The coronavirus pandemic as an exogenous shock to the financial industry Keynote speech at the Hachenburg symposium

Check against delivery.

1 What does the coronavirus pandemic mean for the financial sector?

The coronavirus pandemic is not completely behind us just yet, but the contours of future economic developments are already taking shape. Structural change in the real economy is likely to pick up speed – digital transformation, demographic change, and climate policies pose challenges for the real economy and the financial sector. Higher debt levels in the private and public sectors, boosted by low interest rates, are making the macroeconomic setting vulnerable.

Unlike the global financial crisis of 2007-08, the shock during the pandemic did not originate in the financial system. Even so, the shock threatened to spill over into the financial sector by way of rising credit risk, as many enterprises and sectors of the real economy saw their liquidity and solvency directly jeopardised by lockdown measures.

The immediate crisis has since been overcome. So what are the key lessons?

One important lesson is that the monetary and fiscal policy measures in response to the crisis were necessary to shield the real economy and financial sector from the pandemic fallout. In Europe, fiscal measures supported around one-third of new lending (ESRB 2021). In particular, lending to smaller enterprises and to sectors hit hard by the crisis have benefited.

In Germany, fiscal measures such as special loan programmes by the Kreditanstalt für Wiederaufbau (KfW), bridging aid and short-time working benefits directly supported the liquidity and solvency of firms.[2] This stabilised lending. Loans with KfW guarantees, for example, made up around 14% of new lending to enterprises between March and September 2020.[3]

These measures did not render market forces ineffective. Rather, comprehensive government measures helped ensure that financial markets could continue functioning, despite the high level of economic uncertainty.

Banks maintained the credit supply, not least because they were largely shielded from the economic repercussions of the crisis by monetary, fiscal, and supervisory measures. Banks certainly had to master operational and logistical challenges during the crisis. Yet, in terms of credit losses, it has been a “non-crisis crisis” for banks up to now. GDP fell by 5% in 2020, its sharpest drop in decades,[4] but bank balance sheets have so far largely been spared losses.

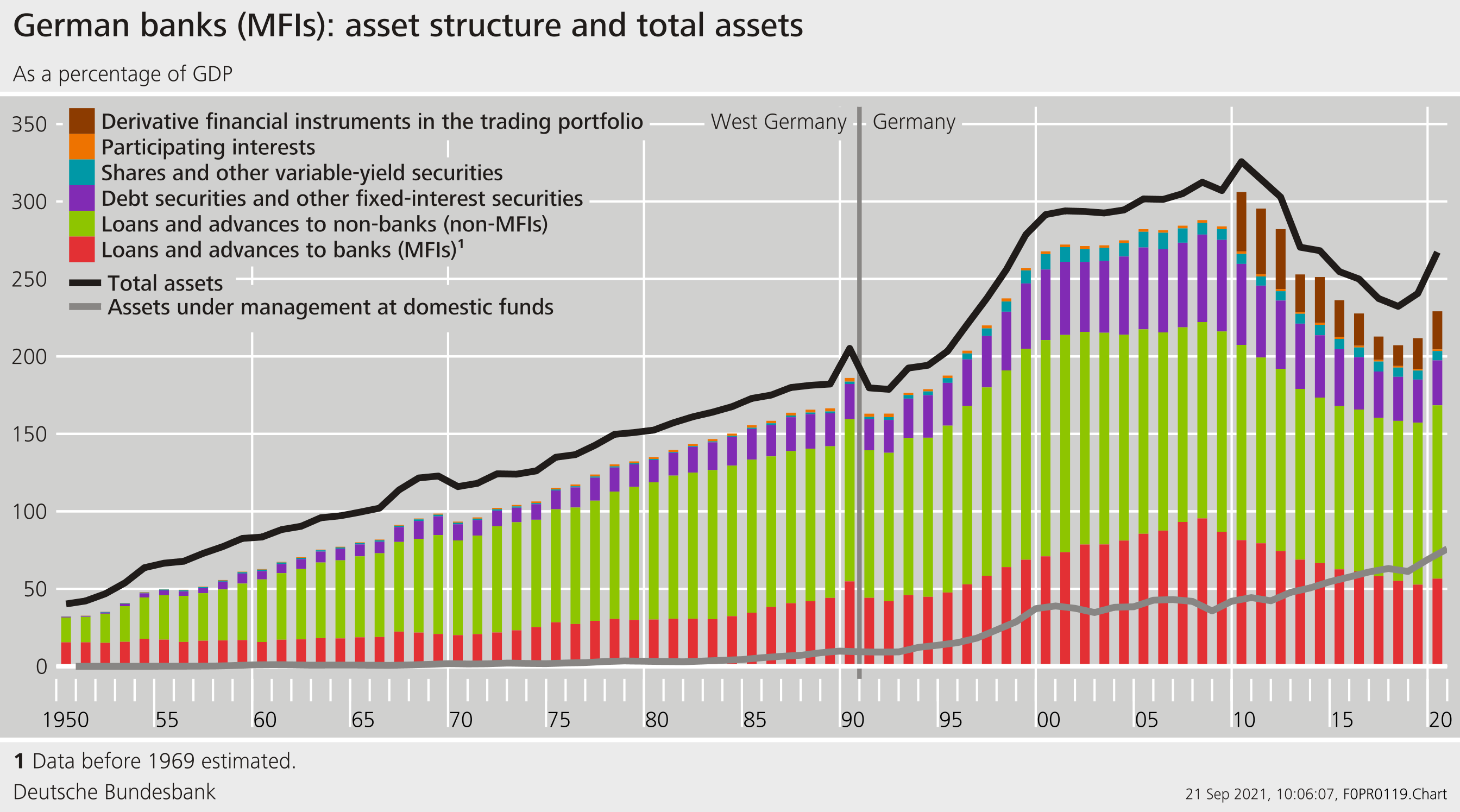

At the macroeconomic level, the robust level of bank lending during the coronavirus crisis is reflected in a growing size of the banking sector. Historically, the banking sector has grown significantly since the early 1950s: total assets held by banks have risen from just under 40% of GDP in 1950 to more than 300% shortly before the financial crisis (Chart 1). This increase reflects economic development, but also the international deregulation of financial markets. The global financial crisis of 2007-08 stopped this long-term trend, and banks’ total assets dropped to a level below 250% of GDP.

Chart 1: Structure of German banks’ assets

Banks’ assets have been back on the increase since 2019. Mortgage loans have been an important driver. The volume of such loans has been growing dynamically for some years now, and the coronavirus pandemic has not stopped this trend. Due to liquidity needs in the real economy, lending to enterprises has picked up as well over the past few months.

The banking system has played a significant role in covering the liquidity needs of firms, especially at the start of the pandemic. In the first half of 2020, funding provided by private banks even exceeded government-guaranteed loans. Sectors that were hit especially hard by the crisis, such as hotels and restaurants, made heavy use of the KfW’s government-guaranteed loans.

A second key takeaway from the coronavirus pandemic is that the financial sector was better prepared for negative shocks than it was prior to the global financial crisis. Thanks to the reforms implemented over the past decade, banks are better capitalised today. This helps them to absorb shocks and the associated losses, without having to cut back excessively on lending.

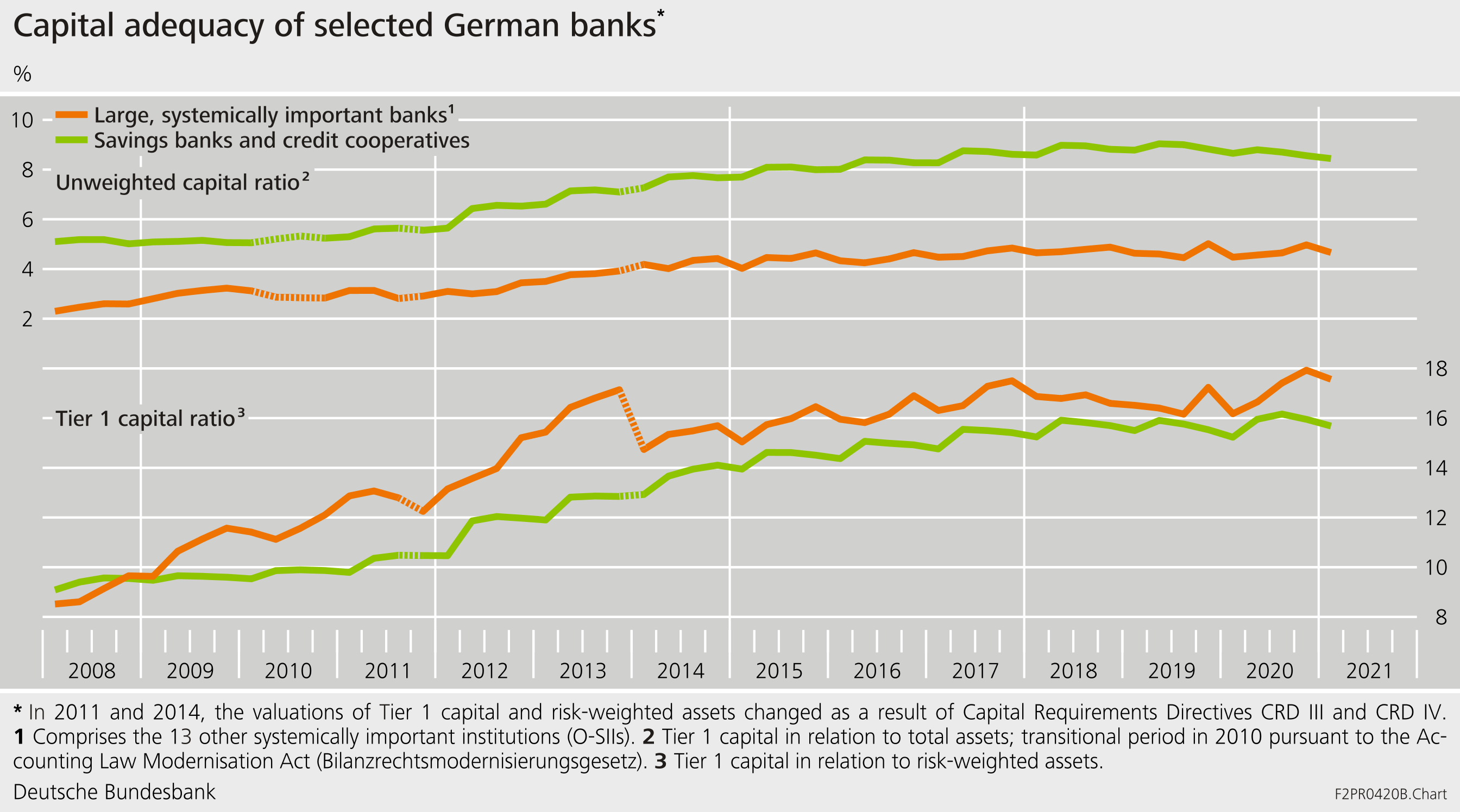

Since 2008, the Tier 1 capital ratio, which is the ratio of Tier 1 capital to risk-weighted assets, has risen – from less than 10% to just under 18% among savings and cooperative banks and just under 16% among large, systemically important banks (Chart 2).

The unweighted capital ratio likewise went up, although this increase has levelled off in recent years. And here we see significant differences across categories of banks: at just over 8%, the unweighted capital ratio of the savings and cooperative banks is almost double that of the big banks.

Chart 2: German banks’ capital

Trends of bank capital during the pandemic are interesting to note: the unweighted capital ratio fell while the risk-weighted ratio rose. One reason is that crisis-related loans are partially backed by government guarantees and thus come with lower risk weights. Supervisory measures have also had an impact. For example, the adjustment of a factor for loans to small and medium-sized enterprises (SME supporting factor) was brought forward by one year, causing the relevant risk weights and hence risk-weighted assets to decrease.[5] Even without a change in capital, the tier 1 capital ratio would thus rise.

The increase in capitalisation over the past decade is also a reflection of the financial sector reforms following the financial crisis. One objective of these reforms is to build up buffers in the banking sector, so that losses can be better absorbed and the banking sector does not respond by deleveraging.

German banks entered the coronavirus pandemic with a relatively small countercyclical capital buffer (CCyB). The buffer was activated in June 2019 in response to a build up of the financial cycle[6] and thus cyclical risk the German financial system.[7] Banks were given 12 months to build up the countercyclical capital buffer of 0.25% of their risk-weighted domestic exposures. In March 2020, after the pandemic had broken out, the CCyB requirement was lowered to zero.

More than a decade has now passed since the global financial crisis. We are able to evaluate the impact of the reforms, the side effects, and the gaps in regulation.[8] Evaluations show that the financial market reforms of the past decade have had no relevant undesired side effects and that lending in particular has not suffered.[9]

Even so, there are some who advocate a shift in the regulation. On the one hand, proposals have been tabled to simplify regulation and to reduce the burden on banks. On the other, subjecting financial intermediaries such as investment funds to tighter regulation is being discussed, as they have become more important since the global financial crisis and have extended their market shares.

It certainly makes sense to avoid excessive complexity and unnecessary costs of regulation as well as to address newly emerging risks.[10] That said, lowering capital requirements would have unwanted side effects and would weaken the resilience of the financial sector. At first glance the incumbent institutions would be “relieved” of a burden. But, ultimately, the system would become more vulnerable to risks. Market consolidation could be delayed; pressure on weaker institutions to restructure and critically review business models would weaken and, last but not least, new firms entering the market could intensify competitive pressure and put a strain on banks’ margins.

The regulatory debate should therefore be based on a realistic assessment of the financial sector during the pandemic. A report on the German banking sector by the consultancy firm McKinsey states: “Yes, banks helped stabilize and reengage the economy during the COVID-19 pandemic, but their public reputation has declined.” (McKinsey & Company 2021).

And to this I would add: Yes, banks were better equipped and, above all, better capitalised to overcome shocks thanks to the reforms of the past decade. But owing to the nature of the shock and the huge degree of macroeconomic uncertainty which the pandemic unleashed around the world, they would have been unable to manage this task alone. Significant fiscal and monetary policy measures were needed to reduce uncertainty and safeguard liquidity, bolstered by supervisory measures.

Thanks to the resilience of the banking sector, there was no crisis of confidence in the financial system, unlike in the global financial crisis of 2007-08. Better capitalisation helped make the stabilisation measures effective. At the end of the day, we can’t say how things might otherwise have turned out: we don’t know how great the damage to the financial sector would have been in the absence of comprehensive support measures.

What is certain, though, is that the banking sector barely suffered losses thanks to the policy measures. That had positive effects: banks maintained their lending –without having to use their capital buffers.

In order for the banking sector to continue playing its part, we now need to look more at future risks. Losses still might materialise after all when the support programmes are rolled back. Risk models based on historical data may deliver a distorted picture of future risks. Future losses are hardly likely to be absorbed as swiftly and as comprehensively by government measures as was the case during the coronavirus shock. That's why macroeconomic risks will probably have more of an impact on bank balance sheets than in 2020. Banks and other market participants need to ready themselves for this.

2 How have the financial sector and the real economy developed?

Stable and efficient banks are key for the banking sector to service the real economy. The coronavirus crisis provided a vivid example of this. However, the crisis was also exceptional. To better understand the relationship between developments in the financial sector and the real economy, it is worth taking a look at longer-term developments.

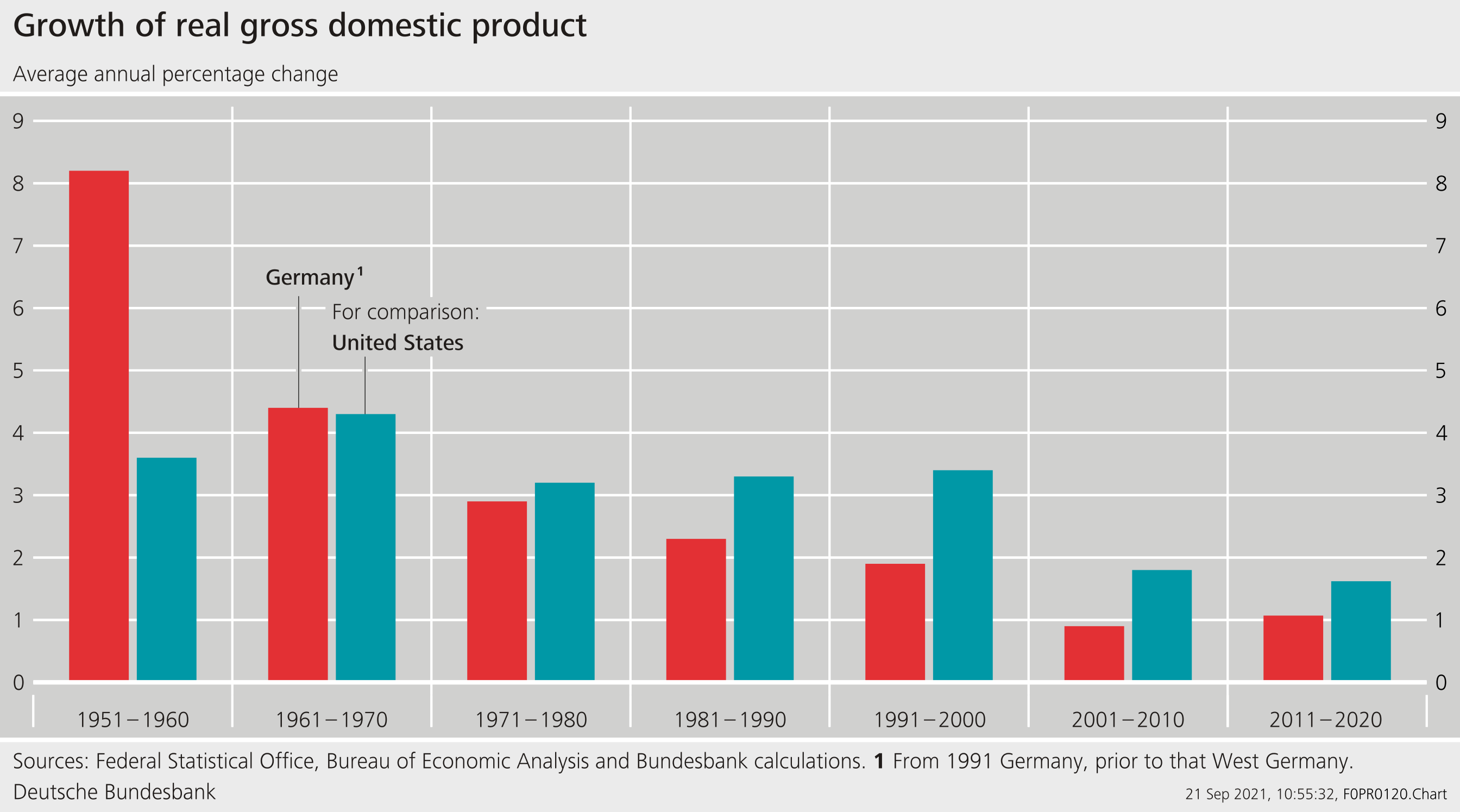

Over the past 70 years, economic growth in Germany has declined: in the 1950s and 1960s, average growth was 4-8% a year; since the 1970s, growth declined to 1‑2% (Chart 3). This decline is not unusual: the 1950s and 1960s were a phase of catch-up growth, in particular to the US. Over the years, drivers of growth shifted to internal sources and innovation. Crises, meanwhile, had a dampening effect: the oil crises of the 1970s, the global financial crisis of 2007-08 and currently the coronavirus crisis.

Chart 3: Growth of real gross domestic product

What role has the German financial sector played in the slowing of economic momentum in recent decades? Blaming only the financial sector for the slow-down in growth would certainly be unfair. But the financial sector certainly has an important part to play in steering investments in the right direction and promoting innovation.

It is difficult to measure how productive the financial sector is. The ratio between transaction volume and the number of employees in the financial sector has risen. This could, at first glance, be interpreted as an increase in productivity in the banking sector. However, this metric doesn't tell the full story. How bank loans and other services impact the real economy is the relevant welfare measure.

The costs of financial services are an indicator of financial sector efficiency: if productivity improves and if technology supports the processing of information, then prices of financial services should come down.

Whether the costs of financial services have indeed come down was initially studied based on US data. Thomas Phillipon (2015) used data from the past 130 years. These data show that, in the 1920s, the US financial sector made up a higher percentage of value added than in the 1960s; since around 1980, the significance of the financial sector has increased again. Yet growing in size does not mean that the financial sector is also producing more cost-effectively. The annual costs of intermediation were, in fact, relatively constant, at roughly 1.5-2% a year, as measured in terms of the financial sector’s total assets. These macroeconomic data do not reflect significant economies of scale or size effects, nor do technological innovations have a visible impact on the prices of financial services.

Analyses for Europe confirm this finding (Bazot 2018): over the past 60 years, the European financial sector has grown relative to GDP. However, the costs of financial intermediation have tended to rise rather than fall. In Germany, the costs of financial services have remained largely unchanged.

Evidence on economies of scale is likewise mixed at the individual bank level. And even if individual banks do achieve economies of scale, the systemic risk posed by large banks is relevant from a macroeconomic perspective (Boyd and Heitz 2016). Larger, systemically important financial institutions can typically obtain funding at more favourable terms than smaller institutions, as they benefit from implicit government guarantees. If this effect is taken into account, the economies of scale measured fall considerably.[11] Generally, implicit guarantees have shrunk with the financial market reforms of recent years; for German banks, there is, however, no evidence of a downward trend.[12]

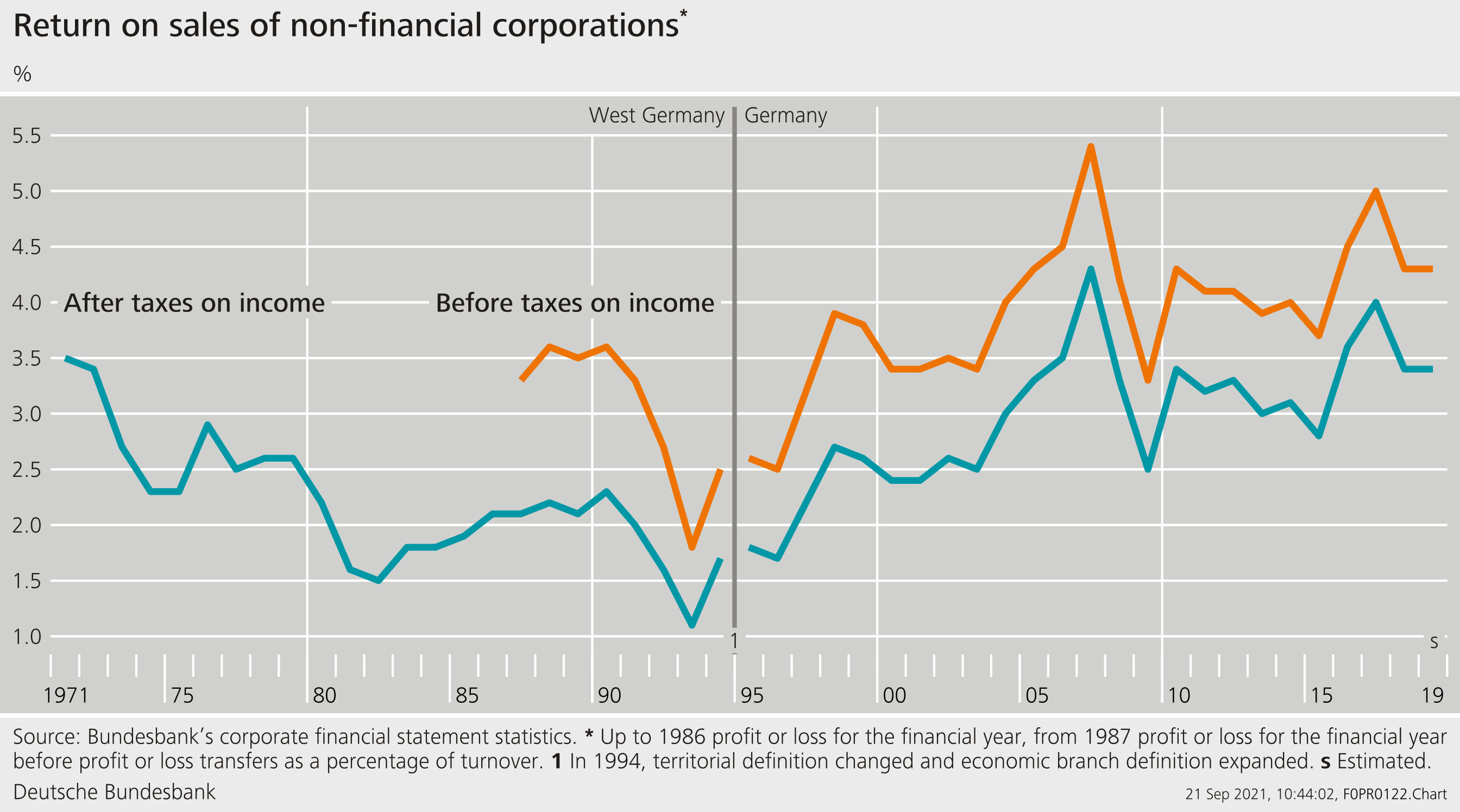

Trends relating to the profitability of banks and non-financial corporations provide further evidence on the efficiency of the financial sector. For non-financial corporations, the return on sales was 3.4% after taxes in 2019, a similar figure as in the early 1970s (Chart 4). Up until the mid-1990s, enterprises’ profitability fell, but it improved thereafter.

Chart 4: Return on sales of non-financial corporations

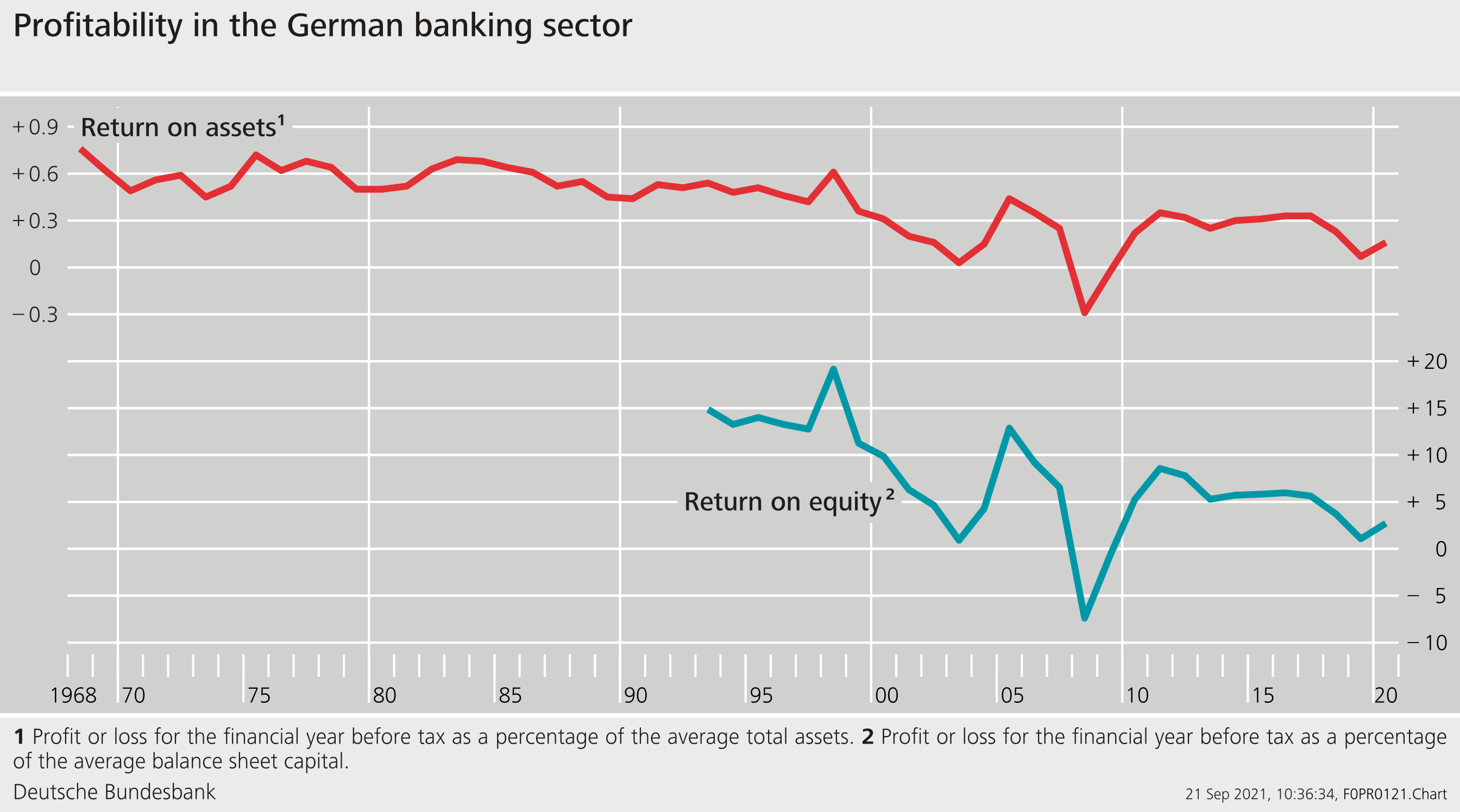

Profitability trends for banks have been different (Chart 5): the return on assets has fallen over time. Trends in the profitability of banks and non-financial corporations thus diverge.

In addition, there are differences across types of banks: over the past 20 years, savings banks and cooperative banks have kept their return on equity fairly steady at 10%; large banks with an international focus have reported a lower and more volatile return on equity. Before the global financial crisis, the large banks had a return on equity of almost 30% at times.[13]

Chart 5: Profitability in the German banking sector

Figures on profitability show that banks’ bemoaned weak margins are not a new phenomenon. Margins started declining in the 1990s, and this coincides with the deregulation of the financial sector.[14] This sheds doubt on the claim that an expansionary monetary policy stance is to blame for banks’ weak margins and low profitability. Larger banks with a smaller footprint in regional lending and deposit business, in particular, have been harder hit by the deregulation of global financial markets and growing international competition.

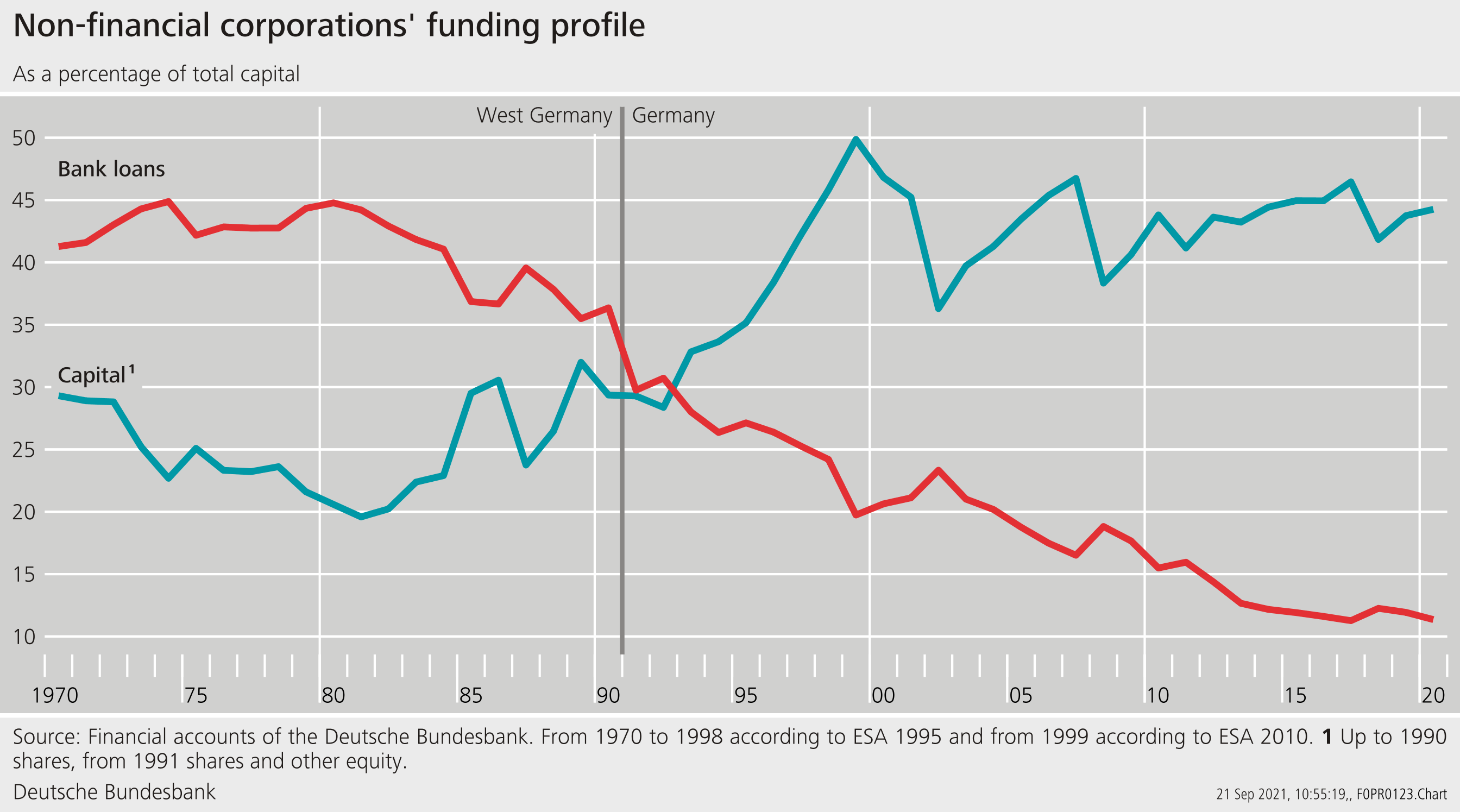

At the same time, non-financial corporations have increasingly funded themselves through retained earnings and other external sources (Chart 6). Equity as a percentage of total corporate sector capital rose from 30% in 1970 to just under 45% in 2020. The percentage of bank loans dropped from around 40% to 10% over the same period (Deutsche Bundesbank 2018). Currently, this trend appears to be reversing somewhat. Bank lending to enterprises has been back on the increase since 2014, as the leeway for internal financing has lessened and funding conditions are, at the same time, relatively favourable (Deutsche Bundesbank 2020a).

One way that banks have responded to growing competitive pressure and declining domestic demand for loans is by expanding into foreign markets. After the financial crisis, they reduced these foreign loans again, not least in order to better meet rising capital requirements (Goodhart and Pradhan 2020).

Chart 6: Financing of non-financial firms

Return on equity is frequently used to measure the banking sector’s performance. Analysing the return on equity makes little sense from a macroeconomic perspective, though: the high yields observed before the global financial crisis were undoubtedly good for banks’ owners and for staff on variable pay. However, they were ultimately a harbinger of the crisis – and the high costs that it would entail for taxpayers.

Changes in return on equity can indeed be caused by many factors: risk premia, cost structures, productivity and, not least, competition within the sector matter. If capitalization rises, banks will take fewer risks. The return on equity will thus drop. From a financial stability perspective, this is good news. It is thus important to take a nuanced view of changes in profitability.

Generally, banks can make an important contribution to economic welfare. But this contribution is measured not by banks’ return on equity, but by the role they play in promoting growth and innovation and in allocating risks appropriately in a society.

Macroeconomic data provide no indication that there is a correlation between the size of the financial sector and the pace of growth and innovation in the real economy. At first glance, the correlation is, if anything, negative – growth of the financial sector has in recent decades been accompanied by weaker growth in the real economy. Ultimately, a more nuanced analysis at sector or even enterprise level is needed to capture the banking sector’s contribution to developments in the real economy.[15]

3 What future challenges does the financial sector face?

To enable the financial sector to fulfil its macroeconomic functions, it must be in a position to tackle future challenges. These challenges are the result of four major global trends:

Digitalisation: The digital transformation is creating new ways of delivering financial services – more quickly, more efficiently and possibly more securely than within the existing structures.

Banks’ business relationships with their customers can supply them with important information. Transactions on deposit accounts can provide banks with insights into payment behaviour and creditworthiness. But what happens if other businesses obtain similar or even better information about the customer's payment habits and credit standing?

It remains to be seen whether the provision of financial services will become separated from banks’ deposit business in the future. When it comes to procuring and processing information, businesses running digital business models could have an edge over banks (Brunnermeier, James and Landau 2019).

Similarly, providers of digital payment systems can offer alternatives to established payment methods and increase their market share. As a result, the introduction of digital payment methods may potentially have a major impact on competitive structures in the financial sector.

Of course, established institutions can tap into the potential offered by digitalisation. Yet the interplay of new and old providers is what ultimately drives innovative momentum. It has to be possible for participants to enter and exit the market. Investment in new systems is needed, and banks have to manage digital risks.[16]

Demographic change: In the coming years, demographic change will be a key driver of macroeconomic developments and will confront banks with very specific challenges. At the operational level, banks need to revise their branch strategies. On the one hand, branches are a key sales channel, particularly in an ageing society. On the other hand, maintaining a branch network is expensive, and many banks are already closing branches as a way of cutting costs.

Credit and deposit growth are also affected by changes in the age structure of the population because the type and form of wealth accumulation and financial requirements change over the course of a lifetime.[17]

To address these developments, banks must reassess not only their sales channels but also their range of products and services.

Climate change: Climate change is one of the greatest challenges facing society and affects all areas of life – including the financial system (Buch and Weigert 2021). Physical risks, such as extreme weather events, cause damage and destroy assets. The process of adjustment towards a climate-neutral economy is associated with transition risks, e.g. when assets lose value as a result of an unexpected change in climate policy (Carney 2015).

Climate-related risks affect banks via the conventional risk categories, such as credit or market risk. Banks should therefore take adequate account of climate risks in their risk management and should be sufficiently resilient. Central banks can play a key part in this by analysing the impact of climate risks on the financial system and helping to improve the disclosure and recognition of these risks.[18]

Macroeconomic risks: Following the slump in the wake of the coronavirus pandemic, the German economy is now recovering rapidly. In many services sectors, economic activity is growing thanks to the easing of pandemic containment measures. In industry, bottlenecks in the supply of intermediate goods and commodities are slowing down the recovery. Provided that these supply bottlenecks do not worsen and the pandemic does not necessitate any additional containment measures, the German economy should continue to recover. According to current projections by the Bundesbank, economic growth will come to 3.7% in 2021 and 5.2% in 2022. In 2023, growth in real gross domestic product is likely to fall to 1.7% (Deutsche Bundesbank 2021).

Despite the positive growth outlook, there are risks. First, the real economy could suffer a setback if the pandemic escalates again and further containment measures become necessary. Second, supply bottlenecks could last longer and the inflation rate could grow much more strongly in the recovery phase than is currently expected on average. An unexpectedly steep rise in inflation could be accompanied by an increase in market rates and sharp market corrections.

The current environment shares some similarities with the situation prior to the outbreak of the coronavirus pandemic: lending is expanding strongly, housing prices are still on the rise, and financial markets are showing low volatility, high valuations and compressed risk premia.

What is therefore needed is good management and effective supervision to address banks’ risks in their current business. Yet we also need to have functioning mechanisms for dealing with banks that won't be up to the challenges of the future. Much has been achieved in this area since the financial crisis but there is still more to do (FSB 2021). This is especially true of Europe (Hellwig 2019). The reform of the European Stability Mechanism (ESM) was a key step in the right direction; the upcoming review of the Bank Recovery and Resolution Directive (BRRD) offers an opportunity to correct ongoing shortcomings.[19]

4 What needs to be done?

The coronavirus crisis has made considerable demands on banks, both in terms of their operations and regarding the supply of the real economy with urgently needed credit. The comprehensive crisis-related fiscal measures have allowed banks to continue lending. Yet structural challenges facing the sector remain and, if anything, have intensified. There are three particular areas in which action needs to be taken.

- Dealing with digitalisation

Collecting and processing information has, for centuries, represented the banking sector’s competitive advantage in the provision of financial services to the real economy. With the advent of digitalisation, this has changed: new, smaller players – Fintech firms – are developing innovative business models and provide financial services. And actors which have data on nearly everyone and everything – Bigtech firms – have now appeared on the scene.

If Bigtech firms provide financial services, they can impact financial stability through their size and market power. It is the task of competition authorities to create and maintain a level playing field. But central banks and supervisory authorities likewise need to look into the impact of Bigtech firms on financial markets. Market dominance can lead to systemic importance – if, for instance, a single firm provides key services for large swathes of the financial sector.

Yet what contribution can central banks and supervisory authorities make?

First, we can apply our analytical capabilities to better understand the role of Bigtech firms in the financial system and their implications for financial stability.

Second, we can provide a platform for international dialogue and collaboration – in order to better analyse the interplay of risks in the financial system across borders and to mitigate them.

Third, Bigtech activities in the financial sector need to be regulated such that they do not pose risks to financial stability. Shifting regulation away from an entity-based towards and activity-based approach can be useful in this regard (FSB 2019b). An important trade-off needs to be borne in mind here: regulation should neither distort competition nor stifle useful innovation, yet innovation can be associated with new risks.

- Reviewing incentive mechanisms

The ability of the financial sector to cope with future macroeconomic challenges will hinge on incentive mechanisms. Goodhart and Pradhan (2020: p. 166) note: “In an important sense, we view the past and future macroeconomic maladies as a reflection of dramatic demographic trends, but also as a failure of corporate governance and in the structure of capitalism. Debt has been made too easy to adopt, and equity finance too unattractive. Equity finance is not attractive to corporate executives, so long as the focus on RoE remains, and such executives continue to share in the limited liability of all shareholders

.”

Regulatory approaches so far have largely centred around imposing higher capital requirements in order to mitigate risks in the banking sector. Sufficient capitalisation not only protects the individual bank from risks not covered by capital buffers but also makes the financial system as a whole more robust.

Both banks and supervisors, thus focus on regulatory capital ratios: banks can comply with higher capital ratios by either increasing capital, such as through retained profits, or by reducing their risks through deleveraging.

However, one should not lose sight of the institutional framework and the incentive system within which banks operate. One regulatory objective over the past ten years has been to change incentive structures within the banking industry. In order to minimise incentives for excessive risk taking, the Financial Stability Board (FSB) developed standards for compensation practices and for the transparency of systemically important financial institutions (FSB 2019a). Implementation of these standards is reviewed regularly. In addition, the European Banking Authority (EBA) has issued guidance on remuneration practices, and it regularly disseminates information on the remuneration of “material risk takers”.[20] However, there has, to date, not yet been any systematic evaluation of the success achieved in sustainably changing incentives.[21]

In the area of supervision, it is not enough to just look at regulatory metrics. In a dynamically evolving environment, banks’ business models and potential risks to financial stability need to be analysed. Supervisors thus analyse the risks inherent in banks’ business models, though they must stay neutral as regards the choice of business model.[22] Banks need to decide which new technologies to deploy and how to design their business models. Supervisors take new digital risks into account when analysing business models, in particular with regard to risk management and the use of artificial intelligence (AI) in credit assessments or portfolio management. From the point of view of financial stability, implications of different business models for risks in the system as a whole need to be assessed.

The digital transformation is making it increasingly difficult to draw a clear distinction between business models in the financial and non-financial sectors. The boundaries between different categories of risk are seamless. Elizabeth McCaul (2019) refers to a “migration of risks” as it is increasingly difficult to distinguish between risk categories. Oversight of risks thus requires connecting information from various sources. For example, statistical data from the balance of payments statistics may be relevant for supervisors. In order to be able and permitted to use such information efficiently, not only technical adjustments to information systems but often legal amendments to enable the necessary data exchange and access are required.

- From crisis management to crisis prevention

The financial sector has continued to function during the coronavirus pandemic. That’s good news. The less good news is that vulnerabilities which had already been building up prior to the pandemic have intensified. It is now important to find the right moment to switch from crisis management mode to crisis prevention mode.

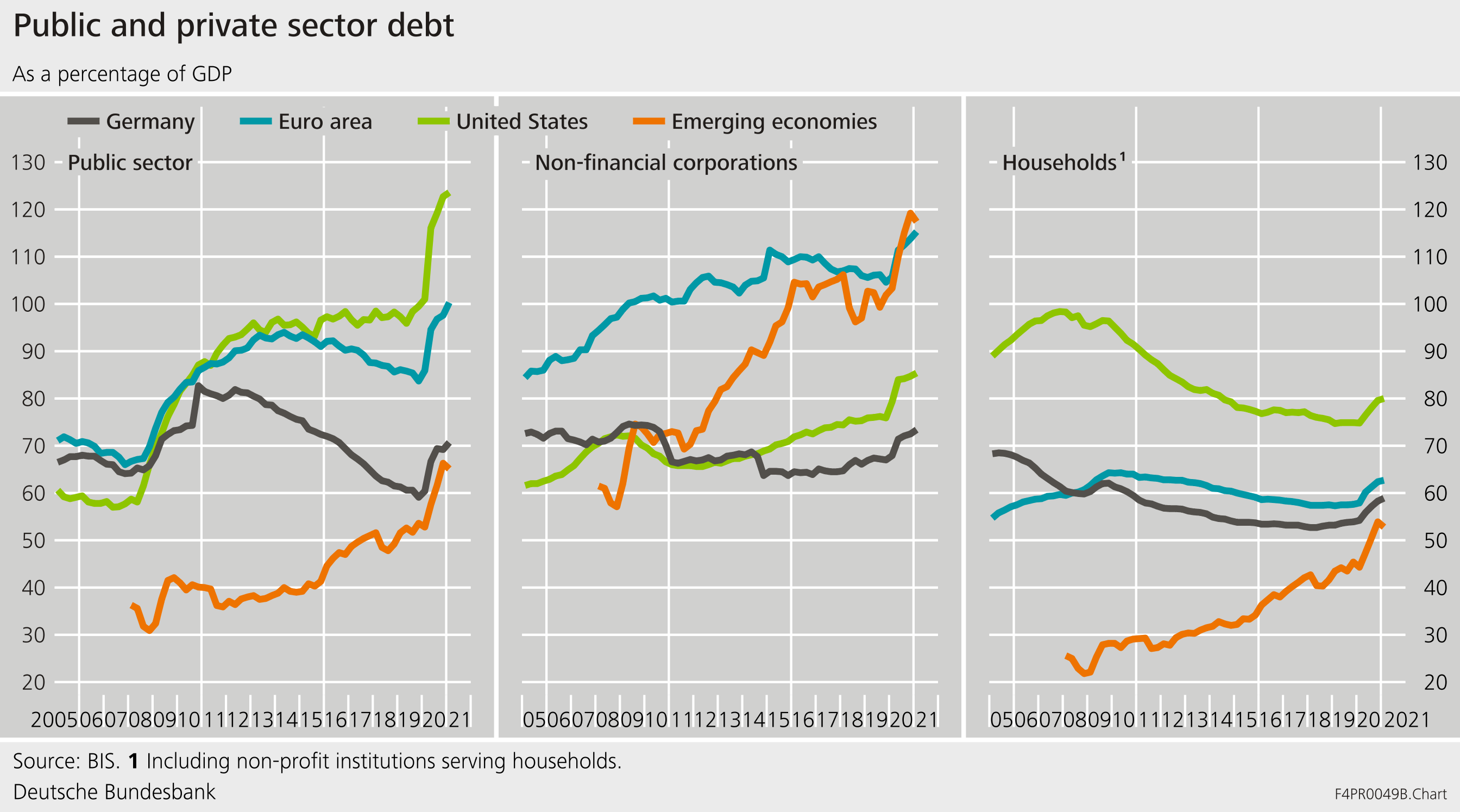

Public and private sector debt has risen (Chart 7). Debt of non-financial corporations relative to GDP had already risen globally before the pandemic. The extended cyclical upswing, low interest rates and favourable financing conditions all contributed to this increase. The need for liquidity caused by the coronavirus crisis pushed up indebtedness further, including that of households. While public debt had been on a decline prior to the pandemic, especially in Europe, this trend has reversed.

Chart 7: Public and private sector indebtedness

The risks in German banks’ loan portfolios have shifted. Even prior to the pandemic, the structure of bank loan portfolios had shifted to relatively weak firms (Deutsche Bundesbank 2019). Firms with relative good credit risk had switched to market-based funding sources or retained earnings. These allocation risks have become further entrenched during the coronavirus pandemic.

As regards banks, risk-weighted capital ratios have increased. However, the rise in capital ratios partly also reflects the impact of supervisory measures.

The financial sector will face new potential risks going forward. Banks will have to deal with the fallout from climate change and climate policy, higher private and public sector debt, and international political risks that could spill over into the German financial sector.

The financial sector can cope with these risks and fulfil its functions for the real economy only if it is sufficiently resilient. A strong financial sector contributes to a resilient economy that can deal with and recover from smaller crises. This allows reaching a higher growth path than would be the case if risks were avoided altogether (Brunnermeier 2021).

The current crisis did not test the resilience of the financial system. Fiscal and monetary policy have tempered the impacts of the pandemic on the financial system. The crisis should thus not be taken as an opportunity to entrench the crisis-induced supervisory relief or to water down supervisory requirements for banks.[23]

On the contrary: the recent macroeconomic stabilisation has led to a continued build-up of vulnerabilities over the financial cycle. Resilience in the financial sector with regard to future risks thus needs to be maintained. Nobody knows when and how the next shock will hit. We therefore need robust and well-capitalised financial institutions to maintain financial stability and ensure the functioning of the financial system. This will ultimately protect the real economy and economic growth.

5 References

Albuquerque, Rui, Luís Cabral and José Guedes (2019). Incentive Pay and Systemic Risk. Review of Financial Studies, Society for Financial Studies 32(11): 4304-4342.

Bazot, Guillaume (2018). Financial Consumption and the Cost of Finance: Measuring Financial Efficiency in Europe (1950–2007). Journal of the European Economic Association 16(1): 123–160.

Beccalli, Elena, Mario Anolli and Giuliana Borello (2015). Are European banks too big? Evidence on economies of scale. Journal of Banking and Finance 58: 232-246.

Boyd, John H. and Amanda Heitz (2016). The social costs and benefits of too-big-to-fail banks: A “bounding” exercise. Journal of Banking and Finance 68: 251-265.

Brunnermeier, Markus (2021). The Resilient Society -- Lessons from the pandemic for recovering from the next major shock. Endeavor Literary Press

Brunnermeier, Markus K., Harold James and Jean-Pierre Landau (2019). The digitalization of money. National Bureau of Economic Research. Working Paper 26300. Cambridge, MA.

Buch, Claudia M. and Benjamin Weigert (2021). Climate Change and Financial Stability: Contributions to the Debate. https://www.bundesbank.de/resource/blob/869058/f33e5c6b7081fe801dc663205f7feee9/mL/paper-buch-weigert-data.pdf

Carney, Mark (2015). Breaking the tragedy of the horizon – climate change and financial stability. Speech given by Mark Carney, Governor of the Bank of England, Lloyd’s of London, 29 September 2015.

Colonnello, Stefano, Michael Koetter and Konstantin Wagner (2020). Effectiveness and (in)efficiencies of compensation regulation: Evidence from the EU banker bonus cap. IWH Discussion Papers 7/2018, Halle Institute for Economic Research (IWH).

Deutsche Bundesbank (2018). Monthly Report. January 2018. Frankfurt a. M.

Deutsche Bundesbank (2020a). Monthly Report. February 2020. Frankfurt a. M.

Deutsche Bundesbank (2020b). Financial Stability Review. Frankfurt a. M.

Deutsche Bundesbank (2021). Monthly Report. July 2021. Frankfurt a. M.

Davies, Richard and Belinda Tracey (2014). Too Big to Be Efficient? The Impact of Implicit Subsidies on Estimates of Scale Economies for Banks. Journal of Money, Credit and Banking 46: 219–253

DeYoung, Robert, Emmy Y. Peng and Meng Yan (2013). Executive Compensation and Business Policy Choices at U.S. Commercial Banks. Journal of Financial and Quantitative Analysis 48 (1): 165–196

European Systemic Risk Board (ESRB) (2021). Financial stability implications of support measures to protect the real economy from the COVID-19 pandemic. Frankfurt a.M.

Financial Stability Board (FSB) (2017). Framework for Post-Implementation Evaluation of the Effects of the G20 Financial Regulatory Reforms. Basel.

Financial Stability Board (FSB) (2019a). Implementing the FSB Principles for Sound Compensation Practices and their Implementation Standards: Sixth progress report. Basel.

Financial Stability Board (FSB) (2019b). BigTech in finance. Market developments and potential financial stability implications. Basel.

Financial Stability Board (FSB) (2021). Evaluation of the effects of too-big-to-fail reforms: Final Report. Basel.

Gai, Prasanna, Malcolm Kemp, Antonio Sánchez Serrano and Isabel Schnabel (2019). Regulatory complexity and the quest for robust regulation. Reports of the Advisory Scientific Committee No 8. Frankfurt a. M.

Goodhart, Charles and Manoj Pradhan (2020). The Great Demographic Reversal – Ageing Societies, Waning Inequality, and an Inflation Revival. Palgrave Macmillan.

Gropp, Reint, Andre Guettler and Vahid Saadi (2020). Public guarantees and allocative efficiency. Journal of Monetary Economics 116(C): 53-69.

Hellwig, Martin (2000). Banken zwischen Politik und Markt: Worin besteht die volkswirtschaftliche Verantwortung der Banken? Perspektiven der Wirtschaftspolitik 1(3): 337-356

Hellwig, Martin (2019). Banks, Politics, and European Monetary Union. Discussion Paper of the Max Planck Institute for Research on Collective Goods. 2019/13. Bonn.

International Monetary Fund (IMF) (2021). World Economic Outlook, April 2021. Washington D.C.

Krippner, Greta (2012). Capitalizing on Crisis: The Political Origins of the Rise of Finance. Harvard University Press. Cambridge, MA.

McCaul, Elizabeth (2019). Convergence of Risk Convergence of Risk – “Breaking the Silos”. IBM RegTech Summit. 26 September 2019.

McKinsey & Company (2021). German banking returns to the playing field. Global Banking Practice. July 2021. Düsseldorf.

Philippon, Thomas (2015). Has the US Finance Industry Become Less Efficient? On the Theory and Measurement of Financial Intermediation. American Economic Review 105(4): 1408-1438.

Reinstädtler, Gabriela, Marie Sophie Ruffing and Gerd Waschbusch (2018). Aktuelle Ertragslage von Banken – Belastungsfaktoren und Wege aus der Ertragskrise. Zeitschrift für das gesamte Kreditwesen 71(18): 10–15.

Footnotes:

- My thanks to Manuel Buchholz, Friso van der Meyden, Marlies Ria Uekermann, Benjamin Weigert, Matthias Weiß and Johanna Winkel for their valuable contributions and comments on an earlier version of this text. Any remaining errors and inaccuracies are entirely my own.

- For an overview of such measures, see

- These figures are based on the AnaCredit credit register.

- See Federal Statistical Office: https://www.destatis.de/EN/Press/2021/03/PE21_N023_p001.html

- The SME supporting factor was introduced when Basel III was implemented in Europe. It reduces the capital requirements for loans to small and medium-sized enterprises and is intended to improve SME access to loans. The adjustment additionally lowered the capital requirements for loans to SMEs.

- Financial cycles are the ups and downs in financial and real economic variables within the financial system over the medium term. Key variables include the aggregate loan supply and real estate prices. The financial cycle is distinct from the business cycle, which maps briefer fluctuations in economic activity. A sharp upswing in the financial cycle can drive up financial system vulnerability and lead to a build-up of systemic risk. See the Bundesbank’s glossary at https://www.bundesbank.de/en/homepage/glossary for a definition.

- See Countercyclical capital buffer www.bafin.de

- An international framework for such evaluations was devised by the Financial Stability Board (FSB 2017).

- See https://www.fsb.org/publications/evaluation-reports/

- See the report of the ESRB’s Advisory Scientific Committee (Gai, Kemp, Sánchez Serrano and Schnabel 2019).

- Classification as a systemically important financial institution appears to have a positive effect on economies of scale, as this status means that banks receive funding from investors on more favourable terms (Davies and Tracey 2014).

- See https://www.fsb.org/wp-content/uploads/P280620-2.pdf

- See Deutsche Bundesbank (Monthly balance sheet statistics, statistics of banks’ profit and loss accounts).

- For a discussion of the deregulation of the financial sector, especially in the United States, and the politico-economic rationale, see Krippner (2012).

- See, for example, Gropp, Guettler and Saadi (2020) for an analysis of the influence of government guarantees on the allocation of loans.

- Almost half of the Bundesbank's on-site bank inspections since 2010 have identified deficiencies in risk management, 15% of which were in the area of IT management (Deutsche Bundesbank 2021, p. 56).

- See, amongst others, Reinstädtler, Ruffing and Waschbusch (2018) for a discussion of the situation in Germany.

- See https://www.bundesbank.de/en/press/contributions/climate-change-and-central-banks-867984

- See https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/12732-Banking-Union-Review-of-the-bank-crisis-management-and-deposit-insurance-framework-BRRD-review-/public-consultation_en

- See https://www.eba.europa.eu/regulation-and-policy/remuneration

- For more recent studies on incentives in the banking system, see Albuquerque, Cabral and Guedes (2019) and DeYoung, Peng and Yan (2013). These studies, however, do not refer specifically to the reforms implemented since the global financial crisis. One example of a more recent study is Colonnello, Koetter and Wagner (2020), who analyse the effects of European banks’ compensation policies based on EBA data.

- See https://www.bundesbank.de/en/tasks/banking-supervision/bundesbank/operational-tasks/banking-supervision-at-the-deutsche-bundesbank-operational-tasks--622934

- In an open letter to the European Commission, the central banks of the ESCB recently stressed the need for the full, timely and consistent implementation of all Basel III standards. See https://www.bancaditalia.it/media/notizie/2021/Joint-letter-concerning-Basel-III.pdf?language_id=1