Acquisition of financial assets and external financing in Germany in the second quarter of 2023 Results of the financial accounts by sector

Further increase in households’ financial assets

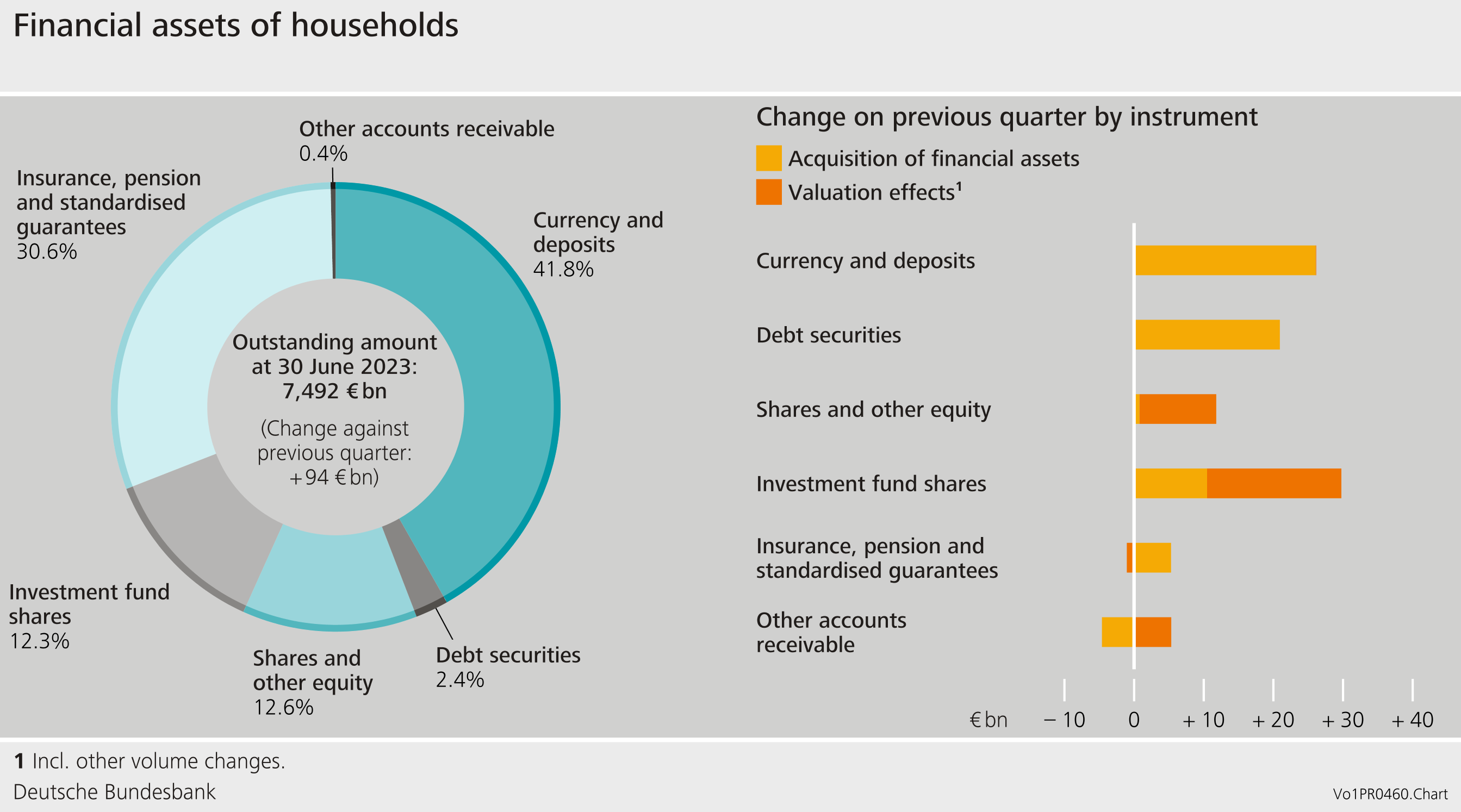

In the second quarter of 2023, households’ financial assets grew by €94 billion, standing at €7,492 billion at the quarter’s end. Following a significant decline in the previous year, this was already the third consecutive quarter-on-quarter increase. Over the second quarter of 2023, households increased their claims by €59 billion and recorded valuation gains of €36 billion.

Against the background of risen interest rates, in the second quarter, households largely continued the investment pattern they had exhibited in the previous quarter. For example, they continued to reduce their sight deposits (-€18 billion) in favour of time deposits, which are generally remunerated at a higher rate (+€43 billion). At €21 billion, households’ net purchases of debt securities were again well above the average of recent years. By contrast, their interest in shares declined significantly. At last report, households only invested just under €1 billion net in shares and other equity. This is the lowest figure since 2016.

Valuation gains primarily resulted from increases in the value of households’ holdings of shares (+€9 billion) and investment fund shares (+€19 billion). By contrast, the market value of debt securities held by households remained virtually unchanged.

Real total return on households’ financial assets follows upward trend

The real total return, i.e. adjusted for inflation, on households’ financial assets (shown in black in the chart) represents the actual return on financial assets for private households. Its computation is based on the period-specific asset structure. The real total return has been negative since the end of 2021, but has been following a clear upward trend for the last two quarters. This increase is largely based on the rise of the short-term real interest rate (shown in grey in the chart), but is enhanced by the real return on shares, which has recently turned slightly positive again, and the increase in real returns on investment fund shares. Taken together, the real total return was back above the short-term real interest rate for the first time in four quarters.

Household liabilities continued to show little movement. Following an increase of €5 billion, they amounted to €2,143 billion at the end of the quarter. As in the previous quarter, this very subdued growth in historical terms was mainly due to the small increase in loans for house purchase. The marked decline of 0.7 percentage point bringing the debt ratio down to 53.6% was thus almost exclusively attributable to the nominal increase in aggregate output.[1] Taken together, households’ net financial assets grew by €88 billion in the second quarter, rising to €5,349 billion.

External financing of non-financial corporations still at low level

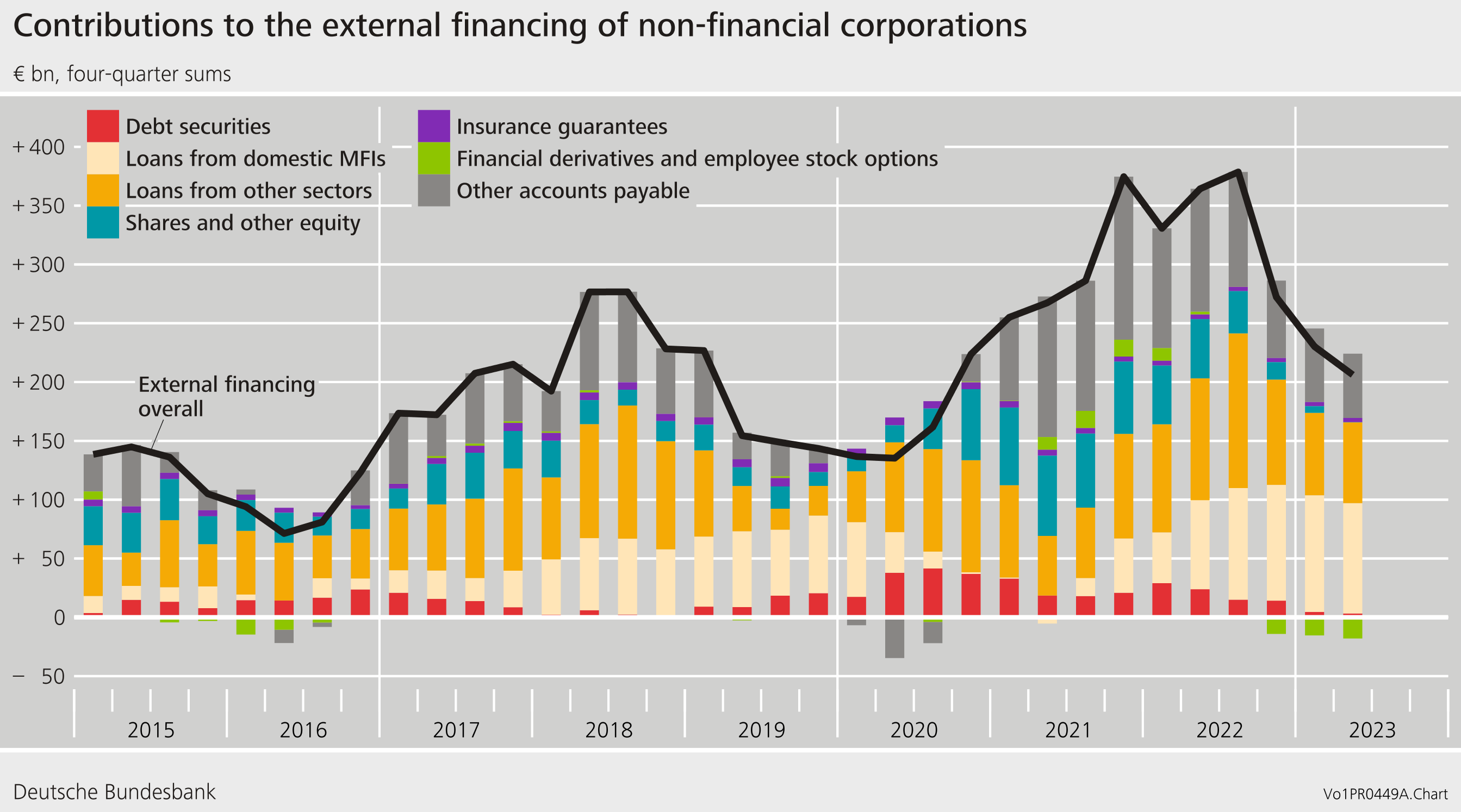

The external financing of non-financial corporations amounted to €43 billion in the second quarter of 2023. Following a weak previous quarter, this constituted a slight recovery, although it still meant that external financing remained below the average of recent years. In particular, borrowing from domestic banks, at €16 billion, was rather weak compared with the recent past. Other liabilities, which notably include trade credits, saw an increase of only €5 billion. In annual terms (four-quarter moving sums), the external financing of non-financial corporations thus declined further, although the downward momentum weakened somewhat.

The liabilities of non-financial corporations grew by €41 billion, standing at €8,082 billion at the end of the second quarter. This rise was primarily attributable to non-financial corporations’ external financing activities. Valuation effects had hardly any impact on the liabilities side of their balance sheets in the quarter under review. Despite higher liabilities, the debt ratio fell from 79.5% to 79.0% as a result of the stronger nominal growth in aggregate output.[2]

The financial assets of non-financial corporations fell slightly, standing at €5,978 billion at the end of the second quarter of 2023. Taken together, non-financial corporations’ net financial assets declined to -€2,104 billion at the end of the quarter.

Owing to interim data revisions of the financial accounts and national accounts, the figures contained in this press release are not directly comparable with those shown in earlier press releases.

Fußnoten: