Macroprudential Policy in Europe: The German Countercyclical Capital Buffer (CCyB) Panel Statement at the Seminar “Financial Stability and Central Banks” Bank of Mexico

Check against delivery.

The global economy is at a crossroads: trade tensions and geopolitical conflicts are leaving their mark in global trade and investment, growth forecasts are being revised downward, and uncertainties abound. Whether and to what extent risks to the growth outlook will materialize is unclear, and there is uncertainty about the longer-term growth potential.

The global financial system is more resilient to these risks and uncertainties because the banking system is better capitalized now than in the period prior to the global financial crisis. However, the global economy remains highly leveraged, risks may have migrated to the non-bank financial system, and vulnerabilities might become exposed unexpectedly.

Central banks are attentive observers of these trends, as the conduct of monetary policy depends on a stable financial system. Hence, I very much welcome the initiative of the Bank of México in organizing this seminar on financial stability and central banks. Given the close interlinkages in the global economy – both real and financial – it is important to learn from each other and to share experiences.

There are three experiences and insights that I would like to share with you today:

- First, I would like to stress the importance of international policy coordination. In Europe, macroprudential policy is essentially a national task, but with close coordination at the European level. This accounts for the fact that the European financial system is highly integrated and that financial shocks might easily spill over across borders.

- Second, I would like to update you on our current assessment of financial stability risks in Germany. Until very recently, the German economy saw an exceptionally long spell of positive growth rates – one of the longest in the post-war years. During the long period of robust growth and low interest rates, cyclical risks have built up in the German financial system. At the current juncture, the slow-down of global growth is certainly being felt in the German economy. Hence, we are concerned that a further (unexpected) aggravation of growth trends might expose the vulnerabilities and cyclical risks that have been building up.

- Third, the countercyclical capital buffer (CCyB) is an appropriate instrument to address cyclical systemic risks. On May 27, the German Financial Stability Committee thus recommended activating the countercyclical capital buffer and raising it to 25 basis points.[1] The recommendation was based on analytical work by the Bundesbank showing that expectations might be overly optimistic with regard to credit risk and the valuation of collateral going forward. In addition, the German banking system has been increasingly exposed to interest rate risk.

1 In Europe, macroprudential policy is a national task that calls for close collaboration at the European level.

Macroprudential policy is a core element of the reform agenda initiated after the global financial crisis, and it plays a particularly important role in the European monetary union, which lacks a single sovereign.[2] The main objective of macroprudential policy is to prevent the build-up of systemic risk – i.e. the risk of destabilising negative externalities in the financial system – and mitigating excessive leverage of the private sector. Macroprudential policy takes a macroeconomic perspective on the financial sector’s stability and resilience, and it complements other policy areas such as monetary policy, microprudential supervision, and – not least – fiscal policy. The global financial crisis and the European debt crisis showed that it is not sufficient to focus on the sustainability of public debt. Rather, mechanisms that address private credit are needed to safeguard the stability of the financial system. Such mechanisms ensure that excessive growth of private credit or a deterioration in the quality of credit does not pose a threat to financial stability.

In Germany, responsibility for macroprudential policy is shared by the members of the Financial Stability Committee: the Ministry of Finance as the chair of the Committee, the Federal Financial Supervisory Authority (BaFin), and the Bundesbank. This set-up institutionalizes a regular exchange of micro- and macroprudential authorities. The Committee can issue warnings and recommendations when there are financial stability concerns. The Committee submits an annual report to the Bundestag on its activities and the stability of the German financial system. The last such report was published in May 2019.[3] The Committee also communicates on important events through press briefings or press releases.

In a number of countries, implementation of macroprudential policy is the joint responsibility of more than one institution. This type of structure means that, based on specialist expertise and the pooled institutional knowledge, its members can exchange views and knowledge on topics of relevance to financial stability, assess the risk situation and reach decisions. However, such a set-up may also lengthen the decision-making process. In a recent paper, Rochelle Edge and Nellie Liang find that countries with Financial Stability Committees with stronger governance mechanisms are more likely to use the CCyB.[4] As more and more evidence on policy decisions accumulates and instruments are implemented, we will certainly learn more about the design of macroprudential policy and governance structures.

The institutional set-up in Europe also acknowledges that markets are closely integrated and that risks might easily spill over across national borders. While, in principle, macroprudential policy is a national task, policies are closely coordinated at the European level. The European Systemic Risk Board (ESRB) and the ECB with its Financial Stability Committee take a cross-country perspective. The ESRB is the macroprudential oversight body for the EU. It can issue confidential or public warnings when it identifies significant systemic risks. Furthermore, the ESRB can issue recommendations for remedial action to address systemic risks. The ECB has the power to top up national macroprudential measures, but not to relax them.[5] Therefore, it can counteract a potential inaction bias at the national level.

Reciprocity ensures that macroprudential measures also apply for cross-border exposures. Generally, reciprocity is useful if measures that are implemented are exposure-based, such as buffers on all exposure towards domestic creditors. There is less need for reciprocity in cases where measures are institution-specific, such as buffers for domestic systemically important institutions. As regards the countercyclical capital buffer in Europe, reciprocity is mandatory for buffers below 2.5%, and it is recommended by the ESRB for buffers exceeding this value. Hence, even prior to activation of the countercyclical capital buffer in Germany, German banks had countercyclical capital buffers of approximately 0.07% of risk weighted assets as a result of their cross-border exposures to countries that had activated the CCyB earlier. In cases where reciprocity is recommended but not mandatory, there is a “comply or explain” procedure at the ESRB.

In sum, macroprudential policymaking in Europe is embedded in a complex set of institutional arrangements, ensuring coordination between national institutions and countries. As the system has not been tested over a full financial cycle, it is certainly too early to tell whether these institutional arrangements help to overcome the inaction bias inherent in macroprudential policy and whether they improve the surveillance of systemic risks. Still, as more evidence accumulates, we will learn from our experiences and improve existing frameworks, if necessary.

2 Cyclical risks have built up in the German financial system.

Although macroprudential policy was established only after the financial crisis as a new policy field, related instruments had already been in use prior to the crisis. According to the integrated Macroprudential Policy (iMaPP) database of the IMF, 23 out of 36 advanced economies (AEs) and 61 out of 98 emerging market and developing economies (EMDEs) had implemented some type of policy instruments that could be classified as macroprudential.[6] Hence, while there has been some experience, especially regarding tools to manage liquidity and foreign exchange mismatches in the banking system[7] deploying new macroprudential instruments such as the CCyB ventures largely into uncharted territory.

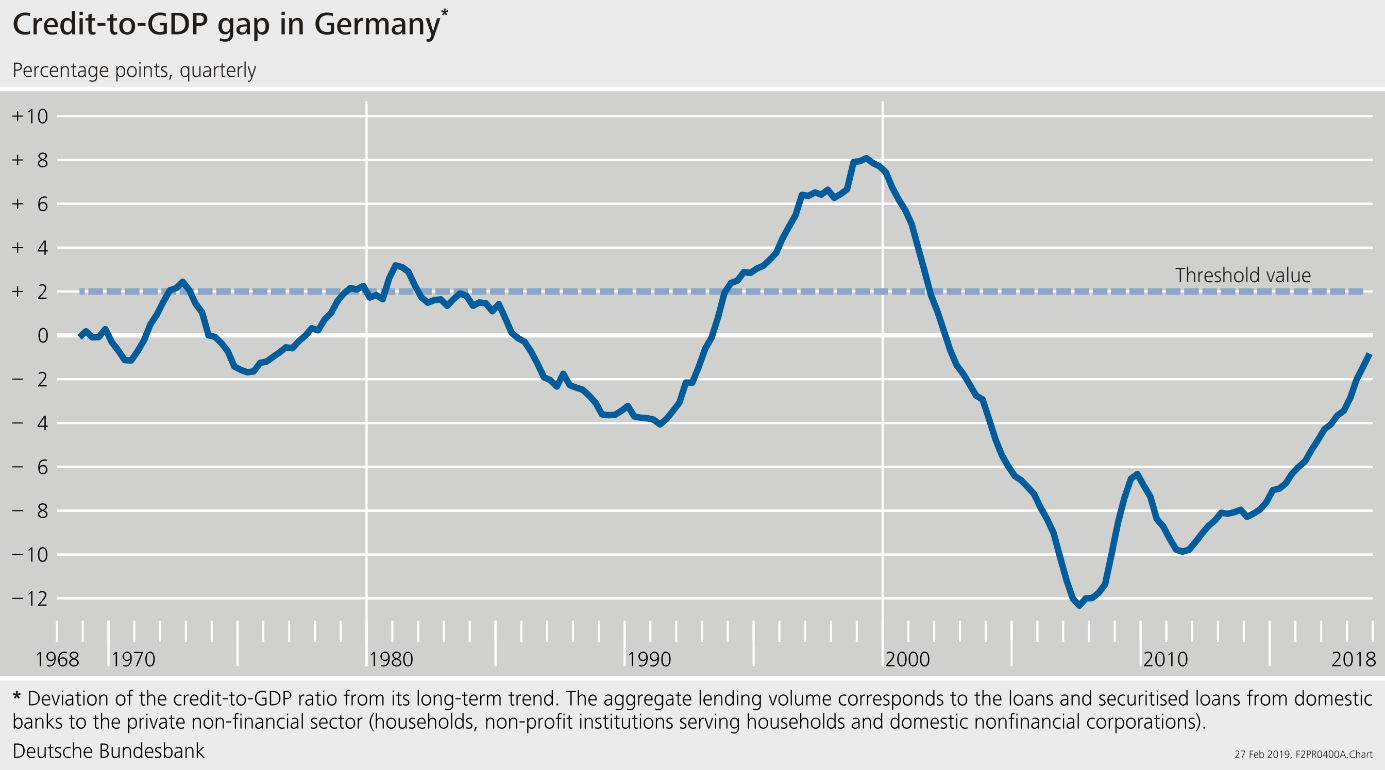

In the case of the CCyB in Germany, the assessment of whether a positive value is appropriate follows the principle of “guided discretion”.[8] The rule-based (“guided”) element is the credit-to-GDP gap. The discretionary element implies that a range of additional indicators is combined with expert judgment.

Ultimately, the decision to activate the buffer was taken even though the credit-to-GDP gap was negative, which would have implied a buffer of 0% based on the rule-based component only. This is where the analytical work of the Bundesbank on cyclical risks in the German financial system came in. In our Financial Stability Review of 2018, we warned against over-optimism after a long period of good growth performance and low interest rates, and the build-up of cyclical risks in the German financial system that might pose a threat to financial stability.[9]

These cyclical systemic risks have built up in the German financial system during a long period of economic growth and low interest rates. Our analytical work identifies three main vulnerabilities:

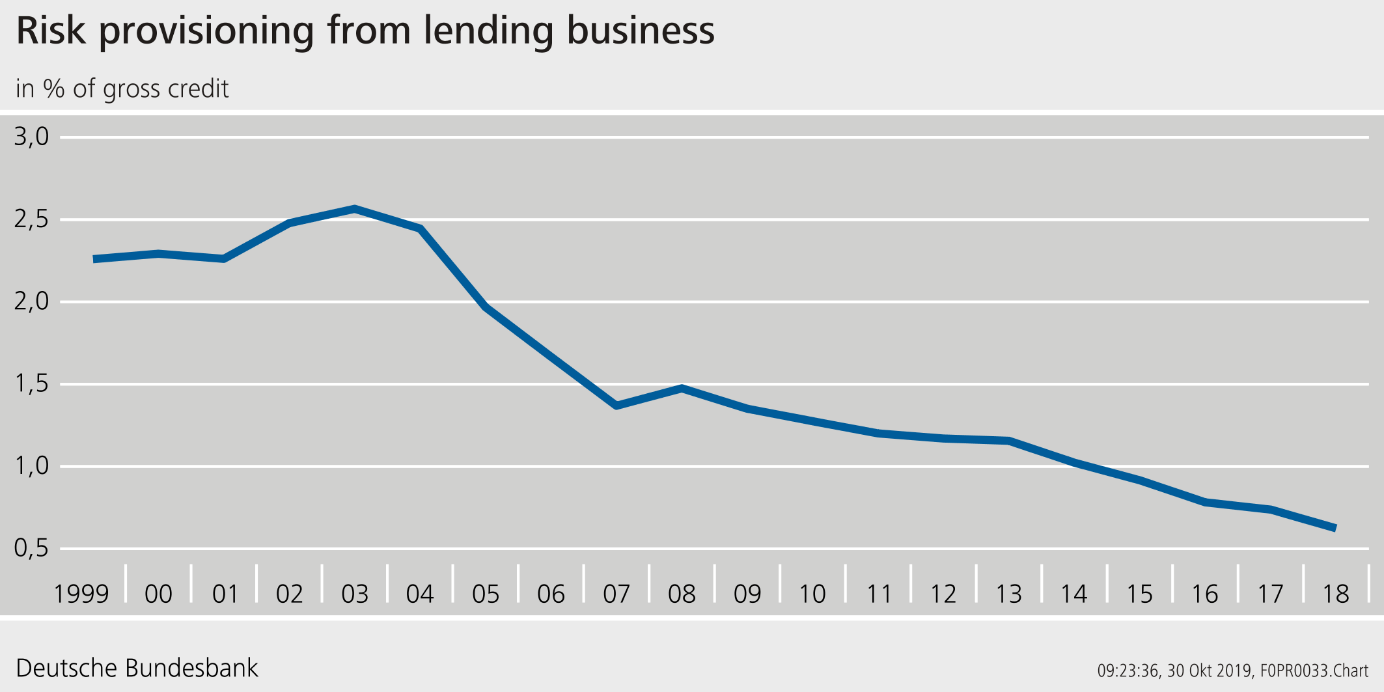

- Underestimation of credit risk: Over the past 20 years, risk provisioning by banks has declined from 2-2.5% of gross credit to about 0.5% (Figure 1). This reflects the good state of the German economy, but might be inadequate in terms of risks going forward. In addition, credit growth has been strong – roughly 5% recently – and the credit-to-GDP gap has been closing quickly (Figure 2).

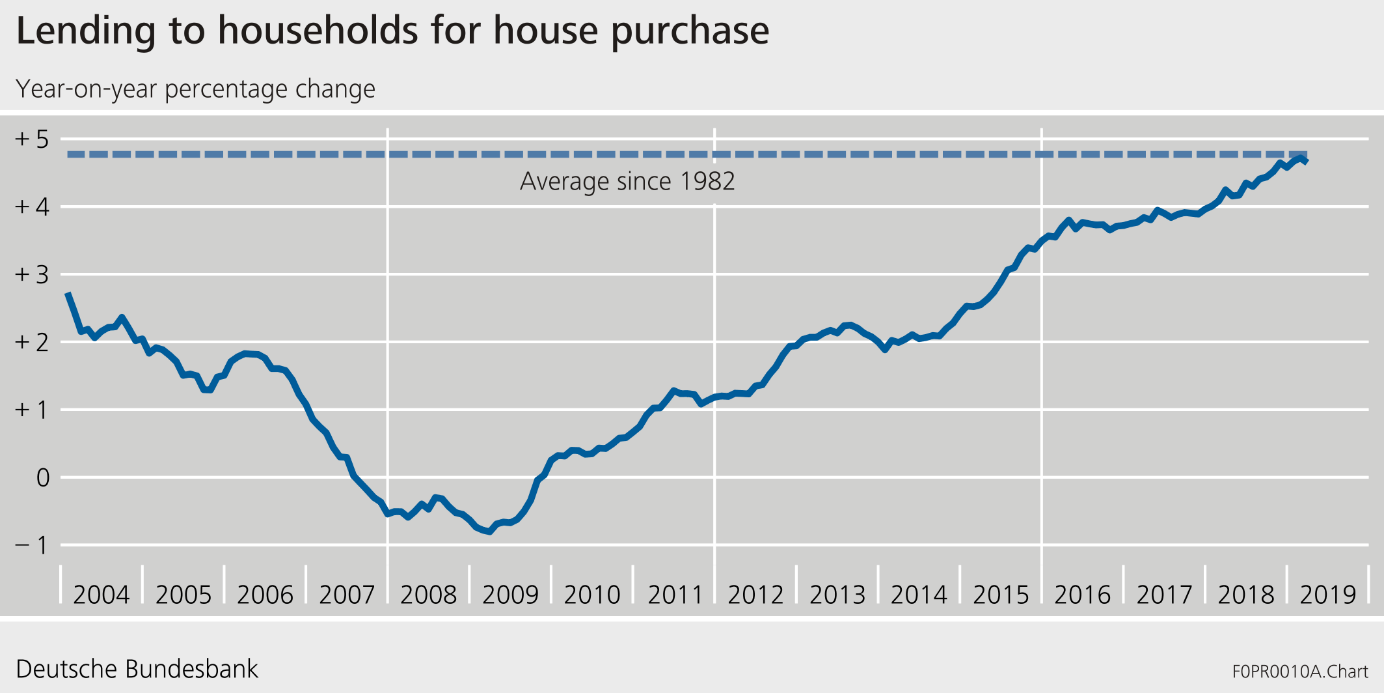

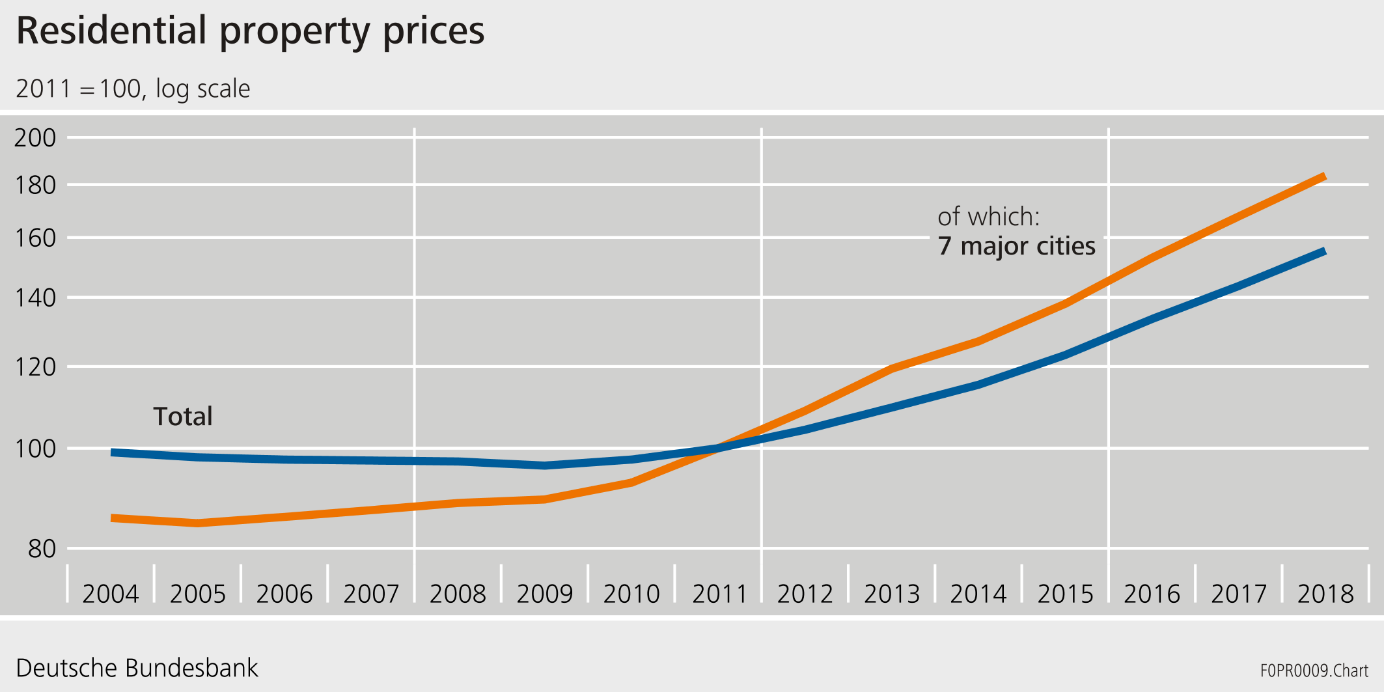

- Overvaluation of collateral: The growth rate of loans to domestic households for house purchase has risen continuously since 2010 (Figure 3). Prices for residential real estate have been rising rapidly in recent years (Figure 4). To some extent, this reflects a catching up as German real estate values have not inflated much over the past decades. However, Bundesbank estimates suggest that property prices in urban areas might be overvalued in the range of 15% to 30% compared to macroeconomic fundamentals.[10]

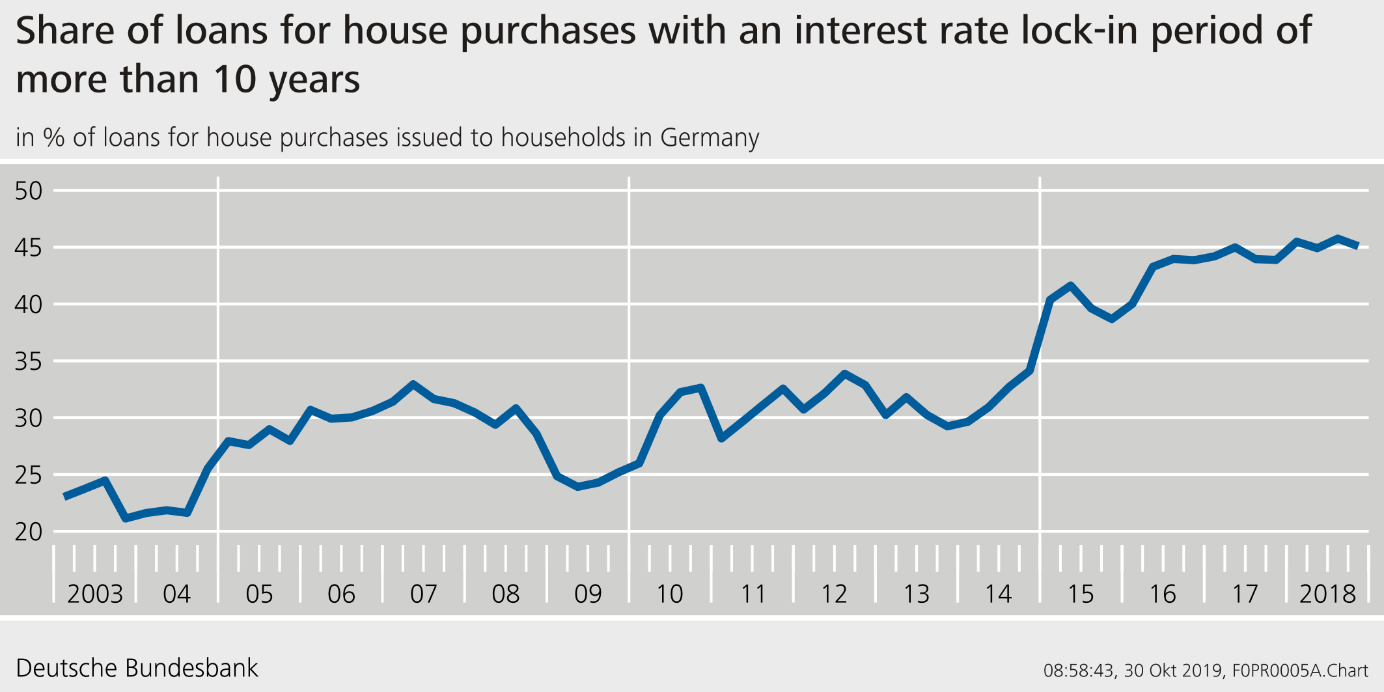

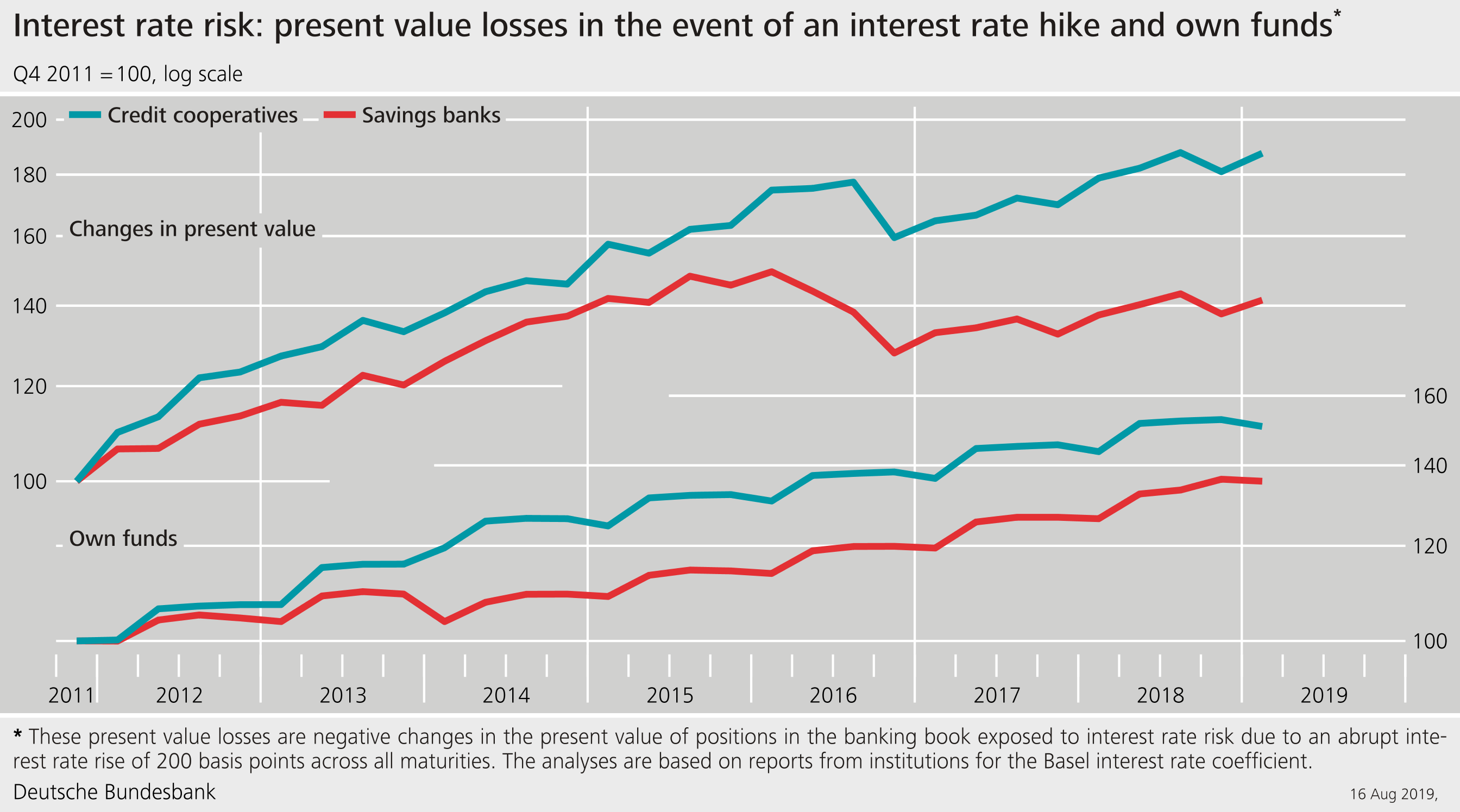

- Interest rate risk: Banks as well as other financial intermediaries might be hit by an abrupt increase in market rates. German banks have, for instance, increased the share of mortgage loans with a maturity of over ten years from 30% to 45% between 2014 and 2018 (Figure 5). Given that mortgage loans in Germany are mostly fixed-interest rate loans, banks have thus increased their exposure to interest rate risks (Figure 6). But interest rates that stay low for even longer are also problematic, as they provide incentives to “search for yield”. German life insurers with nominal payment obligations are particularly affected.

These vulnerabilities pose a potential threat to financial stability because the associated risks are highly correlated, might materialize simultaneously and reinforce each other.

Our analytical work focussed on an unexpected and severe economic downturn as the main risk scenario. Such an economic slump is likely to entail a considerable correction of asset prices, and it might expose several vulnerabilities at the same time. Rising losses from credit defaults would mean falling values of assets and loan collateral. These losses would eat into banks’ available capital buffers.

In sum, there is a risk of many banks responding to such unforeseen developments at the same time in order to meet the capital requirements imposed by the supervisory authorities or the market. However, banks are barely able to build up capital internally in an economic downturn. In addition, raising new capital on the market would probably not be possible either. The only remaining option for banks would be to scale back liabilities (deleveraging) in order to stabilize capital ratios.

As a result, the banking system might excessively curb lending or reduce existing lines of credit. It would then fall short of fulfilling its key role in the economy. Deleveraging by the financial system could amplify an economic downturn as a result.

As the German banking system could intensify an unexpected economic slump by scaling back its lending, the Bundesbank pointed to a need for macroprudential action in its Financial Stability Review of 2018. At the same time, the German Financial Stability Committee discussed which instruments were appropriate to address these risks – among them was the countercyclical capital buffer.[11]

3 The CCyB is the appropriate instrument to address cyclical systemic risks.

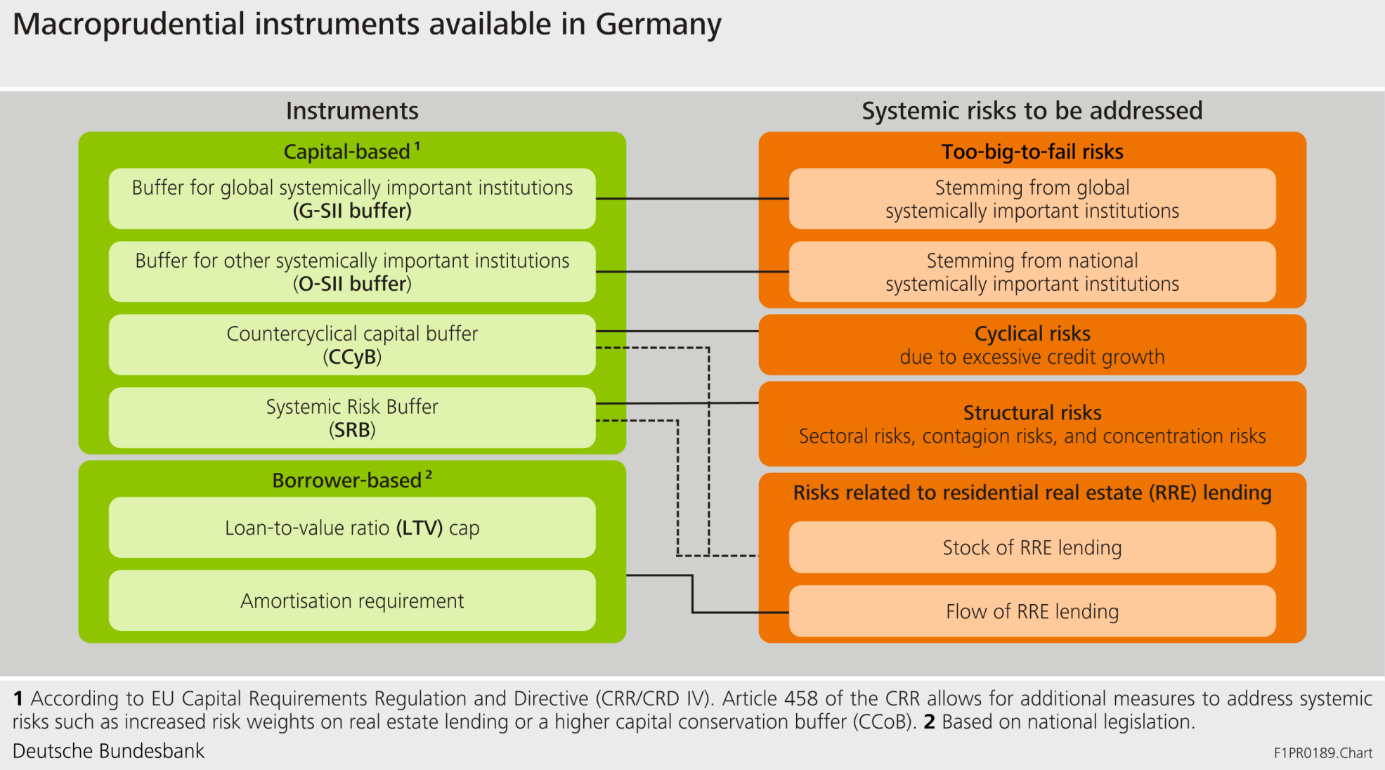

The macroprudential toolkit in Germany, which comprises a number of instruments such as capital-based measures, addresses risks of individual financial institutions such as the capital surcharges for globally or domestically systemically relevant banks. Since 2017, the German macroprudential authorities have also had borrower-based instruments at their disposal to address risks specific to the real estate market such as loan-to-value ratios (Figure 7).

Selecting the right instruments and the right intensity is not a trivial task – there is the risk of taking action too late as well as of acting too early or too strongly, or of not addressing the most severe vulnerabilities. For this reason, the Bundesbank and the Financial Stability Committee discussed various options and started with a “soft” policy tool: communication. Press briefings were held even prior to activating the buffer (in December 2018) to explain the policy decisions being recommended (in May 2019).

There is a long history of central bank communication on monetary policy including regular press conferences following monetary policy decisions. Communication on macroprudential policy may have a shorter track record, but it is highly relevant nevertheless. This holds in particular with regard to activation of macroprudential measures such as the CCyB.

In this respect, two aspects were crucial when communicating and explaining why the countercyclical capital buffer was the appropriate instrument to address cyclical risks in the German financial system.

The first aspect is the – quite intuitive – narrative of the buffer, which derives from its preventive nature: “Build up a buffer in good times that can be used in bad times”

. The CCyB can have a preventive effect in cases where multiple banks are simultaneously confronted by unexpected adverse economic developments and mounting losses. As a result, the CCyB makes the financial system more resilient to macroeconomic risks and thus helps to keep lending stable.

This narrative is easy to communicate as long as the build-up of cyclical risks goes hand in hand with a booming economy. If the economy cools down, communication has to be more specific. Building up the CCyB is appropriate as long as cyclical risks are rising and the increase of the buffer is unlikely to trigger procyclical effects itself. If the cyclical systemic risks ease off, the buffer can be reduced again.

The second – and related – aspect is the way the CCyB can mitigate deleveraging and help stabilize credit supply in bad times. This important feature of the CCyB is rooted in the fact that macroprudential buffers perform a function that is fundamentally different to that of microprudential minimum capital requirements: Minimum capital requirements must be met at all times. Weaker capitalization directly results in measures ranging from supervisory action to the withdrawal of a banking licence. By contrast, macroprudential buffers can provided some “breathing” space. Unlike microprudential minimum capital requirements, banks can therefore use macroprudential buffers to absorb losses on a going-concern basis. The possibility of absorbing losses in this way provides banks with immediate financial leeway, thereby mitigating negative effects stemming from the banking system in a cyclical downturn.[12] An additional feature of the CCyB is that – in contrast to other macroprudential buffers – it can be immediately lowered by the macroprudential authority in periods of stress in order to absorb losses.

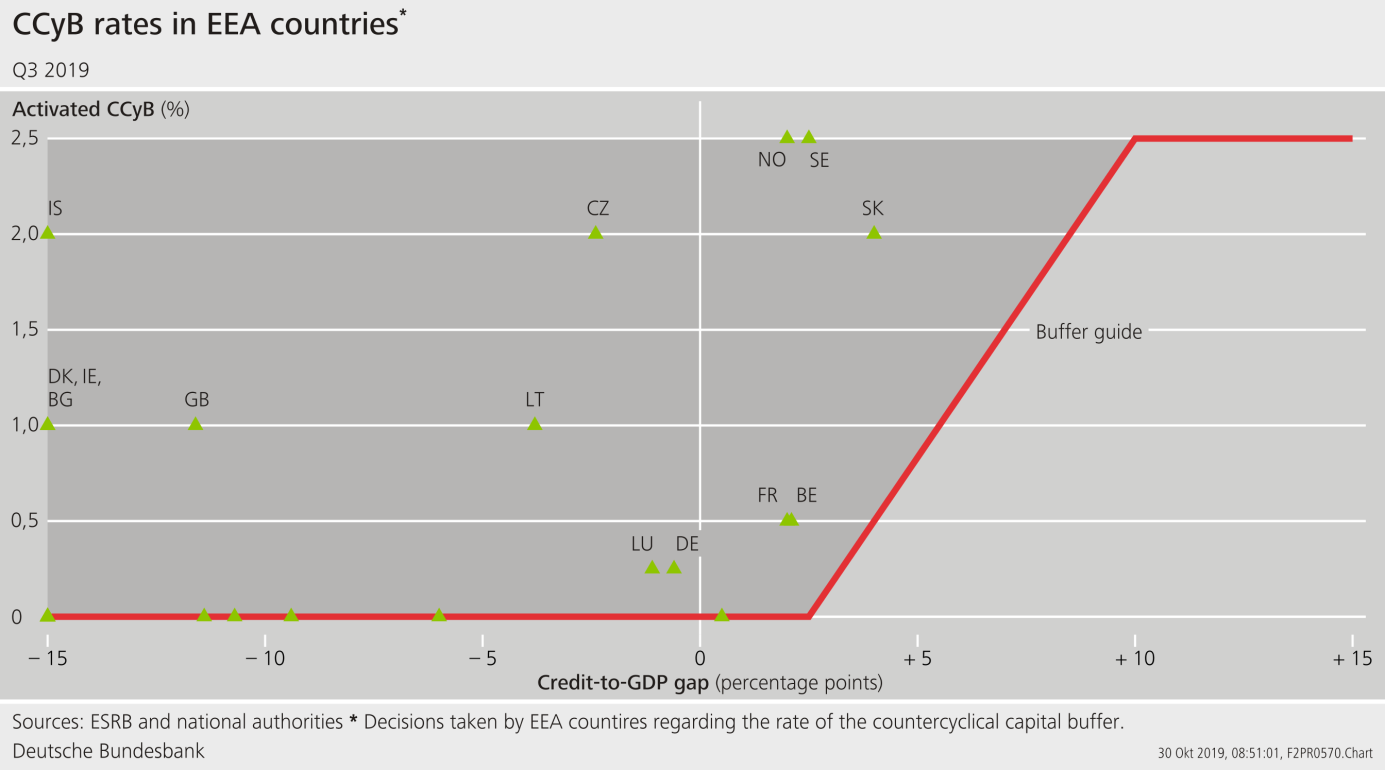

Overall, it took about two years to prepare the buffer decision. In 2017 and 2018, the Bundesbank in its Financial Stability Reviews intensified communication on the build-up of cyclical risks in the German financial system. In 2018 and 2019, the German Financial Stability Committee discussed available instruments to address cyclical risks. In December 2018, it held a press briefing on cyclical risks in the financial system. In May 2019, the Committee recommended to the macroprudential authority, i. e. BaFin, to activate the buffer, which BaFin did in July 2019. The buffer was increased to a level of 0.25% with a phase-in period of one year. The buffer also applies in a reciprocal manner to members of the European Economic Area. Germany thus followed the lead of several other European countries that activated the CCyB ranging from 0.25% to 2.5% (Figure 8).

4 Summing up

Given the risks that lie ahead and the potential threats to the German economy, the obvious question arises whether we have done enough or whether we may have acted too late. This question cannot be answered at the current juncture, and assessing the impact of “soft” measures such as communication will always be difficult. Certainly, the risk of a procyclical effect of the activation of the buffer has not materialized. Most German banks have sufficient levels of capital in excess of the regulatory minimum, implying that a CCyB of 0.25% is likely not binding. In addition, the one-year phase-in period gives banks sufficient time to comply with the buffer requirement. The exact calibration of the buffer is certainly at the lower bound; other European countries have set higher buffer rates. The Bundesbank will continue monitoring the potential build-up of vulnerabilities, bring this analytical work into the Committee, and will publish its next Financial Stability Review in November 2019. Potential adjustments of the CCyB will then have to be discussed in light of the new evidence.

5 References

Alam, Zohair , Adrian Alter, Jesse Eiseman, Gaston Gelos, Heedon Kang, Machiko Narita, Erlend Nier, and Naixi Wang (2019). Digging Deeper: Evidence on the Effects of Macroprudential Policies from a New Database. International Monetary Fund. Working Paper WP/19/66. Washington DC.

Buch, Claudia M., and Benjamin Weigert (2018), Macroprudential Policy in a Currency Union, Review of World Economics 155(1): 23–33.

Deutsche Bundesbank (2018). Financial Stability Review. Frankfurt a.M.

Deutsche Bundesbank (2019). Monthly Report. February. Frankfurt a.M.

German Financial Stability Committee (2019a). Recommendation of 27 May 2019 concerning the increase of the countercyclical capital buffer. Berlin. Available at: https://www.bundesbank.de/resource/blob/799224/0e100978a1a17cfcc164a0756c87aca6/mL/2019-05-27-afs-anlage-empfehlung-data.pdf

German Financial Stability Committee (2019b). FAQs on the first increase of the countercyclical capital buffer. Berlin. Available at: https://www.bundesbank.de/resource/blob/798050/e16ab3892c8c8d10fcde9370e1f173a8/mL/2019-05-27-afs-anlage-faq-data.pdf

German Financial Stability Committee (2019c). Sechster Bericht an den Deutschen Bundestag zur Finanzstabilität in Deutschland. Berlin.

Edge, Rochelle M. and J. Nellie Liang (2019). New Financial Stability Governance Structures and Central Banks, Finance and Economics Discussion Series 2019-019, Board of Governors of the Federal Reserve System (US). Washington DC.

International Monetary Fund (2018). The IMF’s Annual Macroprudential Policy Survey— Objectives, Design, and Country Responses. Washington DC. available at: https://www.elibrary-areaer.imf.org/Macroprudential/Documents/AtaGlance.pdf

Tente, Natalia, Ingrid Stein, Leonid Silbermann, and Thomas Deckers (2015). The Countercyclical Capital Buffer in Germany: Analytical Framework for the Assessment of an Appropriate Domestic Buffer Rate. Deutsche Bundesbank. Frankfurt a.M.

6 Figures

Figure 1

Figure 2

Figure 3

Figure 4

Figure 5

Figure 6

Figure 7

Figure 8

Footnotes:

- German Financial Stability Committee (2019a, 2019b).

- Buch and Weigert (2018).

- German Financial Stability Committee (2019c).

- Edge and Liang (2019).

- This top-up power is confined to capital-and liquidity based measures that have their legal basis in the Capital Requirements Directive (CRD) and the Capital Requirements Regulation (CRR).

- Alam et al. (2019).

- International Monetary Fund (2018).

- Tente, Stein, Silbermann, and Deckers (2015).

- Deutsche Bundesbank (2018).

- Deutsche Bundesbank (2019).

- German Financial Stability Committee (2019c).

- German Financial Stability Committee (2019a, 2019b).