Bundesbank survey: Widespread acceptance of digital euro among general public

Many people in Germany are open to the idea of the digital euro. At the same time, there are still gaps in the general public’s knowledge about the planned new means of payment. These are the results of a recent representative survey of 2,012 people conducted by forsa, a market research and opinion polling company, on behalf of the Deutsche Bundesbank in April 2024.

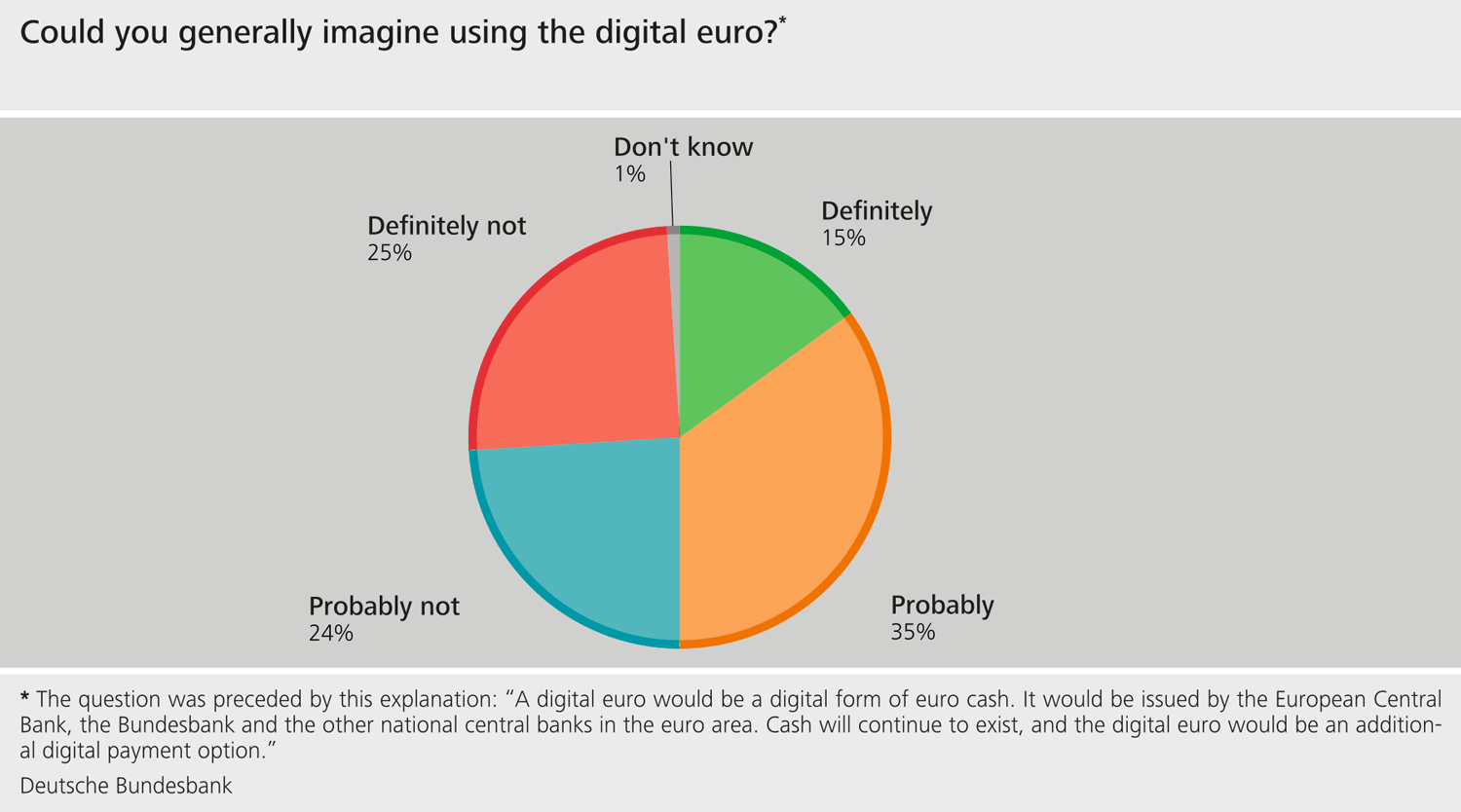

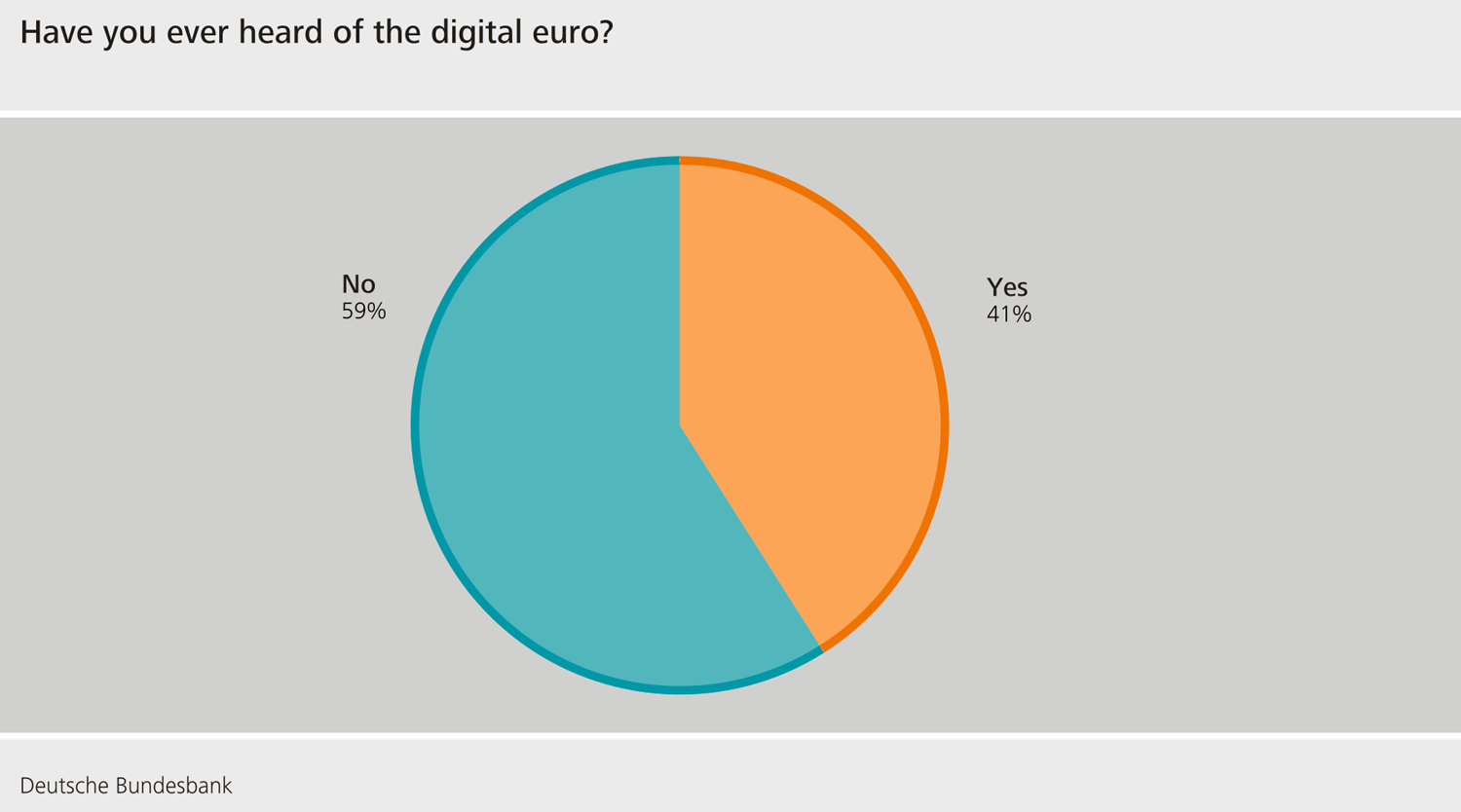

The survey showed that half of the respondents could generally imagine using a digital euro as an additional payment option. People who were previously unaware of the digital euro also indicated that they were open to this new means of payment in the survey. The survey revealed that only 41% of respondents had already heard, read or seen some information about the digital euro, whereas 59% did not know anything about it.

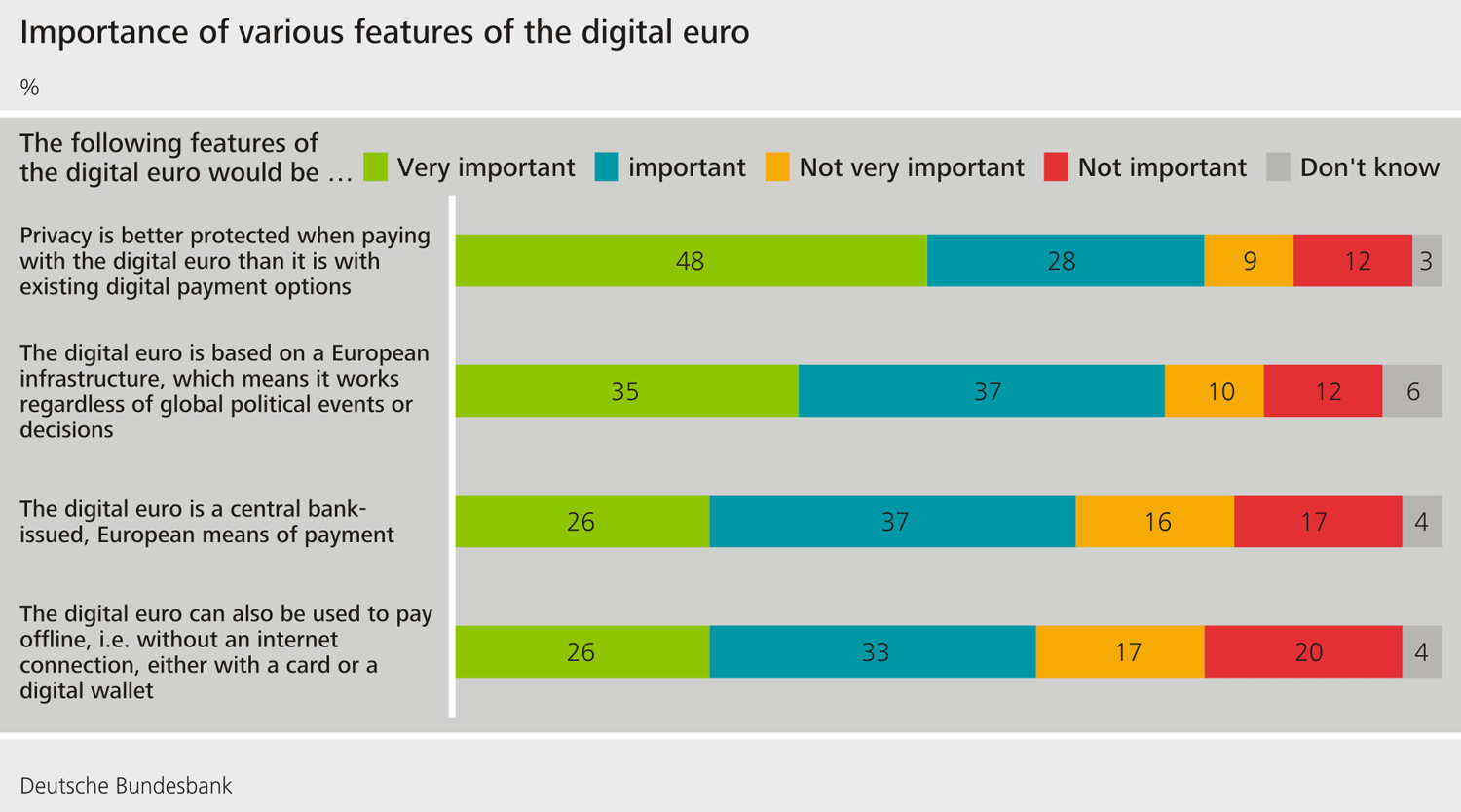

According to the survey, people are particularly concerned about protecting their privacy. More than three-quarters of respondents rated the aspect of privacy in connection with the use of the digital euro as very important or important. Of those surveyed, 59% stated that the planned offline version of the digital euro, which is intended to provide a level of privacy protection similar to that of cash, was very important or important.

Protecting people’s privacy is a key focus of the Eurosystem’s work in the current preparation phase, which is scheduled to run until October 2025. “Eurosystem central banks have no interest in users’ data,” said Bundesbank President Joachim Nagel. The digital euro would protect people’s privacy far better//far more effectively than current commercial payment solutions.

A very large number of respondents (72%) also felt it was important for the digital euro to be based on a European infrastructure, meaning it would function independently of global political events or decisions. The fact that the digital euro, like euro cash, is a government-issued, European means of payment was important to 63% of respondents.

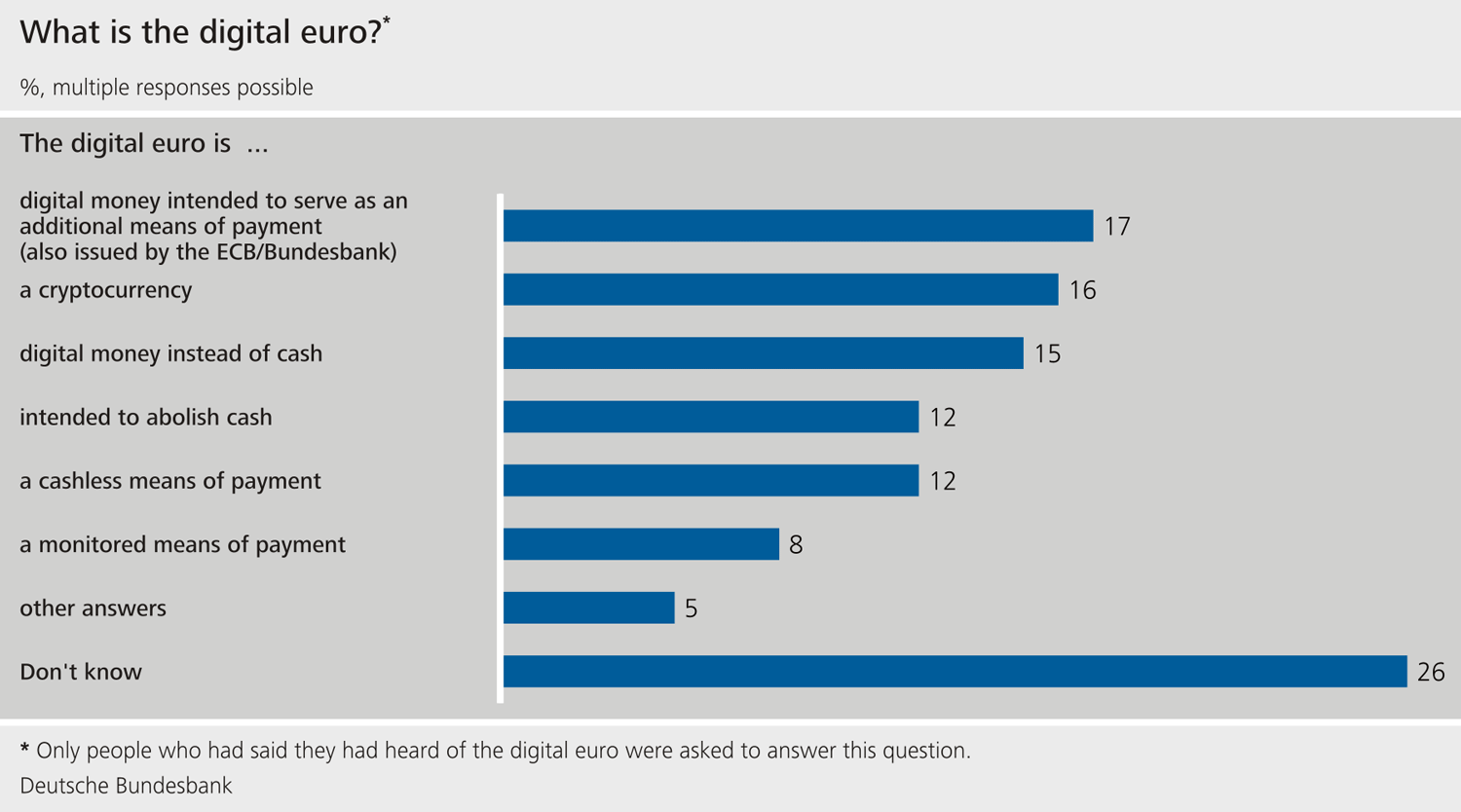

On the other hand, the survey shed light on fundamental misunderstandings even within the group that had already heard, read or seen content about the digital euro. Among this group, 15% believed that the digital euro was intended to replace cash and 12% were under the impression that cash would be abolished with the introduction of the digital euro. Cash is a core product of the Bundesbank and the other Eurosystem central banks,

explained Burkhard Balz, the Bundesbank’s Executive Board member responsible for cash and the digital euro project. We will not be getting rid of it.

The survey also highlighted that only a small number of people were aware that the digital euro, like euro banknotes, would be issued by the Eurosystem central banks. Just 17% answered correctly that it is a digital currency intended to serve as an additional means of payment and will be issued by the ECB or the Bundesbank. Many respondents still had patchy knowledge about the digital euro here, too, with 16% of respondents believing the digital euro to be a cryptocurrency. The prices of crypto-assets such as Bitcoin or Ethereum fluctuate strongly. They do not fulfil the traditional functions of a currency; the stability of their value is not vouched for by a central bank,

explained Mr Balz.

In the survey, 8% of respondents even thought that the digital euro was intended to monitor payment flows. The survey shows us that a great deal of information still needs to be provided and that we have set the right priorities, such as privacy protection, in the preparatory work for the new European means of payment,

said Mr Nagel.

The Eurosystem will decide on the introduction of the digital euro as soon as EU legislators have created the necessary legal basis. In June 2023, the European Commission presented the Single Currency Package, a draft regulation that proposes two sets of measures: a framework for the digital euro and a proposal to safeguard the legal tender of cash. EU legislators will continue to work on the proposal after the European elections. As plans currently stand, people will be able to make their first payments with the digital euro in 2028 at the earliest,

said Bundesbank Executive Board member Mr Balz.