Card payments see strong growth

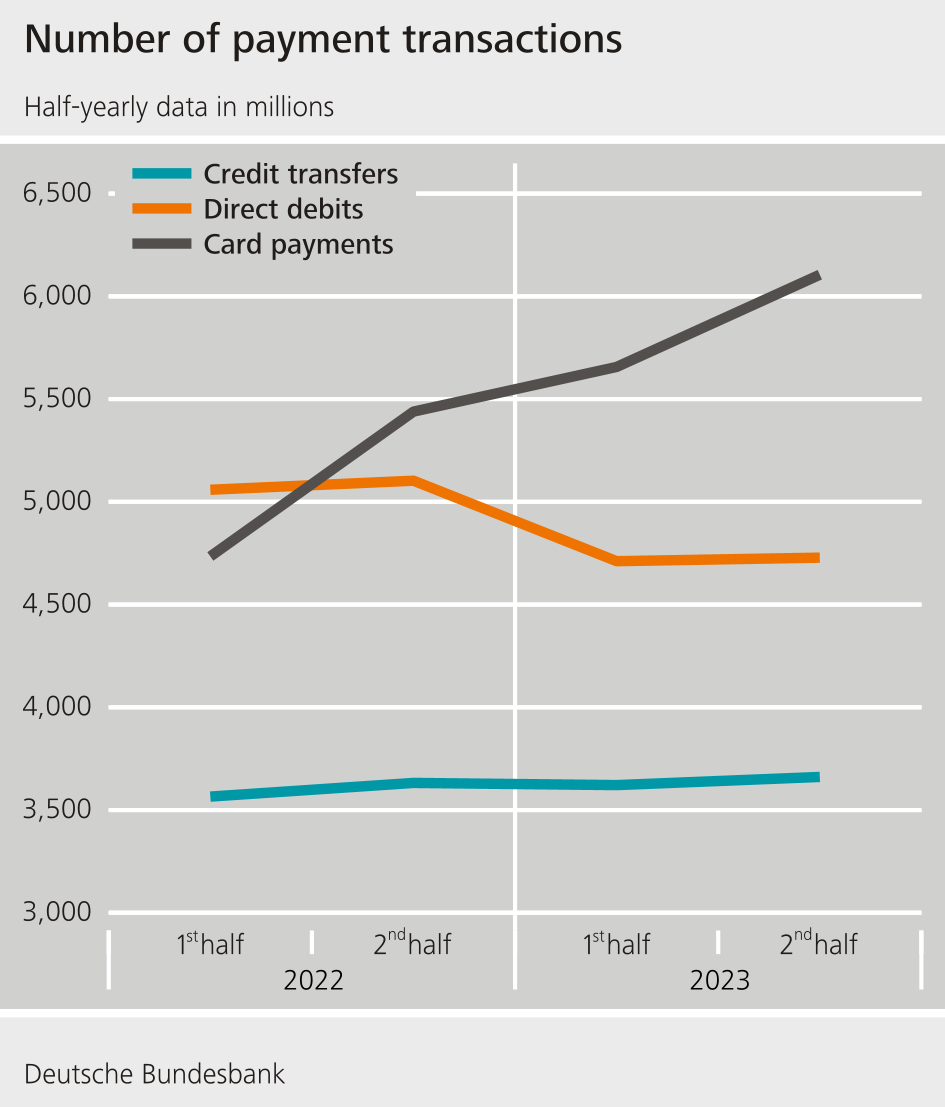

The number of card payments has continued to grow steadily since the end of the pandemic. In 2023, it rose by almost 16 % on the previous year to 11.8 billion transactions. At 39 %, card payments accounted for the largest share of all non-bank payment transactions, followed by direct debits and credit transfers. Most electronic card payments were made using debit cards (83 %), followed by delayed debit cards (15 %) and credit cards (2 %). These are the takeaways from the Bundesbank’s payment statistics, which, since the 2022 reporting year, have been expanded to an increased semi-annual frequency.

In terms of value, however, card payments represented less than 1 % of all cashless payment transactions, which amounted to just over € 70 trillion in 2023. As measured by this total value, credit transfers were once again the most widely used cashless payment instrument in 2023, with a share of more than 90 % (€ 63.6 trillion).

The expanded payment statistics for the first time contain new sub-items for credit transfers, with SEPA instant credit transfers being particularly dynamic: these rose by 58 % in number and by 66 % in value between the first half of 2022 and the second half of 2023. However, this growth was from a low level and accounted for 4 % of all credit transfers and less than 1 % of their total value in the second half of 2023. Over the same period, credit transfers initiated by payment initiation service providers grew – likewise from a low level – by 28 % in number and by 51 % in value.

Direct debits remained highly significant in Germany in 2023, accounting for just over 31 % in terms of transaction numbers. The total value was just over € 5.4 trillion. The use of cheques is continuing to decline steadily in terms of number and value.

The number of ATMs likewise declined significantly. At year-end 2023, there were just under 52,200 ATMs, compared with almost 53,600 at the end of 2022. The number of ATMs with a funds transfer function fell from almost 24,300 to just over 23,200 over the same period. This is, amongst other things, a consequence of banks closing branches.