Acquisition of financial assets and external financing in Germany in the first quarter of 2022 Results of the financial accounts by sector

Households’ financial assets fall for the first time in two years

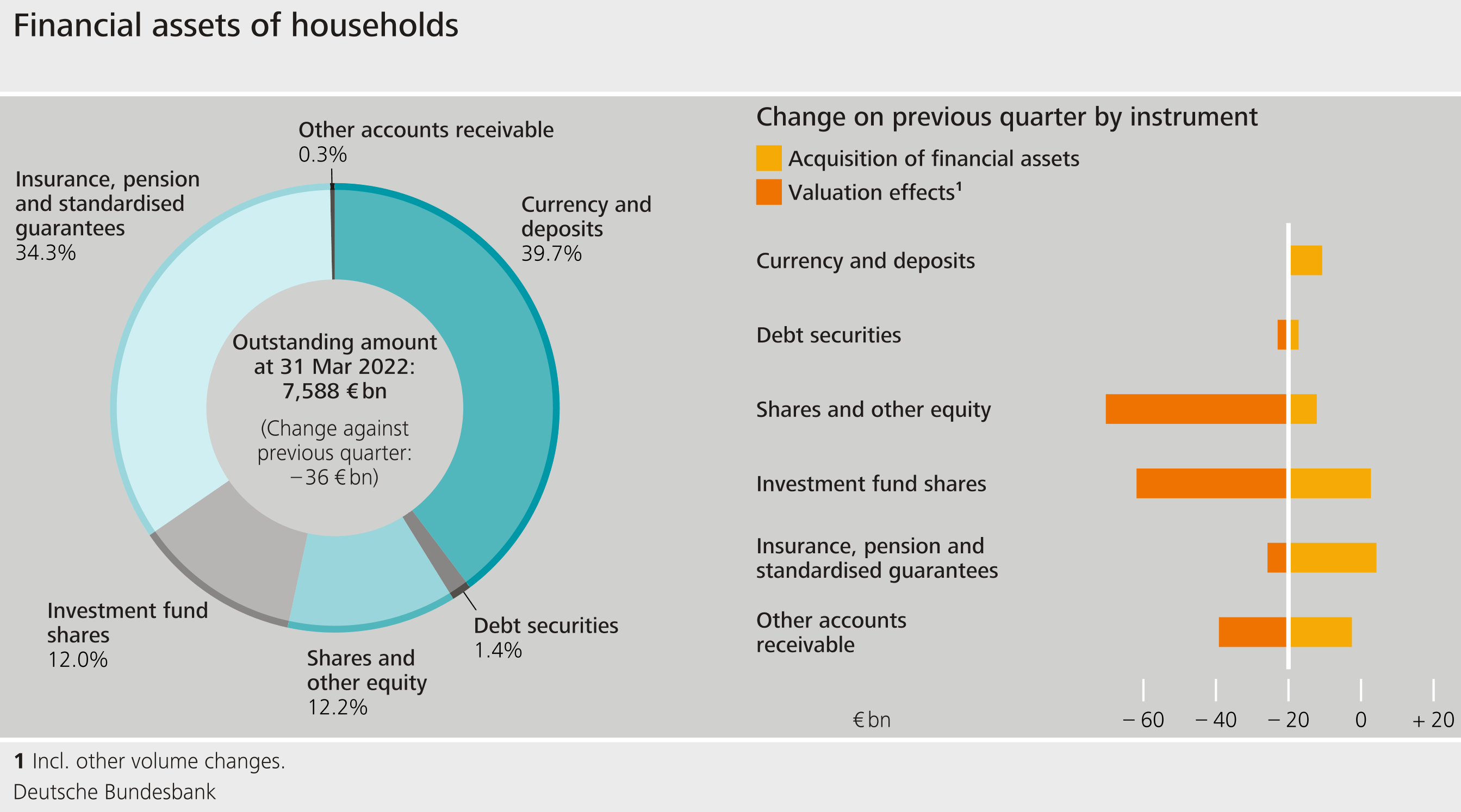

At the end of the first quarter of 2022, German households’ financial assets amounted to €7,558 billion, €36 billion lower than in the previous quarter. This was its first fall in two years. While households’ claims grew by €84 billion, they simultaneously suffered valuation losses of €121 billion.

These valuation losses were mainly attributable to the price falls on the capital market and chiefly concerned shares and other equity (-€50 billion) and shares in investment funds (-€42 billion). These are the second largest valuation losses for households since 1999. Only in the first quarter of 2020, which was heavily impacted by the COVID-19 pandemic, did they record higher valuation losses.

At €84 billion, the transaction-related increase in financial assets was below the average of the last five quarters, but nevertheless higher than in the previous quarter. Households’ investment behaviour in the capital markets was characterised by significant net inflows in claims on insurance corporations (€24 billion) and shares in investment funds (€23 billion). Shares and other equity were purchased in the amount of €8 billion, compared with €14 billion in the fourth quarter of 2021. The very low inflows in currency and deposits (€9 billion) compared with the previous five quarters are also noteworthy. By contrast, transaction-related growth in debt securities was the highest it has been since 2007, despite being relatively modest in absolute terms at €3 billion.

At €2,062 billion, households’ liabilities were €19 billion higher than in the fourth quarter of 2021. The growth in liabilities was thus roughly in line with the trend seen in recent years. The debt ratio, defined as total liabilities as a percentage of nominal gross domestic product (four-quarter moving sum), dipped again slightly to 56.7%. This was due to the renewed increase in economic output.

Households’ net financial assets amounted to €5,527 billion at the end of the first quarter of 2022, €55 billion less than in the previous quarter.

Lower external financing among non-financial corporations

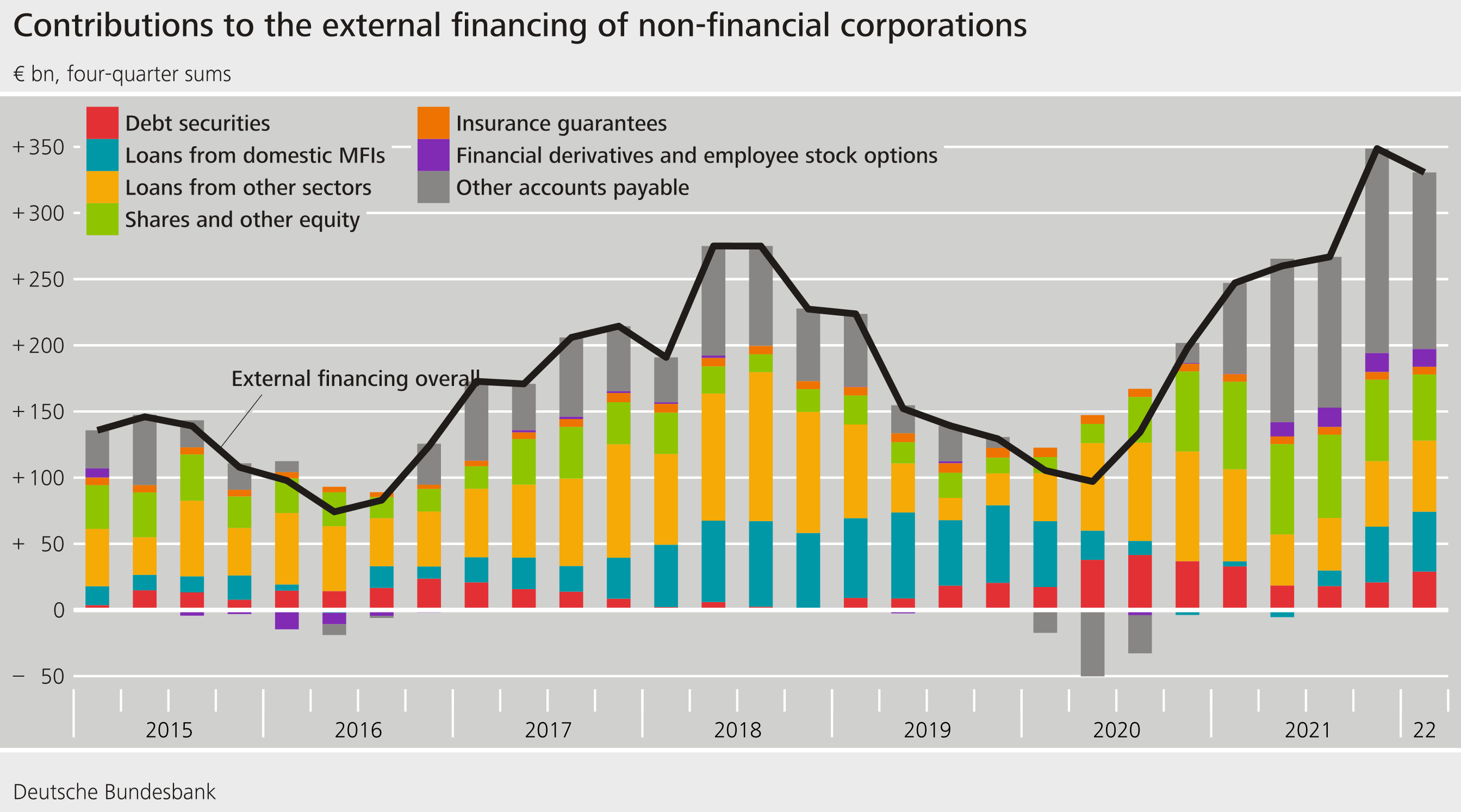

In the reporting quarter, external financing of non-financial corporations came to €84 billion, which was roughly in line with the average of the last five quarters but discernibly less than in the very strong previous quarter. Borrowing was somewhat lower than in the previous quarter, while the issuance of shares and other equity as well as trade credits and advances lost considerable momentum. In the case of debt securities, by contrast, issuance exceeded redemptions by €11 billion.

External financing, which was exceptionally strong in the previous quarter, also slowed slightly in annual terms (four-quarter moving sums). This was mainly attributable to shares and other equity, which have become less significant over the last four quarters in cumulative terms.

The financial assets of non-financial corporations grew by €103 billion over the course of the quarter, amounting to €6,088 billion at the quarter’s end. The individual positions, however, developed in partially opposing directions. The acquisition of financial assets totalled €88 billion. Considerable valuation gains were recorded for other claims, while shares and other equity recorded significant valuation losses.

The decline on the stock exchanges also impacted the liabilities side of non-financial corporations. Issued shares and other equity recorded valuation losses of €300 billion. The liabilities of non-financial corporations contracted for the first time since the first quarter of 2020 and amounted to €8,043 billion at the end of the reporting quarter. At the same time, the debt ratio fell to 80.6%. The debt ratio is calculated as the sum of loans, debt securities and pension provisions as a percentage of nominal gross domestic product (four-quarter moving sum).

Taken together, enterprises’ net financial assets rose to -€1,955 billion at the end of the first quarter of 2022.

Owing to interim data revisions of the financial accounts and national accounts, the figures contained in this press release are not directly comparable with those shown in earlier press releases.