October results of the Bank Lending Survey (BLS) in Germany

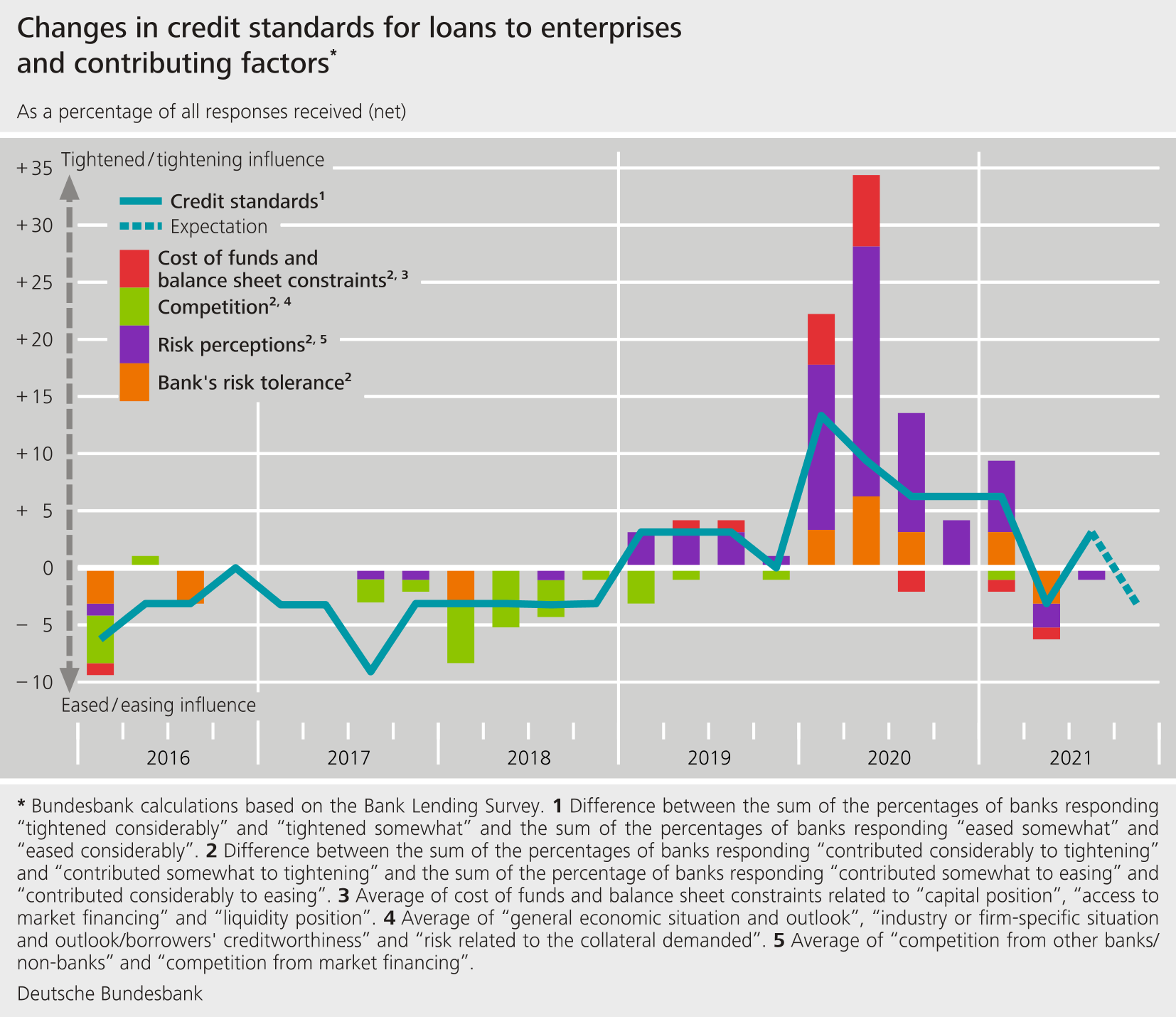

- The German banks responding to the Bank Lending Survey (BLS) tightened their credit standards somewhat for loans to enterprises and loans to households for house purchase in the third quarter of 2021. Credit standards for consumer credit and other lending were eased marginally.

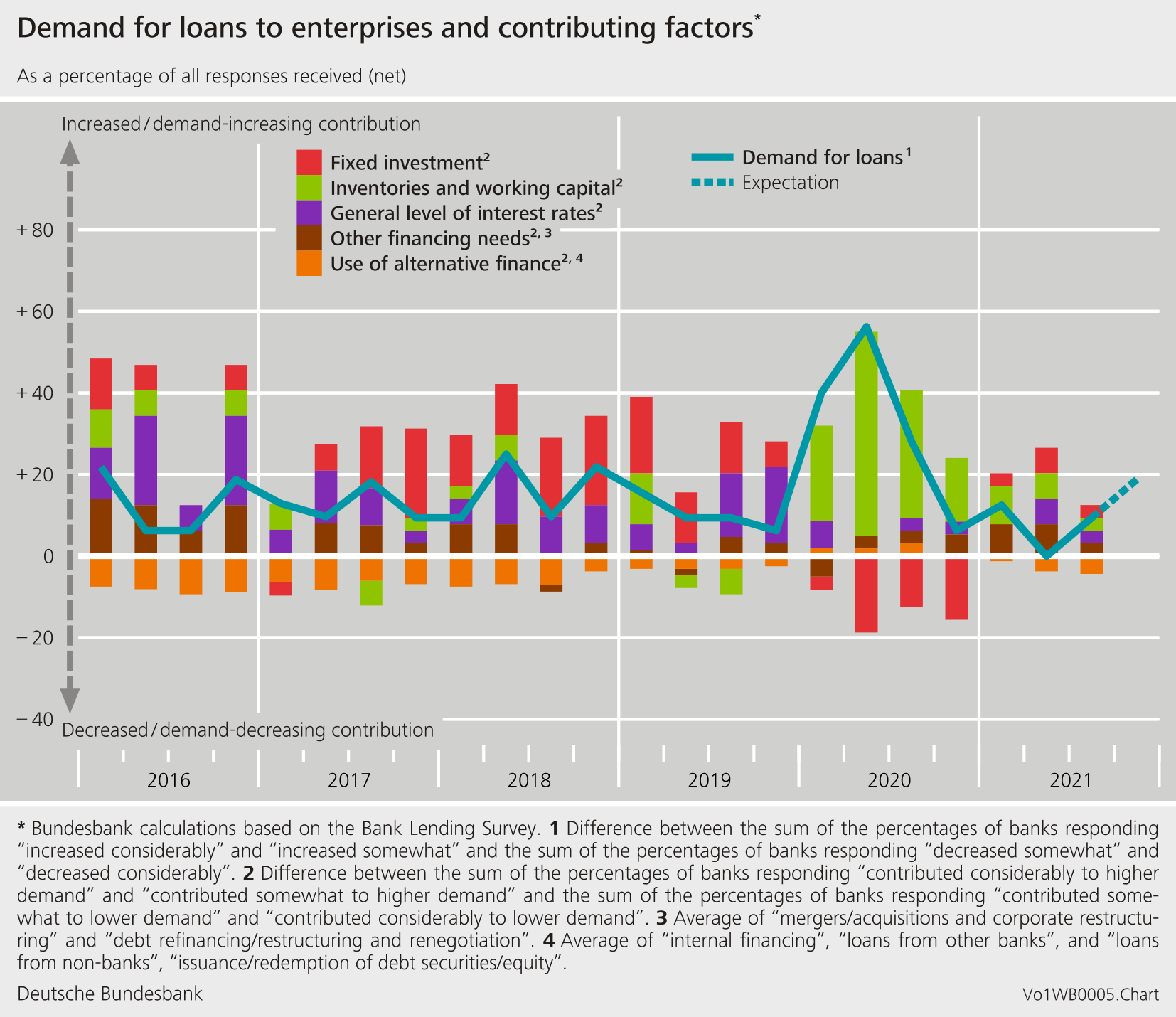

- Loan demand increased in all the surveyed loan categories, but fell significantly short of banks’ expectations in the previous quarter for loans to enterprises and consumer credit and other lending.

- Taken in isolation, the interest rate-reducing impact of the Eurosystem’s expanded asset purchase programme (APP) and pandemic emergency purchase programme (PEPP) had a detrimental effect on bank profitability. In and of itself, the negative interest rate on the deposit facility also continued to contribute negatively to banks’ net interest income.

- The targeted longer-term refinancing operations III (TLTRO-III) in June and September 2021 had a positive impact on the profitability of the banks surveyed. The attractive conditions of the operations were a key factor in banks’ participation in TLTRO-III. The funds taken up were used primarily for granting loans and as a substitute for maturing debt securities and interbank loans.

The October survey round contained ad hoc questions on participating banks’ financing conditions and the impact of the Eurosystem’s purchase programmes (APP and PEPP). Other ad hoc questions addressed the effects of the negative interest rate on the Eurosystem's deposit facility and the two-tier system for remunerating excess liquidity holdings. The survey additionally contained questions on the Eurosystem’s TLTRO-III operations.

Against the backdrop of conditions in financial markets, German banks reported that their funding situation had improved somewhat compared with the previous quarter. Over the past six months, the Eurosystem’s purchase programmes (APP and PEPP) have helped improve the liquidity position of commercial banks and their market funding conditions, but they have still impacted negatively on bank profitability through net interest income. Survey respondents indicated that the purchase programmes had not contributed to credit growth over the last six months. Furthermore, the negative interest rate on the deposit facility once again put a strain on banks’ net interest income. Taken in isolation, it depressed lending and deposit rates and pushed up fees in deposit business. Deposits from firms were affected to a greater degree than deposits from households. The rise in fees was greater than in all previous survey rounds. The two-tier system for remunerating excess liquidity holdings tempered the negative effect on profitability.

Twelve banks from the German sample took part in the TLTRO-III operations in June, and eight in September, mainly on account of the attractive conditions. According to the banks surveyed, the operations had a positive impact on their profitability. Banks reported using the uptake in funds primarily for lending and as a substitute for maturing debt securities and interbank loans. They stated that they would also be participating in future operations mainly because of the TLTRO-III operations’ attractive conditions. The TLTRO-III operations eased lending policies and contributed to a rise in lending, particularly to enterprises.

The Bank Lending Survey, which is conducted four times a year, took place between 20 September and 5 October 2021. In Germany, 34 banks took part in the survey. The response rate was 100%.