Acquisition of financial assets and external financing in Germany in the fourth quarter of 2022 Results of the financial accounts by sector

Households’ financial assets return to growth

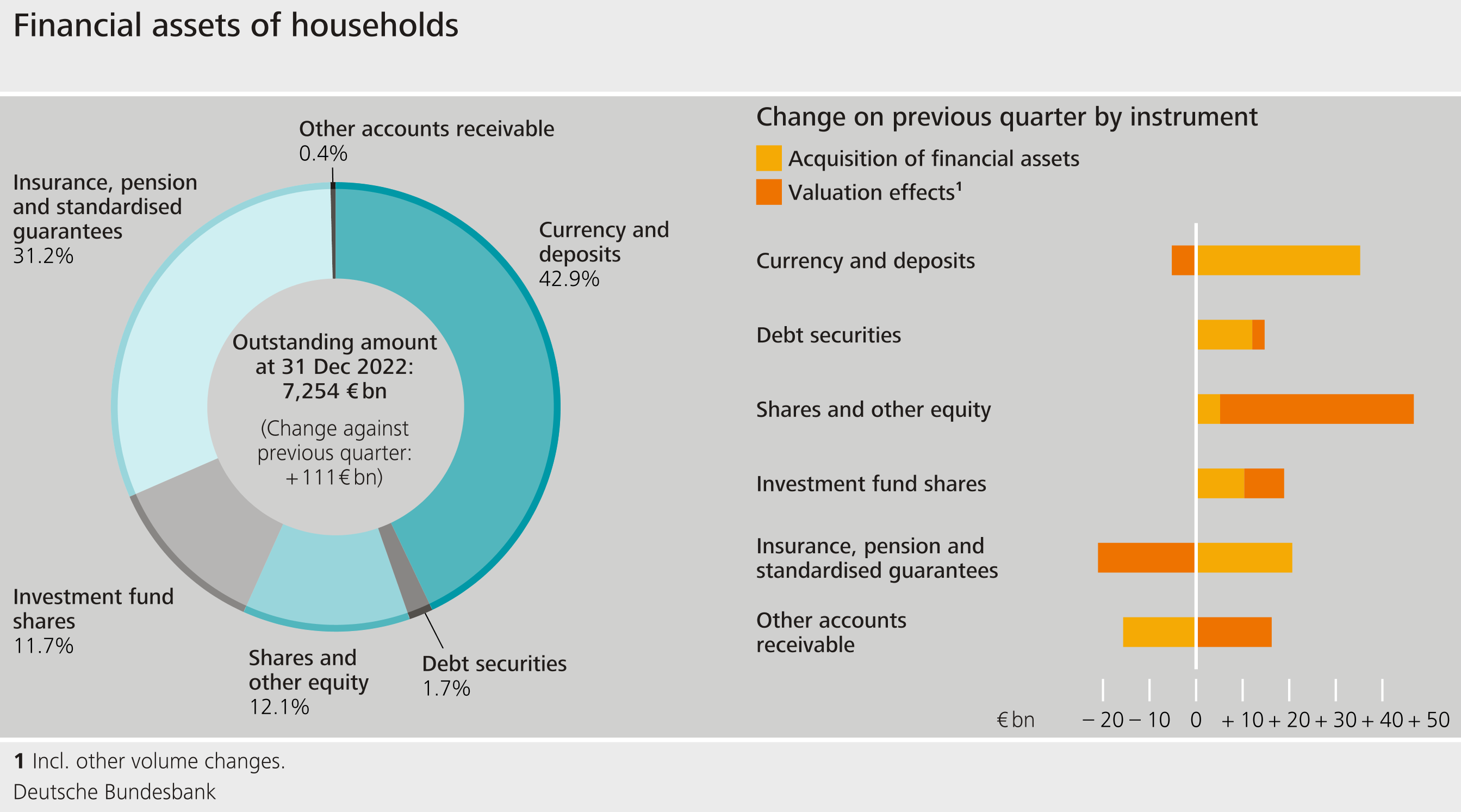

After three quarters of decline, households’ financial assets grew in the fourth quarter of 2022, standing at €7,254 billion at the end of the year. Households’ claims increased by a total of €68 billion. Following three quarters of significant valuation losses, valuation gains were recorded again, amounting to €43 billion in total.

However, valuation changes were not positive across all instruments. While listed shares increased significantly in value, up €32 billion, pension and insurance claims depreciated by €21 billion in the reference period owing to rising interest rates.[1]

Although households once again significantly increased their holdings of currency and deposits, topping them up by €35 billion, they also purchased exceptional amounts of debt securities (€12 billion), which grew more attractive in the context of higher interest rates. By contrast, the momentum behind purchases of investment fund shares was no longer as strong as at the beginning of the year. Other accounts receivable were scaled back on balance.

Households’ liabilities continued to rise, reaching €2,137 billion at the end of 2022, an increase of €12 billion on the third quarter. Nevertheless, the debt ratio fell to 55.2%, which was attributable to the stronger nominal increase in aggregate output in the fourth quarter. The debt ratio represents debt as a percentage of nominal gross domestic product (four-quarter moving sum). Taken together, households’ net financial assets grew to €5,117 billion in the fourth quarter, after falling in the previous three-month period.

Decline in external financing of non-financial corporations

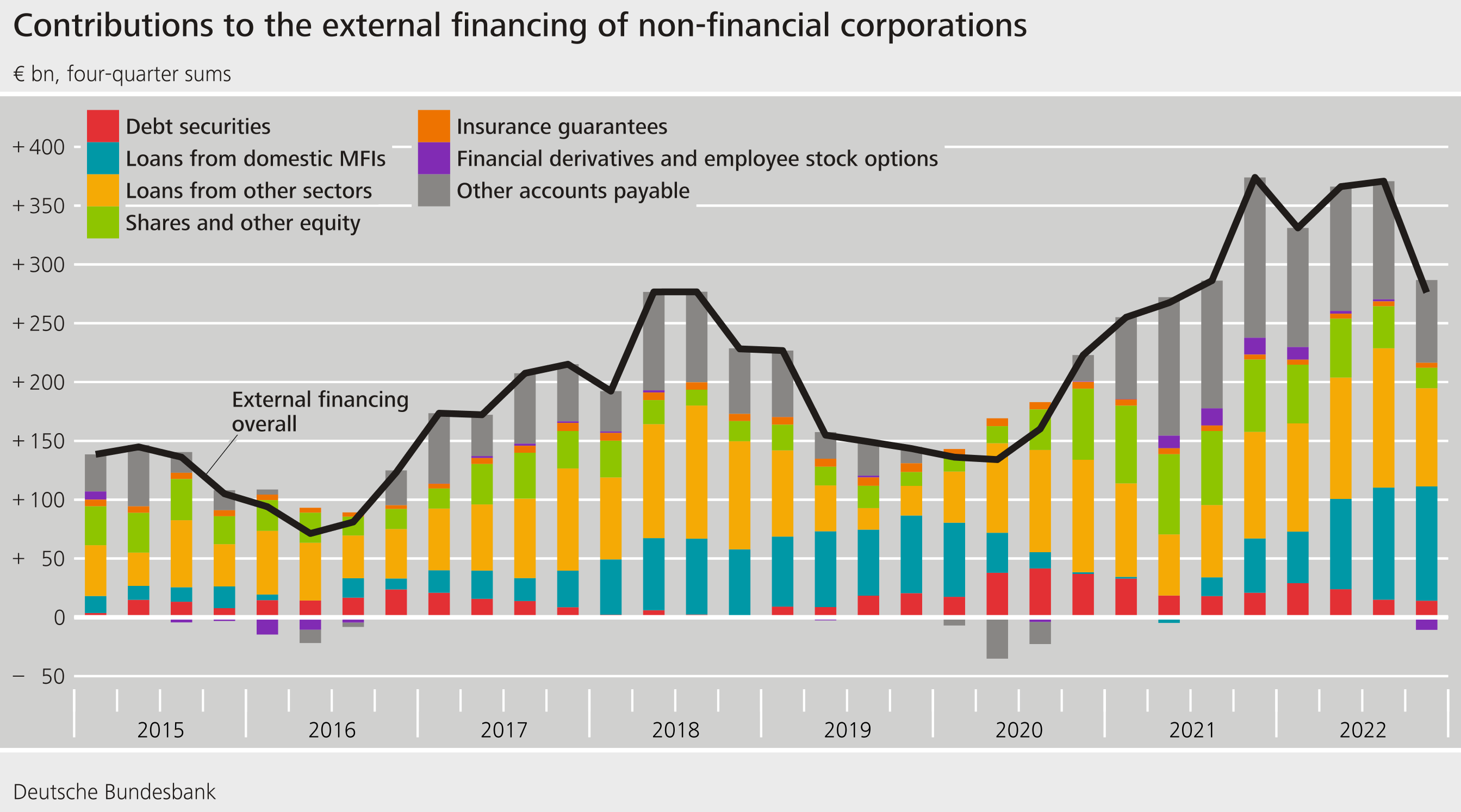

The external financing of non-financial corporations fell to €47 billion in the fourth quarter of 2022 (previously €98 billion). At €38 billion, borrowing was weaker than in the previous quarter (€67 billion). In particular, loans from other financial institutions were repaid on balance. The external financing of non-financial corporations also slowed markedly in annual terms (four-quarter moving sums).

At the end of 2022, the financial assets of non-financial corporations stood at €6,057 billion, down €130 billion on the previous quarter. There were declines in most items, but in particular in financial derivatives (-€107 billion) and shares and other equity (-€39 billion). While transactions pushed up financial assets by €145 billion, non-financial corporations suffered exceptionally high valuation losses totalling €274 billion. The losses for financial derivatives (€79 billion) and non-listed shares and other equity (€94 billion) were particularly striking.

While non-financial corporations’ financial assets shrank, their liabilities grew by €49 billion, standing at €7,780 billion at the end of the quarter. In addition to the aforementioned transaction-related developments, positive valuation changes for listed shares, which amounted to €160 billion, were another factor behind this growth. Nevertheless, there were negative valuation developments in the case of financial derivatives and employee stock options (-€86 billion) as well as other liabilities (-€49 billion).

The debt ratio fell to 80.4%. As was the case for households, this decline was due to the stronger nominal increase in aggregate output. The debt ratio is calculated as the sum of loans, debt securities and pension provisions as a percentage of nominal gross domestic product (four-quarter moving sum).

Taken together, non-financial corporations’ net financial assets fell by €179 billion and amounted to -€1,723 billion at the end of the quarter. The net acquisition of financial assets, i.e. the acquisition of financial assets less external financing, amounted to €97 billion.

Owing to interim data revisions of the financial accounts and national accounts, the figures contained in this press release are not directly comparable with those shown in earlier press releases.

Footnote:

- A methodological change was made to households’ insurance guarantees in the reporting quarter with retroactive effect for 2022, leading to a decline in this item. The new method is based on the Solvency II reporting system, which uses the discounted cash flow method to calculate/evaluate the insurance guarantees https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:02009L0138-20190113.