Statement by Sabine Mauderer at the press conference presenting the Annual Report 2023

Check against delivery.

1 Introduction

Ladies and gentlemen,

I would be happy to now take a closer look at our annual accounts. So first things first, let’s address the question of why the situation is as it is.

As the President has already said: The monetary policy measures taken in recent years have caused the financial risks on the balance sheets of central banks to rise significantly. And these risks materialised in 2023.

Since 2020, increased asset purchases under the APP and PEPP programmes have added substantially to the interest rate risk on our balance sheet. These risks began to crystallise when key interest rates started rising in mid-2022. In 2023, this turned the Bank’s interest rate spread negative overall for the first time.

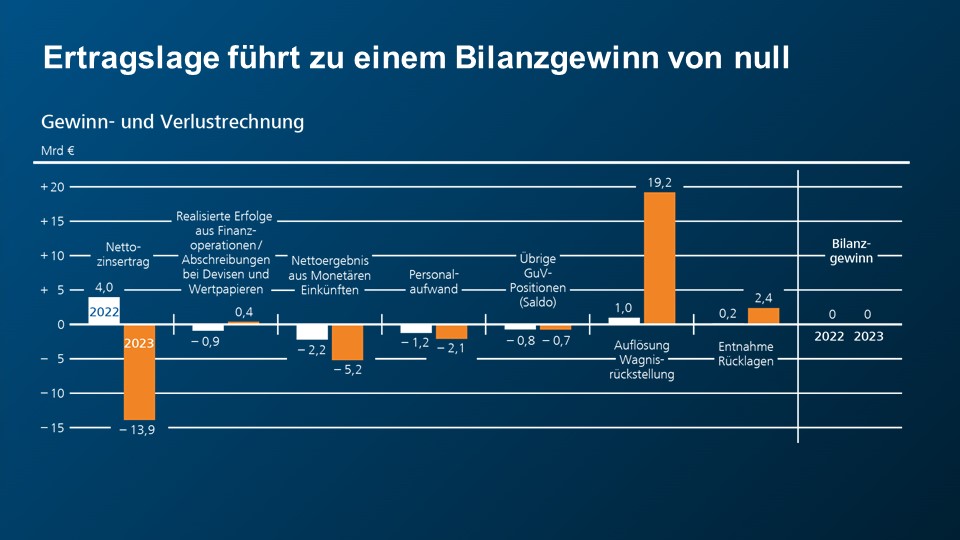

As a result of this, the Bundesbank sustained losses of around €21.6 billion in 2023. To offset these losses, the €19.2 billion in provisions for general risks that we had built up over the past years were released in full. The remaining loss was offset by releasing reserves in the amount of €2.4 billion. The bank is thus reporting a distributable profit of zero. Total assets are down overall.

How did these developments impact on the annual accounts in 2023?

2 Balance sheet

Let’s take a closer look at our balance sheet:

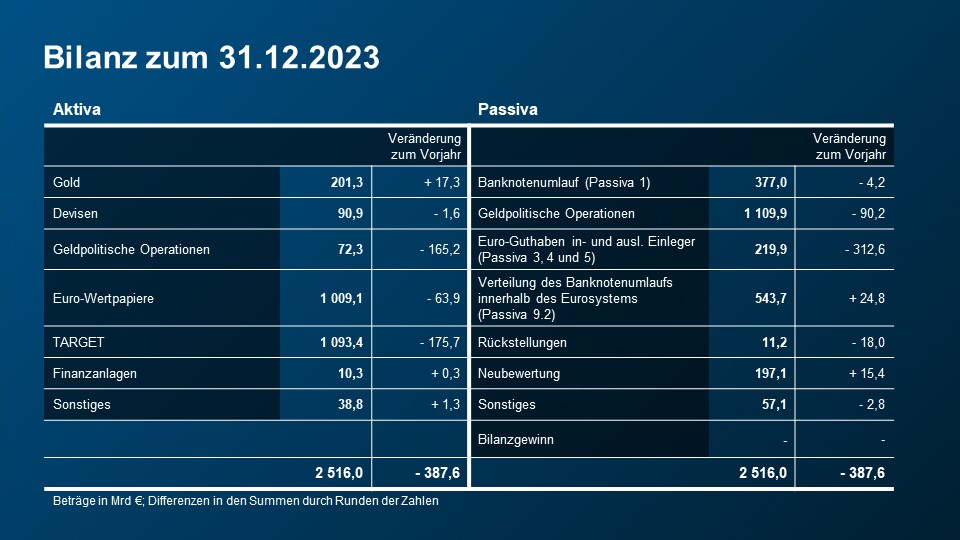

Monetary and foreign exchange policy activities lowered total assets: by around €390 billion, or 13%. Viewed through a longer-term lens, though, total assets are still up on the end of 2019 – i.e. their level before the pandemic and before the start of the highly accommodative monetary policy.

I see three main factors driving the decline in total assets on the assets side:

- First, liquidity outflows meant that the TARGET claims on the ECB fell again for the first time in 2023, dropping by €176 billion.

- Second, lending related to monetary policy operations – above all lending related to the targeted longer-term refinancing operations conducted at particularly favourable interest rates during the pandemic – shrank by €165 billion.

- Third, euro-denominated securities under the monetary policy purchase programmes contracted by €64 billion: This decline was largely confined to the APP holdings, where reinvestments were discontinued as of July 2023. As for the PEPP, meanwhile, reinvestments are scheduled to continue through to the end of 2024, with the volume being reduced as of the second half-year. So we will see further effects from this in the annual accounts for financial year 2024.

The liabilities side of the balance sheet shrank as well, of course, with deposits declining significantly: Euro balances of domestic and foreign depositors dropped to €220 billion year on year as foreign central banks and general government reduced their holdings. In addition, liabilities related to monetary policy operations fell to €1,110 billion on the year. Just as an aside: At present, just under one-third of all deposits of credit institutions throughout the Eurosystem are held with the Bundesbank.

Let’s now take a look at the other key changes on the liabilities side of the balance sheet:

I’d like to start with the “Banknotes in circulation” item: Now that the negative interest rate policy period has come to an end, growth in the volume of banknotes in circulation in the Eurosystem has effectively come to a standstill. The Bundesbank’s share of the Eurosystem’s banknotes in circulation reported on the balance sheet under liabilities item 1 “Banknotes in circulation” is down slightly at €377 billion. By contrast, the volume of banknotes actually issued by the Bundesbank is up slightly. This can be seen in liabilities sub-item 9.2 “Net liabilities related to the allocation of euro banknotes within the Eurosystem”, which has risen to €544 billion.

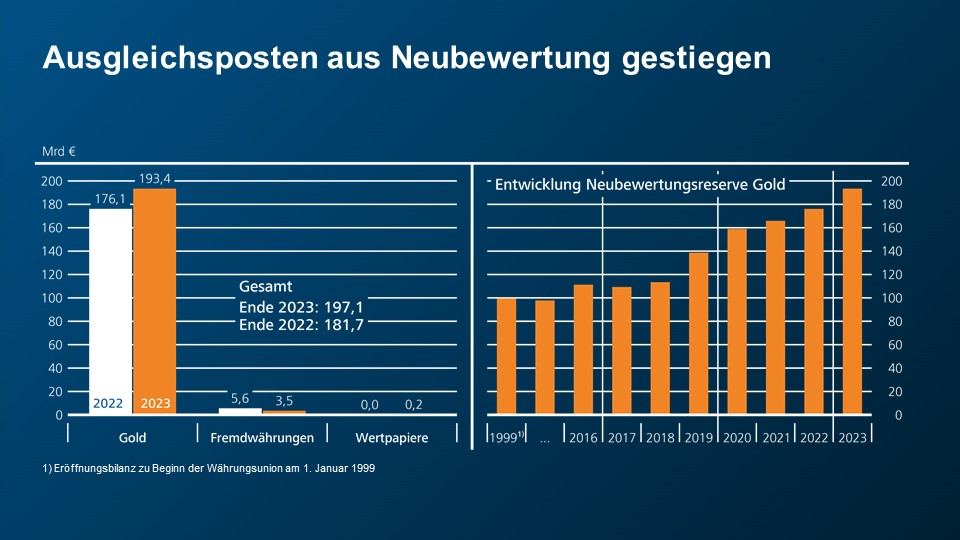

Another item on the liabilities side I would like to discuss is the revaluation accounts item: This item increased on the year, climbing by €15 billion to €197 billion.

You will see a breakdown of the revaluation accounts item on the next slide.

The revaluation reserve for gold contained within that item has risen by €17 billion to €193 billion. Gold is marked to market in euro at the reporting date, and its value was 9.5% up on the year. Viewed over the long term, there is still a sustained marked increase in the revaluation reserve for gold. Compared with its starting balance at the launch of monetary union, this revaluation reserve, with its current balance of €193 billion, is nine times as large as it was at the start of 1999.

By contrast, the revaluation reserve for foreign currency has shrunk by €2 billion on account of the stronger euro. That decline is mainly attributable to assets denominated in US dollar.

3 Profit and loss account

Let’s now turn our attention to the profit and loss account.

As Joachim Nagel has already said: The Bundesbank’s profitability is significantly less favourable than it was in the previous year. The turnaround in interest rates and the associated key interest rate hikes have set many things in motion. Long-term monetary policy securities – generating low levels of remuneration – on the assets side combined with short-term deposits on the liabilities side are causing a considerable strain. In not one, not two, but three respects.

Interest rate risk has impacted on us:

- via our own securities holdings;

- via securities carried on the balance sheets of the other national central banks in cases where these securities are subject to income and risk sharing and are thus included in the pooling of monetary income among national central banks;

- via the ECB’s securities holdings as well.

Regarding the latter – as you will have heard yesterday – the Governing Council of the ECB has decided that the ECB’s losses for this financial year will not be borne by the national central banks. In other words: the ECB’s current losses are not recognised in the Bundesbank’s annual accounts for 2023.

However, the ECB’s losses will impact on the Bundesbank’s profit and loss account sooner or later. Either sooner, if the Governing Council does yet decide in future periods that losses will be assumed by the national central banks. Or later, by the ECB refraining from distributing profits for as long as the loss carryforward on the ECB’s balance sheet first needs to be offset out of ECB profits.

But coming back to the current profit and loss account: Net interest income (bar 1) – the largest component of the profit and loss account – fell by €17.9 billion on the year. It came to -€13.9 billion, turning negative for the first time ever. While net interest income in foreign currency rose to €1.9 billion owing to higher US capital market yields, net interest income in euro contracted to -€15.8 billion.

What happened? In the past years, the monetary policy asset purchases have given rise to longer-term fixed interest positions (generating a low level of remuneration). The counterparts of these on the liabilities side of the balance sheet – besides banknotes in circulation – are short-term interest-bearing deposits of commercial banks. The mismatch in maturities has left an open euro interest rate position on the balance sheet. The significant increase in the deposit facility rate caused the interest rate risk from this open interest rate position to materialise.

Specifically, this means that while the remuneration of monetary policy securities in 2023 increased only marginally (to 0.37% on average), credit institutions’ monetary policy deposits resulted in a significantly increased interest charge (of 3.27% on average for the year) owing to the higher deposit facility rate. On balance, this gives us a negative interest margin of

-2.90% for 2023.

Realised gains from financial operations and write-downs related to foreign exchange and securities (bar 2) were €1.3 billion up on the previous year at €393 million. Realised gains, which had come under a significant strain in 2022 owing to substantially higher US capital market yields, increased by €544 million overall to €546 million.

Write-downs came to €153 million, €769 million less than in the previous year. Write-down requirements were down on Treasury notes in particular owing to the comparatively smaller uptick in US capital market yields.

That brings me to the monetary income item. This item records the net income from assets held by central banks as counterparts to the cash in circulation and to their liabilities from credit institutions’ deposits. In the Eurosystem, this monetary income is shared according to the capital key.

In the net result of pooling of monetary income item (bar 3), the expense increased by €3 billion to -€5.2 billion. This was notably due to the rise in key interest rates and the resulting materialisation of interest rate risk on the supranational securities held for monetary policy purposes. These securities were purchased by other national central banks as part of PSPP and PEPP purchases. The Eurosystem’s holdings came to an annual average of €418 billion. The Bundesbank itself has no holdings. But even so, income and risks from these securities holdings are shared within the Eurosystem. The supranational securities holdings generate only a low level of remuneration.

Compared with the increased main refinancing rate, the interest margin is negative at around -3.4% on an annual average. The lower income resulting from this is balanced out among the national central banks via the common pool of monetary income. Based on its capital share of 26.1%, the charge for the Bundesbank came to around €3.7 billion – that’s €3.3 billion more than in the previous year.

Staff costs (bar 4) in 2023 were €861 million higher at €2.1 billion. This increase was caused by one-off effects related to expenditure on post-employment benefits resulting from higher transfers to staff provisions. One notable factor at play here was the inflation-driven increase in wages and salaries for 2024, leading to higher pension provisions.

The result for financial year 2023 was a loss of almost €21.6 billion. The provisions for general risks of €19.2 billion previously (bar 6) were released in full to offset the accumulated losses (previous year: withdrawal of just under €1 billion). The remaining loss for the year of around €2.4 billion was offset by making withdrawals in the same amount from the reserves (bar 7) (previous year: €0.2 billion), thus reducing the reserves to just under €0.7 billion. As in the previous year, the profit and loss account for financial year 2023 closed with a balanced result, meaning that there was zero distributable profit, as in 2022. No loss carryforward has been recognised.

4 Conclusion

I shall now conclude my remarks by summarising the main takeaways.

The financial burdens are high. And we are expecting them to be considerable again in 2024. Overall, we are assuming that we will have to work with loss carryforwards for some time and therefore be unable to distribute any profits for a longer period. As you know, it won’t be the first time the Bundesbank carries losses forward. That happened back in the 1970s as well. Back then, the net accumulated losses were offset by subsequent profits, and the same can be done in the current situation.

I’d like to conclude my remarks with the most important message for today:

The Bundesbank has considerable assets, which are significantly in excess of its obligations. Our revaluation reserves, for instance, amount to almost €200 billion.

In short, the Bundesbank can bear these financial burdens. The Bundesbank’s balance sheet is sound.