October results of the Bank Lending Survey (BLS) in Germany Credit standards for firms not tightened further

- For the first time in nearly three years, the German banks responding to the Bank Lending Survey (BLS) did not tighten their credit standards for loans to enterprises further in the third quarter of 2024, but eased them marginally instead. On the other hand, they once again tightened their credit standards for loans to households for house purchase and for consumer credit and other lending to households For the fourth quarter, banks are planning to tighten their credit standards for loans to enterprises again, partly owing to pessimistic market and economic expectations.

- The surveyed banks, did not, on balance, change credit terms and conditions for loans to enterprises. Terms and conditions were eased for loans to households for house purchase and tightened for consumer credit and other lending to households.

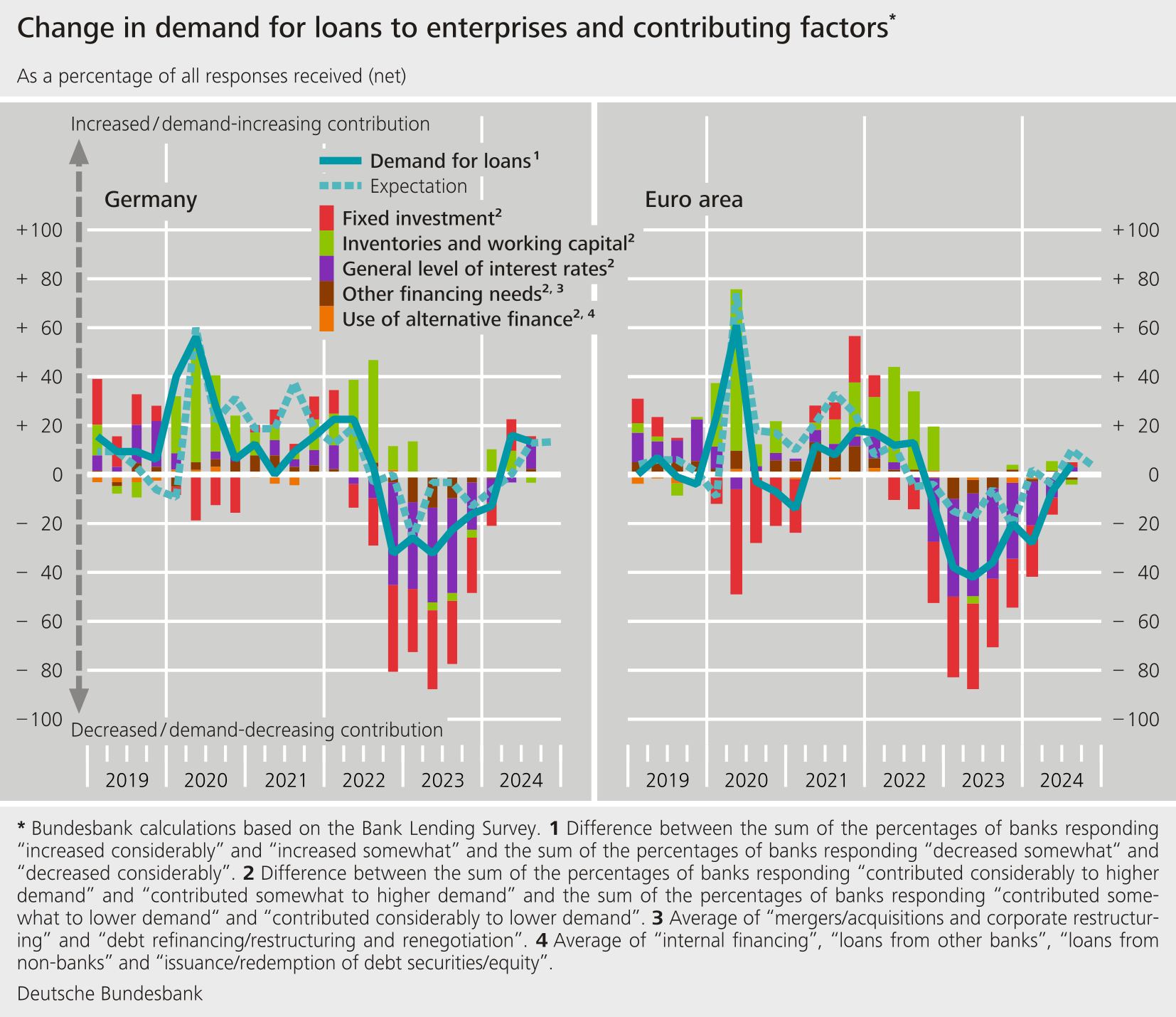

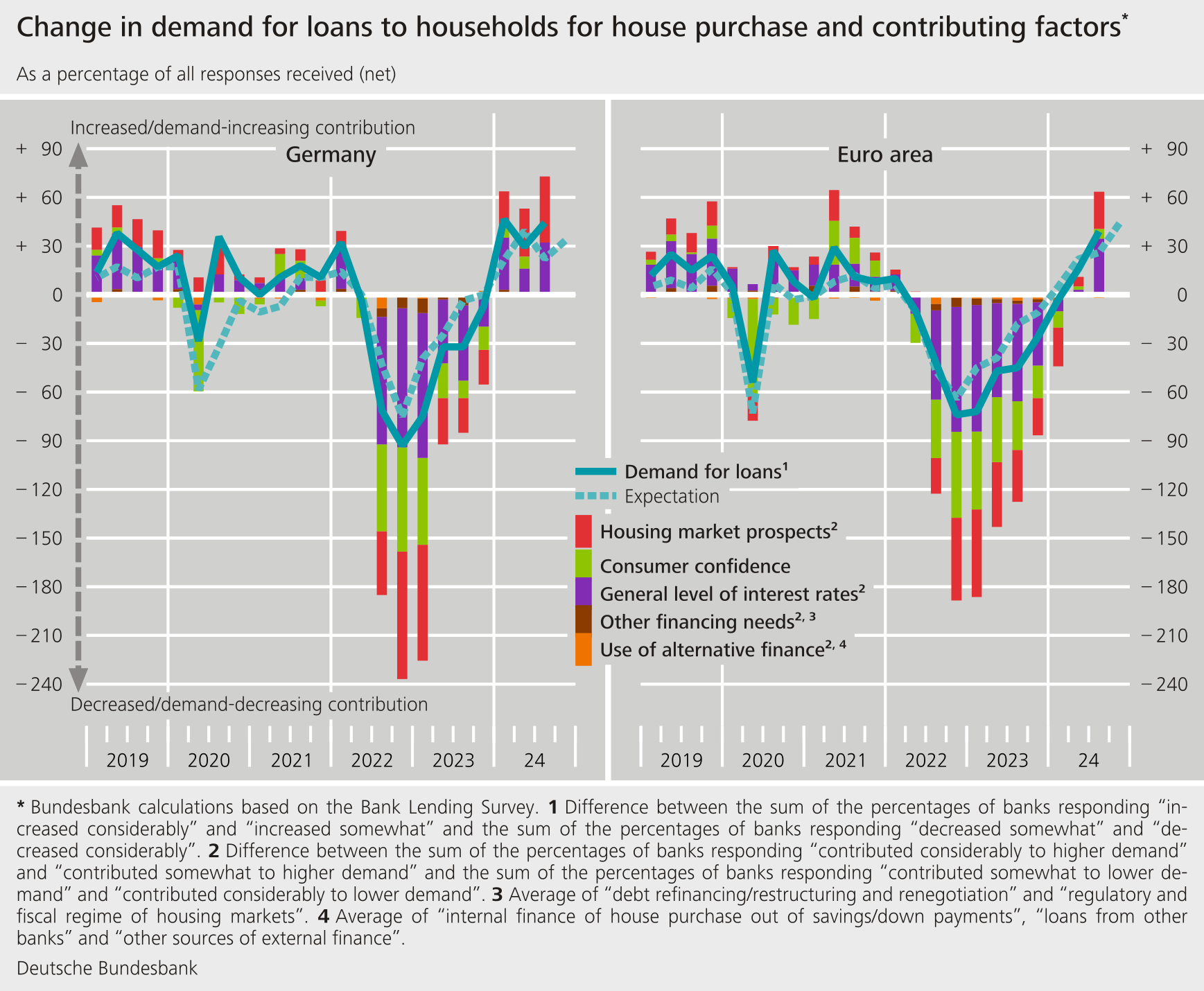

- Demand for loans increased in all three loan categories. As expected by banks, the resurgence of demand for loans to enterprises that started in the previous quarter continued. The increase in demand for loans to households exceeded the previous quarter’s expectations.

- The ECB Governing Council’s past and expected key interest rate decisions had a positive impact on net interest income, thereby contributing to an improvement in banks’ profitability in the 2024 summer half-year. For the winter half-year 2024-25, banks are expecting the key interest rate decisions to have a negative impact on their net interest income as well as on their profitability.

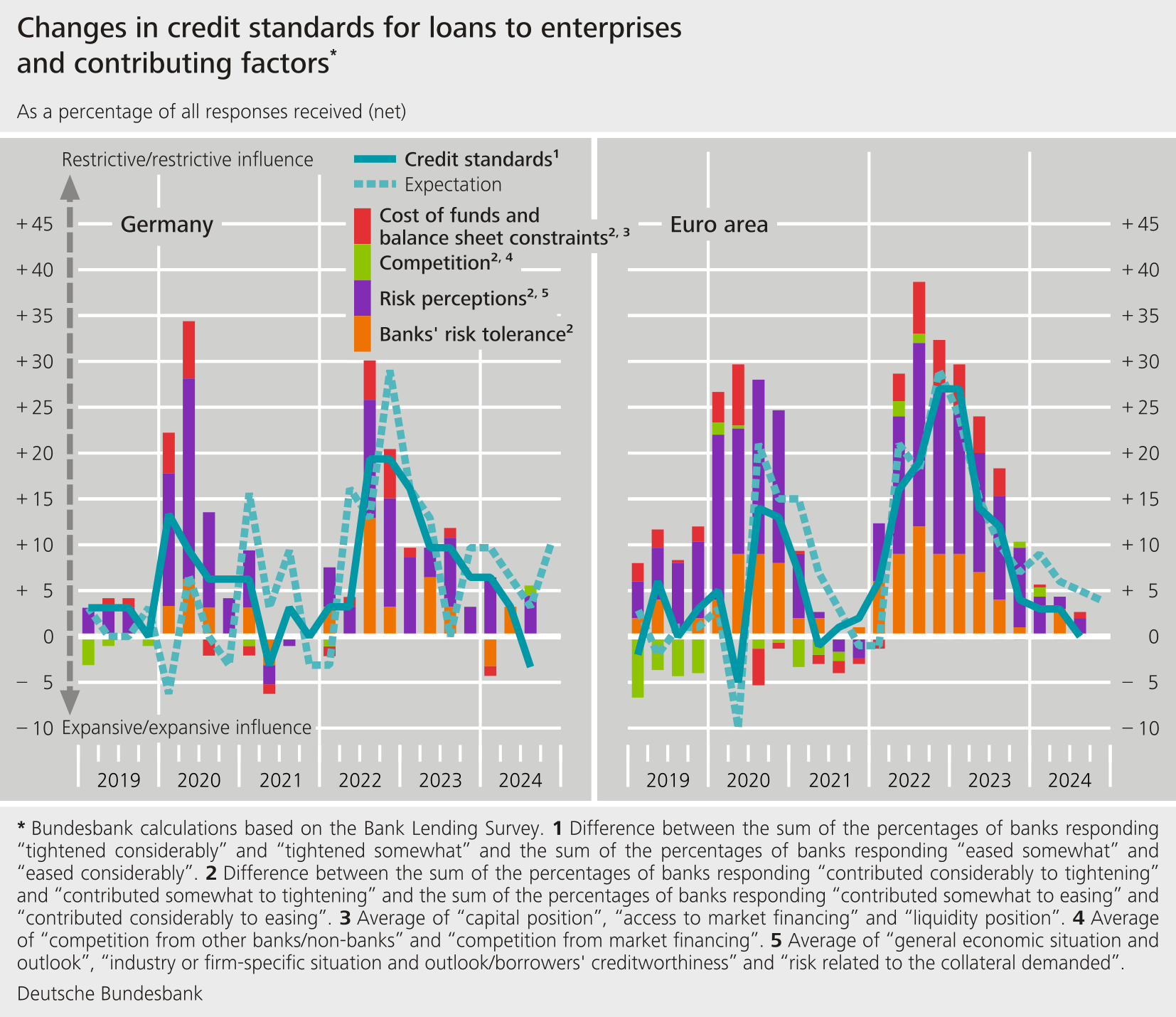

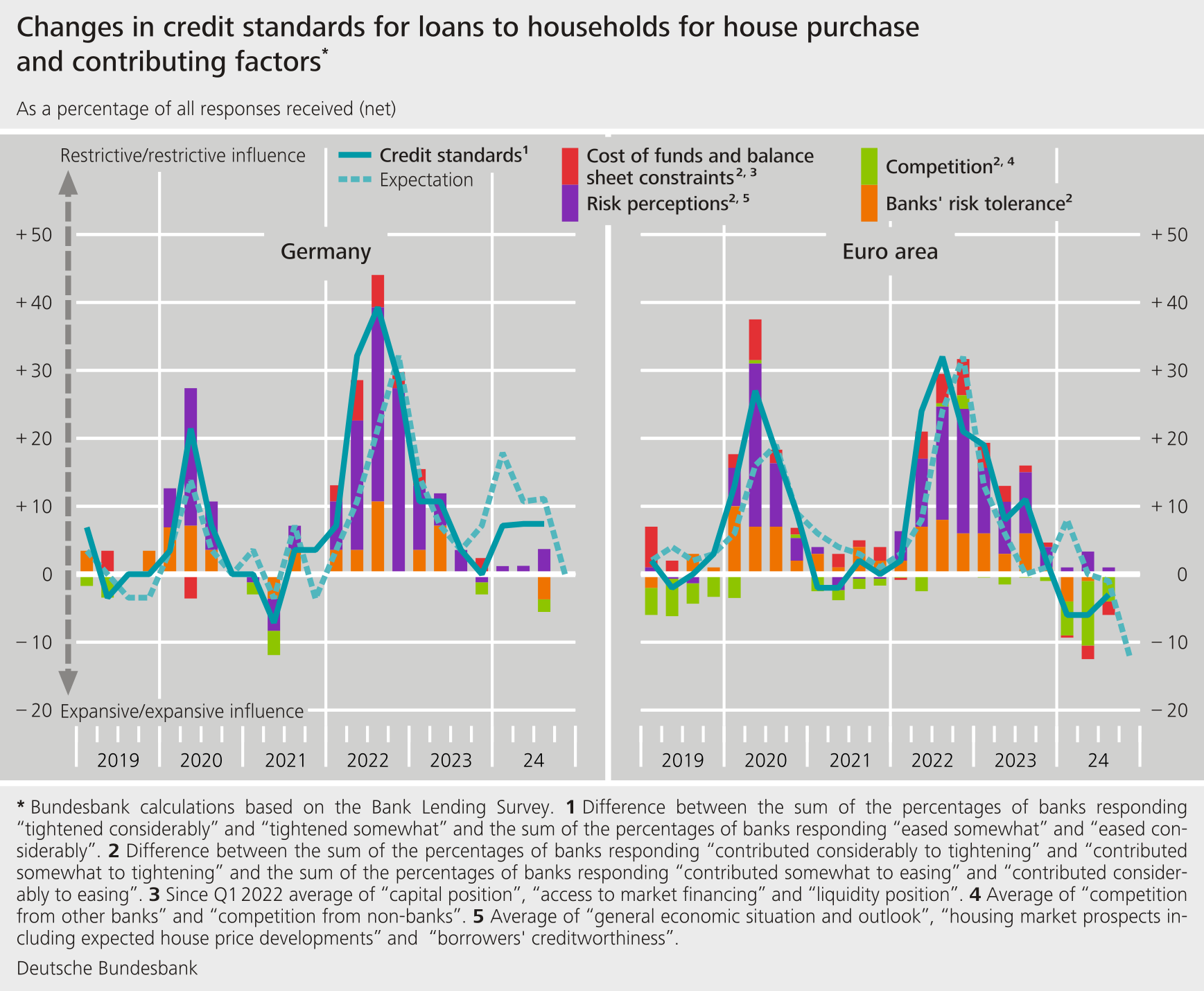

The BLS covers three loan categories: loans to enterprises, loans to households for house purchase, and consumer credit and other lending to households. For the first time in nearly three years, the surveyed banks did not tighten their credit standards (i.e. their internal guidelines or loan approval criteria) for loans to enterprises further, but eased them marginally. By contrast, they tightened their standards for loans to households again. The net percentage of banks that adjusted their requirements was −3% for loans to enterprises (compared with +3% in the previous quarter), +7% for loans for house purchase (compared with +7% in the previous quarter), and +15% for consumer credit and other lending to households (compared with +7% in the previous quarter). In the previous quarter, banks had planned to tighten their standards marginally for loans to enterprises. By contrast, the adjustments in loans to households for house purchase were broadly consistent with what had been planned in the previous quarter; standards for consumer credit and other lending to households were tightened more strongly than planned.

The recent marginal easing of credit standards for loans to enterprises took place against the backdrop of many and varied low-impact factors – an indication of banks’ uncertain assessments of the general situation. While banks indicated that the general economic situation and the economic outlook were having a restrictive impact on all loan categories, only loans to households have been subject to a tightening of credit standards thus far.

The banks cited their perception of increased credit risk as the key factor behind the tightening of credit standards for loans to households, attributing this to households’ lower creditworthiness. For the fourth quarter of 2024, banks are planning to tighten credit standards for loans to enterprises and consumer credit and other lending to households, but are not planning to adjust the standards for loans to households for house purchase.

Although, on aggregate, banks made hardly any changes in the third quarter to their credit terms and conditions (i.e. the terms and conditions actually approved as laid down in the loan contract) for loans to enterprises, this conceals lower lending rates on the one hand and an increase in margins on riskier loans on the other. Terms and conditions for loans to households for house purchase were eased, on the whole. The expansionary adjustments are the outcome of reduced lending rates and lower margins irrespective of credit ratings. As regards consumer credit and other lending to households, meanwhile, limits on loan amounts and increased margins irrespective of credit ratings were the main reasons for the tightened credit terms and conditions overall.

Demand for bank loans in Germany rose on balance in all loan categories in the third quarter of 2024. The pick-up in demand for loans to enterprises that had begun in the previous quarter continued. This was consistent with banks’ expectations in the previous quarter. Banks saw the decline in the general level of interest rates as the main reason for the increase in demand. For the first time in around two years, this factor no longer dampened, but rather supported, firms’ demand for loans. In addition, funding needs for debt refinancing, restructuring and renegotiation increased. After a second quarter in which fixed investment had been the main driver of overall demand growth, only small and medium-sized enterprises demanded marginally more lending for this purpose in the third quarter. The “inventories and working capital” factor, which had also contributed significantly to the increase in demand in the previous quarter, had an overall slightly dampening effect on demand in the third quarter, as large firms had less need for loans for this purpose. A reduction in internal financing options pushed demand slightly upwards.

According to banks, households increased their demand for loans for house purchase mainly because they took a more positive view of the housing market outlook. In addition, the general interest rate level once again pushed up demand. Banks believe that demand for consumer credit and other loans to households increased since more durable consumer goods were being purchased and consumer confidence was on the rise. The rejection rate rose for loans to enterprises and consumer credit and other lending to households, whereas it fell for the second time in a row for loans to households for house purchase. For the next three months, the surveyed banks are expecting to see demand increase further across all three loan categories.

The October survey round contained ad hoc questions on participating banks’ financing conditions and the impact of the ECB Governing Council’s past and expected key interest rate decisions. It also included questions on the impact of the Eurosystem’s monetary policy asset portfolios and on the third series of targeted longer-term refinancing operations (TLTRO III).

Against the backdrop of conditions in financial markets, German banks reported that their funding situation had improved somewhat compared with the previous quarter. The ECB Governing Council’s past and expected future key interest rate decisions have had, overall, a positive impact on banks’ profitability over the past six months. However, following the two interest rate cuts in June and September of this year, fewer banks reported a positive impact than in previous surveys. Banks continued to attribute the positive impact to an increase in net interest income. For the 2024-25 winter half-year, banks are expecting the key interest rate decisions to have a negative impact on their net interest income as well as on their profitability. The reduction in the Eurosystem’s monetary policy securities holdings, taken in isolation, had a positive impact on profitability, as it contributed to an increase in net interest income. German banks assessed the impact on their capital ratios, too, as positive.

Over the past six months, TLTRO III has had hardly any impact on the financial situation of banks in Germany. Only in terms of profitability did banks continue to report a positive impact. For the first time, TLTRO III no longer had any impact on the liquidity position of banks in Germany. As the deadline for repaying borrowed funds in full is December 2024, banks are not expecting TLTRO III to have any further impact on their financial situation over the next six months.

The Bank Lending Survey, which is conducted four times a year, took place between 6 September and 23 September 2024. In Germany, 33 banks took part in the survey. The response rate was 97%.