Acquisition of financial assets and external financing in Germany in the second quarter of 2022 Results of the financial accounts by sector

Households’ financial assets fall for the second quarter in succession

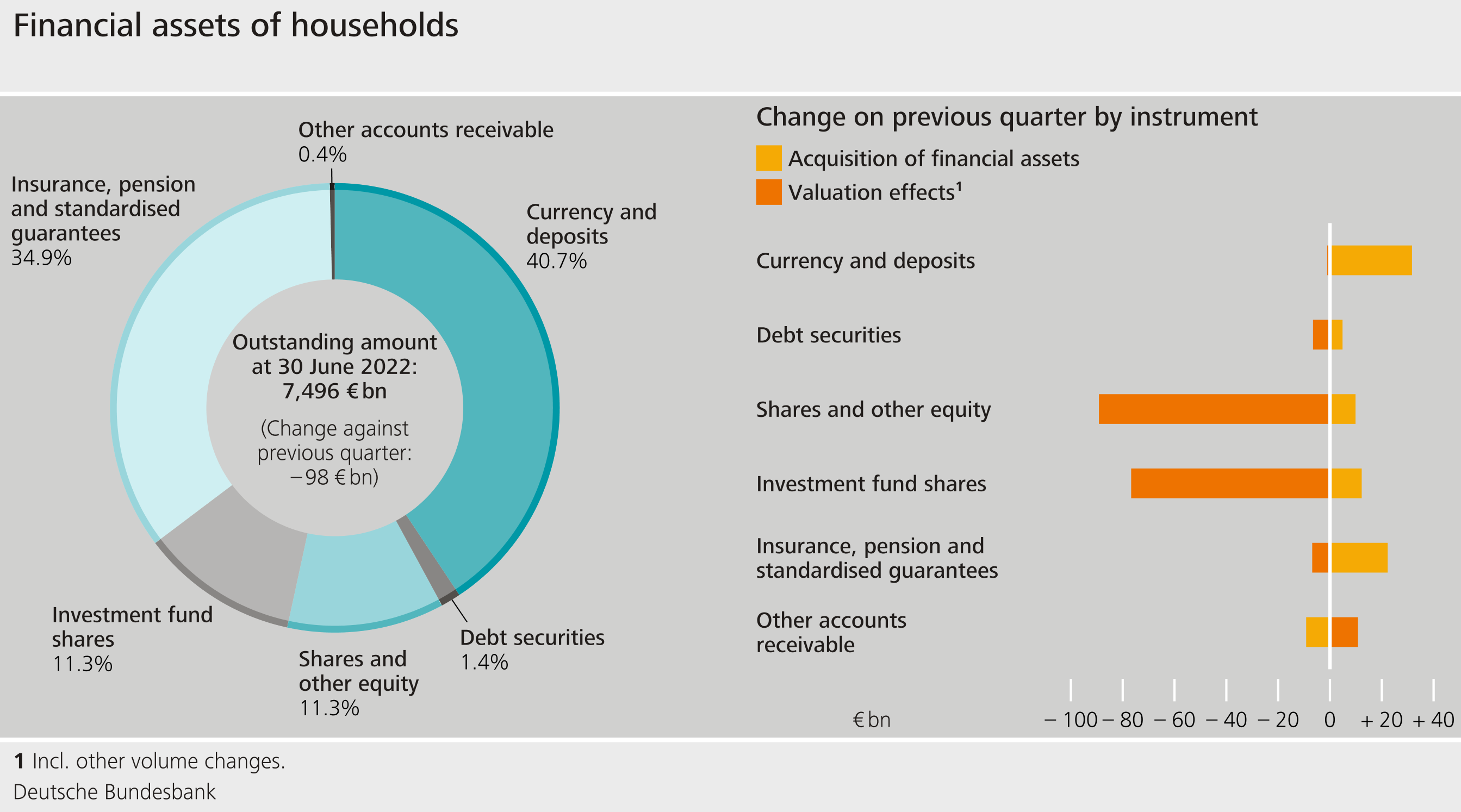

Households’ financial assets fell by €98 billion in the second quarter of 2022 and thus for the second time in succession. At the end of the quarter they stood at €7,496 billion. This is the sharpest decline in more than two years. While households’ claims grew by €72 billion, this did not compensate for the significant valuation losses totalling €170 billion.

Valuation losses affected almost all asset classes on the market. Shares and other equity held by households lost €89 billion in value, investment fund shares €77 billion and debt securities €7 billion. Overall, valuation losses in the reporting quarter were subsequently up by €56 billion on the first quarter of 2022.

As a result of transactions, financial assets increased less than in those quarters marked by the coronavirus pandemic. Households acquired relatively few investment fund shares (€12 billion), but slightly more debt securities (€5 billion). Lately, inflows of €32 billion were recorded for currency and deposits and inflows of €22 billon for claims on insurance corporations.

Households’ liabilities continued to rise, reaching €2,090 billion at the end of the second quarter of 2022, an increase of €30 billion on the first quarter. However, in the context of still increasing economic output and higher disposable income, the debt ratio dipped again slightly to 55.8%. The debt ratio is calculated as total debt in relation to nominal gross domestic product (four-quarter moving sum).

Households’ net financial assets fell significantly by €127 billion as a result of valuation losses and amounted to €5,406 billion at the end of the second quarter of 2022.

External financing among non-financial corporations increases slightly

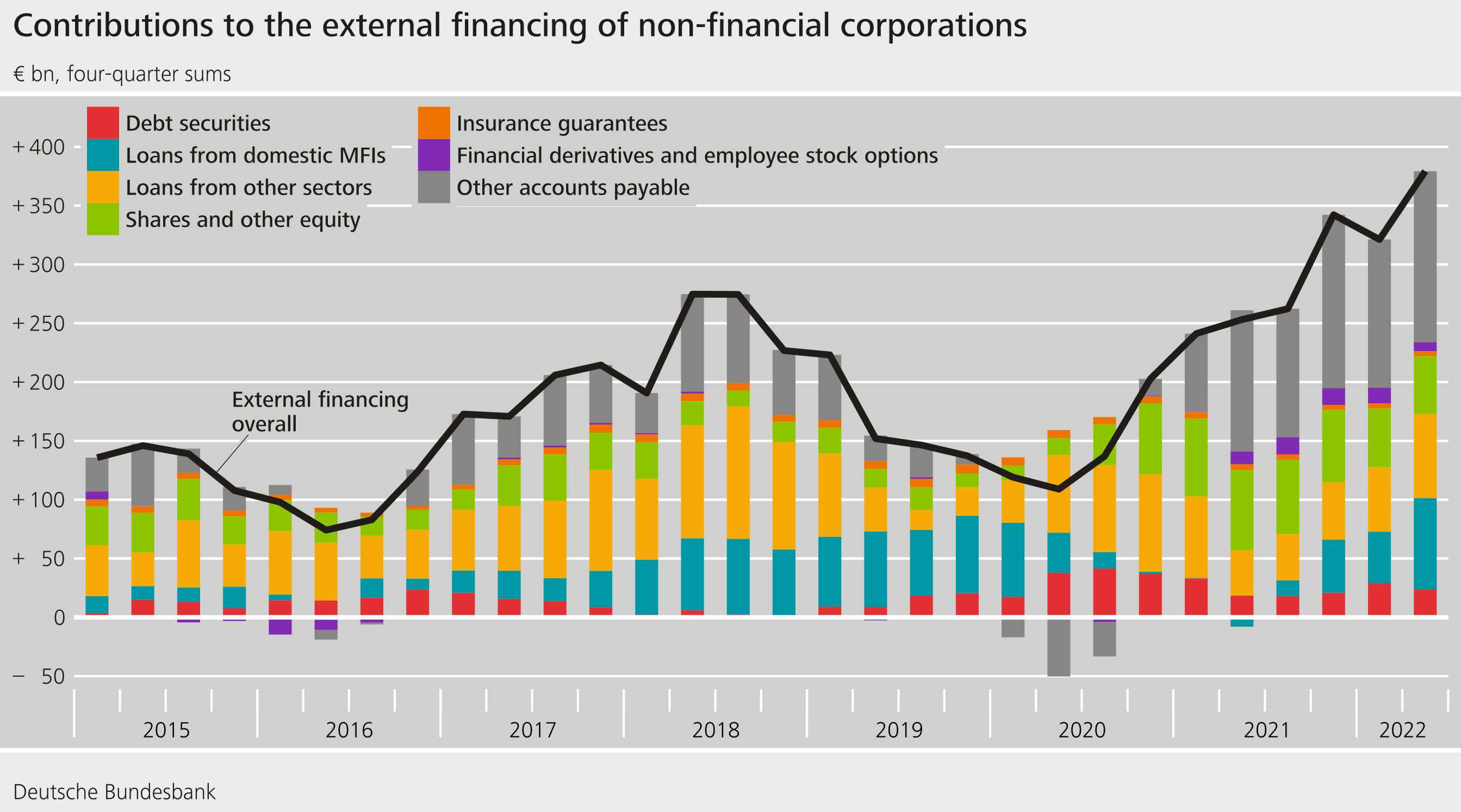

After falling significantly in the first quarter of 2022, external financing increased again slightly in the reporting quarter to stand at €82 billion. At €39 billion, borrowing was also somewhat higher than in the previous quarter. Shares and other equity were issued to the value of €8 billion, a little more than in the previous quarter, but much less than in the fourth quarter of 2021.

The external financing of non-financial corporations also accelerated in annual terms (four-quarter moving sums). This increase is largely attributable to a high level of borrowing. This development is partly related to the Federal Government’s new assistance loans for enterprises particularly affected by the energy crisis. Other accounts payable – consisting of trade credits and advances – also made a significant contribution to the growth in external financing.

The financial assets of non-financial corporations amounted to €6,097 billion at the end of the second quarter of 2022, which was €26 billion less than in the previous quarter. This is the first decline since the first quarter of 2020. Transactions pushed up financial assets by €36 billion. However, as with households, this was outweighed by discernible valuation losses, especially in the case of shares and other equity (€97 billion).

Similarly, shares and other equity issued by non-financial corporations suffered from ongoing negative developments on the stock exchanges, resulting in valuation losses of €405 billion. Overall, the liabilities of non-financial corporations fell again significantly and stood at €7,762 billion at the end of the quarter.

Overall, net financial assets grew to -€1,665 billion. The net acquisition of financial assets totalled -€46 billion. However, this decrease in net acquisition was more than compensated by the severe negative valuation losses on the liabilities side.

Despite the overall rise in debt, the debt ratio – calculated as the sum of loans, debt securities and pension provisions in relation to nominal gross domestic product (four-quarter moving sum) – fell to 79.8%.

Owing to interim data revisions of the financial accounts and national accounts, the figures contained in this press release are not directly comparable with those shown in earlier press releases.