Acquisition of financial assets and external financing in Germany in the third quarter of 2024 Results of the financial accounts by sector

- Households’ financial assets up by €197 billion.

- Households’ liabilities up slightly; debt ratio down.

- Firms’ external financing up to €59 billion.

Households’ financial assets still rising

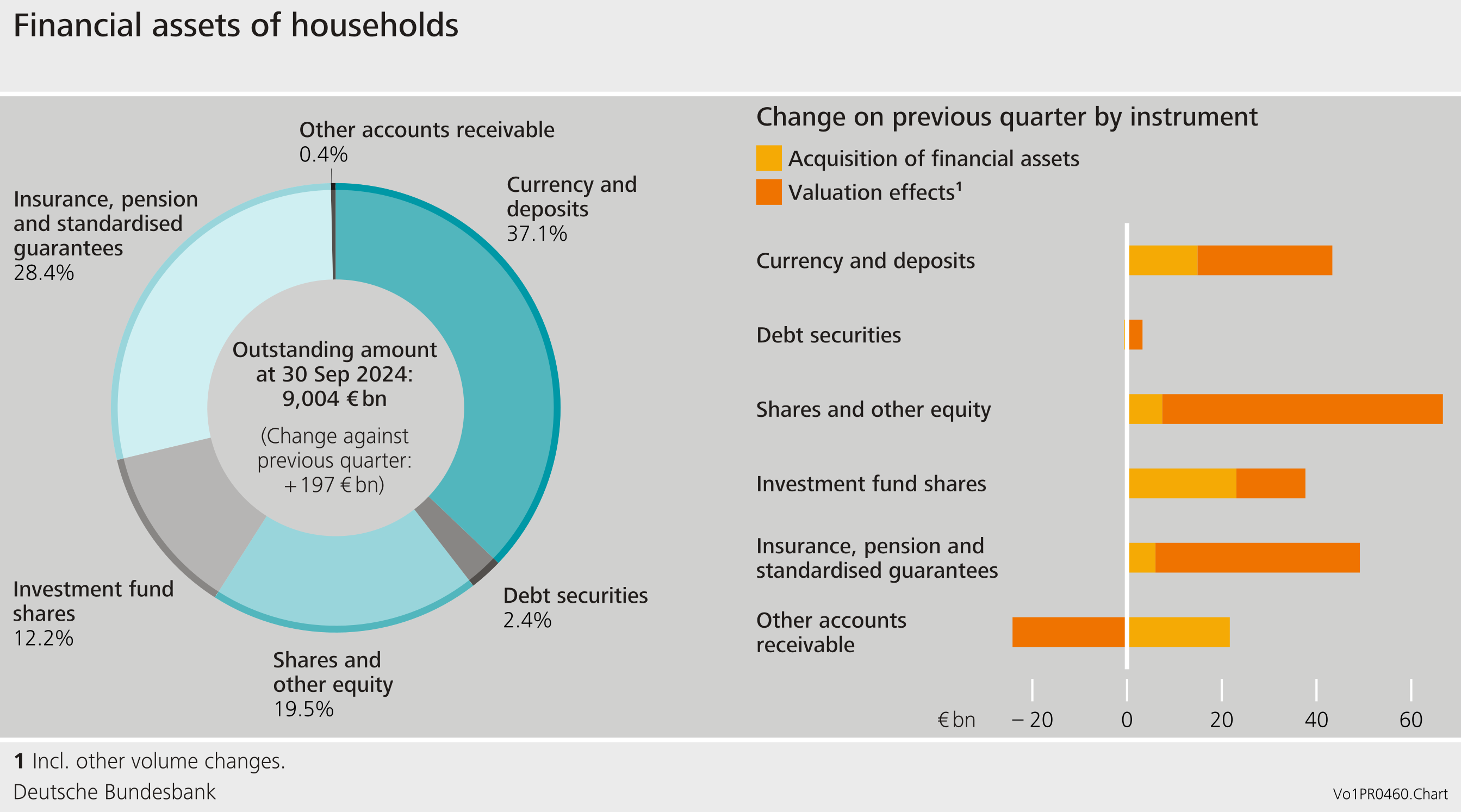

In the third quarter of 2024, German households’ financial assets grew by €197 billion, closing the quarter at a new record high of €9,004 billion. This is a continuation of the uninterrupted growth trend that has lasted since end-2023. This growth is attributable to both an increase in investment activities and significant valuation gains. Households increased their claims by €73 billion and generated valuation gains of €124 billion.

This means that stocks have increased significantly more than in the previous quarter[1], with valuation gains on insurance and pension claims accounting for €43 billion.[2] Investment fund shares generated valuation gains of €15 billion, reflecting positive developments in the investment market despite temporary fluctuations.

After investing €42 billion in deposits in the second quarter of 2024, households invested only €9 billion in deposits in the third quarter. One reason for the drop may have been an increase in the attractiveness of other forms of investment due to their improved valuation – in particular investment fund shares (in the value of €23 billion) and shares and other equity (in the value of €7 billion).

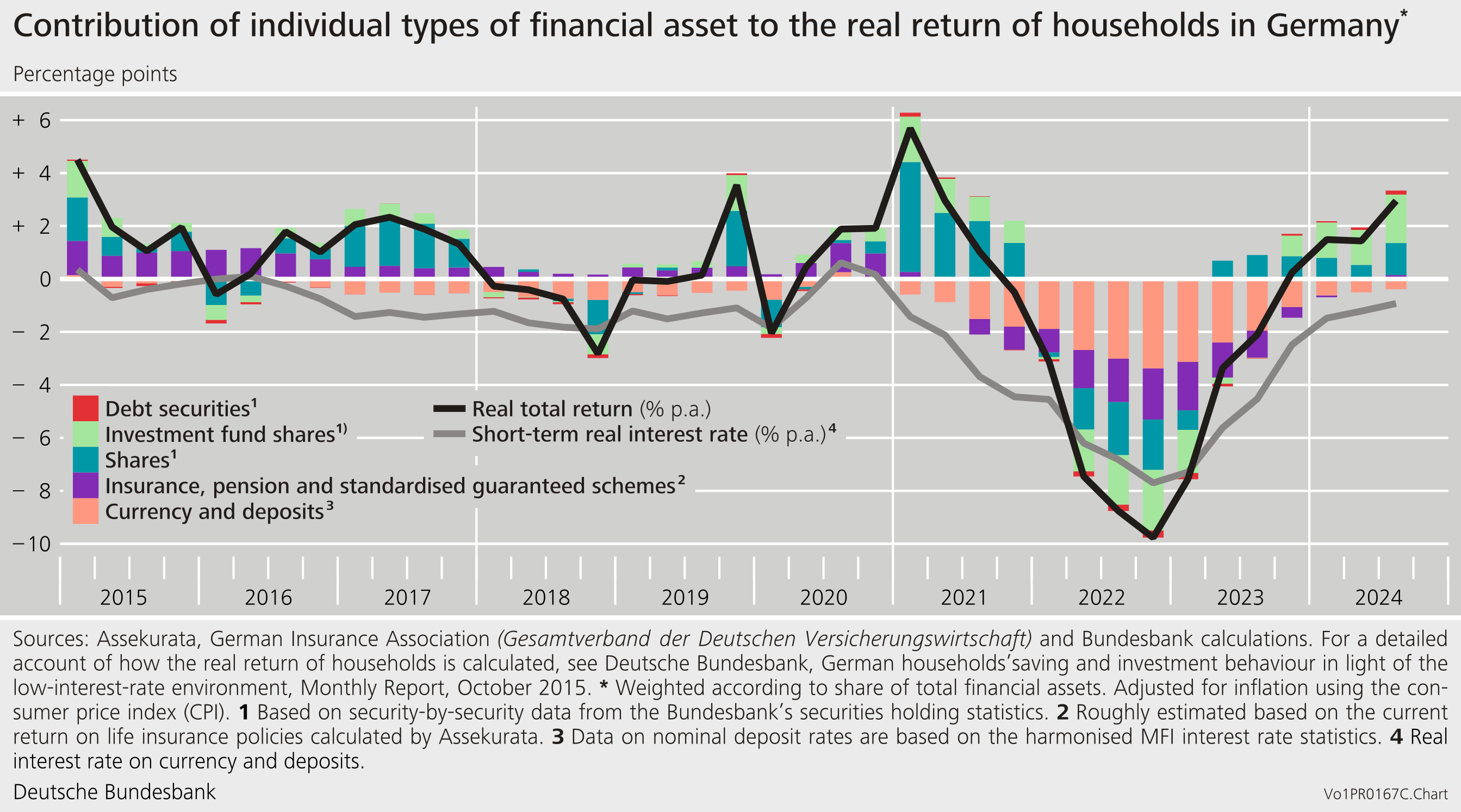

Real total return on financial assets up

The real total return – i.e. adjusted for inflation – on households’ financial assets represents the actual return on financial assets for households based on the period-specific asset structure of financial assets. It rose to just under 3 % in the third quarter of 2024, with shares and investment fund shares, in particular, contributing positively to the real total return. The real return on cash and deposits remained negative, which continued to have a dampening effect.

Households’ liabilities up slightly

Households’ liabilities grew by €8 billion to a total of €2,154 billion in the third quarter of 2024. The growth was mainly because borrowing went up to €9 billion, to which falling interest rates are likely to have contributed. However, owing to the nominal increase in gross domestic product, the debt ratio fell by 0.2 percentage point to 50.3 %.[3]

According to the financial accounts, households’ net financial assets increased in total by €189 billion to €6,850 billion in the third quarter of 2024. With the Distributional Wealth Accounts (DWA), the Bundesbank provides additional data on the distribution of household wealth. According to the DWA, the wealthiest 10 % of households hold more than 70 % of net wealth, while the less wealthy half of all households hold less than 1 %.[4]

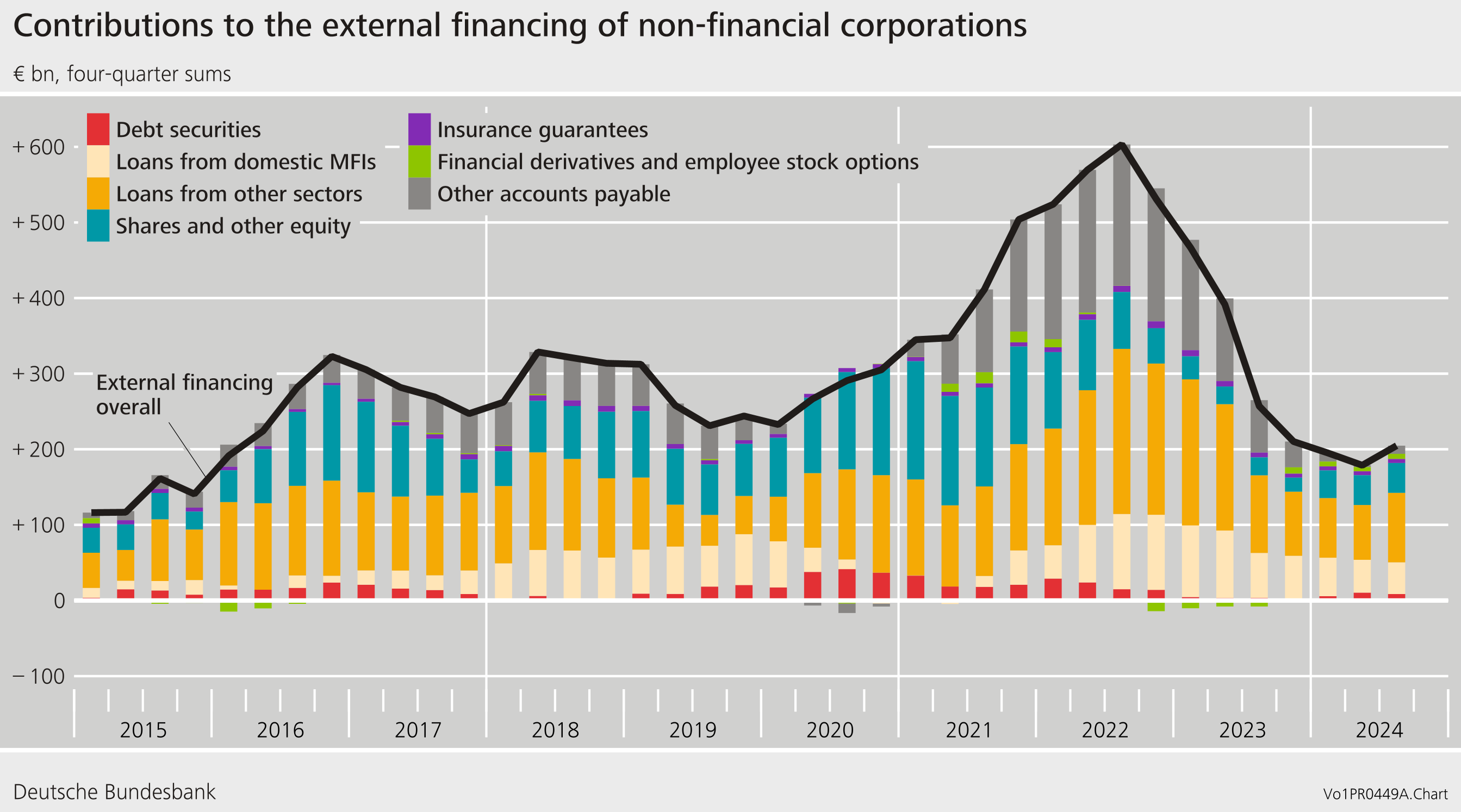

External financing of non-financial corporations back up

Non-financial corporations’ external financing rose by €13 billion to €59 billion in the last quarter. On balance, borrowing amounted to €35 billion, with a large percentage (€21 billion) coming from abroad. Issuance of shares and other equity remained comparatively stable at €12 billion.

In annual terms, i.e. based on four-quarter moving sums, non-financial corporations’ external financing thus grew for the first time since the third quarter of 2022.

At the end of the third quarter of 2024, non-financial corporations’ liabilities grew by €235 billion to €11,655 billion. Significant valuation gains were recorded among issued equity (in the value of €134 billion). The increase in loan stocks to €3,712 billion was almost entirely attributable to new borrowing, especially by domestic non-banks and foreign firms. The volume of issued equity rose to €5,458 billion, not least due to changes in valuation amounting to €123 billion. Taken together, debt instruments rose slightly, increasing the debt ratio from 68.1 % to 68.3 %.[5]

The financial assets of non-financial corporations rose significantly by €163 billion, reaching €8,964 billion at the end of the quarter under review. Taken together, non-financial corporations’ net financial assets dropped to -€2,691 billion.

Owing to interim data revisions of the financial accounts and national accounts, the figures contained in this press release are not directly comparable with those shown in earlier press releases.

Footnotes:

- Considerable other valuation changes in the deposits positions were recorded in the third quarter due to a change in sector classification.

- The methodology for calculating households’ technical provisions is based on the Solvency II reporting system, under which the discounted cash flow method is used to calculate/value these provisions: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:02009L0138‑20190113 The relevant interest rate structure for discounting technical provisions in Solvency II is determined by EIOPA on a monthly basis. At each valuation date, the provisions for all existing contracts must be valued at current interest rates. This form of market price valuation means that, under Solvency II, technical provisions are significantly influenced by the current interest rate environment. This means that individual quarters may exhibit stronger valuation effects.

- The debt ratio represents debt as a percentage of nominal gross domestic product (four-quarter moving sum).

- In the DWA, net wealth comprises the following types of assets and liabilities: deposits, debt securities, listed shares, investment fund shares, insurance claims (life insurance and private retirement provision), financial business wealth, and liabilities in the form of loans for house purchase and other debt. Net wealth is ultimately calculated as the difference between the total aforementioned assets and liabilities. For more information on the DWA, see also https://www.bundesbank.de/en/press/press-releases/bundesbank-releases-distributional-wealth-accounts-for-households-in-germany-921302

- The partially consolidated debt ratio is calculated as the sum of loans, debt securities and pension provisions as a percentage of nominal gross domestic product (four-quarter moving sum). For loans, a partial consolidation is carried out by deducting intra-sector claims/liabilities.

Further information

The data on the financial accounts are available at