On the road to greater regulatory proportionality? Speech delivered at the strategy conference of the Rhineland Savings Banks and Giro Association

Check against delivery.

1 Introduction

Ladies and gentlemen

Some of you may perhaps recall that I have been a guest at the Rhineland Savings Banks and Giro Association’s strategy conference once before – two years ago, to be precise. On that particular occasion, I shared my views on a variety of topics including the precarious situation in Greece and the slump in China’s equity market. Fast forward to the present day, and there are other, not entirely new challenges we are looking at: digitalisation, regulatory matters, interest rate levels.

We are here today to discuss strategies which you can use to counter the current challenges. I would like to make a practical contribution to today's proceedings by talking about the challenge of regulation. My speech here will focus particularly on small banks and savings banks with a regional footprint and show how the regulatory landscape might evolve for them.

2 Regulation – a challenge

Let me begin by asking you this: what do you, personally, associate with regulation and supervision? I trust you will all now be thinking of your competent analysts at the Bundesbank. But for many of you, I would imagine, your thoughts will also be turning to paperwork, constraints, costs. And let me tell you: you wouldn't be wrong. Regulation and supervision are indeed a challenge – they do create constraints, they do run up costs.

Yet it is no less true that regulation is necessary, and it is useful. The paperwork, the constraints, the costs – there are good reasons for all these things.

After all, the services provided by banks and savings banks are crucial for a stable economic cycle, for growth and prosperity. Banks and savings banks fund investments, they manage savings and deliver important services, such as processing payments.

But taking risks is also part of the banking business. And when you take risks, there’s a chance you might fail. But when a financial institution fails, the implications are far-reaching – and I don’t just mean for the institution itself, but also for its investors, for the real economy, and for us all. The financial crisis, which marks its tenth anniversary over the next few weeks, taught us that the failure of a single institution is enough to trigger a chain reaction throughout the entire sector.

Smart regulation ensures that banks and savings banks can still go about their business, but that they are appropriately protected against the biggest risks. It shields the economy, consumers and the financial system itself against turbulence. The reason we can’t give financial institutions full rein is because of the important part they play in the economic cycle.

That's a point that often goes unnoticed in the debate surrounding regulation. Please don't get me wrong: regulation and supervision are not sacrosanct; criticism is certainly not out of bounds. In the days when I myself was being supervised, I voiced criticism when I felt it was right to do so. But criticism, whatever form it may take, needs to be constructive and honest and it shouldn’t be unduly sweeping. Regrettably, that cannot be said of all the utterances in the public debate on this topic.

3 Regulatory proportionality is lacking

Regulation and supervision are crucial, and it's right that they should be something of a burden. But it is also clear that needlessly heavy demands should be avoided. Regulation needs to cost as much as necessary but also as little as possible.

And I fear this is a mark we’ve been falling short of in some respects lately. Because regulation has grown ever more complex over time. The years since the onset of the financial crisis, in particular, have seen the Basel Committee adopt wide-reaching global reforms. The idea behind these initiatives was to learn the right lessons from the financial crisis and to be better equipped going forward to fend off disruptions of that magnitude. The increased complexity of regulations, then, is merely a reflection of the mounting complexity of global banking business. So you could say it is warranted – and the sector’s global players are mostly certainly in a position to get to grips with the new rules.

But in actual fact, the bulk of these complex rules, especially in Europe, apply not only to major multinational institutions but to every single bank and savings bank as well. And that’s quite a problem. Because when small and medium-sized institutions comply with the rules, they do not benefit from the same economies of scale which their larger rivals can harness. For one thing, small institutions face much heavier costs, relatively speaking, when they invest in IT infrastructure or hire an additional employee for their Compliance department. That’s a downside they can only partly offset by cooperating with other institutions from their network. As such, the single rule book runs counter to the idea of a level playing field and creates problematic incentives in terms of uniformity and size in the banking sector.

Regulation today already takes account of proportionality to a degree. Tiered standards exist in areas such as reporting, where large institutions are required to meet more frequent and comprehensive reporting standards, and supervisors largely exercise proportionality when applying the minimum requirements for risk management. Proportionality is also embedded, in principle, in the EBA guidelines on the supervisory review and evaluation process. But in practice I repeatedly encounter situations where the existing gradations are inadequate in my eyes. The proportionality principle is nothing new, then, but it still has not been anchored deeply enough.

4 The road to greater proportionality: a chronology

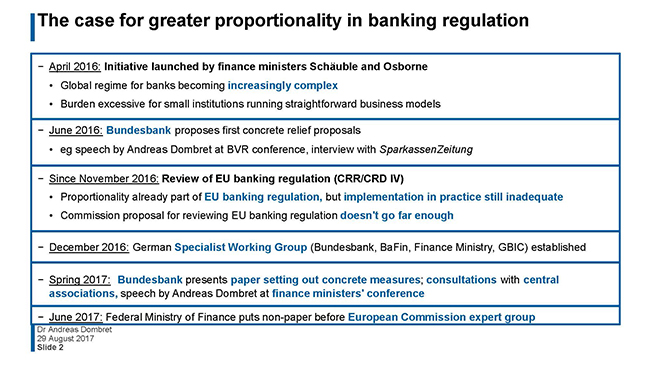

That’s why we took action and explored ways in which the principle of proportionality could be embedded more deeply within the regulatory and supervisory frameworks. Let me start by running you briefly though the events of the past one-and-a-half years.

German Finance Minister Wolfgang Schäuble and his then UK counterpart George Osborne moved the ongoing debate forward substantially in April last year by noting, in a joint paper, the increasing complexity of banking regulation and pointing to the excessive burden on small institutions running straightforward business models. It is a topic we at the Bundesbank also feel very strongly about. Hence my decision to go public with the first set of specific proposals a little while later.

That November then saw the European Commission likewise table its proposals for strengthening proportionality as part of the general overhaul of EU banking regulation, which is still an ongoing process. These proposals would make major changes to the small print, and I am certain that we will be able to roll out a number of meaningful initial improvements.

That said, the proposals don't go far enough – which is why we thought ahead. The establishment of a German Specialist Working Group was followed by the drafting of a Bundesbank paper setting out concrete measures as well as several consultations with the German central associations. The outcome of this process is a German "non-paper” – that is, a discussion paper – which the Federal Ministry of Finance put before the competent expert group of the European Commission in June this year.

5 Which way?

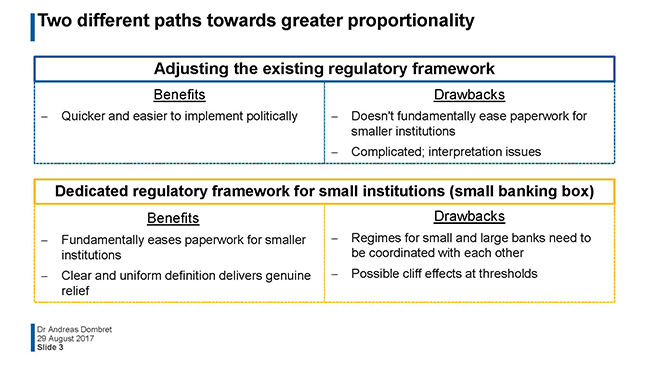

The first path has a clear practical advantage: it would be quick and relatively simple to implement, especially since European legislation on banking regulation is currently being revised anyway. It does have its disadvantages, however: realistically speaking, smaller institutions will not gain any substantial relief from their burdens on account of a few specific improvements to regulation. There is also the risk of ending up with a patchwork of exceptions that are difficult to interpret.

The second path would be more radical. The creation of a separate regulatory framework for small institutions – also known as the "small banking box" – would mean more fundamental relief for these institutions. A clear and consistent definition would also prevent any difficulties in interpretation. Though the implementation and maintenance of this would be somewhat more complicated, in future the regulations for small and large banks would be developed in parallel and in alignment with each other. Depending on how the threshold values for the small banking box are set, there is also the risk of cliff effects.

We have carefully weighed up these and many other arguments in the Specialist Working Group on Proportionality. The group’s purpose was to facilitate the exchange of views between politicians, supervisors and the banking industry. The Federal Ministry of Finance, BaFin, the Bundesbank and the five central associations of the German banking industry were all represented in this group.

These members agreed that it would be expedient to bolster proportionality in regulation. The aim of the working group was therefore to work out specific proposals on how to alleviate the burden of regulation on small institutions with simple business models. And it delivered on that aim: the non-paper that I mentioned earlier, which was written with the group’s help, is now in Brussels, where it is being used as the basis for further discussion at the European level.

5.1 The question of "Who?": a three-tier approach

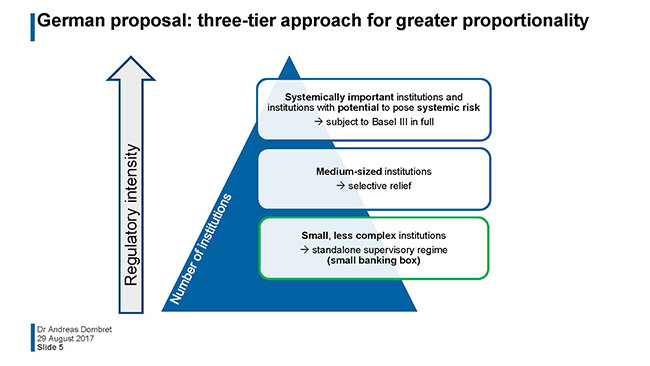

At the very top are the systemically important and potentially systemically risky institutions – the smallest group in terms of numbers but extremely important in terms of risk. Because of this, it is also the most intensely regulated. Generally speaking, this group includes institutions with total assets of over €20 billion. Nothing will change for these institutions: all of the Basel III requirements will still apply, as will the additional capital buffer, the total loss absorbing capacity, and so on.

A second group would include institutions which are not large and systemically important, but which are also not small and low-risk, which is why it is not possible to make any extensive simplifications for them. Nonetheless, the proposal does include for this middle group some targeted relief measures which could be achieved by making specific amendments to the current regulations.

Finally, the third group is made up of small and non-complex institutions – the banks that are most affected by the fixed costs of regulation without their systemic importance being considered individually. This group – the largest in numerical terms – is to have its cost burden alleviated radically by means of a separate regulation: the small banking box.

The burning question now, of course, is which institutions belong in which group – and particularly, which banks could be included in the small banking box. I will say right off that I am not able to conclusively answer this important question today. These classifications have to be balanced carefully, and we will do this as part of European-level discussions.

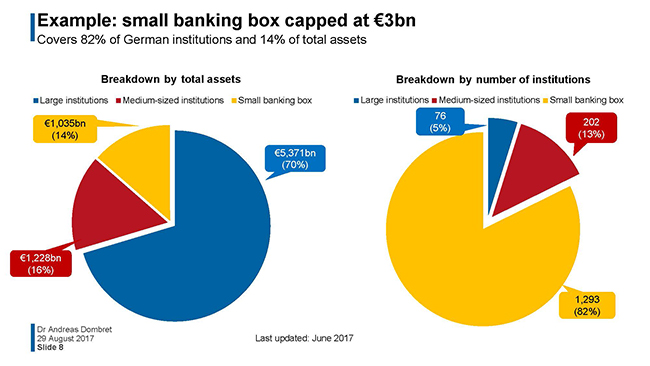

I would, however, like to give you an initial idea of how this classification might look. By talking of small institutions, this suggests that a qualification criterion for the small banking box would be relatively modest total assets. For example, in Germany, a total assets threshold value of €3 billion could put more than 80% of institutions into this category.

What constitutes large and small in other member states is completely different, however. To account for this heterogeneity, absolute size would have to be supplemented with relative size.

This could be the ratio of the bank’s total assets to its home country’s economic power or the size of the domestic banking sector, though in this case, too, size isn’t everything. I’ve already said that not only do institutions in the small banking box have to be relatively small, they also must not be too complex. This is why we need additional criteria.

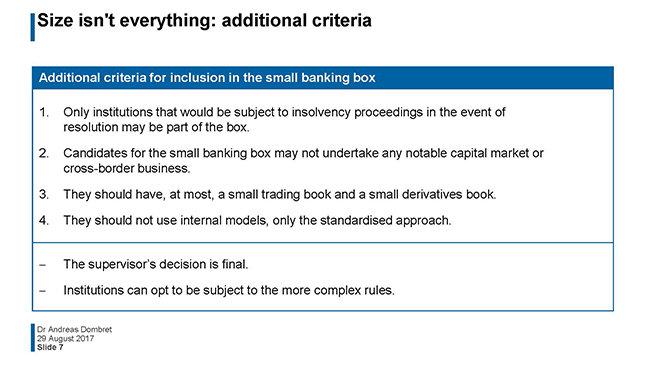

- First, only institutions that we believe would be subject to insolvency proceedings in the event of resolution may be part of the box.

- Second, candidates for the small banking box must not engage in any notable capital market or cross-border business.

- Third, they should have, at most, a small trading book and a small derivatives book.

- Fourth, instead of internal models, they may only use the standardised approach.

This list of requirements prevents institutions with riskier business models from being part of the simplified regime.

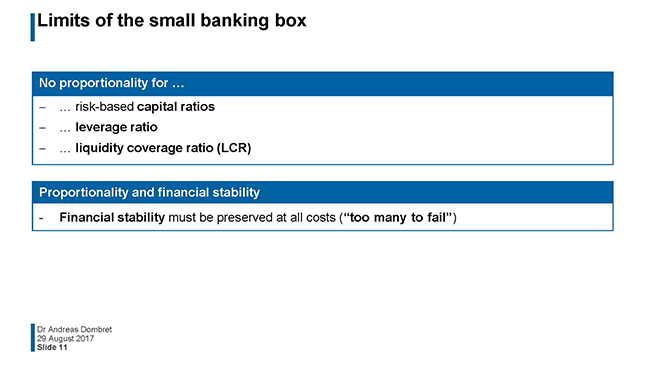

Experience has taught us, however, that there will almost never be a perfect list of criteria that covers every eventuality. This is why the final decision should always rest with the supervisors. Should they have serious misgivings, they can opt not to subject an institution to the simplified rules. They can also take into account the systemic risks arising from the connectedness of several small institutions – that is to say, small banks which are "too many to fail".

Incidentally, this possibility to choose should not be a one-way street. I believe that institutions that would be considered eligible for the small banking box should also nevertheless be given the option of being supervised pursuant to the more complex rules.

But coming back to the figures: if we were just to apply a threshold value of €3 billion, around 1,300 banks and savings banks in Germany could fall under the simplified rules, or just over 80% of all institutions, as mentioned earlier. This would be equivalent to 14% of the German banking sector’s total assets. Of course, this is just an initial calculation and it doesn’t include the additional criteria I listed.

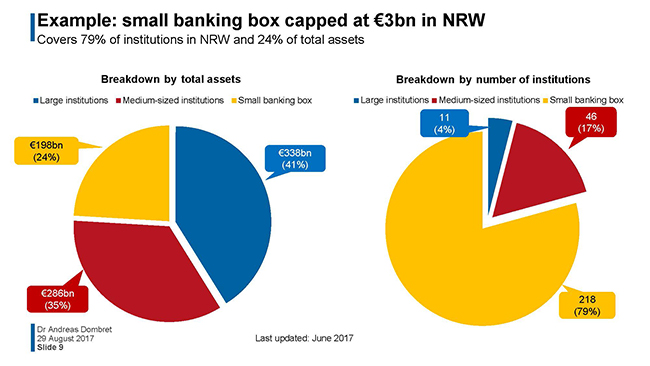

If you look at the banks and savings banks in North Rhine-Westphalia alone, the picture is largely the same: here, too, around 80% of the institutions could come under the simplified rules. This would be equivalent to 24% of total assets in this state.

Some of you will no doubt be wondering what happens when institutions are close to the threshold value. This is a good question, because alone around 50 German savings banks have total assets between €2.5 and 3.5 billion, some of which are in the Rhineland – perhaps some of you even run one of these institutions.

The question of potential cliff effects always comes up when quantitative thresholds are set. Nonetheless, we regulators cannot do without thresholds. I believe two things are important to prevent institutions from moving in and out of categories or, worse still, basing their business strategy on attempts to stay within a certain threshold. First, quantitative thresholds must be flanked by qualitative criteria and supervisors must also take decisions on a case-by-case basis. In other words, just because a bank’s total assets fall below a specified threshold, that is nowhere near enough for it to be included in the small banking box. Second, we are discussing introducing transitional arrangements to help make it easier to switch between regimes – something that we want to be an option.

Ladies and gentlemen, a sensible and workable definition of institutions whose burden could be relieved is perfectly feasible. And while it may appear that way at first glance, creating the small banking box does not necessarily require a whole new set of rules. All that is needed is a short section in the CRR dedicated to the issue.

5.2 The question of "what?": reducing the paperwork

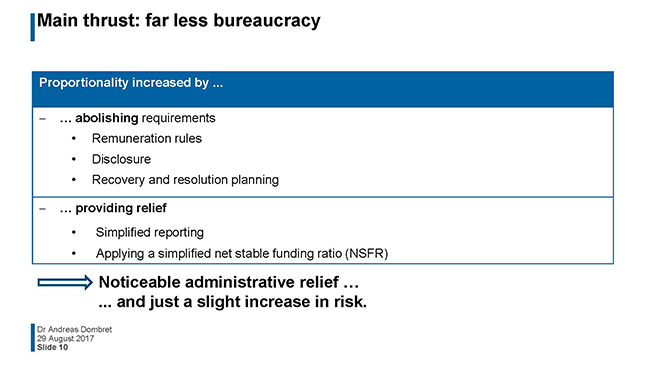

Some of these requirements could be completely eliminated for institutions in the small banking box. I could, for instance, imagine largely exempting small banks from disclosure requirements and abolishing remuneration rules for them. In addition, they could be absolved from recovery and resolution planning.

Full exemption from other requirements would be a step too far. But that should not prevent us from trying to make things easier for small banks. For example, reporting could be reduced to a core reporting process – a standardised reporting approach, if you like. A simplified form of the net stable funding ratio (NSFR ) is also up for debate.

When designing the small banking box we must weigh up the benefits for supervisors, ie ensuring financial stability, against the burden it creates for banks. As a rule of thumb, we can say that any rules that are dispensable for effective supervision are up for negotiation.

6 Limits of the small banking box

And, of course, we also want to avoid unintended consequences. Simplifications in one area must not create additional work in another area. That also means that a sensible division of labour and cooperation within banking associations should not be made needlessly complicated.

However, I am not overly concerned about this issue either. As I said earlier, the principle of proportionality is not new and is already well-established in our risk-oriented supervisory practice. So far, the banking associations have managed well in organisational terms. And I would like to remind you that the very purpose of our joint proposal is to avoid unnecessarily high amounts of paperwork.

7 What happens next?

The objective of reducing the regulatory burden for small and medium-sized institutions is attracting more and more supporters. Speaking in Jackson Hole at the weekend, Chair of the United States Federal Reserve Janet Yellen spoke in favour of reducing the burden on smaller institutions.[1]

Achieving this goal will be no stroll in the park, however. In drawing up a concept for the small banking box, we have taken the first important steps. The aim now is to gain a European majority for our idea.

For a reminder of how difficult that could be, we have to bear in mind just how different European countries and their banking sectors are. A lot of our European neighbours have only a relatively small number of banks, virtually all of them medium-sized to large. Others have a lot of small banks, but have experienced serious problems with them in the recent past. And in some other countries, the banking system is currently undergoing a far-reaching transformation process, which means that the structure of the banking system will experience sweeping change.

The question we encounter is always the same: why should we agree to a small banking box? That is the situation within Europe, and that is where we must provide information, explain the situation and convince people.

For that to succeed, we must present a united German front. If we in Germany do not manage to all stand behind the small banking box concept, we will have a hard job convincing other European countries.

Ladies and gentlemen, the motto of your strategy conference today and tomorrow roughly translates as "Building a successful future. Together". Let us make that the motto for the small banking box project.

Thank you for your attention.

Footnote:

Janet Yellen, "Financial Stability a Decade after the Onset of the Crisis", 25 August 2017, https://www.federalreserve.gov/newsevents/speech/yellen20170825a.htm