January results of the Bank Lending Survey (BLS) in Germany Credit standards in all loan categories tightened

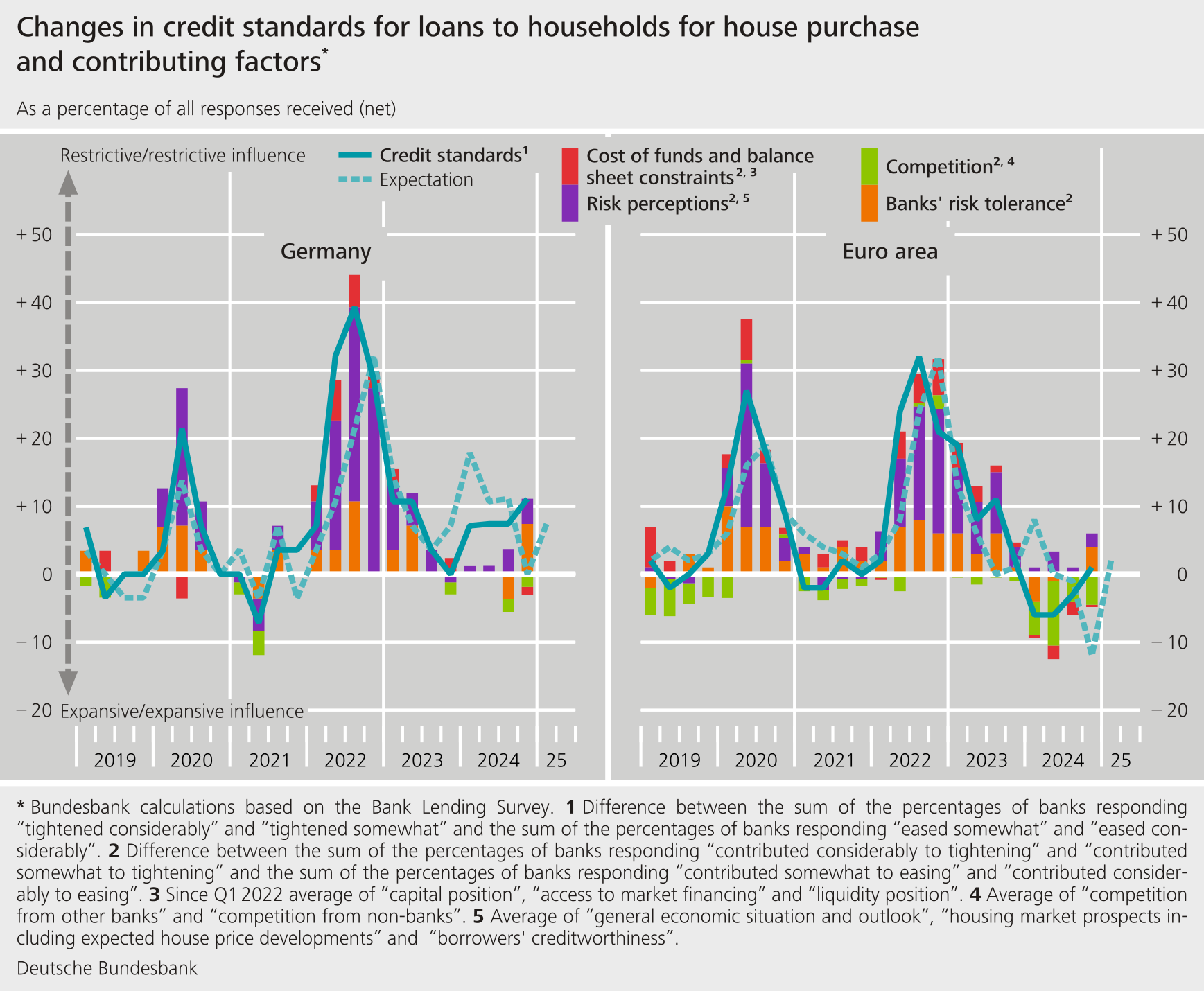

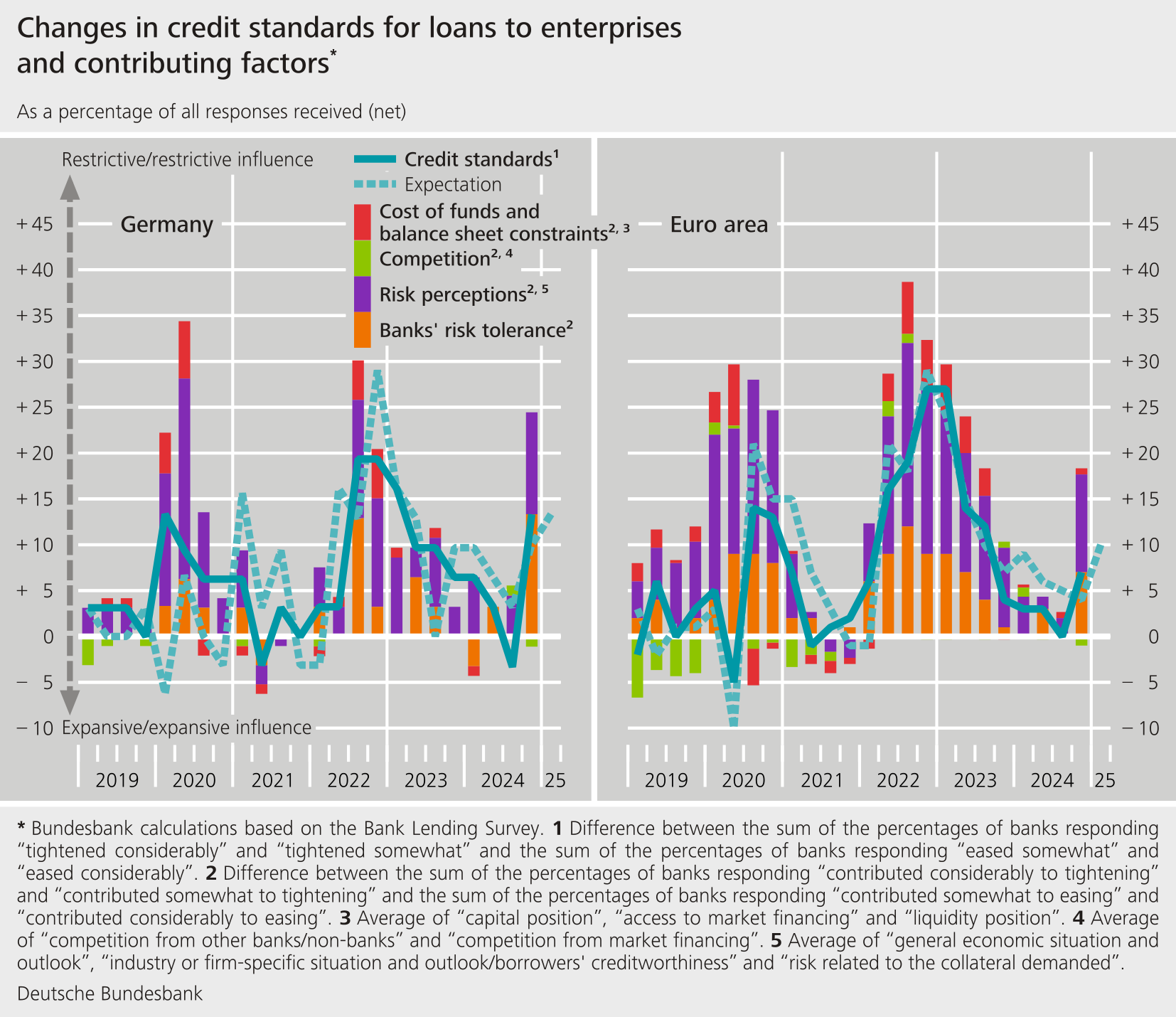

- The German banks responding to the Bank Lending Survey (BLS) tightened their credit standards in the fourth quarter of 2024. This applies to loans to enterprises and loans to households for house purchase, as well as to consumer credit and other lending to households. The banks’ primary rationale for tightening was that their risk tolerance had decreased and credit risk had increased.

- The surveyed banks tightened their terms and conditions for loans to enterprises overall but eased terms and conditions for loans to households for house purchase. On balance, they did not make any adjustments to consumer credit and other lending to households.

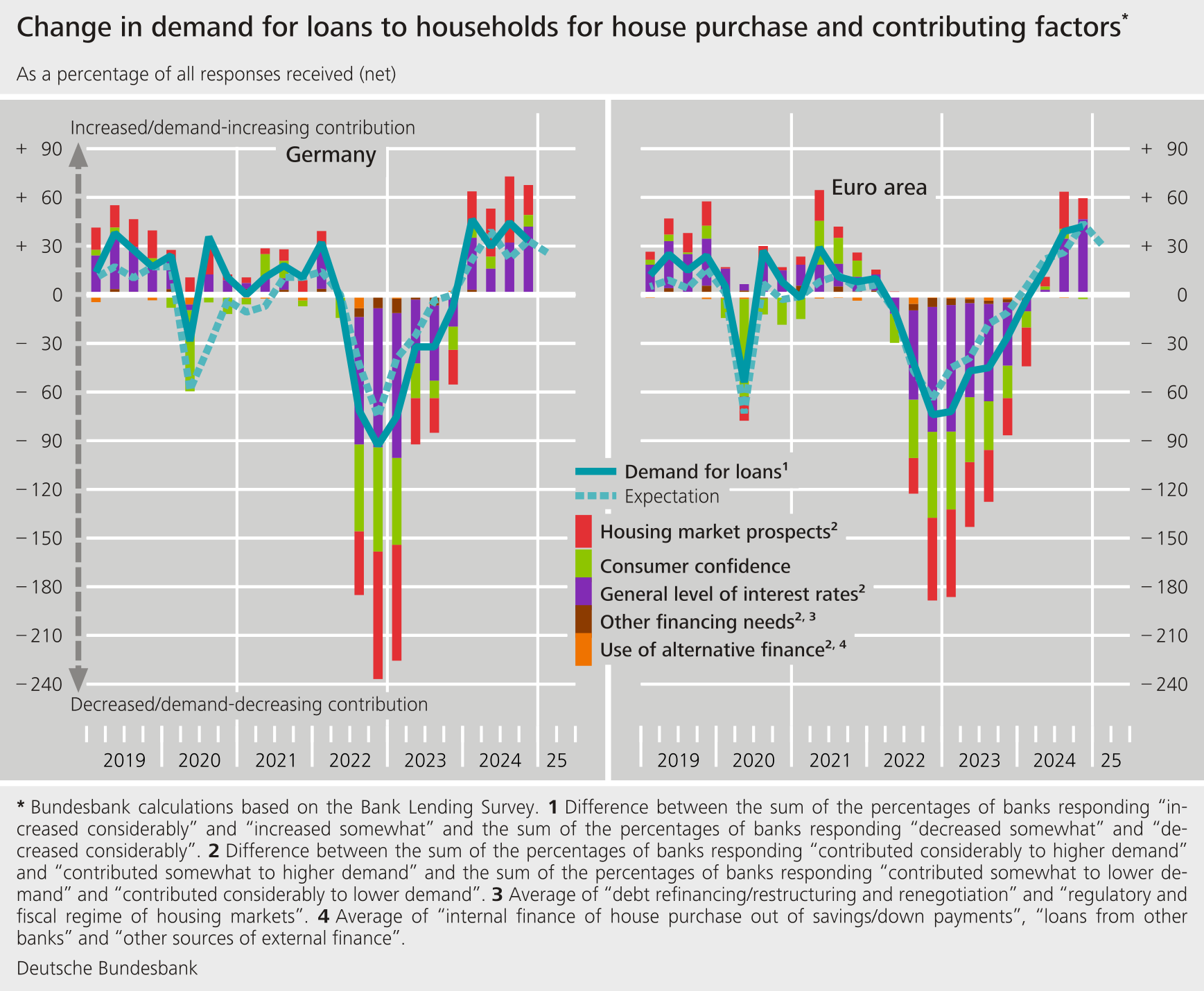

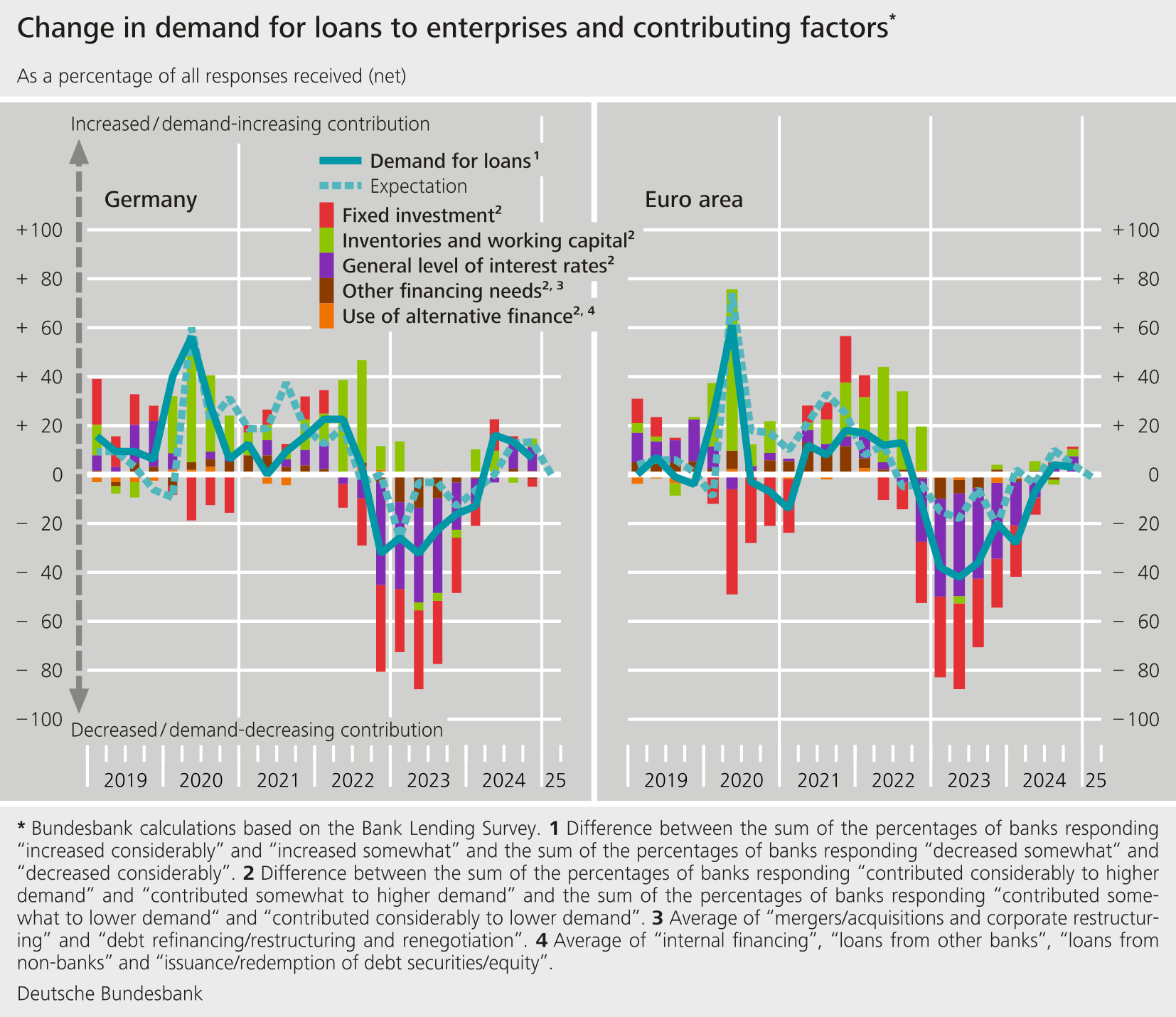

- Demand for loans continued to rise in all loan categories, especially loans to households for house purchase.

- The banks surveyed in the BLS expect that more comprehensive regulatory and supervisory requirements, particularly those created by the implementation of the Basel III reform package, will contribute to an increase in risk-weighted assets and require them to tighten their credit standards further over the next 12 months.

- The tightening of credit standards, terms and conditions for loans to enterprises was strongest for loans to the energy-intensive manufacturing industry, construction (excluding real estate) and the real estate sector over the past six months.

- The level of the non-performing loans (NPL) ratio and other indicators of credit quality had tightening effects on credit supply for loans to enterprises and for consumer credit and other lending to households over the past six months.

The BLS covers three loan categories: loans to enterprises, loans to households for house purchase, and consumer credit and other lending to households. On balance, the surveyed banks tightened their credit standards (i.e. their internal guidelines or loan approval criteria) in all three loan categories. The net percentage of banks that increased their requirements was + 13 % for loans to enterprises (compared with − 3 % in the previous quarter), + 11 % for loans for house purchase (compared with + 7 % in the previous quarter), and + 11 % for consumer credit and other lending to households (compared with + 15 % in the previous quarter). The tightening of credit standards for loans to enterprises and for consumer credit and other lending was broadly consistent with what the banks had planned in the previous quarter. For loans to households for house purchase, the banks had not planned any adjustments.

The banks’ primary rationale for tightening in all loan categories was that their risk tolerance had decreased and credit risk had increased for both loans to enterprises and loans to households. This assessment relates to the general economic situation, but also to category-specific factors. For example, sector-specific and firm-specific factors played a major role in loans to enterprises. With regard to loans to households for house purchase, a deterioration in the banks’ assessment of the residential real estate market outlook had an impact, while the decrease in households’ creditworthiness had a tightening impact on consumer credit and other lending. For the first quarter of 2025, the banks are planning to tighten their credit standards further. Here, credit risk is likely to continue to have a restrictive impact on the adjustment of credit standards owing to the tense economic situation and a decline in borrower creditworthiness. In addition, banks expect implementation of the Basel III reform package to necessitate a tightening of their credit standards.

On balance, banks tightened their terms and conditions (i.e. the terms and conditions actually approved as laid down in the loan contract) only for loans to enterprises. In doing so, they expanded margins irrespective of creditworthiness. In addition, they reduced the average size of loans, demanded more comprehensive collateral and applied tighter standards to covenants. As in previous survey rounds, the banks were able to meet their customers’ needs with regard to interest rates. Terms and conditions for loans to households for house purchase were eased, on the whole. The expansionary adjustments are the outcome of reduced lending rates and lower margins irrespective of credit ratings. On balance, banks did not make any adjustments to consumer credit and other lending to households.

The surveyed banks reported that demand for bank loans in Germany had risen overall in all loan categories in the fourth quarter of 2024, especially loans to households for house purchase. This was largely due to the lower general interest rate level. In addition, the banks reported that households believed that the outlook for the residential real estate market had improved further. The current increase in demand for loans to enterprises was only weak, thus falling short of the banks’ expectations from the previous quarter. Following increases in demand in the previous two quarters in which fixed investment had still played a role, small and medium-sized enterprises, in particular, were reluctant to request loans for this purpose. The high degree of uncertainty regarding the economic and (geo)political situation is likely to have contributed to this.

Loan requests and applications from firms were again rejected at a higher rate than previously. The loan rejection rate rose among small and medium-sized enterprises, in particular. The rejection rate also increased for consumer credit and other lending to households, but remained unchanged for loans for house purchase. For the first quarter of 2025, the banks expect firms’ demand to remain unchanged. In their lending business with households, they expect a renewed increase in funding needs, especially in the area of residential real estate financing.

The January survey contained ad hoc questions on banks’ funding conditions, on the impact on banks’ lending policies of new regulatory or supervisory requirements relating to capital, leverage, liquidity and provisioning as well as questions relating to the impact of non-performing loans (NPLs) and other indicators of credit quality. In addition, a question was asked about credit supply and demand for loans across main sectors of economic activities, along with a question on the impact of excess liquidity on bank lending.

Against the backdrop of conditions in financial markets, German banks reported virtually no change in their funding situation compared with the previous quarter. Banks responded to new regulatory and supervisory activities by continuing to strengthen their capital position in 2024. Banks expect risk-weighted assets to increase, especially for average loans, over the next twelve months. In addition, banks expect that changes in supervisory and regulatory requirements will necessitate a tightening of their credit standards across all loan categories. This is likely to reflect, in particular, the new rules on the calculation of risk-weighted assets under the Basel III reform package. Published in June 2024, this package is made up of the revised Capital Requirements Regulation (CRR) and the revised Capital Requirements Directive (CRD).

In the second half of 2024, the level of the NPL ratio (the stock of gross NPLs on the bank’s balance sheet as a percentage of the gross carrying amount of loans) and other indicators of credit quality had restrictive effects on credit supply for loans to enterprises and on consumer credit and other lending to households. For the first half of 2025, the banks are expecting the NPL ratio and other indicators to continue having such a restrictive effect.

The tightening of credit standards for loans to enterprises was strongest for loans to the energy-intensive manufacturing industry, construction (excluding real estate) and the real estate sector over the past six months. However, all other sectors surveyed – with the exception of other services – also saw further tightening. Over the next six months, the banks are expecting further tightening in almost all surveyed economic sectors, the exception being easing in other services. Banks are planning to tighten the most in the manufacturing sector, particularly in the energy-intensive manufacturing industry, and in the real estate sector (mainly commercial real estate). Firms’ demand for loans, according to the banks’ assessment, rose only in the real estate sector in the past six months; this only applied to residential real estate, however. Meanwhile, demand for commercial real estate declined slightly. Demand also declined in the other major economic sectors. In the second half of 2024, firms’ funding needs were lower than in the first half of the year, especially in manufacturing and construction (excluding real estate). For the coming six months, the banks are anticipating a further rise in firms’ demand only in the residential real estate sector. By contrast, they expect hardly any changes in demand for loans in the other sectors of the economy.

The banks do not see developments in excess liquidity held with the Eurosystem as having had any impact on bank lending over the past six months. By their account, that is unlikely to change in the next six months.

The Bank Lending Survey, which is conducted four times a year, took place between 10 December 2024 and 7 January 2025. In Germany, 33 banks took part in the survey. The response rate was 97 %.