April results of the Bank Lending Survey (BLS) in Germany Demand continued to rise in all loan categories

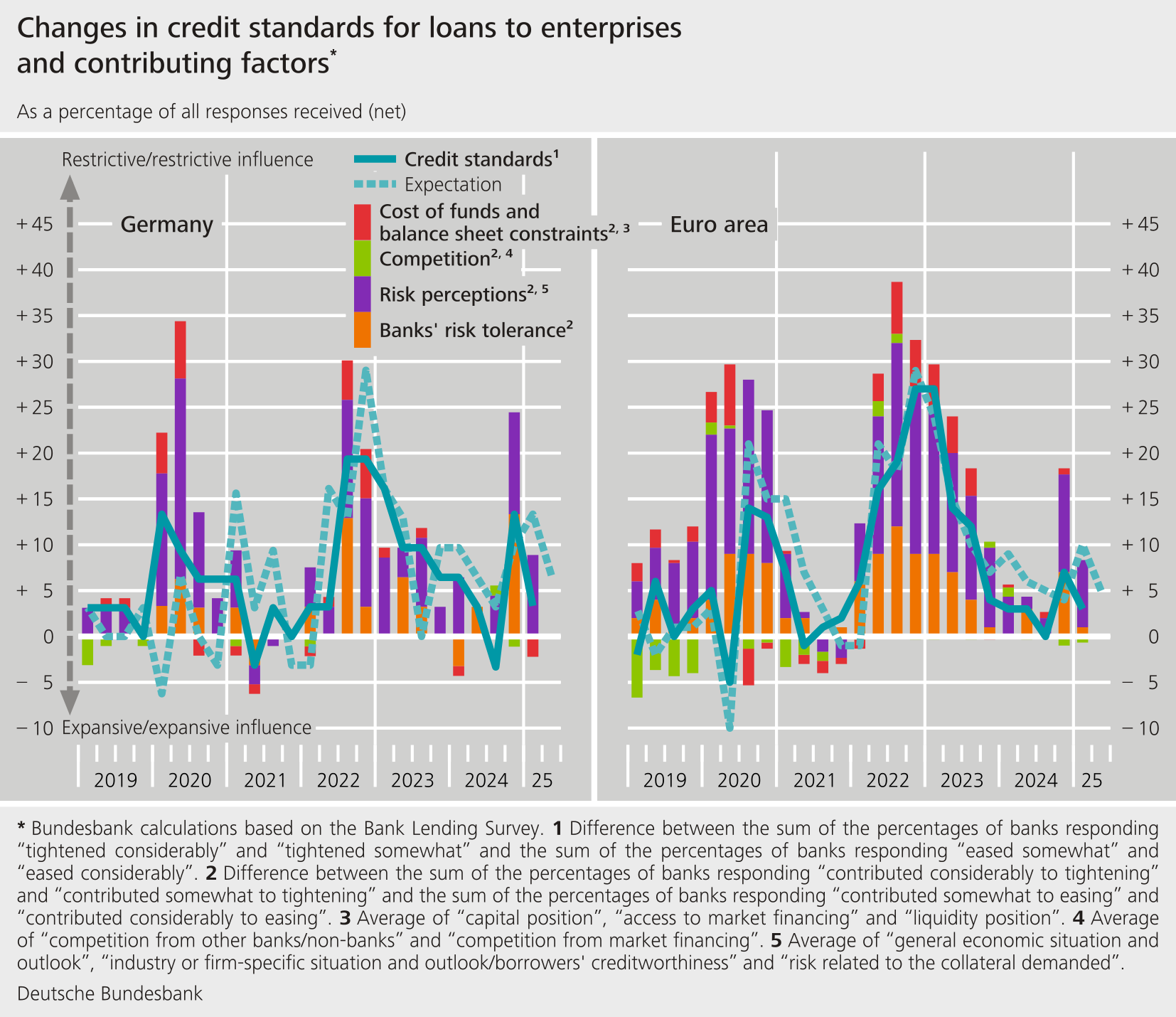

- The German banks responding to the Bank Lending Survey (BLS) tightened their credit standards slightly for loans to enterprises in the first quarter of 2025, primarily based on risk considerations. By contrast, banks eased their credit standards for loans to households for house purchase. They did not see a need to adjust their credit standards for consumer credit and other lending to households.

- Banks tightened their credit standards for loans to enterprises to a lesser extent than they had planned in the previous quarter. They had originally intended to tighten their credit standards for loans to households.

- The banks that took part in the survey made credit terms and conditions for loans to enterprises and for consumer credit and other lending to households more restrictive on balance, whilst easing terms and conditions for loans to households for house purchase.

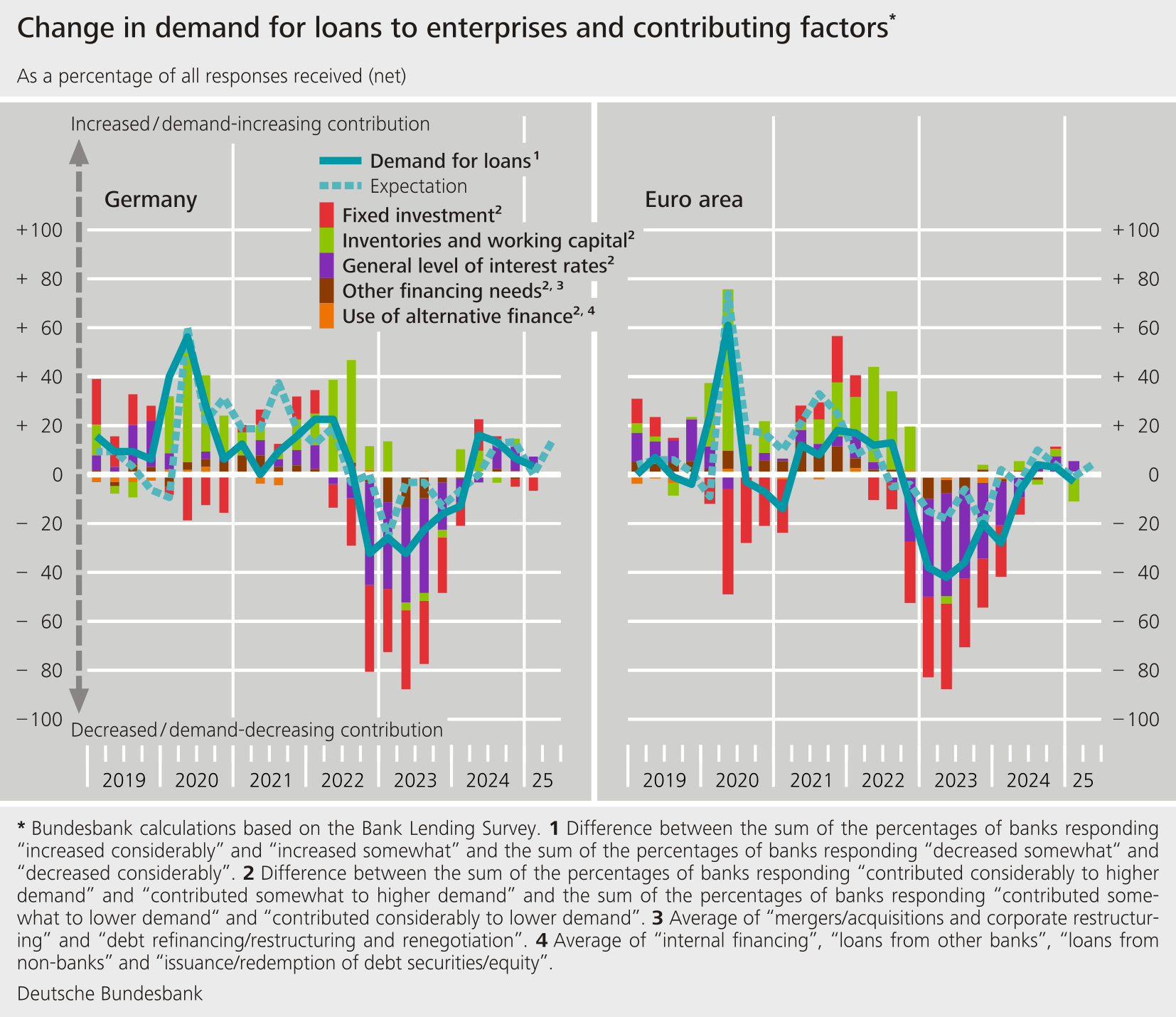

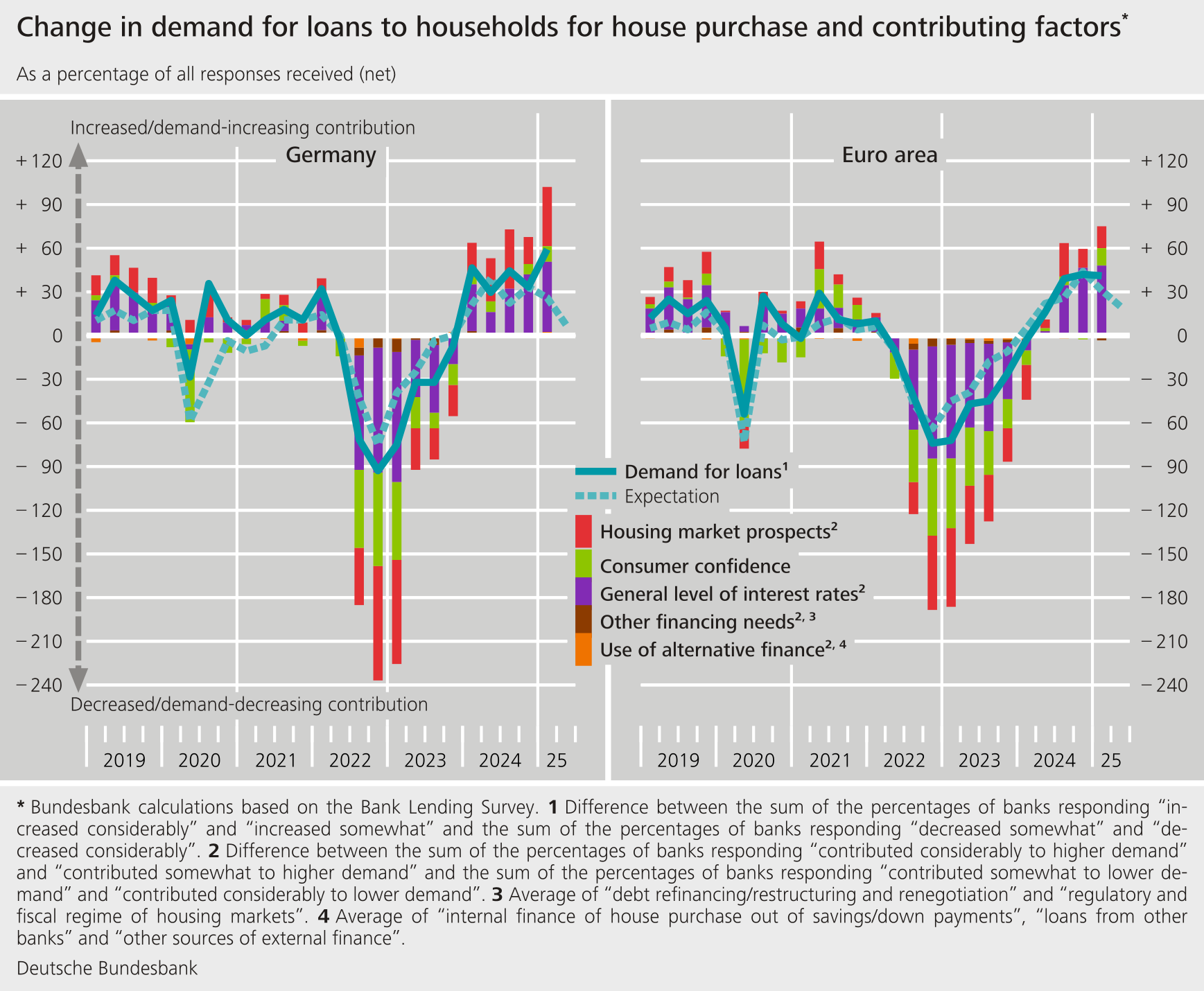

- Demand for loans continued to rise in all loan categories, with loans to households for house purchase increasing significantly.

- The level of the non-performing loans (NPL) ratio and other indicators of credit quality had tightening effects on lending policies for loans to enterprises and for consumer credit and other lending to households over the past three months.

- The ECB Governing Council’s past and expected key interest rate decisions had a negative impact on net interest income, thereby contributing to a deterioration in banks’ profitability in the 2024-25 winter half-year. For the summer half-year, too, banks are expecting the key interest rate decisions to have a negative impact on their net interest income as well as on their profitability.

The BLS covers three loan categories: loans to enterprises, loans to households for house purchase, and consumer credit and other lending to households. On balance, the surveyed banks tightened their credit standards (i.e. their internal guidelines or loan approval criteria) slightly for loans to enterprises. By contrast, they eased their credit standards for loans to households for house purchase. They left their credit standards for consumer credit and other loans to households unchanged. The net percentage of banks that tightened their standards stood at +3% for loans to enterprises (compared with +13% in the previous quarter). Credit standards for loans to enterprises were tightened only for large enterprises. Standards for small and medium-sized enterprises were eased somewhat on balance. The net percentage of banks that tightened their standards for loans to households for house purchase was -7% (compared with +11% in the previous quarter); for consumer credit and other lending to households, this figure was 0% (compared with +11% in the previous quarter). Banks tightened their credit standards for loans to enterprises to a lesser extent than they had planned in the previous quarter. They had originally intended to tighten their credit standards for loans to households.

The banks justified the slight tightening of credit standards for loans to enterprises on the grounds of a perceived increase in credit risk. This assessment relates to the general economic situation, but also to sector and firm-specific factors. Banks’ main rationale for easing credit standards for loans for house purchase was their higher risk tolerance. Another factor was that the outlook on the housing market had improved. They also reported that competition with other banks had increased and capital costs had decreased. For the second quarter of 2025, banks are planning to tighten their credit standards in all loan categories. Here, credit risk is likely to have a restrictive impact on the adjustment of credit standards owing to the tense economic situation and a decline in borrower creditworthiness.

On balance, banks tightened their terms and conditions (i.e. the terms and conditions actually approved as laid down in the loan contract) for loans to enterprises as well as for consumer credit and other lending to households. The restrictive adjustments in both loan categories are the outcome of higher lending rates and an increase in margins irrespective of credit ratings. The banks justified these adjustments primarily on the grounds of their reduced risk tolerance and a perceived increase in credit risk. Banks eased their terms and conditions for loans to households for house purchase overall by reducing their margins. They stated that this was mainly due to stronger competition and an improvement in their liquidity base.

The surveyed banks reported that demand for bank loans in Germany had risen on balance in all loan categories in the first quarter of 2025, with loans to households for house purchase registering significant growth. Banks stated that the marginal rise in demand for loans to enterprises was driven by various factors: increased demand for mergers, acquisitions and corporate restructuring, as well as for refinancing, debt restructuring and renegotiation. In addition, debt securities were replaced to some degree by bank loans. Interest rate levels once again supported demand for loans, albeit to a lesser extent than in the previous two quarters. By contrast, financing needs for fixed investment declined on balance. The high degree of uncertainty surrounding economic and (geo)political developments is likely to have been a factor here. According to the surveyed banks, the considerable rise in demand for loans to households for house purchase was mainly attributable to the lower level of interest rates and households’ positive view of the outlook on the housing market. Higher consumer confidence also boosted demand. Banks put the rise in demand for consumer credit and other lending to households down to an increase in purchases of durable consumer goods. The loan rejection rate for loans to enterprises went up again, but only for loan requests and applications from small and medium-sized enterprises. There was no change in the rejection rate for large enterprises. The rejection rate declined for loans for house purchase and for consumer credit and other lending to households. For the second quarter of 2025, banks are expecting to see demand increase further across all three loan categories. On balance, they expect demand for housing loans to rise at a significantly more subdued rate than in the first quarter.

The April survey round contained ad hoc questions on participating banks’ financing conditions and the impact of the ECB Governing Council’s past and expected key interest rate decisions. It also contained questions about the impact of the Eurosystem’s monetary policy asset portfolios and of NPLs and other indicators of credit quality on the institutions’ lending policies.

Against the backdrop of conditions in financial markets, German banks reported virtually no change in their funding situation compared with the previous quarter. The ECB Governing Council’s past and expected future key interest rate decisions have had, overall, a negative impact on banks’ profitability over the past six months. After the interest rate cuts in October and December 2024 and in February and March 2025, key interest rate decisions ceased to have a positive impact for the first time since this question was introduced. For the 2025 summer half-year, banks are once again expecting key interest rate decisions to have a negative impact on their net interest income as well as on their profitability. Taken in isolation, the reduction in the Eurosystem’s monetary policy securities holdings weakened the liquidity position of banks in Germany. German banks assessed the impact on their financing conditions and capital ratios, too, as slightly negative.

In the first quarter of 2025, the level of the NPL ratio (the stock of gross NPLs on the bank’s balance sheet as a percentage of the gross carrying amount of loans) and other indicators of credit quality had restrictive effects on lending policies for loans to enterprises and on consumer credit and other lending to households. In the second quarter of 2025, the banks are expecting this restrictive effect stemming from the decline in credit quality to continue.

The Bank Lending Survey, which is conducted four times a year, took place between 10 March and 25 March 2025. In Germany, 33 banks took part in the survey. The response rate was 97%.