July results of the Bank Lending Survey in Germany Banks tighten credit standards

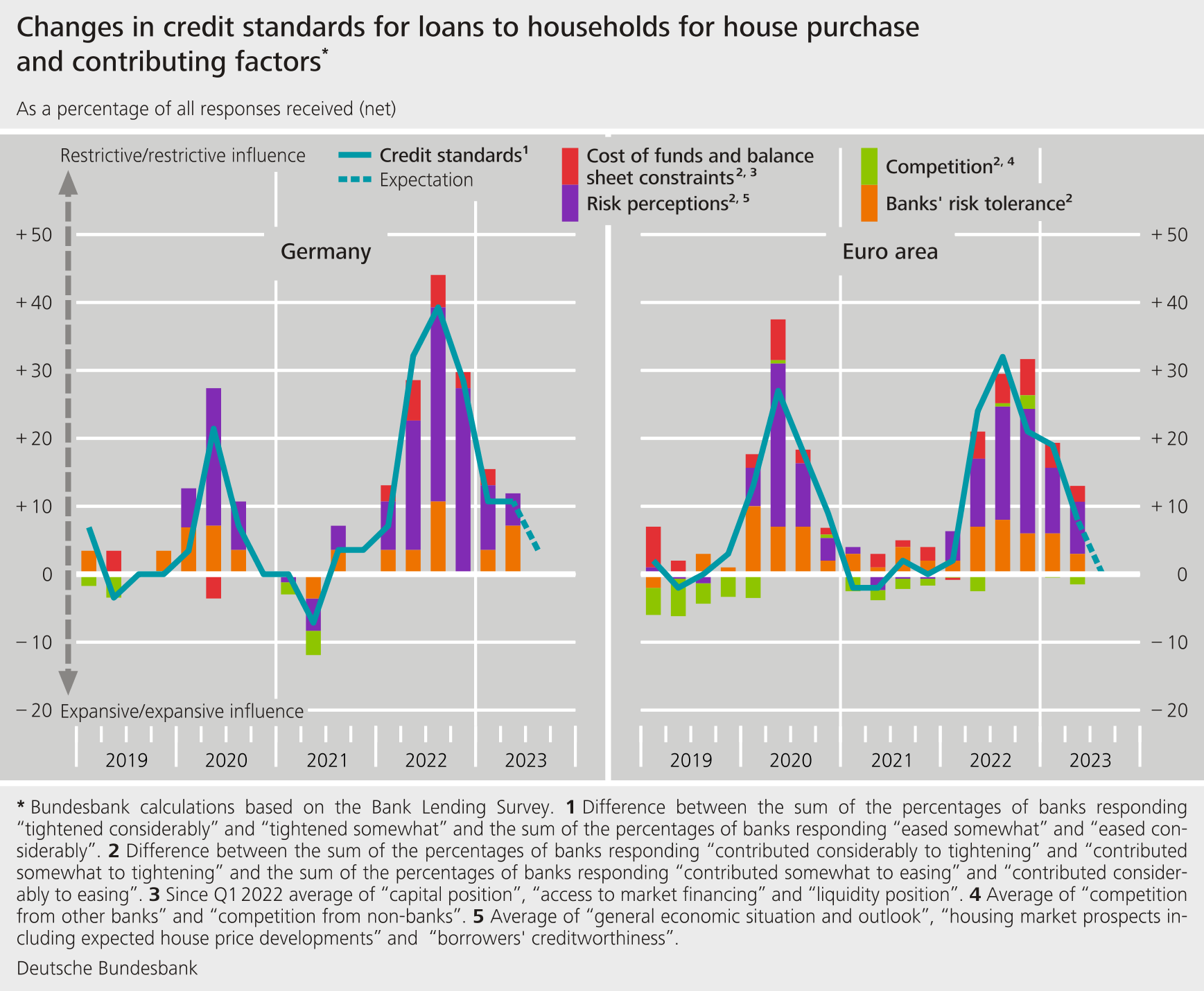

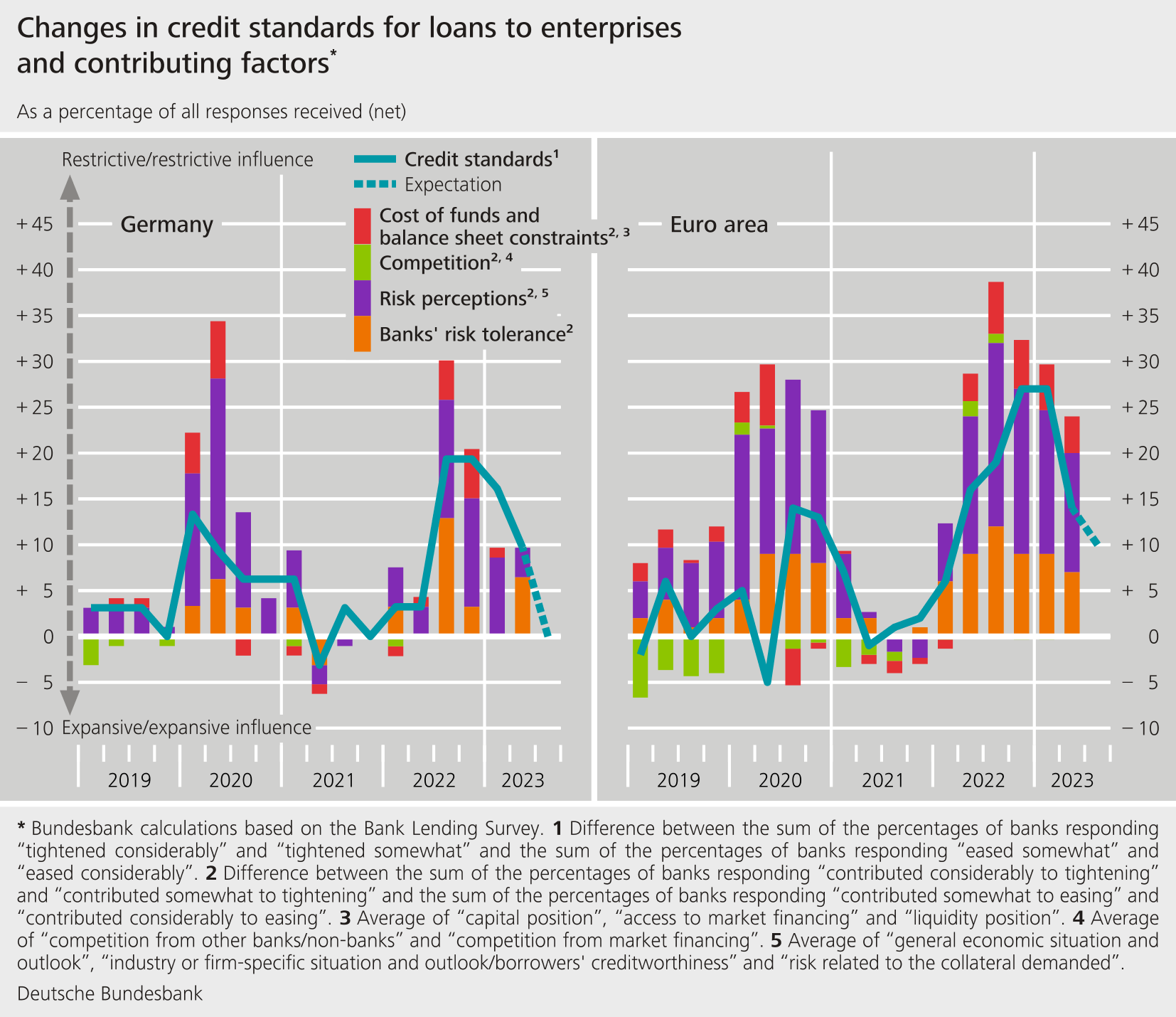

- The German banks responding to the Bank Lending Survey (BLS) tightened their credit standards for loans to enterprises, loans to households for house purchase, and consumer credit and other lending in the second quarter of 2023. The modifications were almost entirely consistent with the plans announced in the previous quarter. For the third quarter of 2023, banks are not planning to tighten their credit standards meaningfully in any of the three loan categories.

- Terms and conditions were made more restrictive in all three loan categories, as indicated by, in particular, a widening of margins.

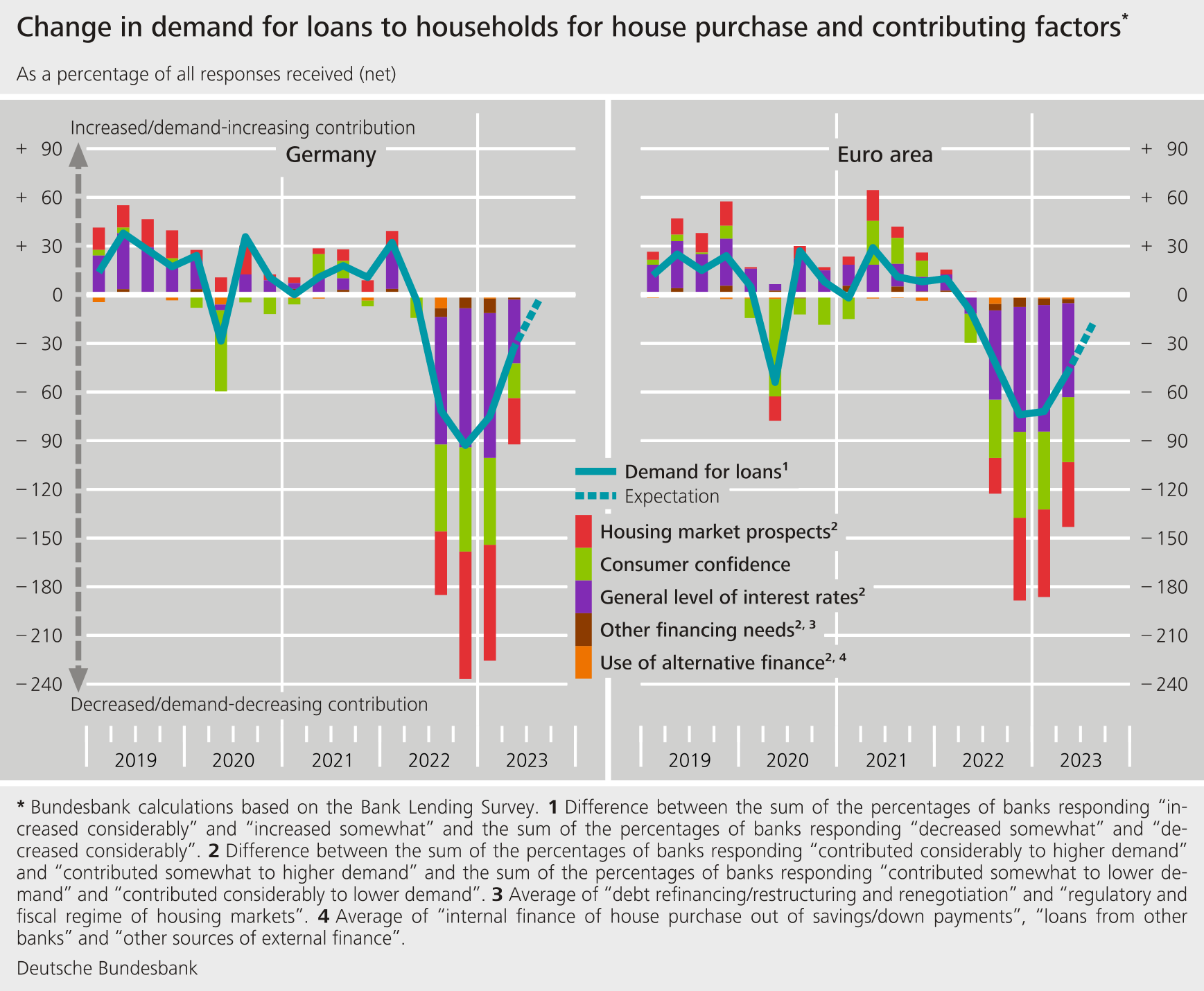

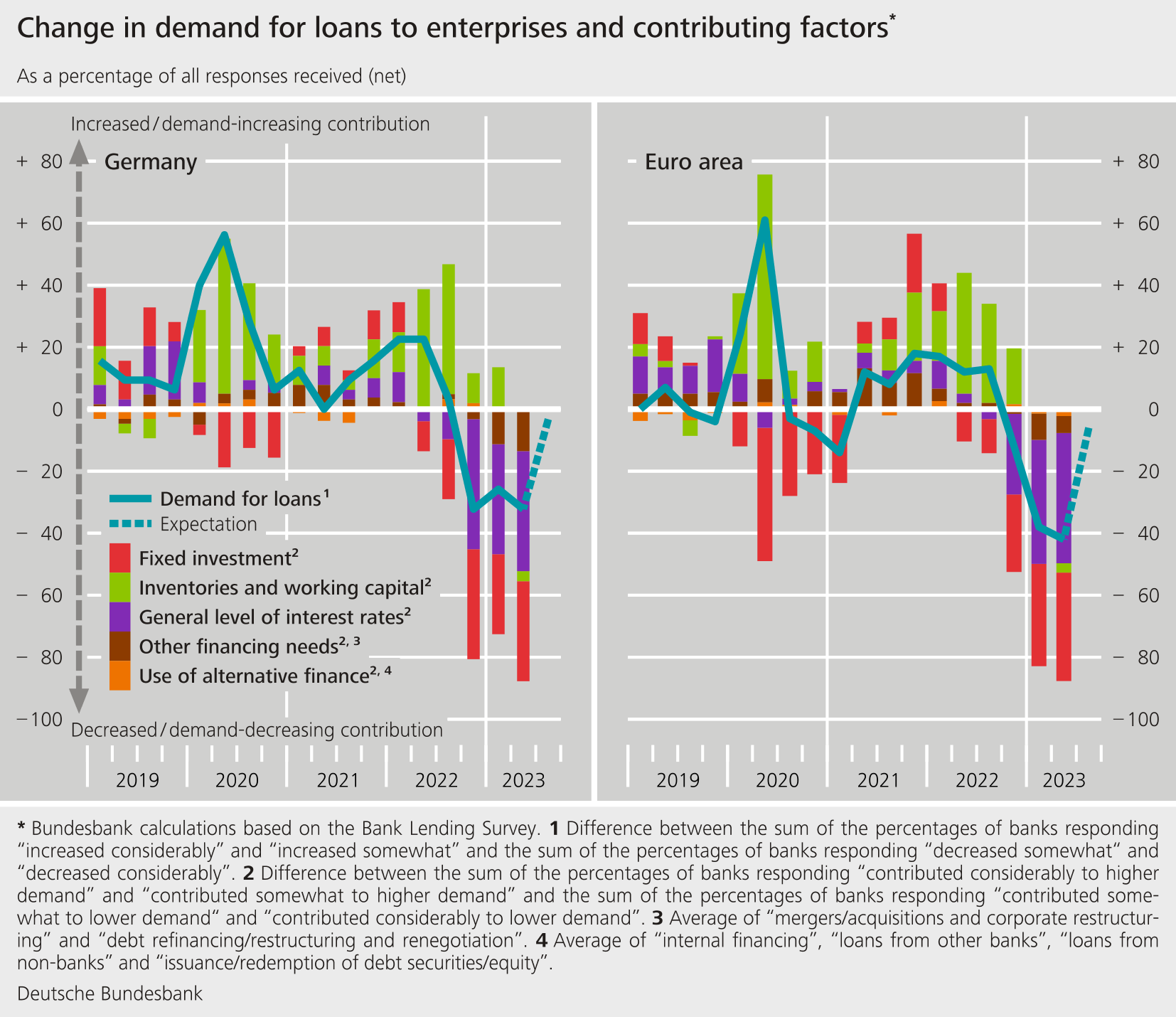

- Loan demand diminished once again in all three loan categories. Households’ demand for loans no longer fell as sharply as in the three preceding quarters. For the third quarter, the surveyed banks are expecting demand in all three loan categories to remain virtually unchanged.

- The tightening of credit standards for loans to enterprises over the past six months had a disproportionately severe impact on the real estate sector.

- Climate-related risks and climate change mitigation measures have had a restrictive impact on credit standards and terms and conditions for loans to enterprises over the past 12 months and, taken in isolation, have stimulated demand for loans to enterprises.

The BLS covers three loan categories: loans to enterprises, loans to households for house purchase, and consumer credit and other lending to households. The surveyed banks tightened their credit standards (i.e. their internal guidelines or loan approval criteria) in all three loan categories. The net percentage of banks that tightened their standards was +10% for loans to enterprises (compared with +16% in the previous quarter), +11% for loans for house purchase (compared with +11% in the previous quarter), and +14% for consumer credit and other lending (+14% in the previous quarter). The extent of the tightening was almost entirely consistent with the plans announced by the banks in the preceding quarter. The banks cited a lower risk tolerance and what they assessed as an increase in credit risk as reasons for tightening their credit standards in all three loan segments.

Relevant risks in corporate lending included, in particular, the deterioration in the general economic situation and outlook. The greatest risk regarding loans for house purchase was the gloomier outlook in the housing market. For the third quarter of 2023, banks are not planning any further meaningful tightening of their credit standards.

On aggregate, the banks tightened their terms and conditions (i.e. the actual terms and conditions agreed in the loan contracts) in all three loan categories. The tightening was reflected chiefly in a widening of margins, which were widened more strongly for loans to enterprises than for loans to households.

Demand for bank loans in Germany continued to decline on balance in all three loan categories. However, demand for loans to households for house purchase fell less sharply than in the three preceding quarters. In all three loan categories, the general level of interest rates continued to be the key factor behind the drop in demand for loans.

Falling fixed investment was the second most important factor behind the decline in demand for loans to enterprises. For the first time since 2019, financing needs for inventories and working capital no longer propped up demand, but had a broadly neutral impact on loan demand. Demand for loans to households for house purchase dropped not only because of the interest rate level, but also because, according to borrowers, the housing market outlook had deteriorated. The loan rejection ratio rose once again in all loan categories. For the next three months, the surveyed banks expect demand for loans to enterprises and households to remain unchanged.

The July survey round contained ad hoc questions on participating banks’ financing conditions and about the impact of non-performing loans (NPL) on the institutions’ credit terms and conditions. It also contained a question on lending policy as well as loan demand in the key economic sectors. For the first time, a question was asked about the impact of climate change on bank lending.

Against the backdrop of conditions in financial markets, German banks reported that their funding situation had deteriorated somewhat compared with the previous quarter. The deterioration is almost exclusively restricted to access to short-term deposits (up to one year). In the first half of 2023, the size of the NPL ratio (percentage share of NPL stocks (gross) to the gross book value of loans) had no meaningful impact on lending policy in any of the three loan categories. For the second half of 2023, banks are expecting their NPL ratios to have a slightly more restrictive impact on their policies for loans to enterprises.

The tightening of credit standards for loans to enterprises was strongest in the real estate sector over the past six months. It was also in this sector where demand fell most significantly. However, the tightening was also comparatively strong in construction (excluding real estate) and in the energy-intensive manufacturing sector. By contrast, banks tightened their credit standards less severely in the services sector (excluding financial services and real estate) and in the wholesale and retail trade sector.

German banks reported that, over the past 12 months, climate-related risks and climate change mitigation measures had had a restrictive impact on their credit standards for loans to those enterprises that had made a relatively sizeable contribution to climate change. Over the next 12 months, the banks are planning to tighten their credit standards more sharply in connection with the impact of climate change. At the same time, the impact of climate change, taken in isolation, stimulated the demand for loans by German banks to enterprises. The banks are expecting climate change to drive demand over the next 12 months, too.

The Bank Lending Survey, which is conducted four times a year, took place between 19 June and 4 July 2023. In Germany, 33 banks took part in the survey. The response rate was 100%.