July results of the Bank Lending Survey in Germany

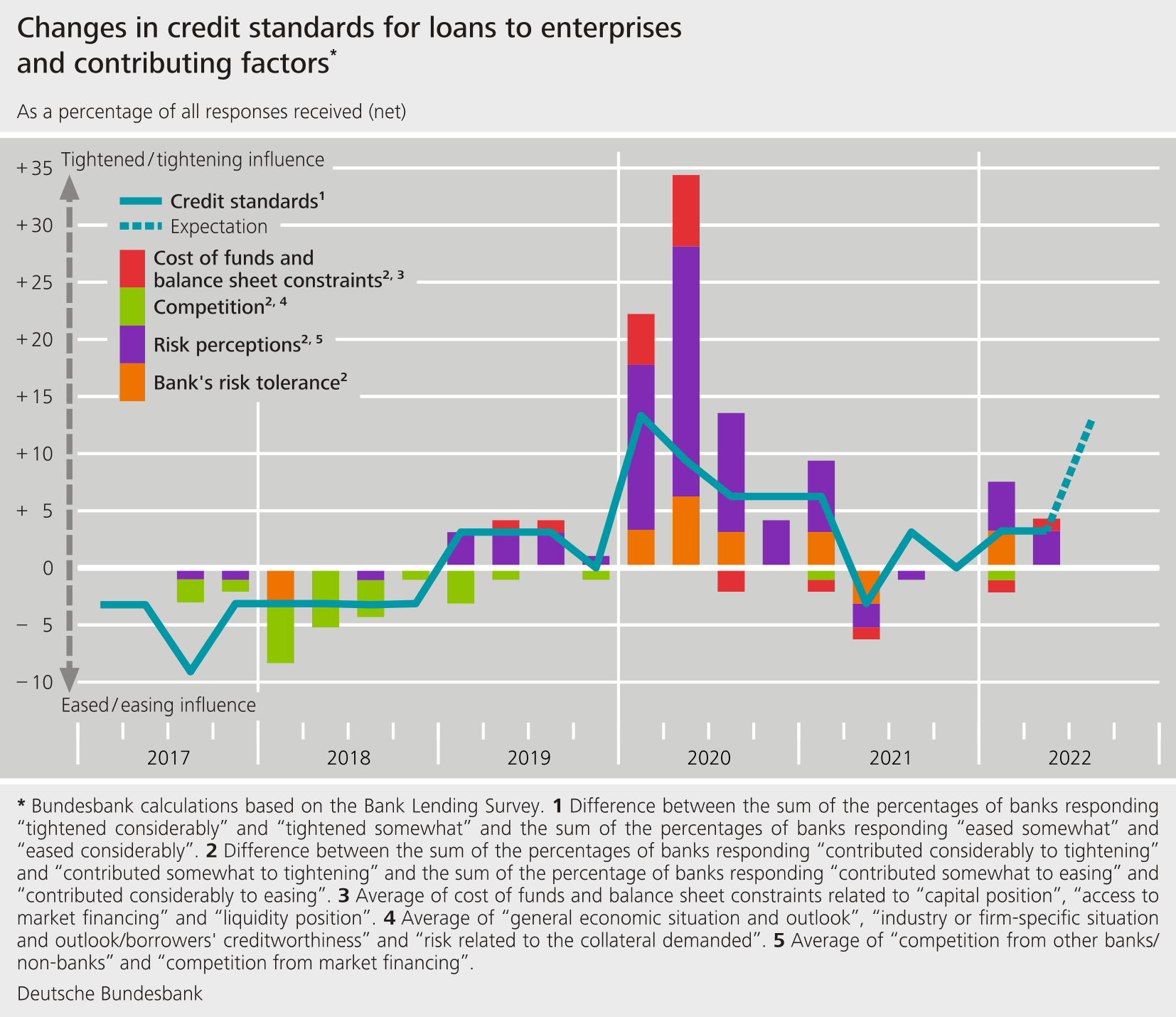

- The German banks responding to the Bank Lending Survey (BLS) marginally tightened their credit standards for loans to enterprises in the second quarter of 2022. In the case of loans to households for house purchase, the tightening of credit standards was stronger than at any other time since the introduction of the BLS. Credit standards for consumer credit and other lending were also tightened. The banks justified the tightening in all credit segments primarily on the grounds of a perceived increase in credit risk.

- Overall credit terms and conditions were tightened in all three credit segments, which was chiefly reflected in a widening of margins.

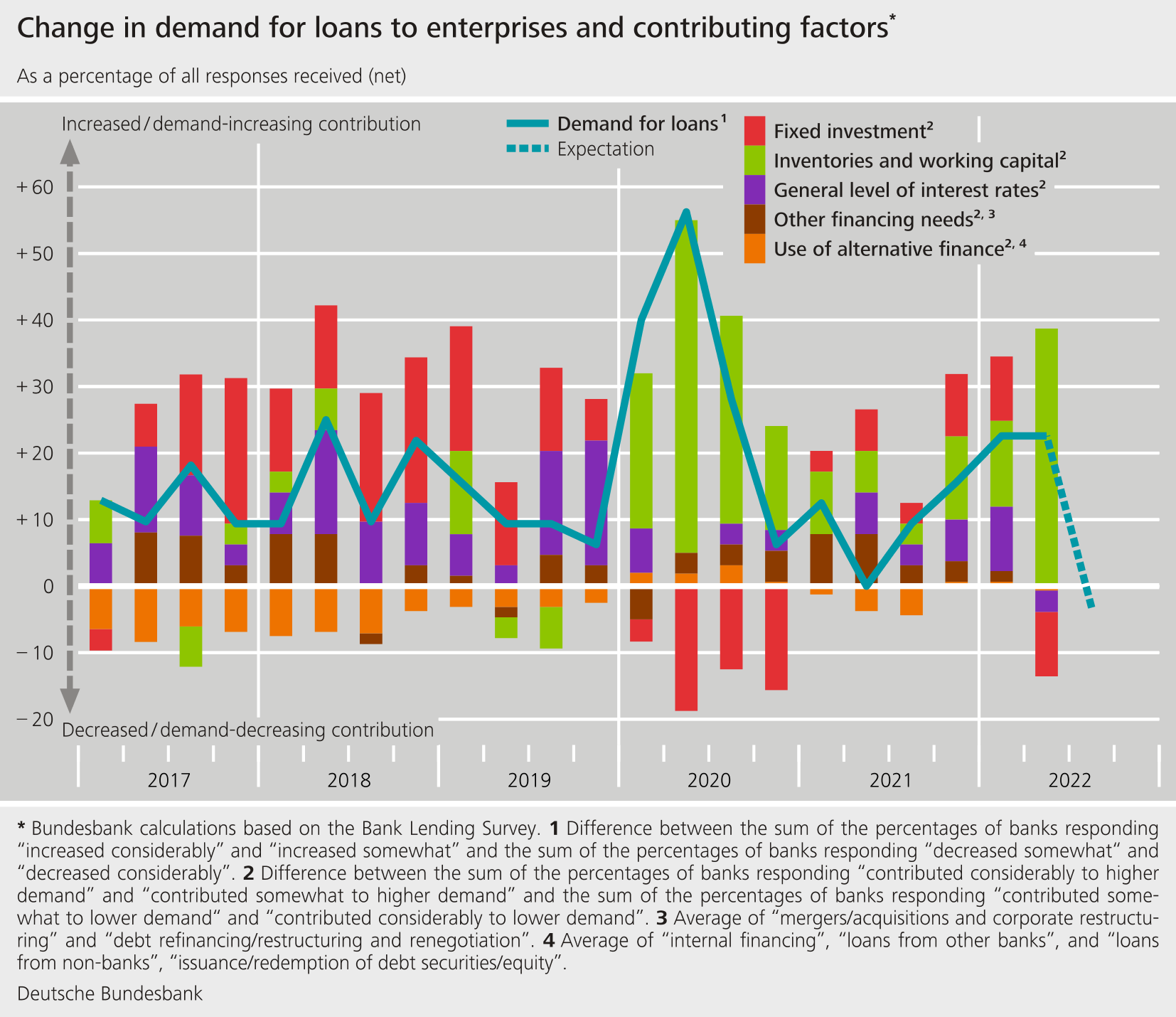

- Demand for loans to enterprises increased once again, particularly for short-term loans. On balance, demand for loans to households for house purchase declined, while demand for consumer credit and other lending continued to rise.

- The NPL ratio again had no meaningful impact on lending policies in the first half of 2022, and the banks are not expecting any meaningful influence for the second half of 2022, either.

- In the first half of 2022, banks left their credit standards largely unchanged in nearly all surveyed sectors of the economy, reporting a discernible tightening only in the residential real estate sector.

The July survey round contained ad hoc questions on participating banks’ funding conditions and about the impact of non-performing loans (NPL) on the institutions’ lending policy. It also contained a question on loan supply as well as loan demand in the key economic sectors.

Against the backdrop of conditions in financial markets, German banks reported that their funding situation had deteriorated somewhat compared with the previous quarter. In the first half of 2022, consistent with banks’ expectations, the size of the NPL ratio (percentage share of gross NPL stocks to the gross book value of loans) had only a marginal impact, or none whatsoever, on lending policy. For the second half of 2022, too, banks are not expecting the NPL ratio to exert any meaningful influence on their lending policies. In the first half of 2022, German banks left credit standards largely unchanged in nearly all surveyed sectors of the economy. Only in the residential real estate sector did they report a discernible tightening. By contrast, they tightened their credit terms and conditions in all sectors. Banks are planning to tighten their standards and conditions across sectors in the second half of the year. According to the banks, loan demand increased in almost all sectors of the economy in the first half of the year, with the wholesale and retail trade being the only sector to provide barely any impetus. Banks are more pessimistic overall for the second half of 2022. In particular, they are expecting a significant decline in the financing needs of enterprises in the commercial and residential real estate sectors.

The Bank Lending Survey, which is conducted four times a year, took place between 10 June and 28 June 2022. In Germany, 33 banks took part in the survey. The response rate was 100%.