October results of the Bank Lending Survey in Germany

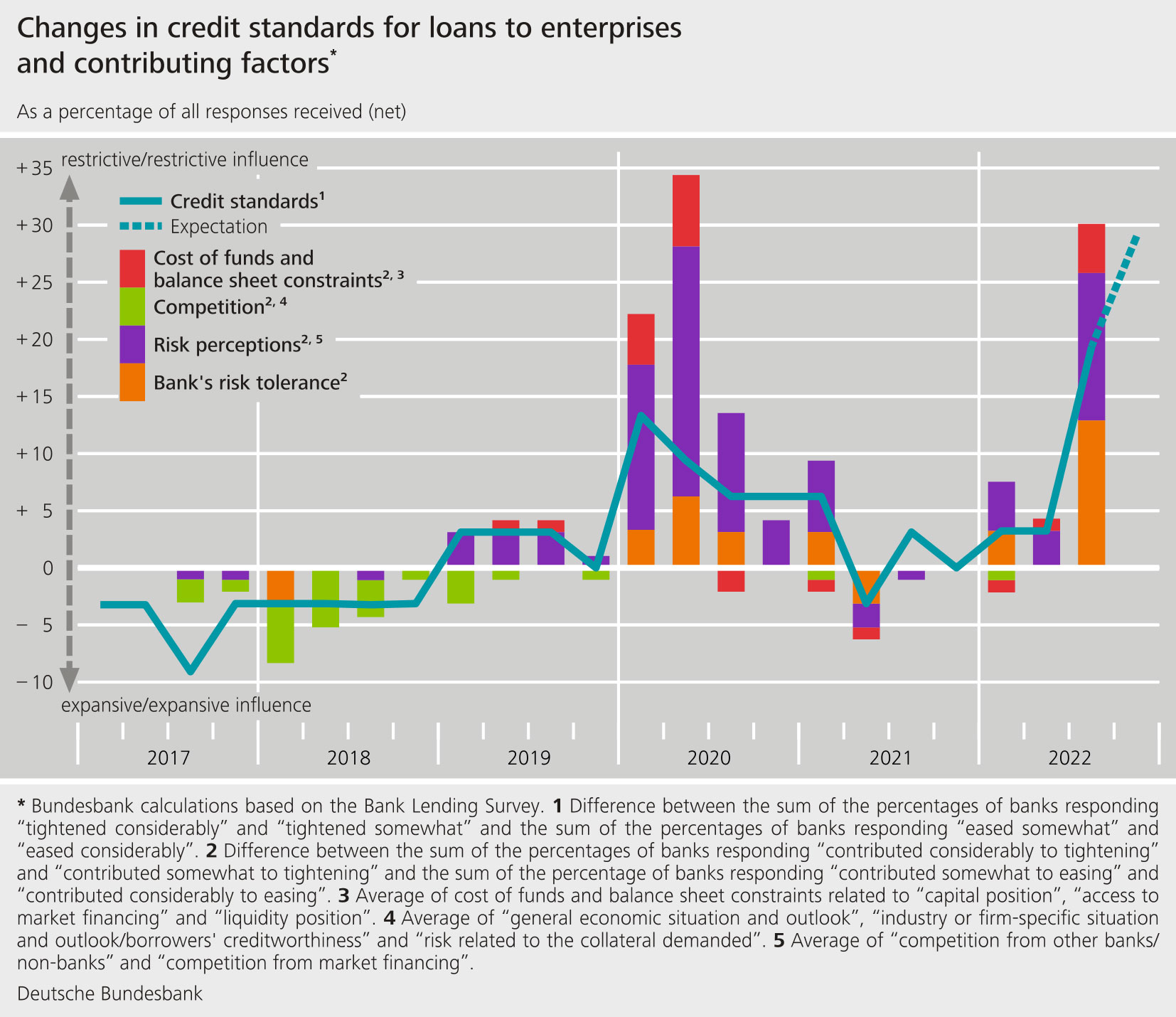

- The German banks responding to the Bank Lending Survey (BLS) adopted stricter credit standards for loans to enterprises in the third quarter of 2022. For the second time in a row, credit standards for loans to households for house purchase have been made more restrictive than at any point in time since the introduction of the BLS in 2003. Credit standards for consumer credit and other lending were also made considerably more restrictive. The banks justified the stricter standards in all loan categories primarily on the grounds of a perceived increase in credit risk.

- Overall, terms and conditions were made considerably more restrictive in all three loan categories, which was chiefly reflected in a widening of margins.

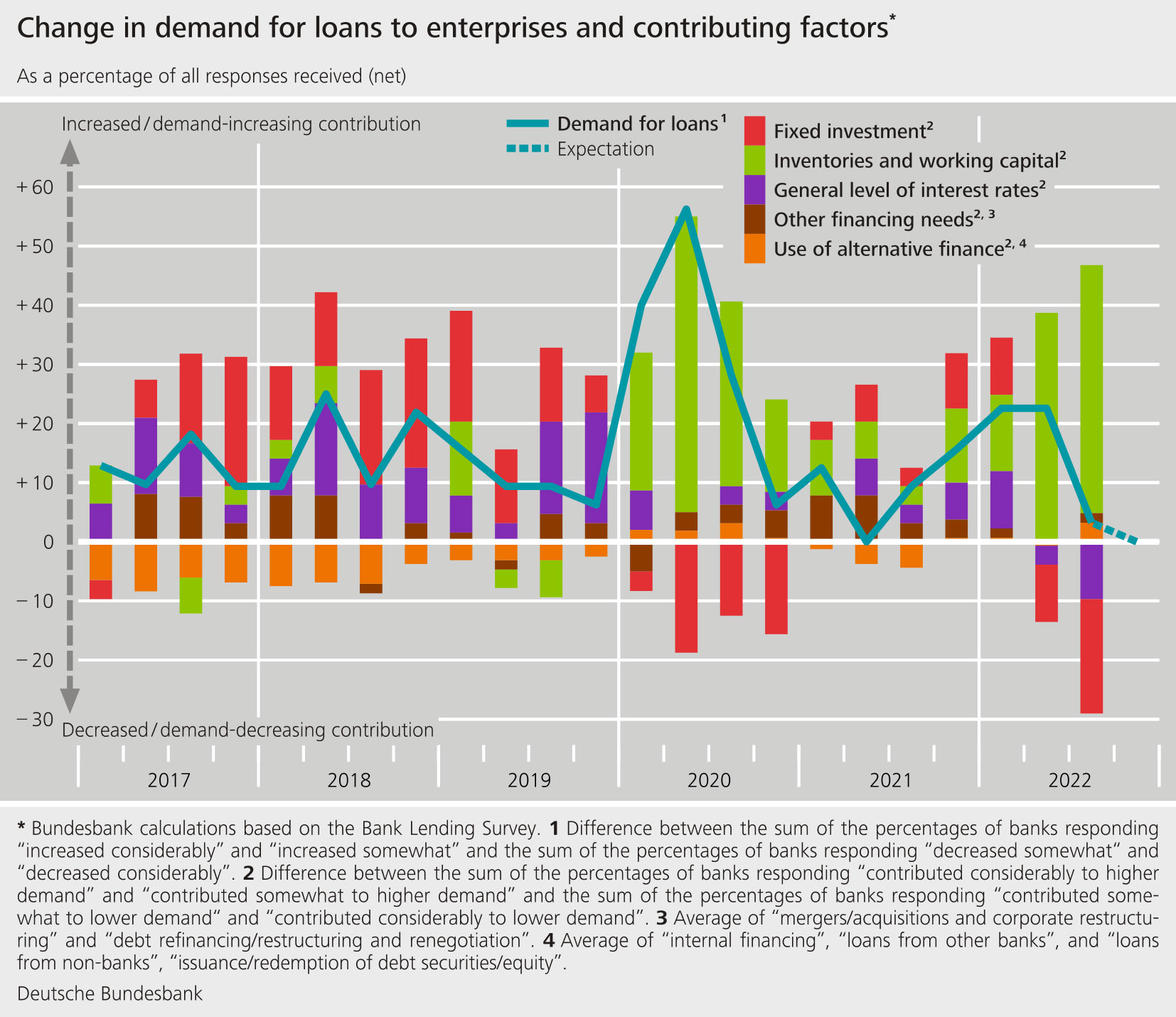

- Enterprises’ demand for loans was up slightly overall, with demand for short-term loans, in particular, proving higher than in the previous quarter. In the third quarter, demand for loans to households for house purchase fell at a rate not seen since the introduction of the BLS. There was also less demand for consumer credit and other lending to households.

- The negative impact of the Eurosystem’s asset purchase programmes on banks’ profitability has abated discernibly over the past six months. According to the banks, the asset purchase programmes had no impact on their lending policy.

- Banks have continued to benefit from the liquidity provided by the third targeted longer-term refinancing operations (TLTRO-III). According to the banks surveyed, TLTRO-III continued to have a positive direct or indirect impact on their financial situation over the past six months.

The October survey round contained ad hoc questions on participating banks’ funding conditions and the impact of the Eurosystem’s asset purchase programme (APP) and pandemic emergency purchase programme (PEPP). Although net asset purchases under the PEPP were discontinued at the end of March 2022 and purchases under the APP were terminated on 1 July 2022, reinvestment is still taking place. Other ad hoc questions addressed the effects of the negative interest rate on the Eurosystem’s deposit facility and the two-tier system for remunerating excess liquidity holdings over the past six months. The survey additionally contained questions on the Eurosystem’s TLTRO-III operations.

Against the backdrop of conditions in financial markets, German banks reported virtually no change in their funding situation compared with the previous quarter. According to the banks, the Eurosystem’s asset purchase programmes have contributed only marginally to an improvement in their liquidity position or market financing conditions over the past six months. On the other hand, the negative impact of the asset purchase programmes on banks’ profitability also diminished significantly. By contrast, according to banks, TLTRO-III continued to have a visibly positive impact on their financial situation, despite the fact that no further transactions have been conducted since December 2021. The operations mainly contributed, either directly or indirectly, to an increase in profitability, a more comfortable liquidity position and improved financing conditions. They also contributed to improving the banks’ ability to fulfil regulatory and supervisory requirements. The banks reported neither the asset purchase programmes nor the TLTRO-III as having a significant impact on lending policy or the volume of lending over the past six months. The negative interest rate on the deposit facility until 21 July 2022 led to a decline in lending and deposit rates and an increase in deposit fees over the past six months. Overall, it once again squeezed banks’ net interest income. The two-tier system for remunerating excess liquidity holdings did, however, soften the adverse impact on earnings.

The Bank Lending Survey, which is conducted four times a year, took place between 16 September and 4 October 2022. In Germany, 33 banks took part in the survey. The response rate was 100%.