Statement at the presentation of the Deutsche Bundesbank’s 2021 Financial Stability Review

Check against delivery.

Ladies and gentlemen,

I would like to welcome you to the presentation of the Deutsche Bundesbank’s Financial Stability Review. The report contains positive takeaways, but also clearly highlights where action is needed.

The financial system has functioned well during the pandemic. The extensive government measures have shielded the financial sector from losses.

But vulnerabilities are continuing to build up – to adverse macroeconomic developments and specifically in the housing market.

Preventive action is needed to increase resilience in the financial system. The countercyclical capital buffer should be built up in good time and risks in the residential real estate market must be contained.

In this year’s Financial Stability Review, we also take a look at what impact changes in climate policy have on the financial sector. Our analyses show that revaluation effects following a rise in carbon prices would be manageable. Targeted and credible climate policy action lowers risks to financial stability.

Let me explore these key messages of the report in more detail.

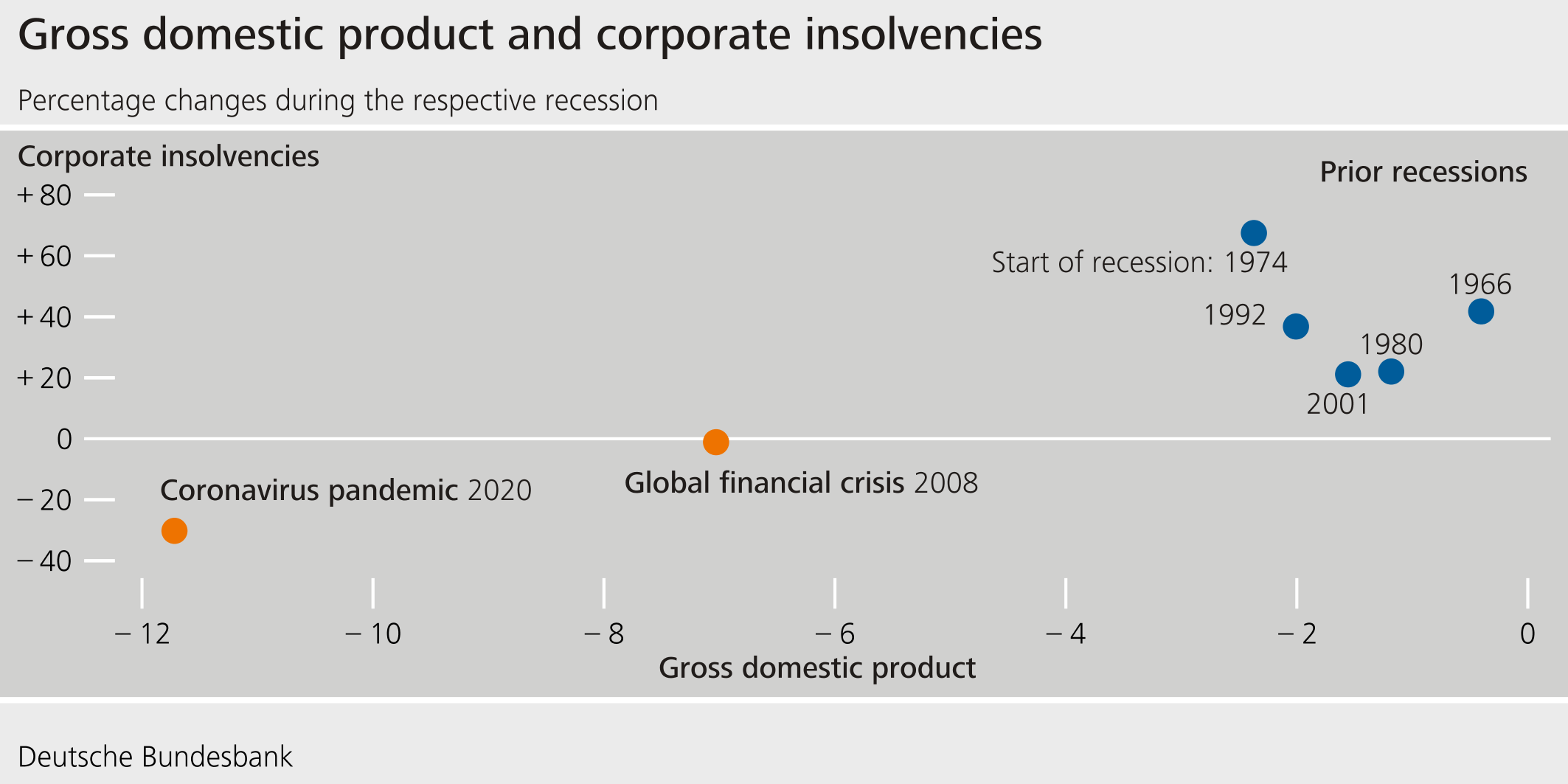

Just a year ago, uncertainty surrounding the economic fallout from the pandemic was greater than it is today. We were concerned about rising insolvencies.

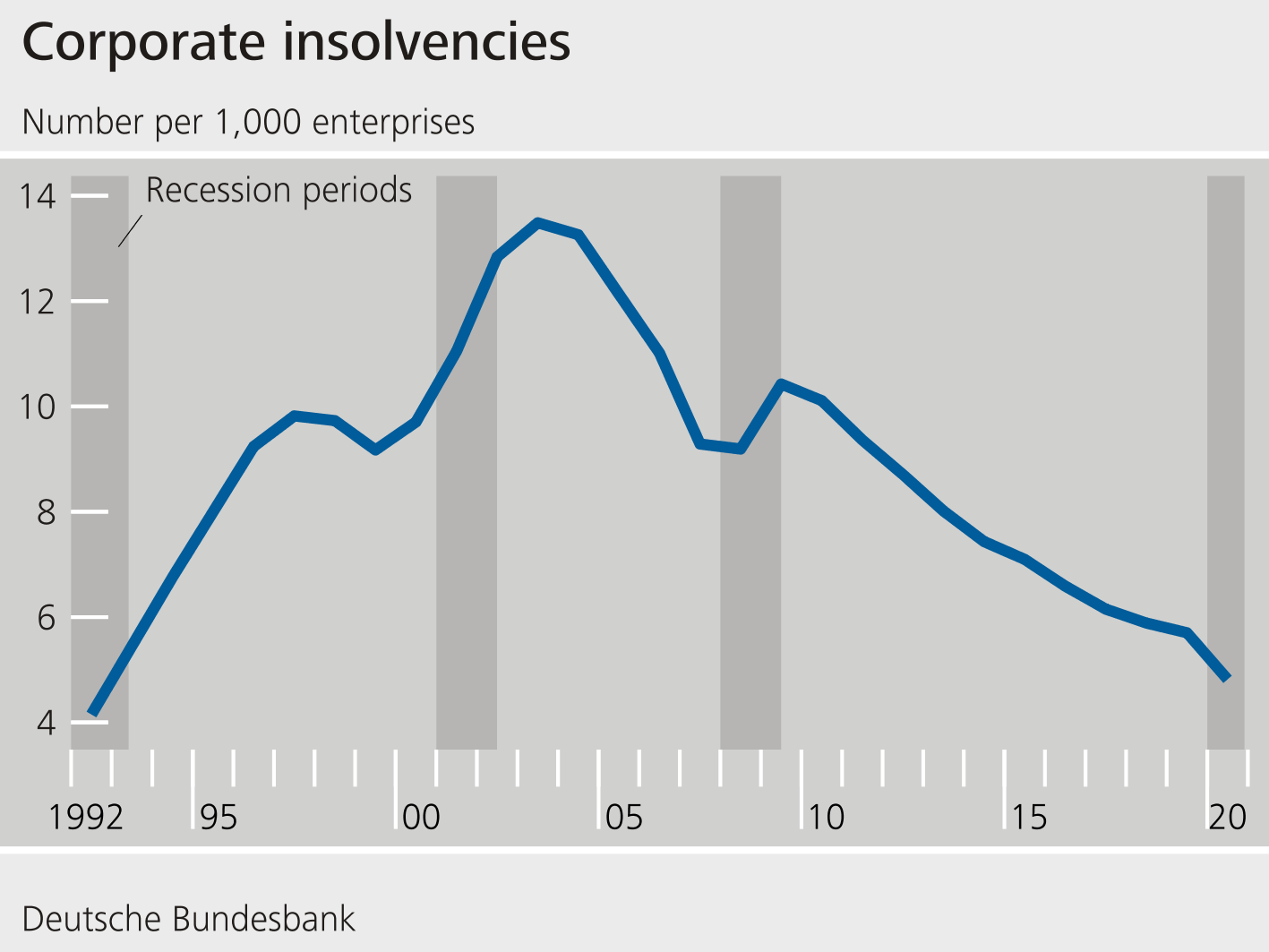

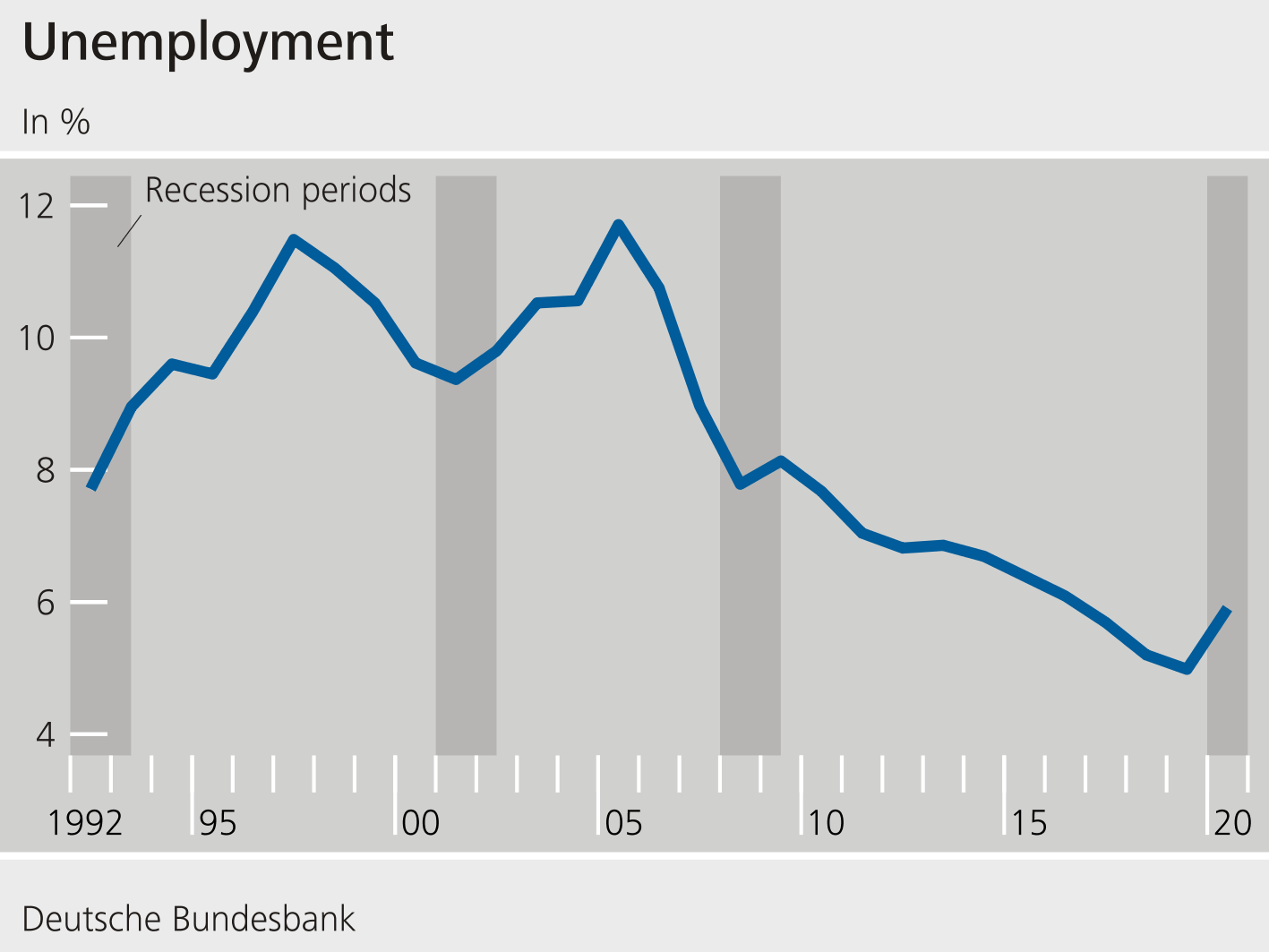

However, the number of insolvencies has not risen during the pandemic. Unemployment has increased only slightly (chart 1). The economy began to recover during 2021. As a result, the risk of major losses in the financial system is now much lower.

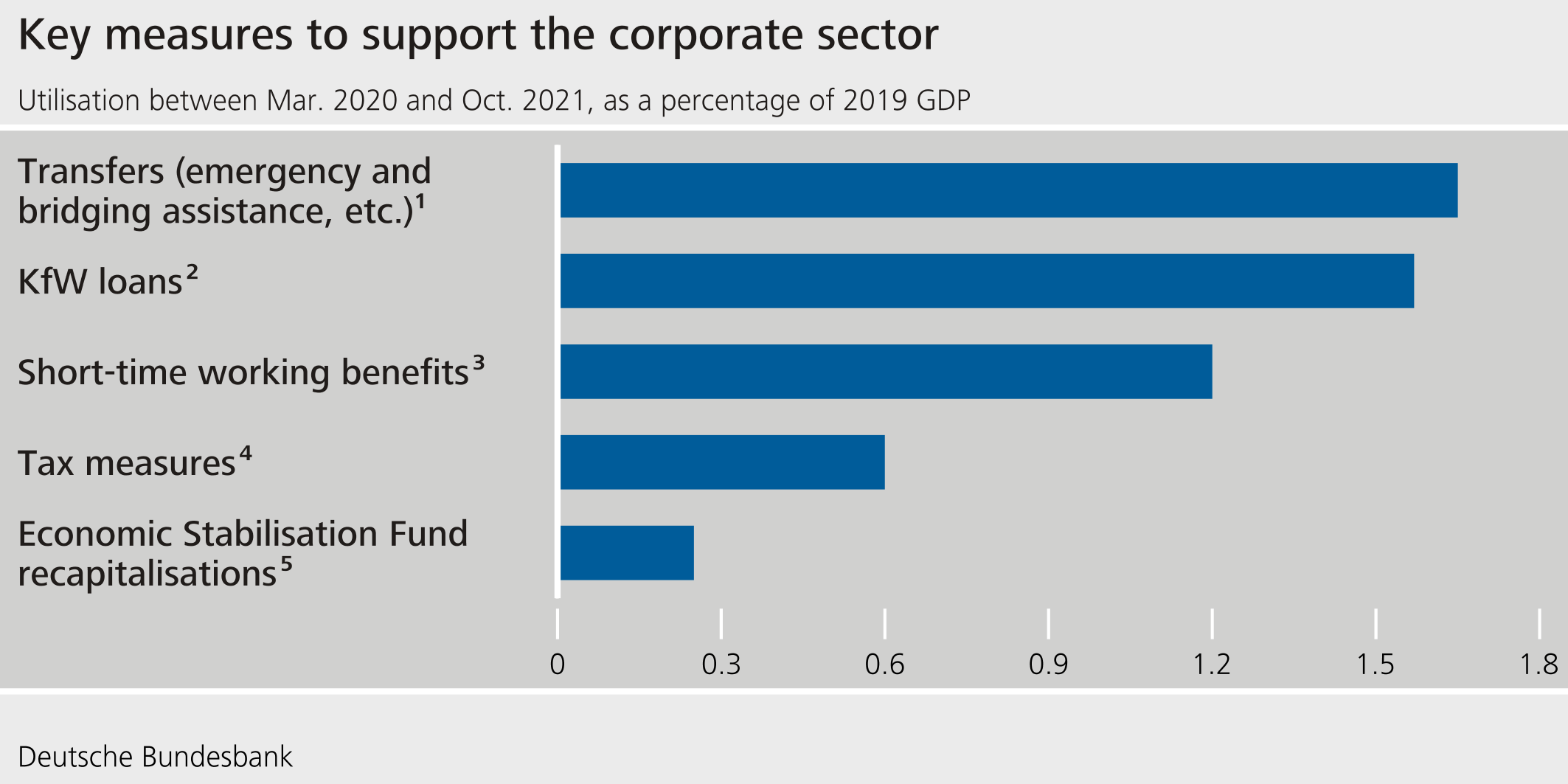

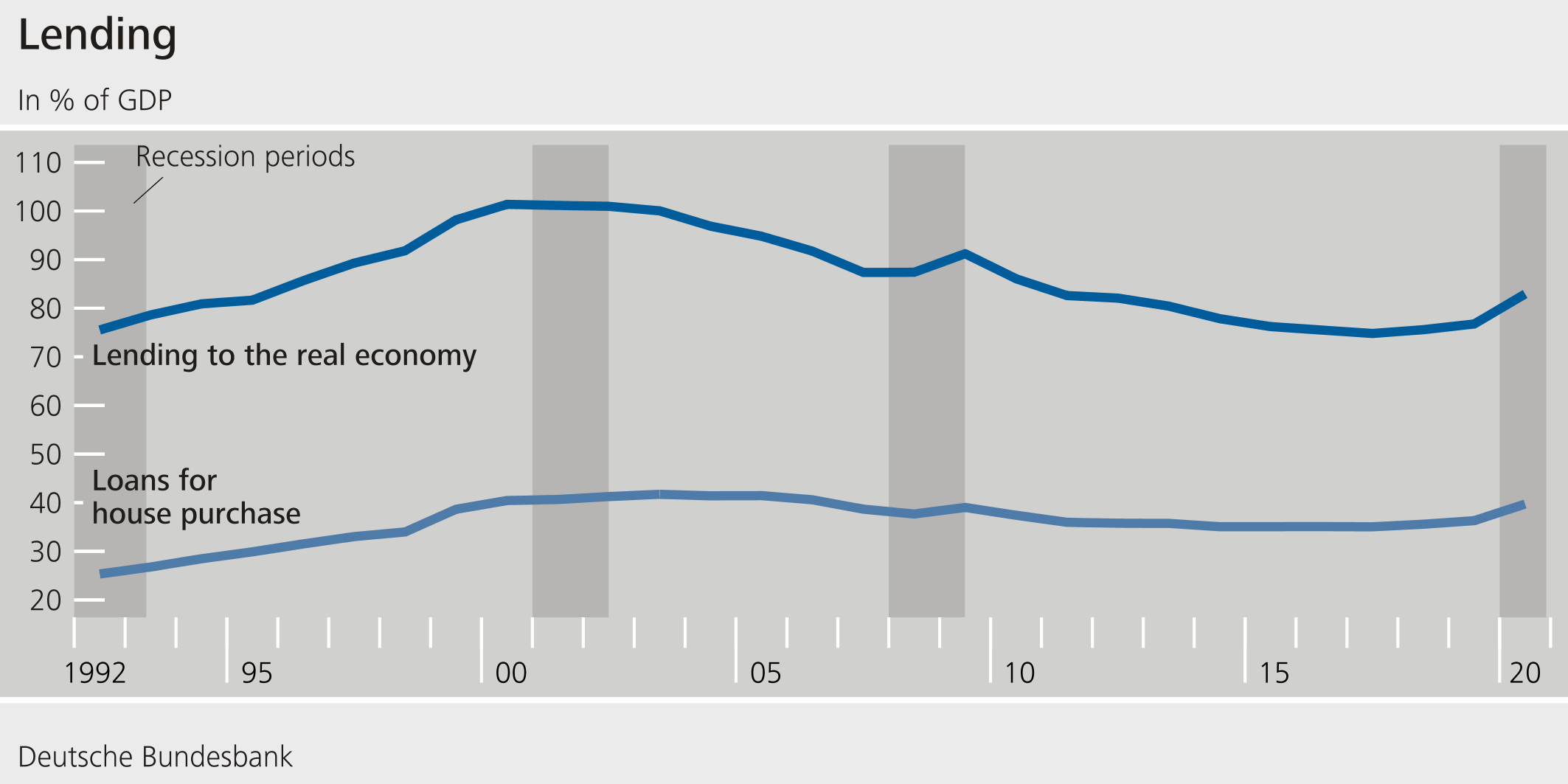

Extensive fiscal measures shielded firms and households against the economic fallout from the pandemic (chart 2). In addition, monetary policy helped to ensure favourable financing conditions. Almost all sectors can obtain cheaper financing now than two years ago. These measures indirectly protected the financial sector. The supply of credit was maintained (chart 3).

This is good news. The government measures taken during the crisis were effective. Economic activity is increasing worldwide. Enterprises in Germany are relying less and less on support measures.

This means we can now renew our focus on structural issues. How will structural change affect the financial system? Have the vulnerabilities that already existed before the pandemic continued to build up? Is the financial sector properly equipped to deal with new challenges and to absorb risk?

Our key message is that now is the right time to take preventive action against future risks.

As with healthcare policy, however, there is a prevention paradox at play. The more effective the prevention, the less severe is the crisis and the easier it is to manage the crisis. But, at the same time, this also means that everyone is less aware of the benefits of prevention.

It is precisely because we have pulled through the crisis relatively well that risks may be underestimated.

Germany actually experienced an exceptionally severe recession for the second time in a row. GDP dropped sharply last year – by five per cent in total. But government measures helped to prevent larger losses in the financial system. The resilience of the banking sector was not tested.

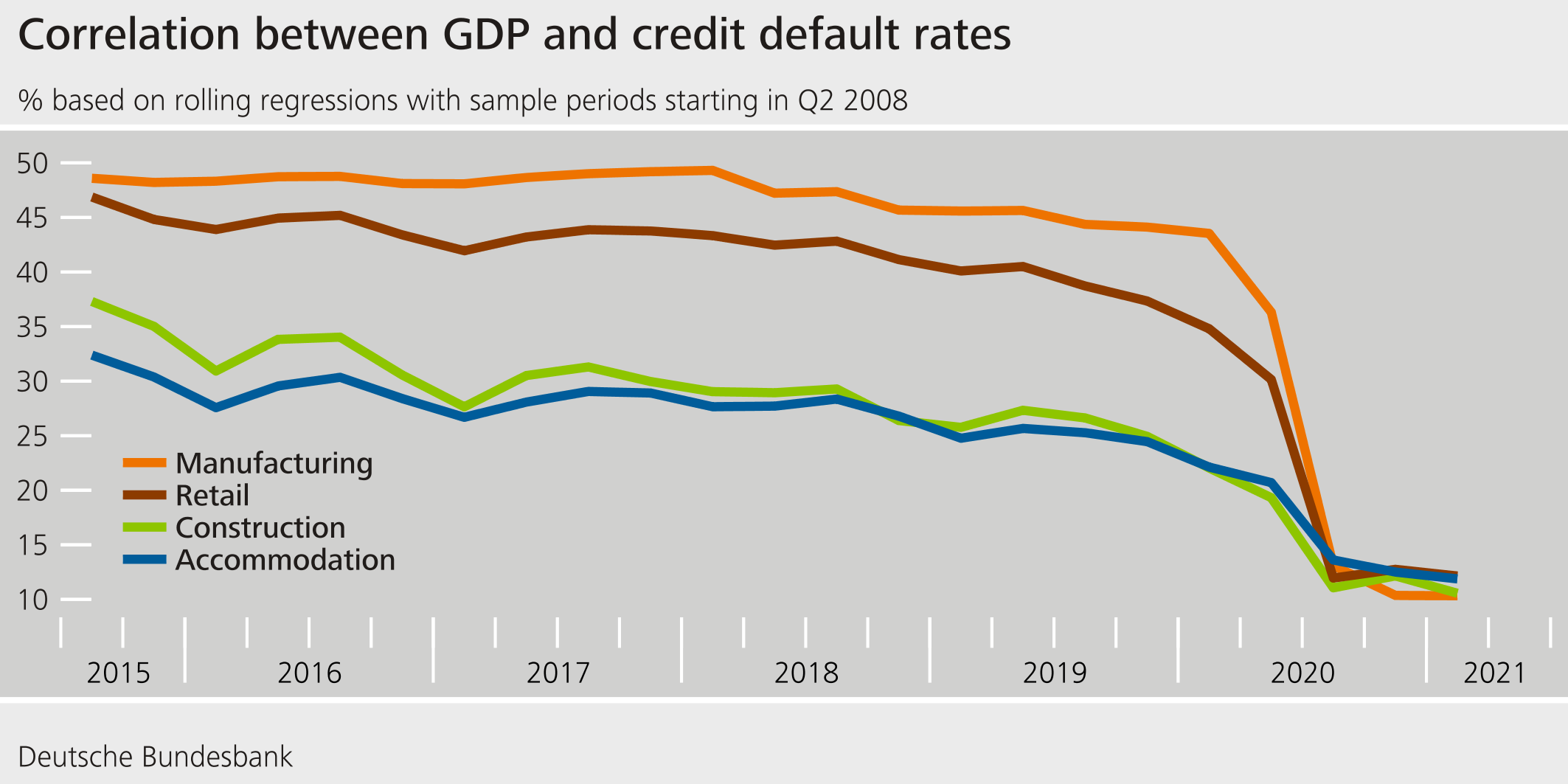

Credit risk and GDP growth are usually closely linked. But during the coronavirus pandemic, this link became much weaker (chart 4).

Even before the pandemic, macroeconomic developments seemed to be having less and less of an impact on credit risk. During the global financial crisis, too, the state intervened. Back then, GDP fell but there was no surge in insolvencies. This was not the case during earlier recessions (chart 5).

This link could become stronger again in future – less favourable macroeconomic developments would then lead to more insolvencies and a rise in credit defaults.

Therefore, economic agents should not assume that the unusual situation of the past few years will be repeated in the future. Otherwise risks may be systemically underestimated. That is why it is important to build up sufficient protection in the financial system against future risk. The next crisis will be different. It cannot be assumed that government support measures will be as extensive as they were this time.

In order to assess how risks in the financial sector will evolve in the future, we need, first, to examine the ways in which it is vulnerable to adverse macroeconomic developments. Second, resilience is key in case risks materialise.

In terms of vulnerabilities, developments that we were already observing prior to the coronavirus pandemic have continued to build up.

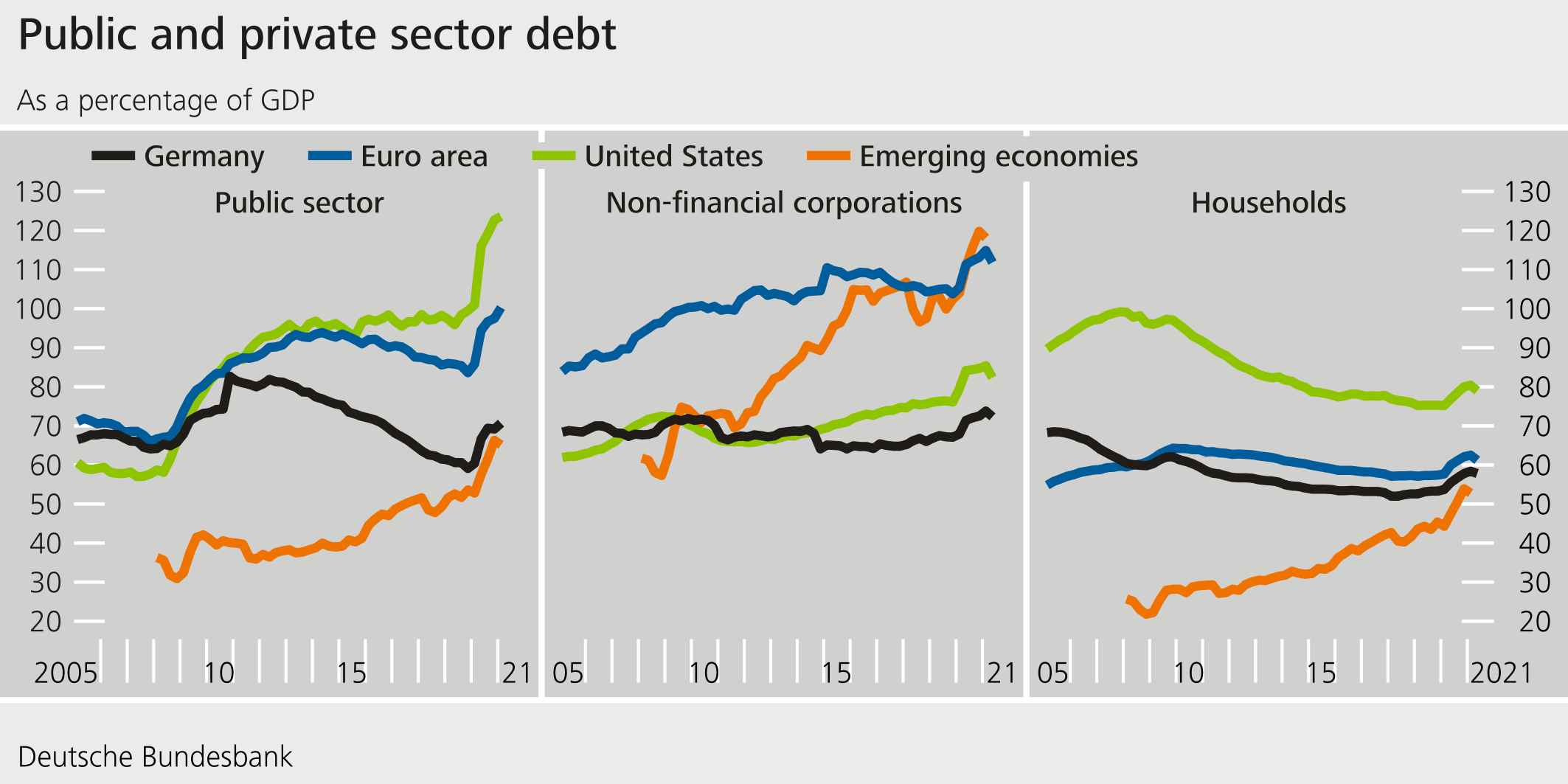

Debt levels have increased worldwide (chart 6). And we see evidence that credit risk may be underestimated. Risk premia on corporate bonds are in some cases lower than they were before the pandemic (chart 7). At German banks, lending portfolios have shifted more towards relatively riskier enterprises. While probabilities of default for relatively risky enterprises as calculated by banks’ internal models have decreased, there has been little improvement in their balance sheet metrics.

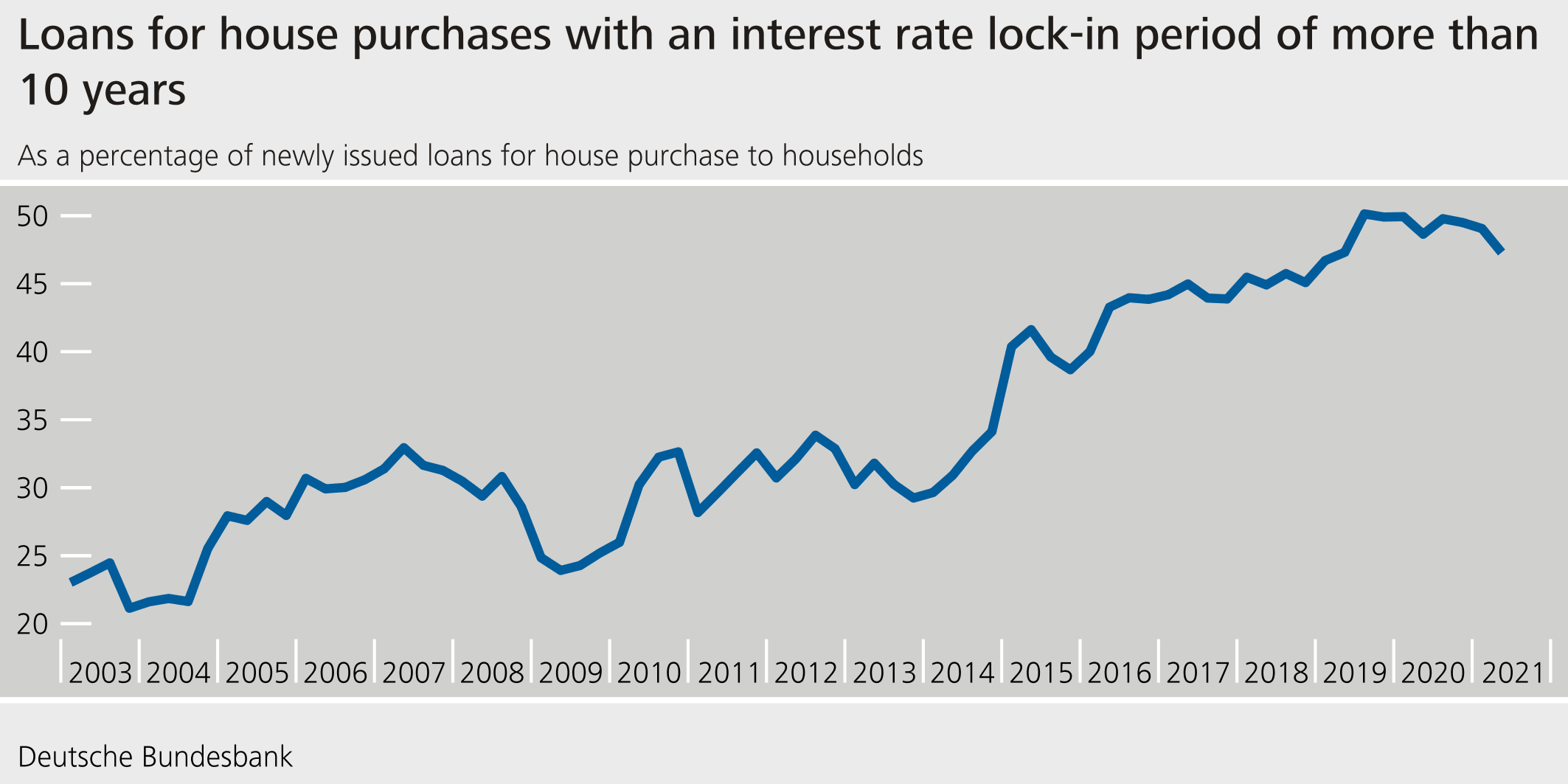

A second vulnerability is interest rate risk. At present, we are expecting the current high inflation to ease again in the next few years. However, the risk of elevated inflation in the medium term has increased. Should inflation see a significantly sharper or more protracted rise than expected, interest rates in the financial markets could go up markedly. This would result in market corrections and price drops. In the short term, rising interest rates would have an impact on the banking sector, in particular: refinancing costs would immediately increase but earnings would

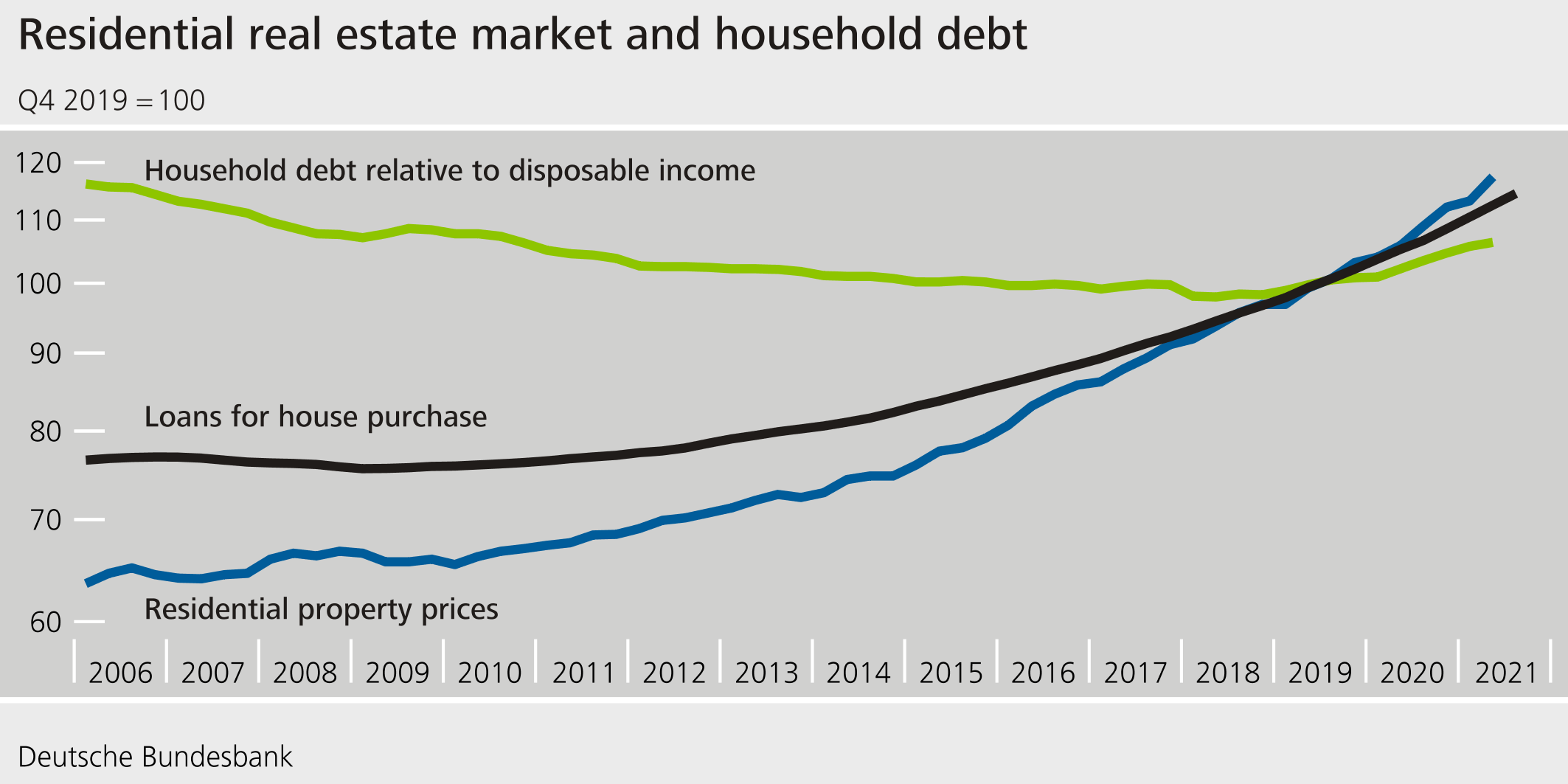

Overvalued assets and collateral represent a third vulnerability. The focus here is on residential real estate prices, which once again saw a sharp rise, growing at an average rate of 6.7 per cent in 2020 (chart 9).

The point at which rising real estate prices can pose a threat to financial stability is when more loans are granted at significantly looser lending standards and prices are expected to rise. In the third quarter of 2021, residential real estate loans were 7.2 per cent up on the previous year. According to a survey, just under 90 per cent of households expect residential real estate prices to keep on rising.

The impact of price corrections may be underestimated. Our calculations show that residential real estate prices are 10 to 30 per cent higher than justified by their fundamentals. This is increasingly the case outside of urban areas, too.

While household debt has been on the rise for a number of years already, but we are not seeing any major easing of lending standards. Data are still lacking at present; however, as of 2023 we should have much better information on lending standards at our disposal.

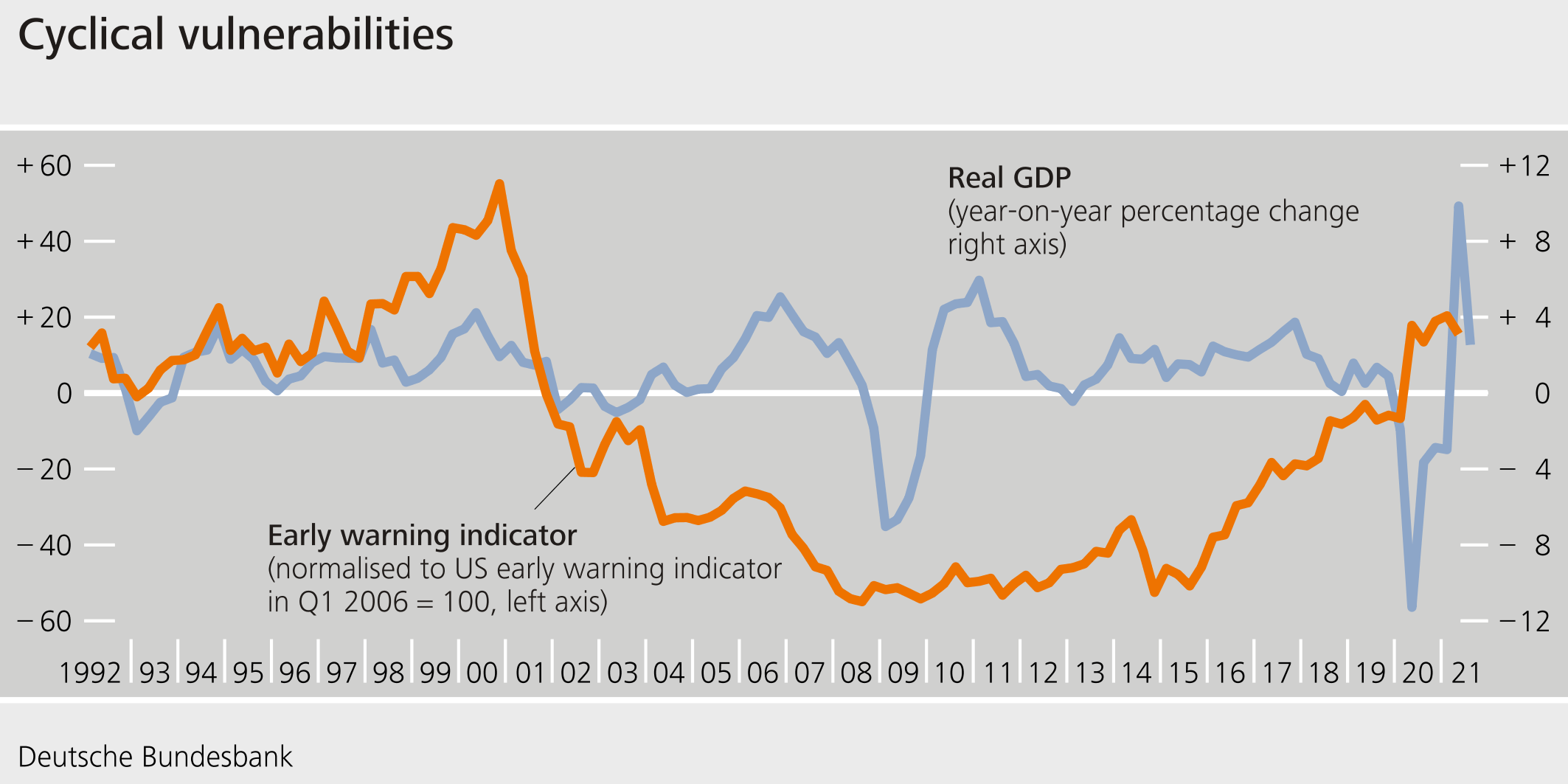

Overall, the situation in Germany is similar to what it was two years ago, back when the countercyclical capital buffer was activated for the first time. The economy is growing, and the financial cycle is expanding. Credit is growing rapidly, market valuations are high and risk awareness is decreasing. The Bundesbank’s early warning indicator, which estimates the probability of financial crises, has continued to increase during the pandemic (chart 10).

But there are also differences to the situation prior to the pandemic:

- The financial cycle is at a more advanced stage and vulnerabilities have continued to build up.

- The economy is in an upswing phase worldwide, which is contributing to supply bottlenecks and price increases. The pandemic is not yet over. The outlook for the economy thus remains uncertain.

That leads me to my second question: is the financial system able to absorb future shocks? Would it continue to function well if economic activity were to slow down?

Scenario analyses show that the German financial system could cope well with a subdued recovery. Specifically, we consider a scenario in which the economy grows at a far slower pace over the next few years than currently expected.

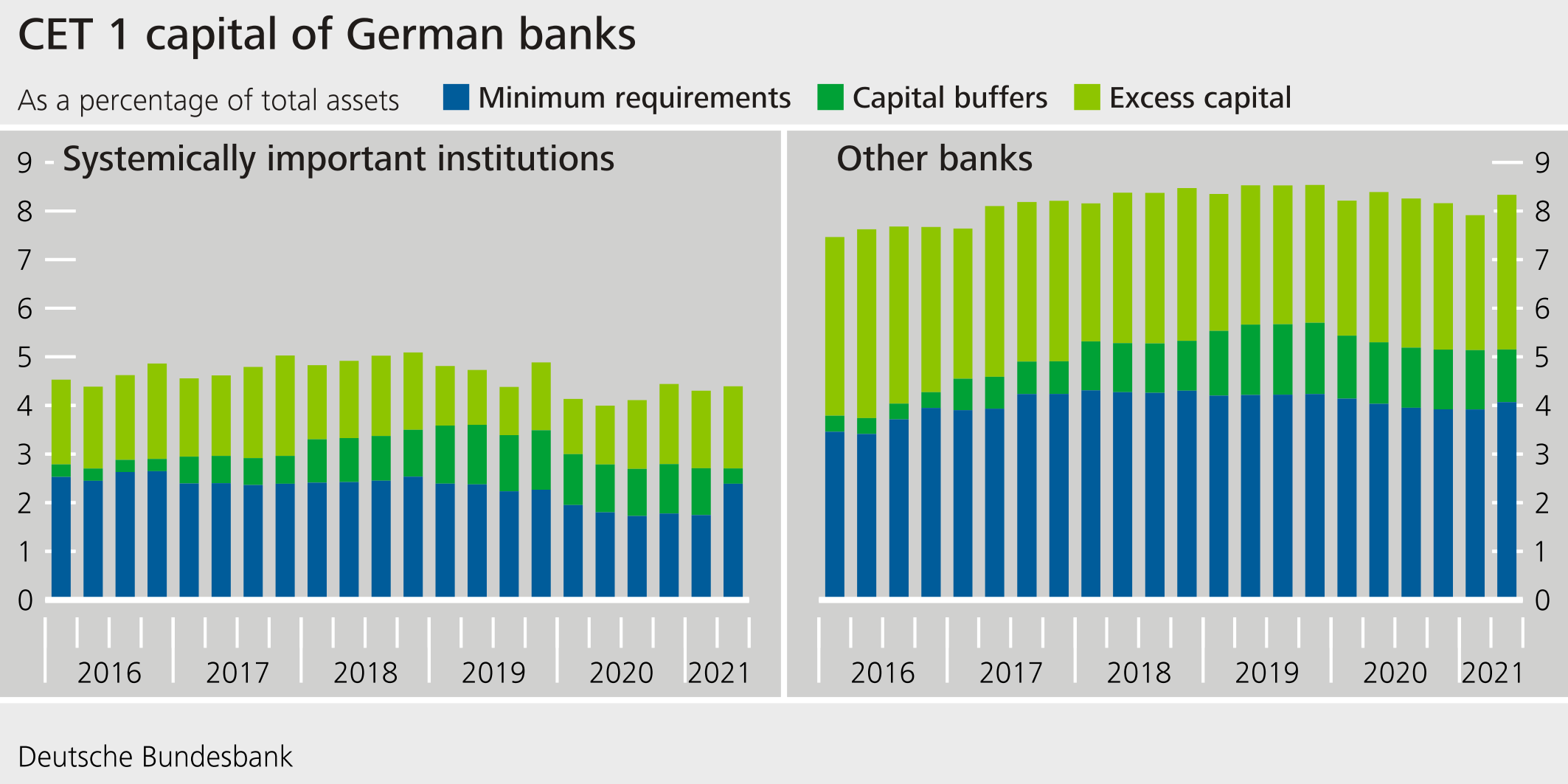

Banks have sufficient capital to cover losses that would arise in such a scenario (chart 11). The supply of credit to the economy would not suffer.

It would be a different story if the economy faced a severe downturn with negative repercussions on financial markets. In such a scenario, negative effects could spill over from the financial sector to the real economy.

To be specific, banks would have to write down defaulted loans and use their capital buffers. However, if banks wanted to preserve their capital ratios by lowering risks, they would grant fewer new loans. And this could have implications for the real economy.

Effective preventive action can mitigate these negative repercussions: the greater the size of capital buffers and the more they are used by banks, the smaller this effect.

The earlier preventive action is taken and the more effective prevention is, the lower the negative impact further down the road. We learned this during the pandemic.

There are no vaccines or “3G” rules for the financial system. But there are measures that can be taken to increase resilience. Each and every bank plays its part by ensuring sound risk management and sufficient capitalisation.

Prevention also requires taking a look at the financial system in its entirety. One preventive measure is the countercyclical capital buffer. It is built up during good times and enables banks to conserve capital for tougher times. Supervisors can thus release this buffer in times of stress.

The crisis has shown that this works: at the outbreak of the coronavirus pandemic, supervisors eased their requirements, giving banks additional scope for lending.

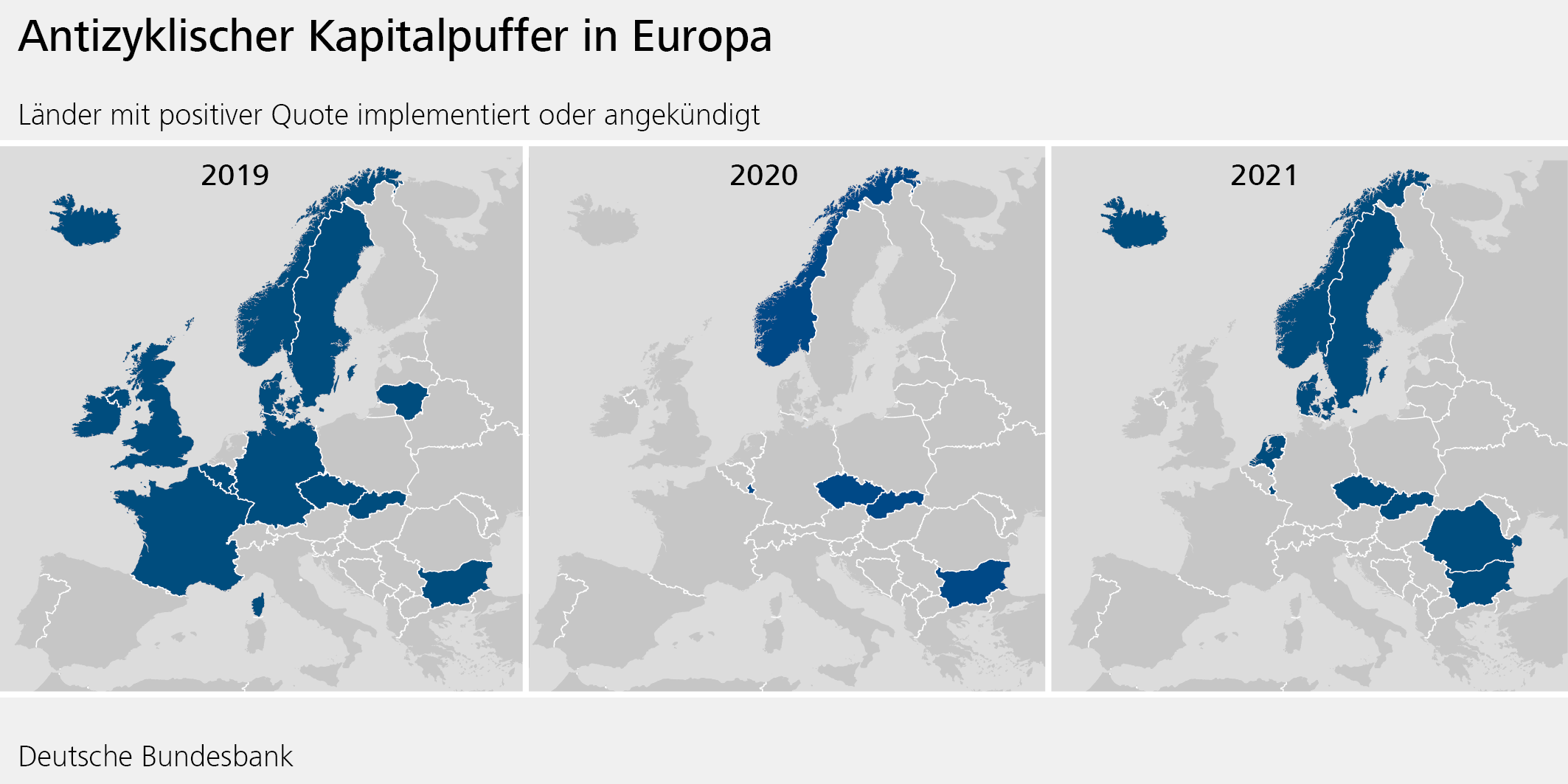

In the meantime, a number of countries have already tightened requirements again in response to the favourable economic situation and the build-up of vulnerabilities (chart 12). Germany, too, should ensure that it returns in good time to building up the countercyclical capital buffer.

Risks associated with real estate financing also need to be contained. Borrowers and lenders alike should keep an eye on debt sustainability. Supervisors can assist here by communicating on sustainable lending standards.

Should a loosening of lending standards appear to be on the cards, the supervisory authorities would have various tools at their disposal.

The legal basis for income-based borrower instruments does not exist yet. However, supervisors should be able to take action if necessary. This is part of prevention. Other European countries have such instruments at their disposal and deploy them when appropriate.

Before I conclude, I would like to touch on a key structural challenge – climate change. We all know that prevention is essential. We need to act now in order to reduce future risks.

This year, for the first time, our report estimates the impact of climate policy on the German financial sector. Specifically, it examines the question: How would changes in climate policy affect the loan and securities portfolios of German financial institutions?

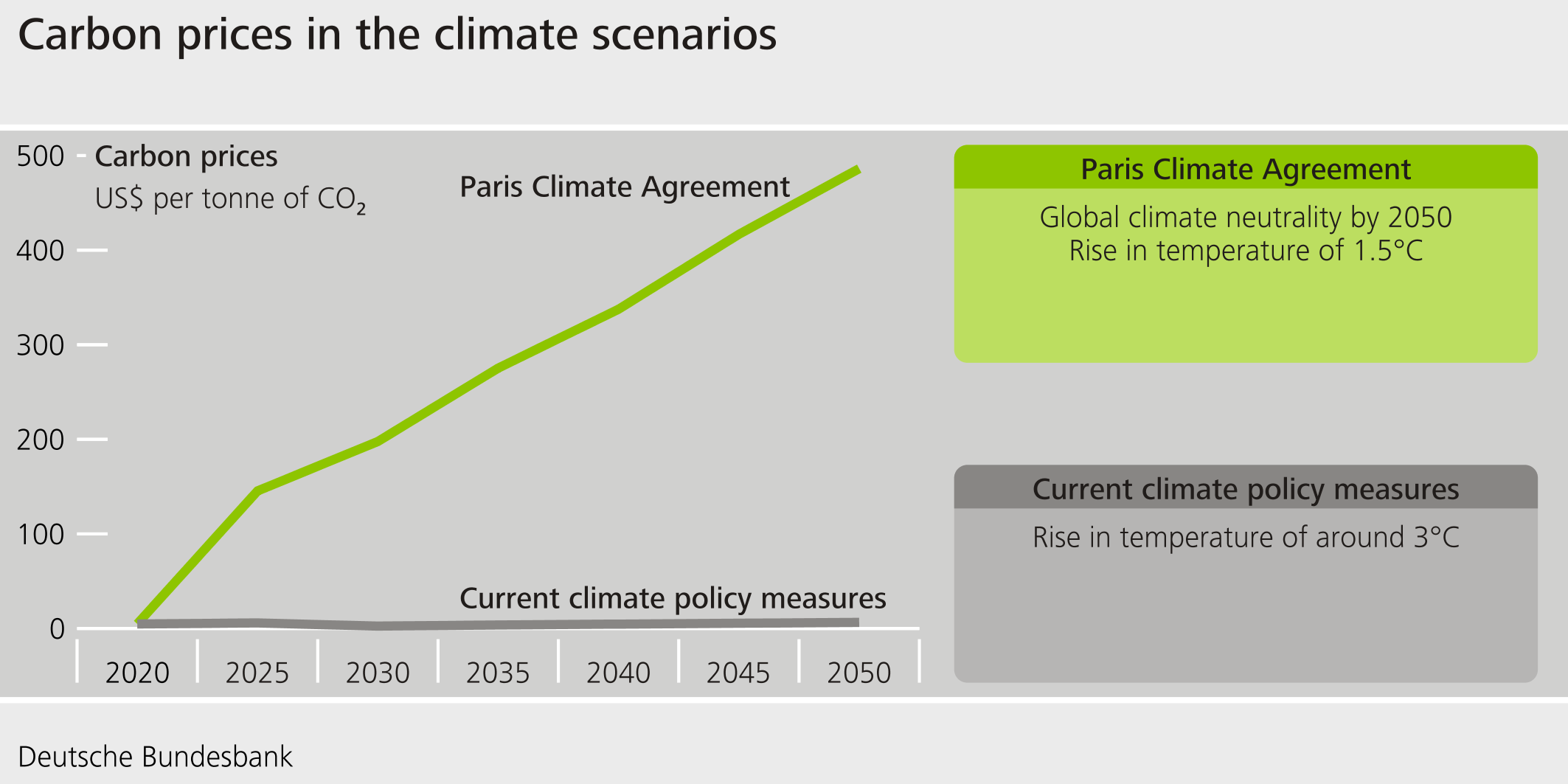

A central climate policy measure is the carbon price trajectory (chart 13). The chapter focuses on transition risks, that is on the impact of carbon price changes on the economy and financial sector. The impact of physical climate risks is not examined. In the scenario that is consistent with the targets of the Paris Agreement and of achieving global climate neutrality by 2050, the carbon price goes up considerably, rising from a global average of US$ 5 per tonne of CO2 to almost US$ 500 in 2050.

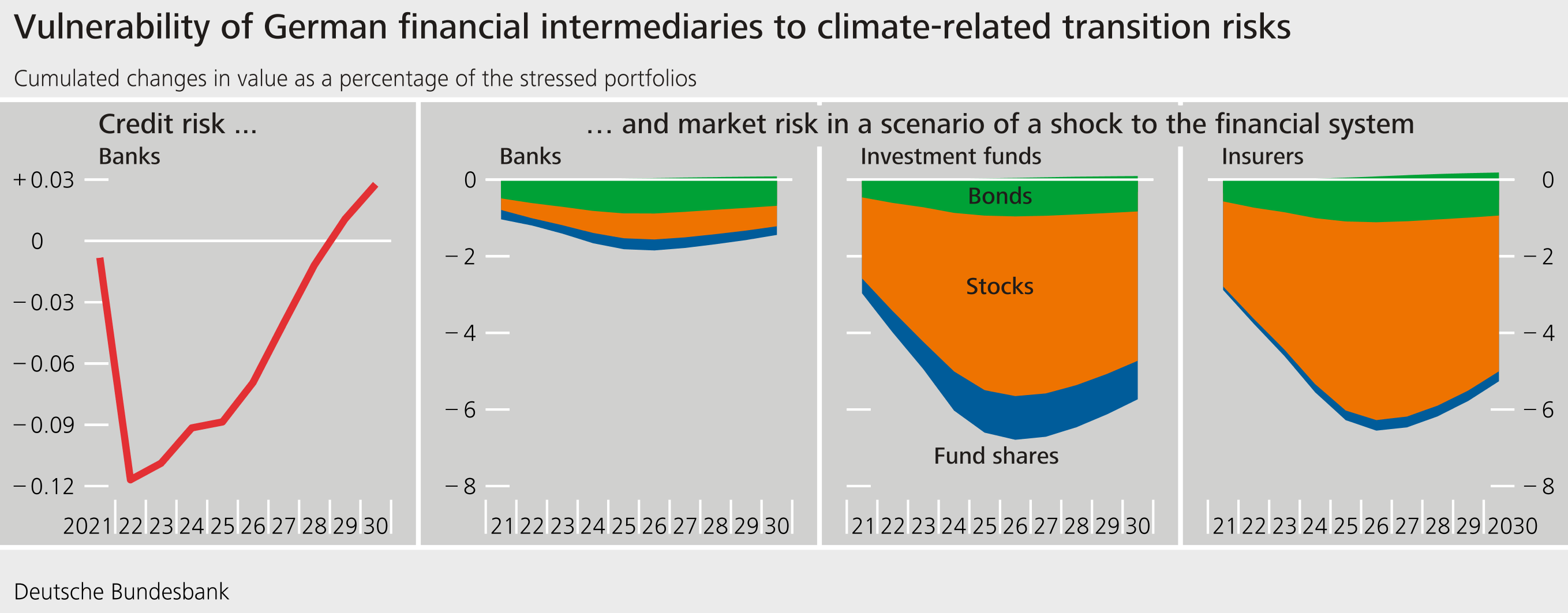

There is good news in this regard: transition risks have far less of an impact on the German financial system than the public debate might suggest. The rise in carbon prices results in a revaluation of financial assets. Overall, the losses in the portfolios of banks, insurers and investment funds remain within a single-digit range (chart 14). The losses show up quite quickly. They then slowly recede as the economy is gradually restructured and the value of financial assets recovers.

There are several reasons why losses are relatively low.

First, our analyses are based on the climate scenarios drawn up by the NGFS, the Network for Greening the Financial System. The impact of these scenarios on GDP is relatively minor.

Second, German banks as a whole have only relatively low exposures to those sectors that are most affected by carbon pricing. However, this effect varies across institutions.

Third, the average remaining term to maturity of financial assets is often less than ten years. However, some climate risks will not materialise until much later than that.

Fourth, our analyses do not cover physical risks, such as flooding or droughts. Yet, if insufficient climate action is taken today, these are likely to become more frequent in the future and entail high costs.

All this means that our analyses do not sound the all-clear. They cover just one element of climate-related risk and are subject to a high level of uncertainty. We will thus continue to work on improving our models and the underlying data sets. A harmonised taxonomy for climate risks and disclosure standards for carbon emissions are central in this regard.

But what our analyses do show is that if clear and reliable decisions on climate neutrality are made, the short-term costs should remain relatively low for the financial system.

All in all, our report shows that prevention works. Resilience and public policies shielded the financial system from the pandemic fallout. Looking ahead it is now essential to strengthen the financial system so that it can face future risks, and is well equipped to deal with structural change.