Deutsche Bundesbank updates impact of Basel III reform package

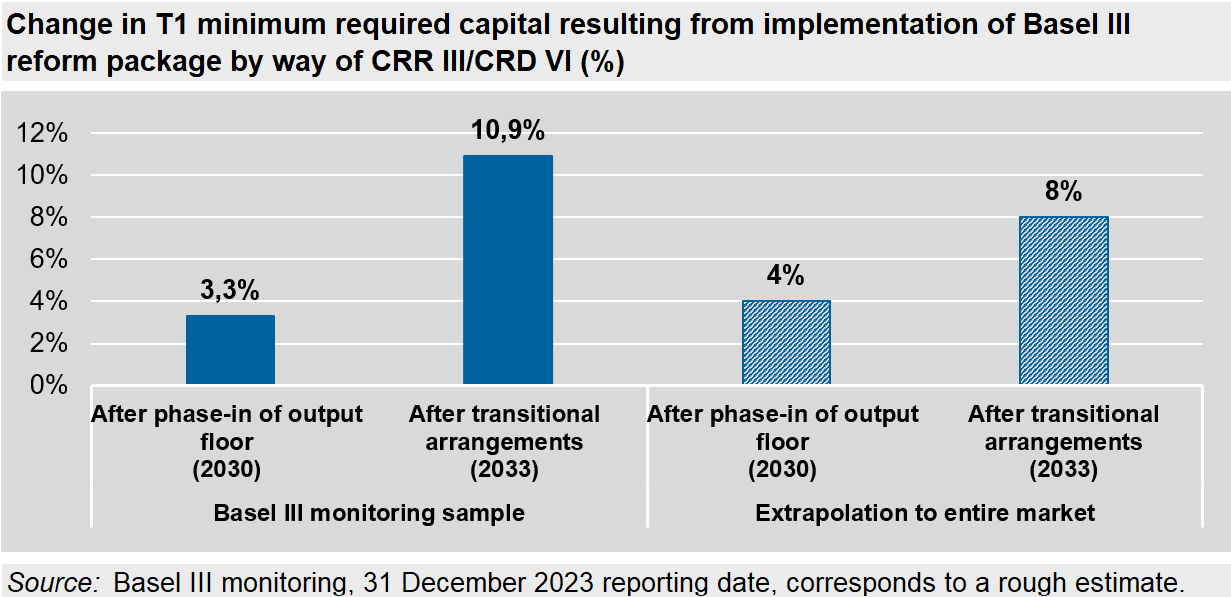

Implementation in the EU of the Basel III reform package will lead to a 3.3% increase in minimum required capital (MRC) by 2030 for a sample of 36 German financial institutions. The Bundesbank calculated this result in a study based on data from large institutions in particular. Once the transitional arrangements cease to apply in 2033, the institutions in the sample are expected to see a 10.9% increase in MRC. The study published today[1] thus broadly confirms the results of the previous year. It corroborates the finding that the German banking sector will be well able to handle the impact of the revised Basel III reform package.

It should be noted that the sample is dominated by large banks which use internal models and that small and medium-sized institutions are extremely underrepresented. A rough extrapolation for Germany’s banking sector as a whole shows that increases in the range of 8% can be expected by 2033 (see the chart). Specifically, this translates to an aggregate increase in tier 1 MRC of €30 billion up to 2033. By way of comparison, the banking system currently holds around €165 billion in common equity tier 1 (CET1) capital above the required amount.

Since 2011, the Bundesbank has been examining the impact of the Basel III reform package in conjunction with the European Banking Authority (EBA) and the Basel Committee on Banking Supervision (BCBS). The 25th such exercise was carried out for the reporting date of 31 December 2023, with a total of 36 institutions from Germany participating.

The study reports that full phase-in of the Basel III reform package would lead to an 8.7% increase in MRC.[2] This calculation is based on the BCBS methodology, which solely includes the internationally standardised G-SII buffer and the capital conservation buffer. In contrast to this, the aforementioned results relating to EU implementation include the national O-SII buffers and the Pillar 2 requirements.

Notes to editors: In parallel with the Bundesbank, the EBA and the BCBS published their Basel III monitoring reports on 7 October 2024. The quantitative impact study for the EU (EBA) covers 159 institutions from 30 countries and the report at the international level (BCBS) encompasses 180 institutions from 26 countries.

Footnotes:

- The final amendments to the Capital Requirements Regulation (CRR III, http://data.europa.eu/eli/reg/2024/1623/oj) and Capital Requirements Directive (CRD VI, http://data.europa.eu/eli/dir/2024/1619/oj) were published in the Official Journal of the European Union in June 2024. CRR III becomes binding as of 2025.

- The increase is down 4.8 percentage points from the previous year’s impact analysis. One reason for these changes as against the previous year is the 2023 introduction of the G-SII buffer for the leverage ratio in the EU.