January results of the Bank Lending Survey in Germany

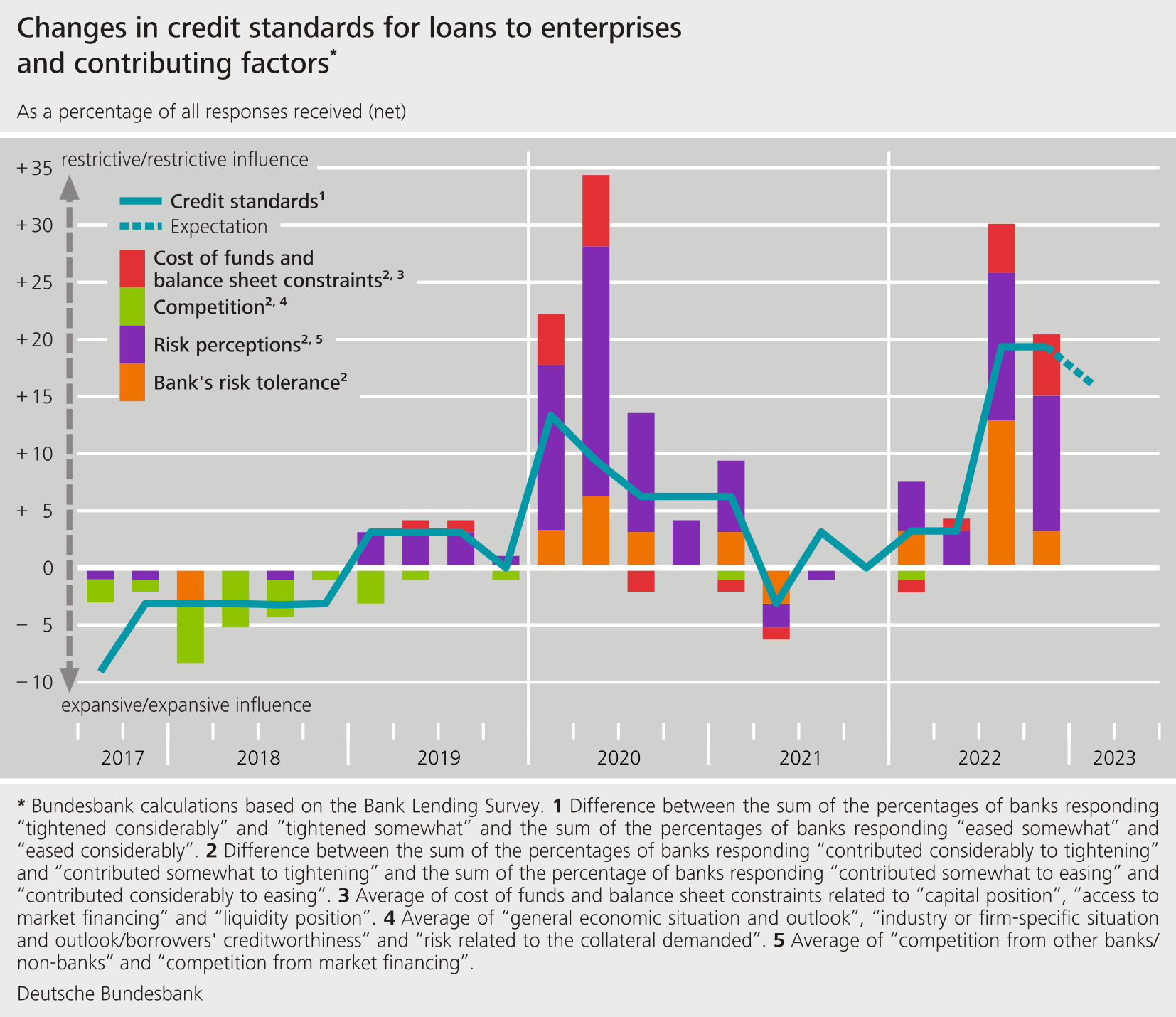

- The German banks responding to the Bank Lending Survey (BLS) tightened their credit standards for loans to enterprises, loans to households for house purchase as well as consumer credit and other lending in the fourth quarter of 2022. The banks justified the tightening in all loan categories primarily on the grounds of a perceived increase in credit risk.

- Credit terms and conditions were also made more restrictive in all three loan categories, which was chiefly reflected in a widening of margins.

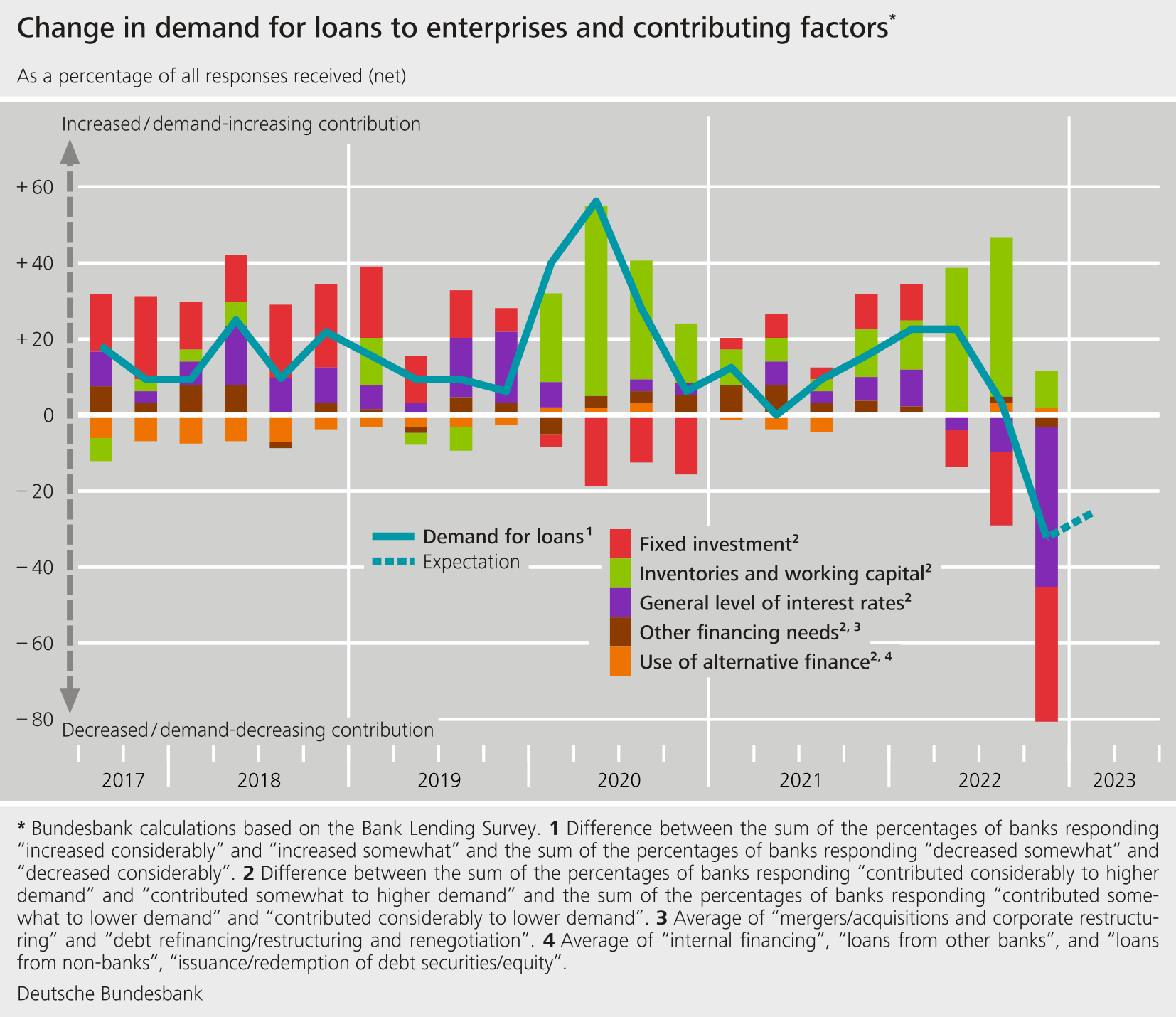

- Demand for loans fell in all three loan categories. For loans to enterprises, this was the first time demand had declined since 2013. In the fourth quarter, demand for loans to households for house purchase plummeted at a rate not seen since the introduction of the BLS in 2003.

- According to the surveyed banks, the non-performing loans (NPL) ratio contributed marginally to a tightening of their lending policies for loans to enterprises in the second half of 2022. For the first half of 2023, the banks are expecting the NPL ratio to have a slightly more restrictive impact on their lending policies.

- According to the banks, regulatory and supervisory requirements had a restrictive impact on their credit standards and margins last year. These effects are probably related to the increase in the countercyclical capital buffer announced by the Federal Financial Supervisory Authority (BaFin) and the introduction of a systemic risk buffer for the residential real estate sector.

- In the second half of 2022, German banks tightened their credit standards in nearly all surveyed sectors of the economy. They set stricter standards, especially in the manufacturing sector and, within this sector, primarily for energy-intensive enterprises, as well as in the real estate sector.

Banks cited the higher general level of interest rates, the significantly worse housing market outlook as perceived by borrowers and the drop in consumer confidence as the main reasons for this decline. Demand for consumer credit and other lending likewise decreased. Banks rejected household loan applications significantly more often than in the previous quarter. Over the next three months, the banks are, on balance, expecting demand in all loan categories to decline further. However, the banks believe that the decline is likely to be weaker than in the final quarter of 2022.

The January survey contained additional questions on banks’ funding conditions, on the impact of new regulatory or supervisory requirements relating to requirements for capital adequacy, leverage ceilings, liquidity and loss provisioning as well as questions relating to the impact of NPLs on banks’ lending policies. It also contained a question on lending policy as well as loan demand in the key economic sectors.

Against the backdrop of conditions in financial markets, German banks reported that their funding situation was virtually unchanged compared with the previous quarter. In response to new regulatory or supervisory requirements, banks continued to strengthen their capital position in 2022. The banks stated that the requirements had a restrictive impact on their credit standards and margins last year. These effects are likely related to the increase in the countercyclical capital buffer that BaFin announced in January 2022 and the introduction of a systemic risk buffer for the residential real estate sector. These two measures will have to be applied from February 2023 and April 2023 respectively. The surveyed banks reported that the size of the NPL ratio (percentage ratio of (gross) non-performing loans to the gross book value of the loans) made a marginal contribution to a tightening of their lending policies for loans to enterprises in the second half of 2022. For the first half of 2023, the banks are expecting the NPL ratio to have a slightly more restrictive impact on their lending policies. In the second half of 2022, German banks tightened their credit standards in nearly all surveyed sectors of the economy. They set stricter standards especially in the manufacturing sector and, within this sector, primarily for energy-intensive enterprises, as well as in the real estate sector.

The Bank Lending Survey, which is conducted four times a year, took place between 12 December 2022 and 10 January 2023. In Germany, 33 banks took part in the survey. The response rate was 100%.