Acquisition of financial assets and external financing in Germany in the first quarter of 2024 Results of the financial accounts by sector

- Net financial assets of private households increased further.

- Valuation gains supported growth of total assets. Real return increased to 1.4%.

- Slight growth in financing of non-financial corporations, liabilities increased.

Households’ financial assets close to €8 trillion mark

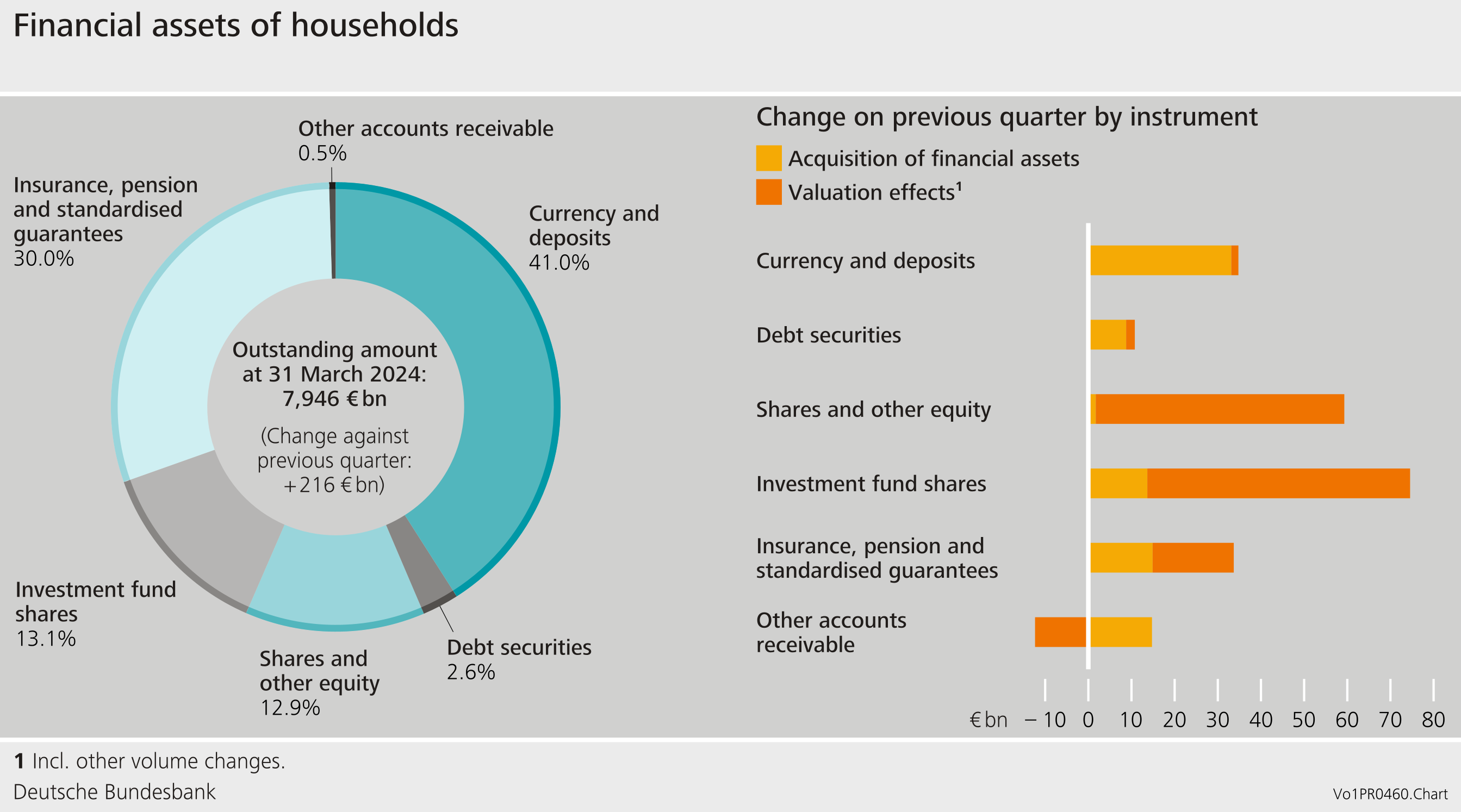

Households' financial assets rose by €216 billion in the first quarter of 2024 and stood at €7,946 billion at the end of the quarter. This increase was partly attributable to transactions having reached their highest level since the first quarter of 2022 (€87 billion). Much like in the previous quarter, there were strong movements in deposits, in particular. Funds were again withdrawn from lower-interest-bearing sight deposits (down €33 billion in the reporting quarter) and replaced by higher-yielding time deposits. The latter recorded the largest growth within a quarter since the time series began in 1991. In terms of other instruments, households exercised restraint on the whole. They still bought debt securities worth as much as €9 billion, as well as shares and other equity worth just €2 billion. Listed shares issued in Germany were sold and shares from foreign issuers were purchased. By contrast, the momentum in investment fund shares was stronger: households bought shares worth €14 billion net. While net purchases of this instrument did not match the highs recorded in 2021, they are still well above the growth seen in recent quarters.

In the first quarter of 2024, households achieved significant valuation gains, totalling €129 billion. The main contributors to these gains were listed shares (up by €42 billion) and investment fund shares (up by €61 billion). Insurance and pension claims also rose in value by €19 billion.

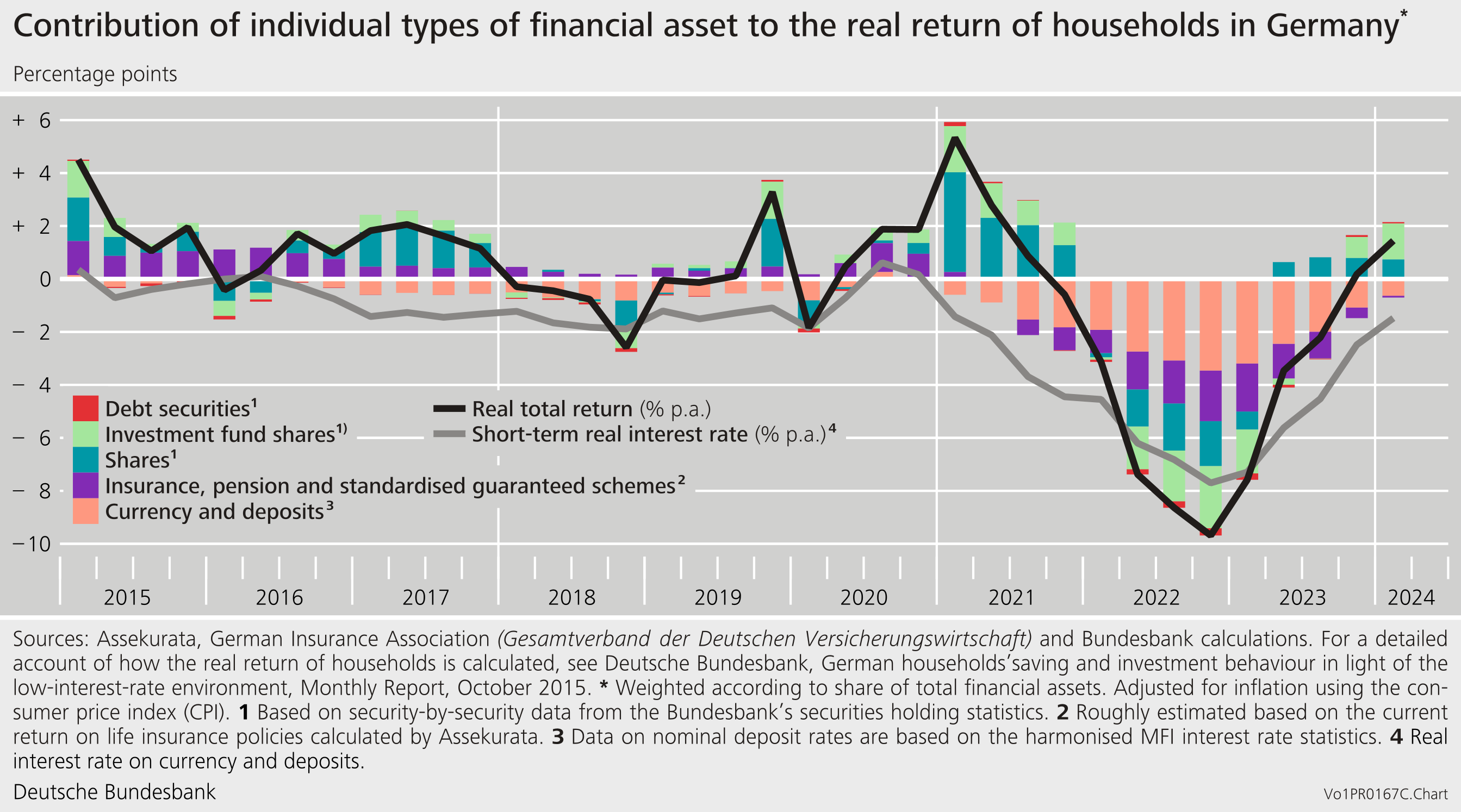

Real total return on financial assets rose further

The real total return, i.e. adjusted for inflation, on households’ financial assets represents the actual return on financial assets for households. Its computation is based on the period-specific asset structure. The real total return stood at 1.4% in the first quarter of 2024. This was a continuation of the upward trend in the real total return observed since the end of 2022. While the positive contributions of debt securities and shares to the real total return remained almost constant compared with the previous quarter, the other instruments all contributed to the sharp rise in the real return. Nonetheless, the individual instruments currency and deposits as well as insurance and pension claims still both yielded a negative real return. As in the previous quarters, the real total return was significantly above the short-term real interest rate.

Households’ liabilities remained unchanged

Households’ liabilities moved sideways in the first quarter of 2024, totalling €2,156 billion at the end of the quarter. As in the previous quarters, the muted growth in liabilities reflected the weak growth in loans for house purchase. The debt ratio[1] declined by 0.5 percentage point to 51.8%. The fall in the debt ratio despite rising liabilities is attributable to the nominal increase in gross domestic product.

Net financial assets rose again

According to the financial accounts, households’ combined net financial assets increased by €214 billion to €5,790 billion in the first quarter of 2024. The Distributional Wealth Accounts (DWA) recently launched by the Bundesbank provide additional data on the distribution of households’ wealth. These data show that wealth inequality is fairly high in Germany. According to the DWA, the wealthiest 10% of households hold more than 70% of net wealth, while the less wealthy half of all households hold just under 1% of net wealth.[2]

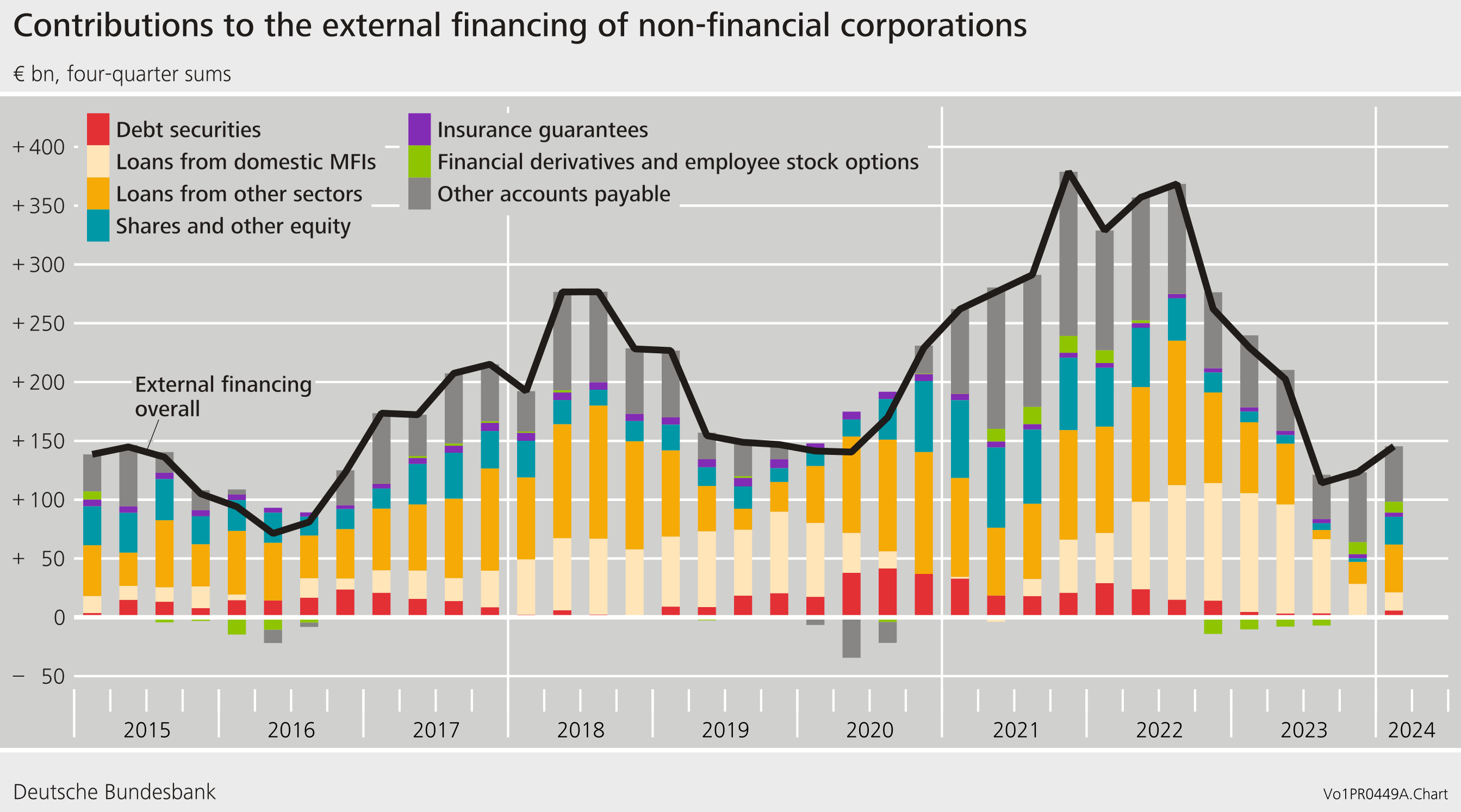

External financing of non-financial corporations similar to previous quarter

At €47 billion, the external financing of non-financial corporations was similar to the previous quarter. Borrowing picked up again and reached €25 billion. Especially net borrowing from banks was significantly positive again, reaching €11 billion at last report after two negative quarters. At €16 billion, issuance of shares and other equity was also more dynamic than in the previous year as a whole.

In annual terms (four-quarter moving sums), following the substantial decline between mid-2022 and mid-2023, a slight increase in the external financing of non-financial corporations was thus observed for the second quarter in a row.

The liabilities of non-financial corporations grew by €179 billion, standing at €8,292 billion at the end of the first quarter of 2024. This growth is again mainly attributable to the increase in the value of the equity issued (+€151 billion). The debt ratio saw a minimal fall, from 77.4% to 77.5%.

The financial assets of non-financial corporations rose by €117 billion, thus reaching €6,227 billion at the end of the quarter under review. Taken together, non-financial corporations’ net financial assets were down to -€2,065 billion.

Owing to interim data revisions of the financial accounts and national accounts, the figures contained in this press release are not directly comparable with those shown in earlier press releases.

Footnotes

- The debt ratio represents debt as a percentage of nominal gross domestic product (four-quarter moving sum).

- In the DWA, net wealth comprises the following types of assets and liabilities: deposits, debt securities, listed shares, investment fund shares, insurance claims (life insurance and private retirement provision), financial business wealth, and liabilities in the form of loans for house purchase and other debt. Net wealth is ultimately calculated as the difference between the total aforementioned assets and liabilities. For more information on the DWA, see also https://www.bundesbank.de/en/press/press-releases/bundesbank-releases-distributional-wealth-accounts-for-households-in-germany-921302 For more information see also Deutsche Bundesbank (2024): Distributional wealth accounts: timely data on the distribution of household wealth, Monthly Report April.

The data on the financial accounts are available at