks barely tightened credit standards further

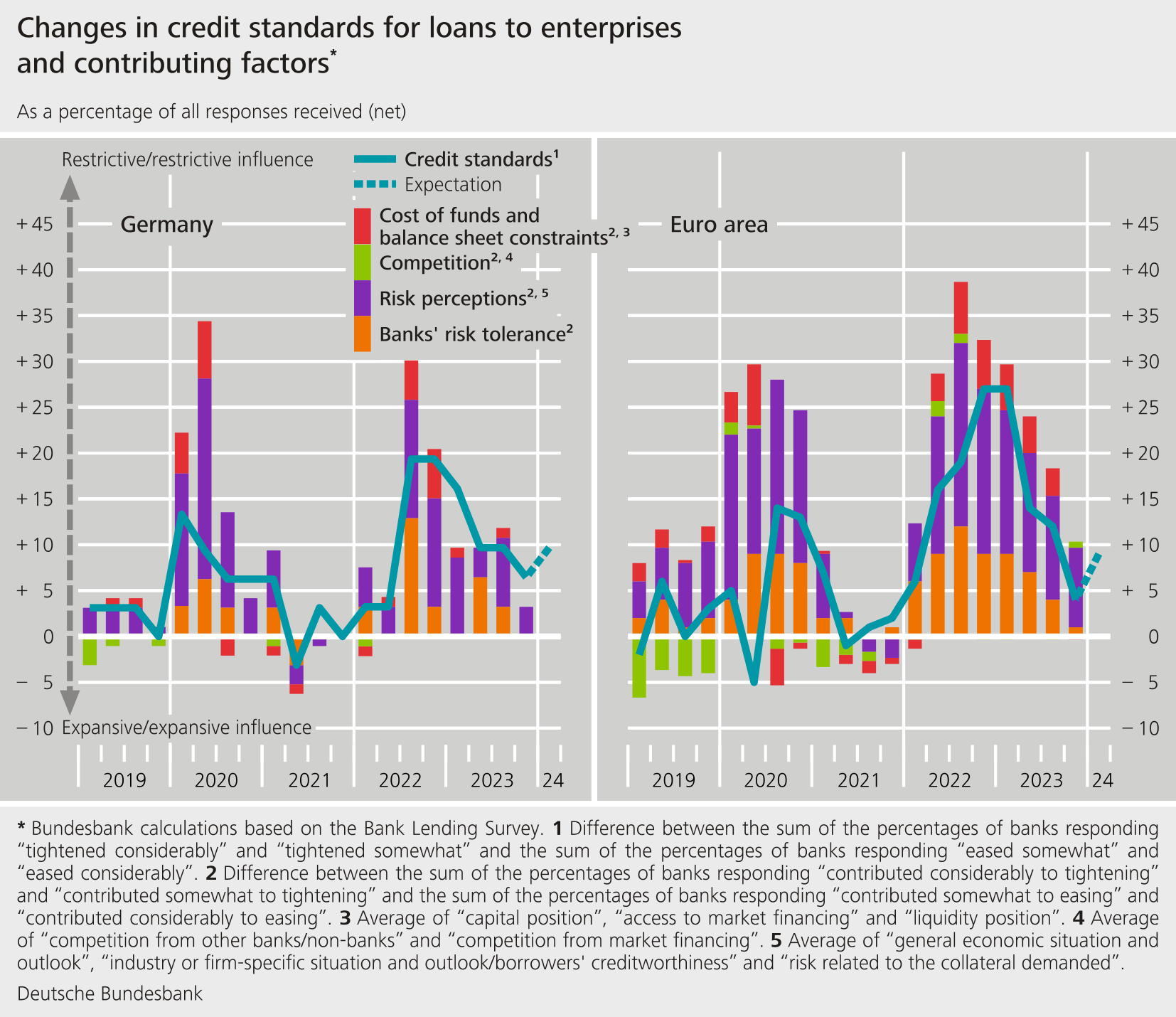

- The German banks responding to the Bank Lending Survey (BLS) barely tightened their credit standards for loans to enterprises, loans to households for house purchase, and consumer credit and other lending any further on balance in the fourth quarter of 2023.

- Only for loans to enterprises were credit terms and conditions tightened. This mainly affected covenants.

- Demand diminished once again in all three loan categories. Overall, however, the decline was smaller than in the previous quarters.

- The banks surveyed in the BLS expect that more comprehensive supervisory requirements will require them to tighten their credit standards over the next 12 months.

The BLS covers three loan categories: loans to enterprises, loans to households for house purchase, and consumer credit and other lending to households. On balance, the surveyed banks barely tightened their credit standards (i.e. their internal guidelines or loan approval criteria) any further. The net percentage of banks that tightened their requirements was +6% for loans to enterprises (compared with +10% in the previous quarter), 0% for loans for house purchase (compared with +4% in the previous quarter), and +4% for consumer credit and other lending (compared with +7% in the previous quarter). In all loan categories, the adjustments were somewhat smaller than the plans for the fourth quarter indicated in the previous survey round. Banks justified this tightening of their credit standards on the grounds of what they perceived to be elevated credit risk. For the first quarter of 2024, the banks are, on balance, planning to tighten their credit standards more noticeably again in all three loan categories. Here, credit risk is likely to continue to have a restrictive impact on the adjustment of credit standards owing to the tense economic situation and a decline in borrower creditworthiness. In addition, banks expect implementation of the seventh update of the Minimum Requirements for Risk Management (MaRisk) to necessitate a tightening of their credit standards.

On balance, banks tightened their terms and conditions (i.e. the terms and conditions actually approved as laid down in the loan contract) only for loans to enterprises. Covenants were tightened and margins on riskier loans increased.

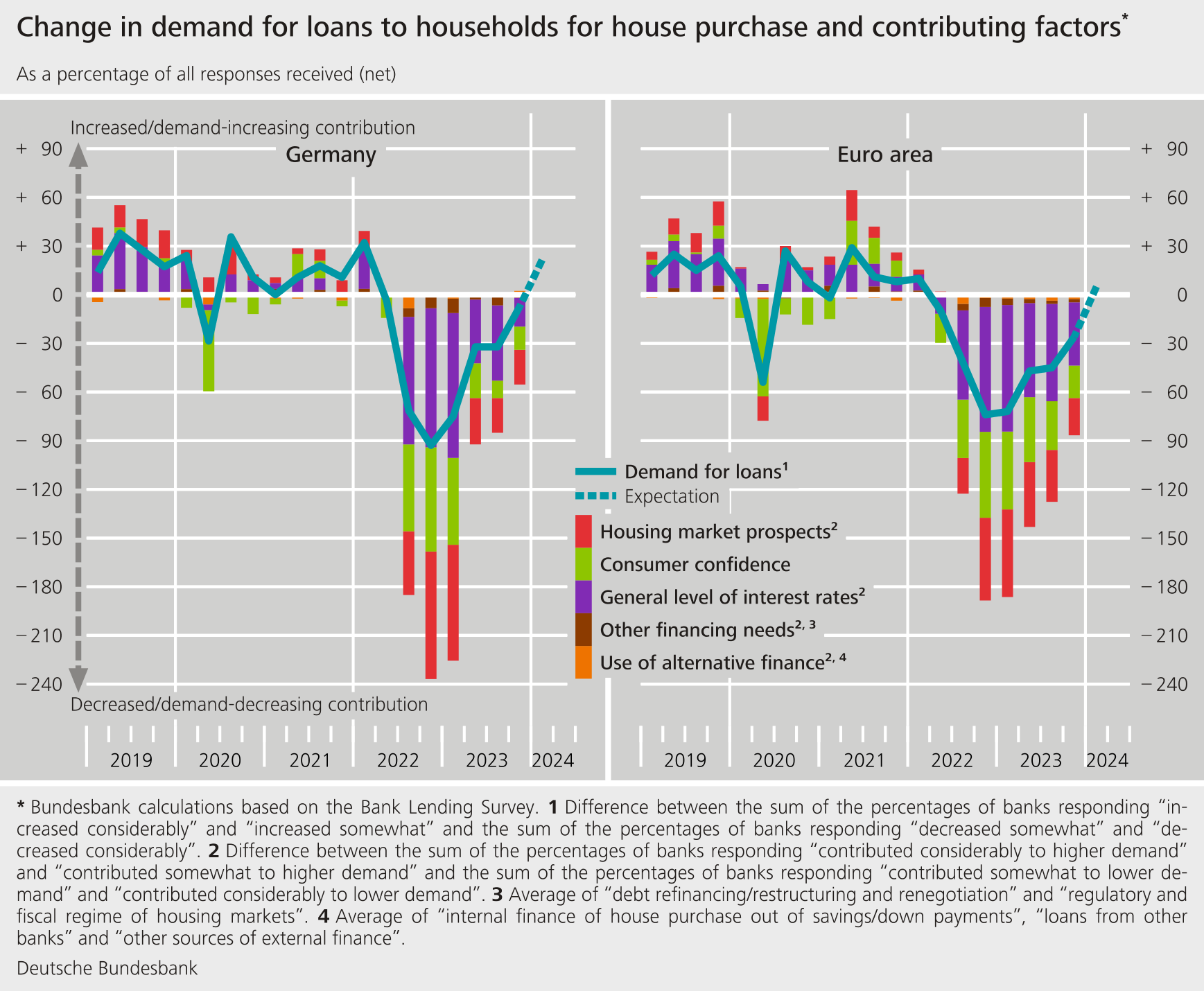

Demand for bank loans in Germany declined on balance once again in all three loan categories, especially for loans to enterprises. Overall, however, the decline was smaller than in the previous quarters. This was broadly in line with banks’ expectations for the fourth quarter. For the first time since the beginning of the monetary policy tightening cycle, the general interest rate level in all three loan categories was only the second most important factor in the decline in loan demand in Germany. Falling fixed investment was the most important factor behind the decline in demand for loans to enterprises. Financing needs for inventories and working capital had a broadly neutral impact overall on loan demand, as was already the case in the previous quarters.

Demand for loans to households for house purchase was dampened primarily by the housing market prospects, including expected house price developments. The loan rejection ratio rose once again in all loan categories. Over the coming three months, the surveyed banks expect a slight decrease in demand for loans to enterprises as well as for consumer credit and other lending to households. The banks are expecting a revival in demand for loans to households for house purchase, yet also emphasise the uncertainty associated with this expectation.

The January survey contained ad hoc questions on banks’ funding conditions, on the impact on banks’ lending policies of new regulatory or supervisory requirements relating to capital, leverage, liquidity and provisioning as well as questions relating to the impact of non-performing loans (NPLs) and other indicators of credit quality. It also contained a question on their credit standards and credit terms and conditions, and on demand for loans across the main sectors of economic activities. For the first time, a question was asked about the impact of excess liquidity on bank lending.

Against the backdrop of conditions in financial markets, the German banks reported virtually no change in their funding situation compared with the previous quarter. Only their access to deposits deteriorated.

Banks responded to new regulatory and supervisory activities by continuing to strengthen their capital position in 2023. Banks expect risk-weighted assets to increase, especially for average loans, over the next twelve months. In addition, banks expect that changes in supervisory and regulatory requirements will necessitate a tightening of their credit standards across all loan categories. For those banks in Germany under national supervision, this will probably reflect the implementation of the seventh update to the Minimum Requirements for Risk Management (MaRisk) which, since 1 January 2024, has required mandatory compliance with additional and, in some cases, stricter requirements for loan origination and monitoring. This also includes guidelines on sustainability. For SSM banks, the ECB has similar guidelines.

This is the first survey round in which the question on the NPL ratio (the stock of gross non-performing loans on the bank’s balance sheet as a percentage of the gross carrying amount of loans) relates to the NPL ratio including other indicators of credit quality. In the second half of 2023, the size of this composite indicator had a restrictive impact on the banks’ policies for loans to enterprises. For the first half of 2024, the banks are expecting their NPL ratios and other indicators of credit quality to have a more restrictive impact on their lending policies in all loan categories.

The tightening of credit standards for loans to enterprises was strongest in the real estate sector over the past six months. Commercial real estate loans were particularly affected. However, credit standards were also tightened for all other sectors surveyed, with the exception of services (excluding financial services and real estate). Alongside the real estate sector, this tightening was comparatively strong in construction (excluding real estate). By contrast, banks tightened their credit standards for retail and manufacturing to a lesser extent. For the next six months, too, banks expect the tightening for real estate loans to be stronger than for the remaining sectors.

The banks do not see developments in excess liquidity held with the Eurosystem as having had any meaningful impact on bank lending over the past six months. By their account, that is unlikely to change in the next six months.

The Bank Lending Survey, which is conducted four times a year, took place between 8 December 2023 and 2 January 2024. In Germany, 33 banks took part in the survey. The response rate was 100%.