Introductory statement at the press conference presenting the Annual Report 2024

Check against delivery.

1 Welcome

Ladies and gentlemen,

I would like to welcome you to our press conference, at which we will present our annual accounts.

First Deputy Governor Sabine Mauderer will explain our annual accounts to you in more detail in just a few moments.

To begin, however, I would like to take a look at current developments in economic activity and prices. I will then explain what conclusions I draw for our monetary policy stance. And, at the end of my statement, I will present the most important figures from our profit and loss account.

2 Need for economic policy action in Germany

Two days on from the snap Bundestag election, the election results are at the focus of attention among the media and the public as a whole.

There is a clear government mandate and a likely option for a coalition. In view of this, I hope that a new government will be formed swiftly.

I am sure that all of the parties involved are cognisant of their responsibility: Germany needs an effective government as soon as possible. A government that uses smart economic policy to enable the economy to get back on track. That puts the German economy on a path to higher growth. By ensuring greater certainty of planning and improving supply-side conditions.

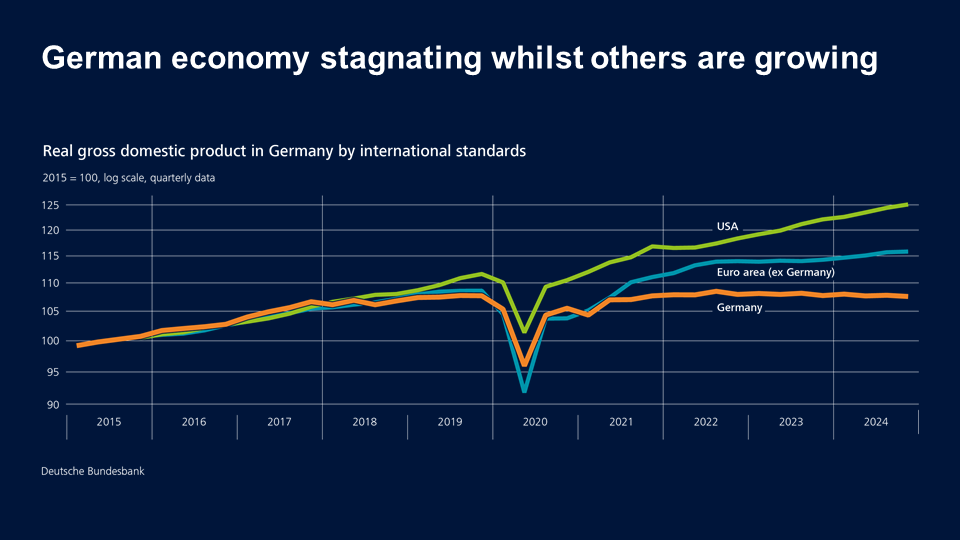

At present, the German economy is in a state of stubborn stagnation. Real gross domestic product has seen practically no growth since 2018.

There was a rapid recovery from the sharp slump at the start of the coronavirus pandemic. Since then, however, the economy has been moving more or less sideways. Meanwhile, other countries such as the United States, but also many economies in the euro area, are on course for growth.

The sluggishness in the German economy cannot be explained by cyclical headwinds alone. Rather, structural problems play a key role.

In particular, export-oriented industry is under great pressure to adapt, which is due, amongst other factors, to the high prices for energy. In addition, it needs to be better prepared for the green transformation and absorb the impact of demographic change.

Furthermore, on global markets, German enterprises are facing growing competition from emerging market economies, which is intensified, in some cases, by subsidies. Many enterprises are also bemoaning the ever higher bureaucratic hurdles and the large fiscal burden required of them by the state. Not least, they are being hindered by the lack of political reliability.

While private consumption is bolstering economic activity, it is seeing only very subdued growth. One likely factor here is that the labour market is increasingly gloomy. However, the uncertain economic outlook is also contributing to households’ reluctance to increase their consumer spending.

A slight economic recovery is expected over the course of the year. For the time being, however, no meaningful upswing is in sight. In addition, there are risks from international trade and geopolitics.

In any case, it is not possible to rule out a third consecutive calendar year with no growth. This makes it all the more important that the new Federal Government swiftly takes effective measures.

Germany continues to have strengths that should be leveraged and expanded upon: stable institutions; enterprises that remain financially sound and are adaptable and, in many cases, highly innovative; a highly skilled and dedicated workforce; and an abundance of clever and creative minds.

Smart, consistent and reliable economic policymaking can unleash a sense of change and increase the willingness for greater investment. I therefore hope that we will have a government that will rouse “German Michel” from his slumber, to draw on an image from “The Economist”.

We will soon be presenting the Bundesbank's proposals on how we can get the German economy on a path to growth. In this way, the Bundesbank is fulfilling its statutory mandate to support and advise the Federal Government on matters of economic policy.

3 Inflation in Germany

Our core mandate, however, is and remains to maintain price stability.

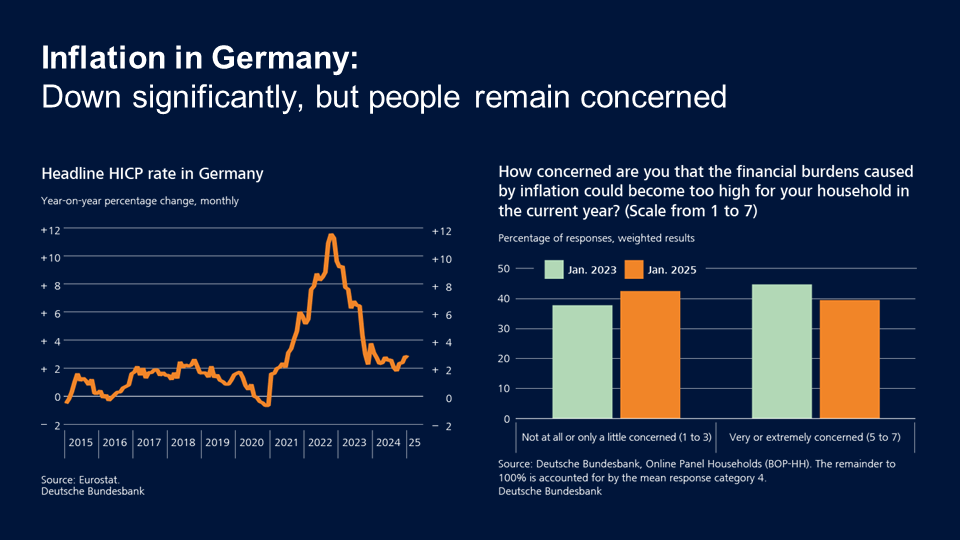

In Germany, the rate of inflation continued to fall last year: on an annual average, the rate of inflation according to the European Harmonised Index of Consumer Prices, or HICP, stood at 2.5 %.

Whilst it has fallen significantly compared with the preceding years, it is still noticeably above the medium-term target of 2 %. And it has risen again in recent months.

However, the uptick from 1.8 % in September to 2.8 % in January is not indicative of a new wave of inflation. Instead, it mainly reflects the sharp decline in energy prices at the end of 2023 and the associated base effect.

We therefore expect that the trend decline is intact and that inflation in Germany will continue to fall. We anticipate that Germany will see a sustainable return to a level of 2 % in 2026.

Despite the prospective price stability, people are still burdened by the issue of inflation. Surveys show that the fear of rising costs of living remains one of the biggest concerns among people in Germany.[1] And this is not surprising, either.

After all, the shock of exceptionally high inflation has left a deep impression. And the decline in inflation rates does not, in fact, mean that prices will go back down again. Certain prices will fall, of course. But we need to get used to a higher level of prices overall.

Of course, another part of the bigger picture is that strong wage growth has now largely offset the inflation-related losses in real income.

Our Bundesbank Online Panel reveals that households are no longer feeling the financial burden of inflation as strongly this year as they did two years ago. However, a considerable proportion of people are still concerned or very concerned that the financial burdens on their household could become too high.

This figure stands at just under 40 %. And, among households with a monthly net income of less than €2,500, more than half are concerned.[2]

Personal experiences of high inflation have a long-lasting impact. For example, they influence inflation expectations for many years.[3] And dissatisfaction about high prices and inflation can also be a political tinderbox.[4]

4 Inflation and monetary policy in the euro area

This makes it all the more important for central banks to spare people the experience of high inflation as far as possible. And to decisively combat excessively high inflation.

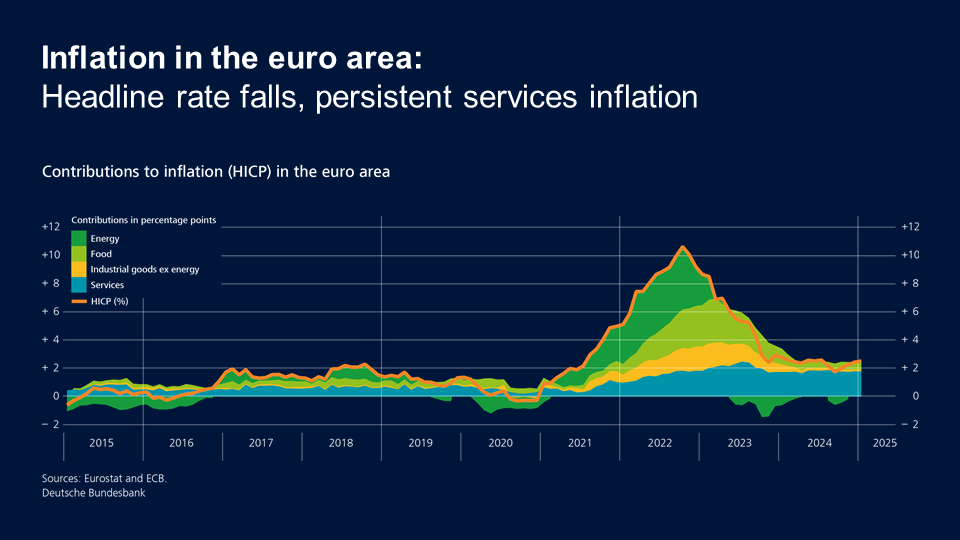

This is precisely what we on the ECB Governing Council have done. Through a historically unprecedented monetary policy turnaround, we have helped to break the wave of inflation and keep inflation expectations anchored. The inflation rate in the euro area continued to fall last year, dropping to an average of 2.4 % for 2024.

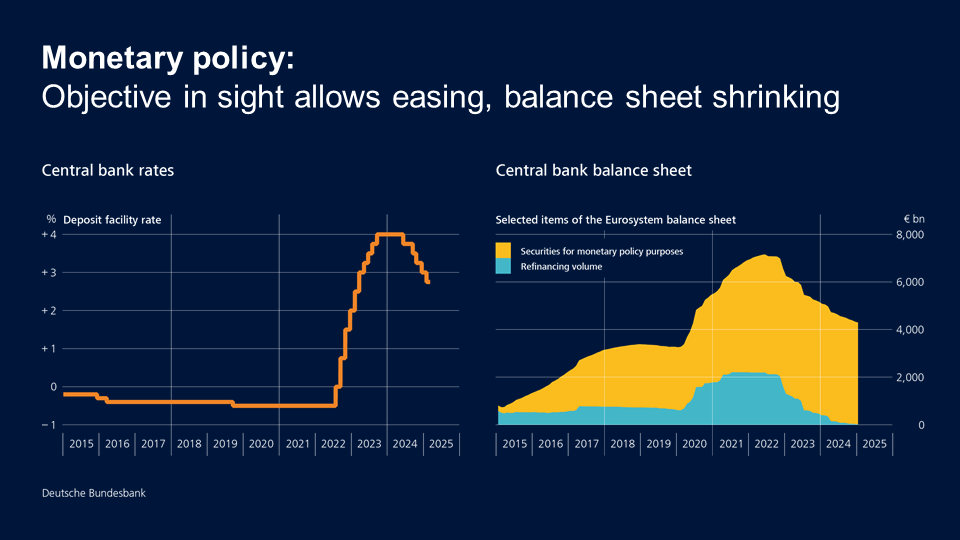

Incoming data suggest that we are likely to reach our medium-term target of 2 % over the course of this year. This would allow us on the Governing Council to lower the key interest rates further.

At this point, we have lowered the deposit facility rate five times; it currently stands at 2.75 %. That is probably no longer all that far from the neutral rate of interest, though it is hard to pin down exactly what this rate is.[5] In addition, we in the Eurosystem have progressed with our gradual shrinking of the balance sheet.

Overall, then, the outlook for prices is fairly encouraging. However, the persistently elevated core inflation and the undiminished strength of services inflation warrant a degree of caution. This is especially true in light of the latest developments on the inflation front.

Headline inflation is now being driven primarily by services. Services inflation is, in any event, much more sluggish than that of components such as energy and food. For months now, it appears to be sticking to the 4 % mark.

Services make up nearly one-half of the statistical basket of goods. In order for headline inflation to fall to 2 %, services prices also need to rise less sharply. And that is precisely what we are expecting to happen, especially as wage pressures gradually recede in the euro area.

On the other hand, inflation could conceivably also come in higher than the current baseline scenario would suggest. If, for example, Europe feels compelled to respond to protectionist measures with retaliatory tariffs, this would be associated with rising import prices. As well as a further depreciation of the euro.

In view of the latest developments on the inflation front and given the high level of uncertainty, it is wise to take one step at a time in terms of monetary policy. And not to rush into further interest rate cuts.

With this in mind, the Governing Council would be well advised to remain true to its existing data-dependent, meeting-by-meeting approach, and not to pre-commit to a particular rate path. In the current uncertain environment, there is nothing to be gained from publicly speculating on where we might stand, in terms of our interest rate policy, in summer or at the end of the year.

5 Annual accounts for 2024

The monetary policy tightening, involving ten interest rate moves in a row and a rise of 450 basis points, has no precedent in the euro area. That is undeniable. But this restrictive monetary policy stance was appropriate and necessary in order to bring inflation under control.

In conjunction with the non-standard expansionary monetary policy measures taken previously, though, it also has significant implications for the Bundesbank’s earnings situation. And that will remain the case for many years to come.

Which brings me to our annual accounts.

As a reminder: in the wake of the sovereign debt crisis, the inflation rate remained stubbornly and, at times, considerably below the target of 2 % for four years. The Eurosystem’s monetary policy was therefore exceptionally loose for several years.

The key interest rates were lowered to zero and below. The Eurosystem offered refinancing operations at very attractive conditions, and banks made extensive use of these. Above all, it purchased securities on a large scale, government bonds in particular.

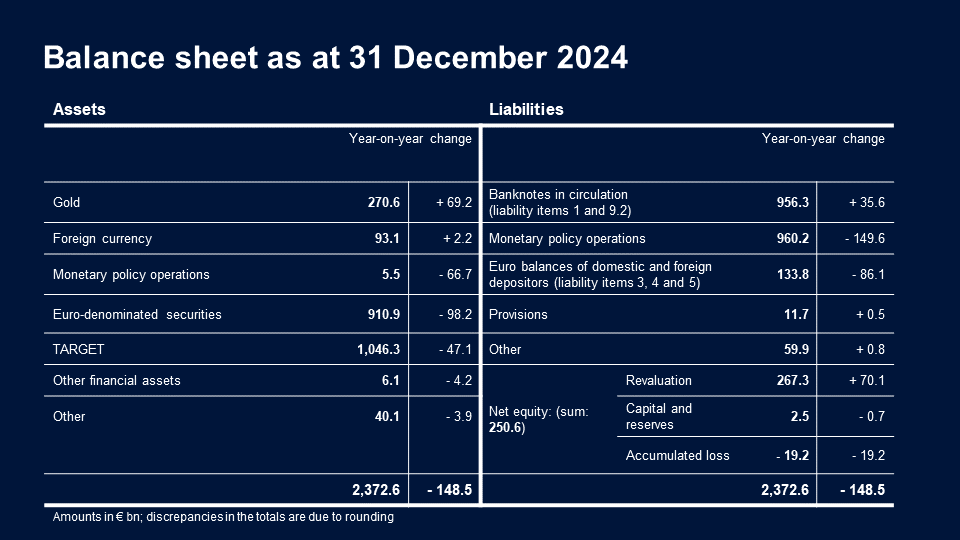

This resulted in a considerably expanded balance sheet: large holdings of low-interest, long-dated securities accumulated on the assets side. While short-term variable rate deposits rose on the liabilities side. This created substantial interest rate risk.

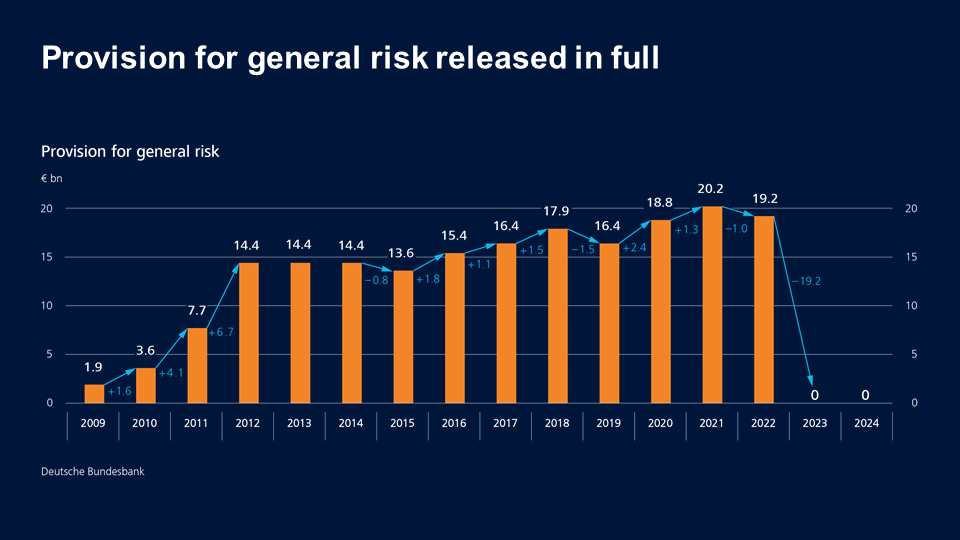

The Bundesbank was aware of this risk and built up a provision for general risk in the amount of just over €20 billion over a period of several years. The interest rate hikes in 2022 and 2023 caused this risk to materialise, and interest expenditure on the liabilities side rose rapidly. At the same time, interest income from the bond portfolios remained at a low level.

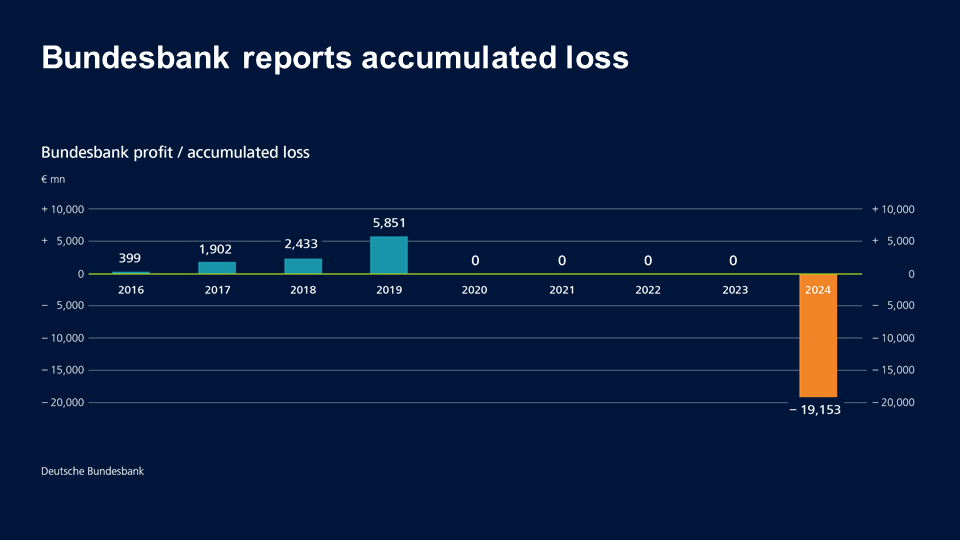

Thanks to the full release of the provision for general risk and the release of reserves, the Bundesbank managed to record a balanced result in financial year 2023. Distributable profit came to zero.

But that left just under €0.7 billion to cover further losses going forward. So it was on the cards that we would have to report an accumulated loss for 2024. I indicated as much at last year’s annual accounts press conference.[6]

Another thing I hinted at last year was that the highest annual burdens would be behind us in 2024.[7] And, indeed, at €19.8 billion, the loss figure for 2024 is lower than for 2023, when it totalled €21.6 billion. Subtracting the remaining reserves, this yields an accumulated loss of €19.2 billion for 2024, which will be carried forward to subsequent years and offset against future profits.

Incidentally, the Bundesbank already recorded an accumulated loss back in the 1970s, most recently in 1979. So you see, dealing with such situations is nothing fundamentally new for us.

For 1974, for example, the Bundesbank recorded an accumulated loss of 8.9 billion Deutsche Mark. This was equivalent to just under 1 % of gross domestic product that year. By way of comparison, the accumulated loss for 2024 corresponds to just under 0.5 % of 2024 GDP.

There are, of course, differences between then and now. The main factors shaping the situation back then are not the same as the ones that are at play nowadays.

The financial burdens are likely to be considerable again in the current year, but less so than in 2024. Because with key interest rates back on the decline and the balance sheet still shrinking, the earnings situation should improve considerably.

So peak annual burdens are likely to be behind us. However, losses are also to be expected for the next few years. The accumulated loss, an item in which the annual burdens from future periods will build up, will therefore increase for some years to come.

After that, profits can be expected once more. These will then be used to reduce the accumulated loss and subsequently to build up new risk provisioning.

Profit distributions to the Federal Government are therefore not a prospect for some time yet. Since we do not know how the key interest rates and the other framework parameters will evolve in the meantime, it would be unrealistic to give a specific date for when profit distributions will become possible again.

As unfortunate as it is that we cannot distribute profits, it must be stressed that the Bundesbank continues to have a sound balance sheet. It has high revaluation reserves. This is particularly true for gold.

The value of these reserves is many times greater than the current and prospective accumulated losses. And that value rose steeply last year.

Sabine Mauderer will present you with more precise figures in a moment.

The Bundesbank is fully unrestricted in its ability to act. We can and will continue to do all that is needed to ensure price stability.

6 Conclusion

Ladies and gentlemen,

European monetary policymakers are looking back on what has been an extraordinary decade: in view of the very low inflation, the monetary policy stance was initially very loose, with years of zero interest rate policy and extensive asset purchases. And then policymakers had to step heavily on the brakes in response to the inflation shock.

This has left its mark on the central bank balance sheet.

It will take some years before the impact on the Bundesbank’s balance sheet has faded once and for all. Looking ahead to the long term, the Bundesbank will transfer profits to the Federal Government again in the future.

However, the most important thing is this: price stability is within reach.

I will now hand over to Sabine Mauderer. Thank you for your attention.

Footnotes:

- See, for example, Sicherheitsreport 2025, survey conducted by the Institut für Demoskopie Allensbach, Stimmungslage in Deutschland – Sorgenbarometer, survey conducted by Ipsos, January 2025.

- Deutsche Bundesbank, Online Panel Households (BOP-HH), results from January 2023 and January 2025. Question: “How concerned are you that the financial burdens caused by inflation could become too high for your household in 2023/2025?” For households with a monthly net income of less than €2,500, 54 % are concerned.

- Malmendier, U. and S. Nagel (2016), Learning from inflation experiences, The Quarterly Journal of Economics 131(1), pp. 53‑87; D’Acunto, F., U. Malmendier and M. Weber (2022), What Do the Data Tell Us About Inflation Expectations?, NBER Working Papers, No 29825, March 2022.

- Diermeier, M. and J. Niehues (2025), (Überschätzte) Inflation: Potenziale für die politischen Ränder, IW-Kurzbericht 13/2025.

- Nagel, J. (2025), r* in the monetary policy universe: Navigational star or dark matter?, Lecture at the London School of Economics and Political Science, London, 12 February 2025.

- Nagel, J. (2024), Introductory statement to the press conference presenting the Annual Report 2023, Frankfurt am Main, 23 February 2024.

- Deutsche Bundesbank (2024), Editierte Abschrift der Frage- und Antwortrunde anlässlich der Jahrespressekonferenz am 23.02.2024.